-

下载亿题库APP

-

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

How to master Valuation Rations?

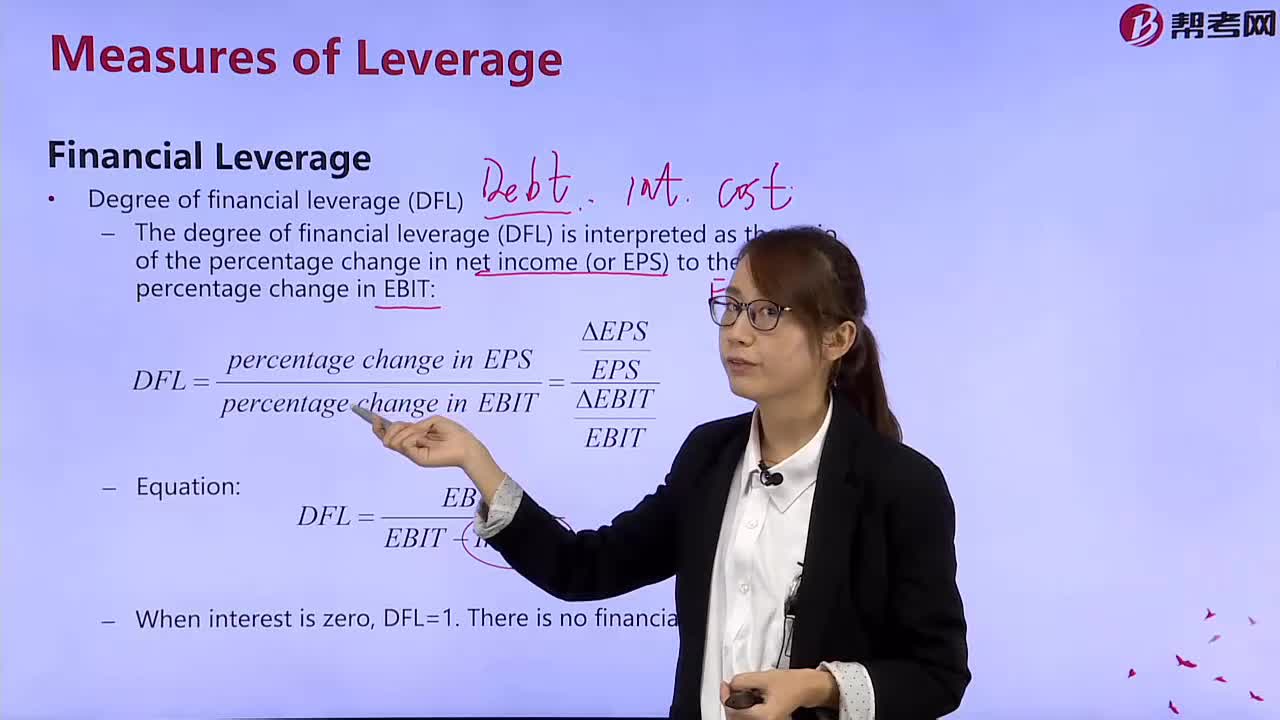

How to calculate the degree of financial leverage?

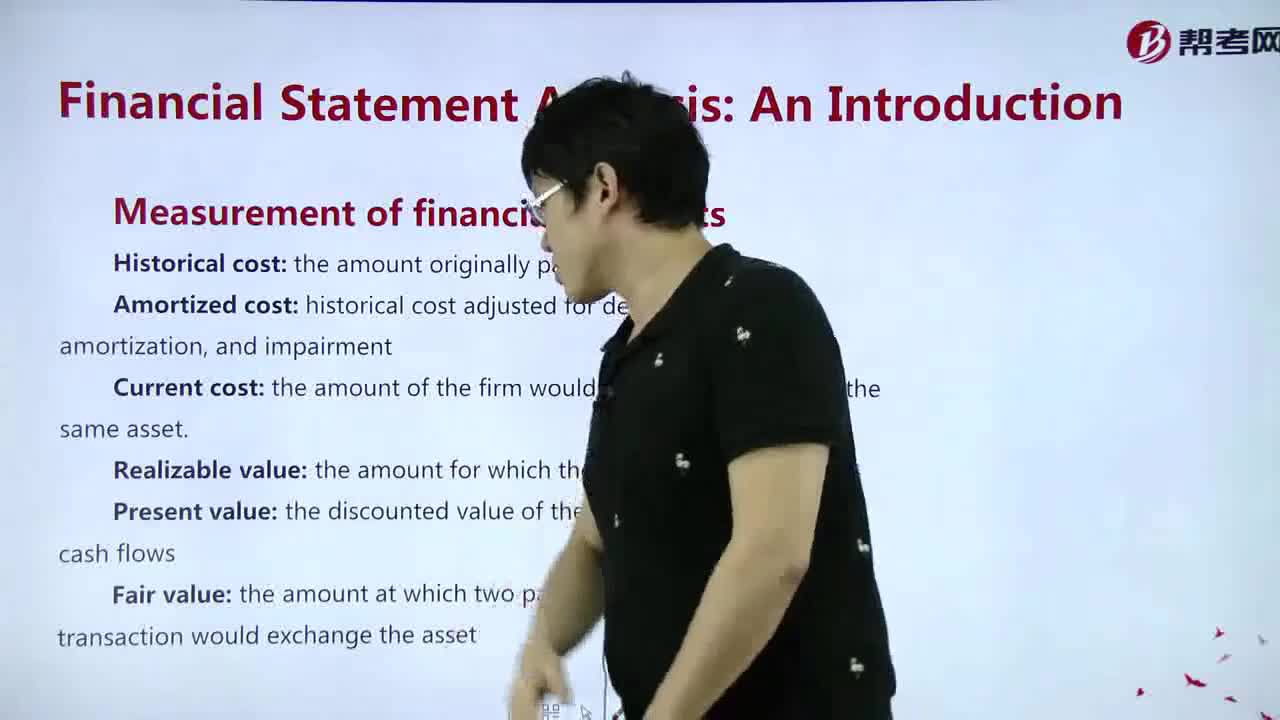

How to master Measurement of financial elements?

What's the Income Valuation-Yield Measure of Bond?

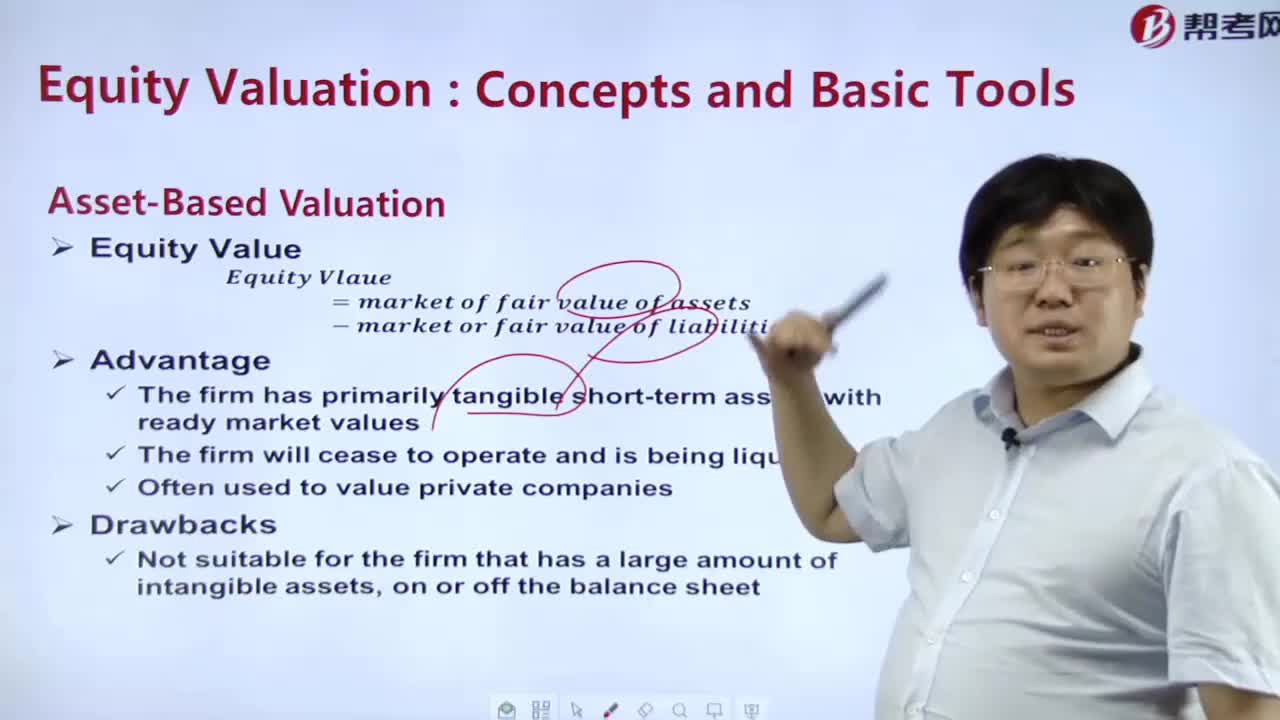

What does asset-based valuation include?

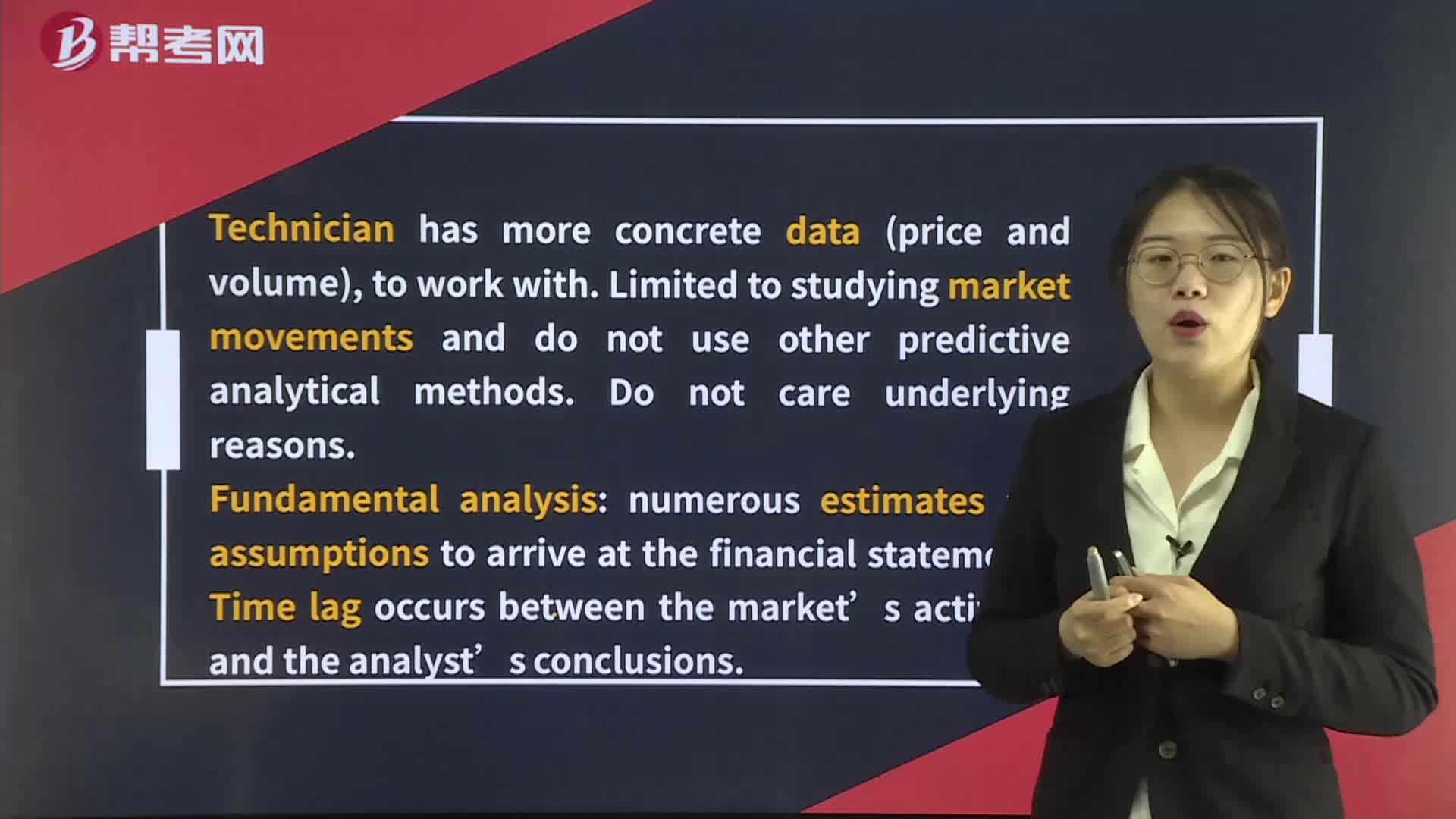

Technical and Fundamental Analysis

Technical Analysis

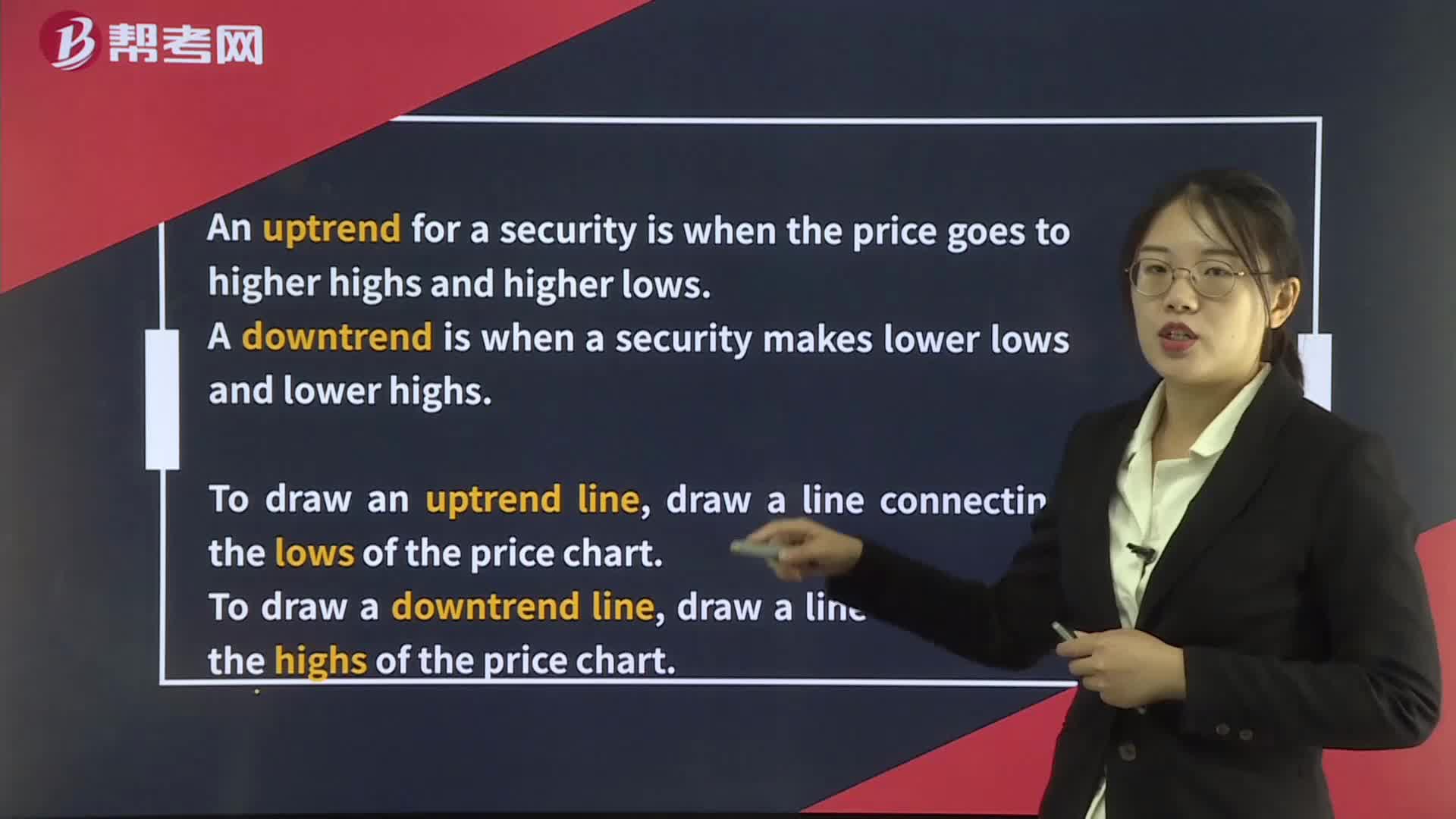

Technical Analysis Tools— Trend

Technical Analysis Tools— Cycles

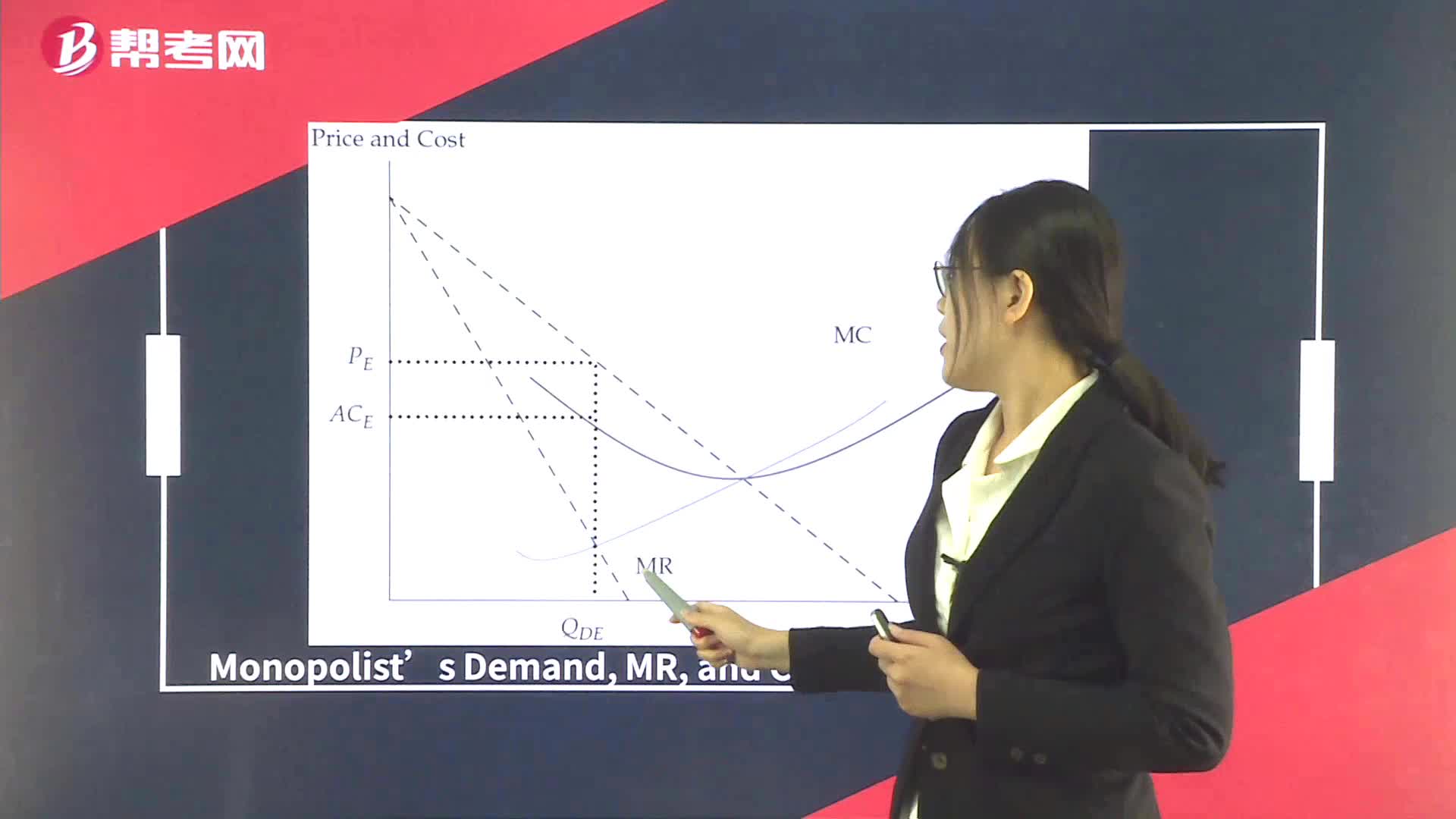

Supply Analysis in Monopoly

Technical Analysis Tools— Charts

Intermarket analysis

04:43

04:43

Statement of Changes in Equity:statement,in equity. The latter items may be shown separately or included in retained:capitalstockincomeconsolidated financial statements.

01:48

01:48

Scope of Financial Statement Analysis:creditorder to form expectations about its future performance and financial position.

03:29

03:29

Breakeven Analysis:but not positive economic profit.

00:54

00:54

Statement of Comprehensive Income:begins with profit or loss from the income statement.

04:00

04:00

Income Statement – Revenue, Other Income, Expenses:Other,Netprofit= Net income

01:32

01:32

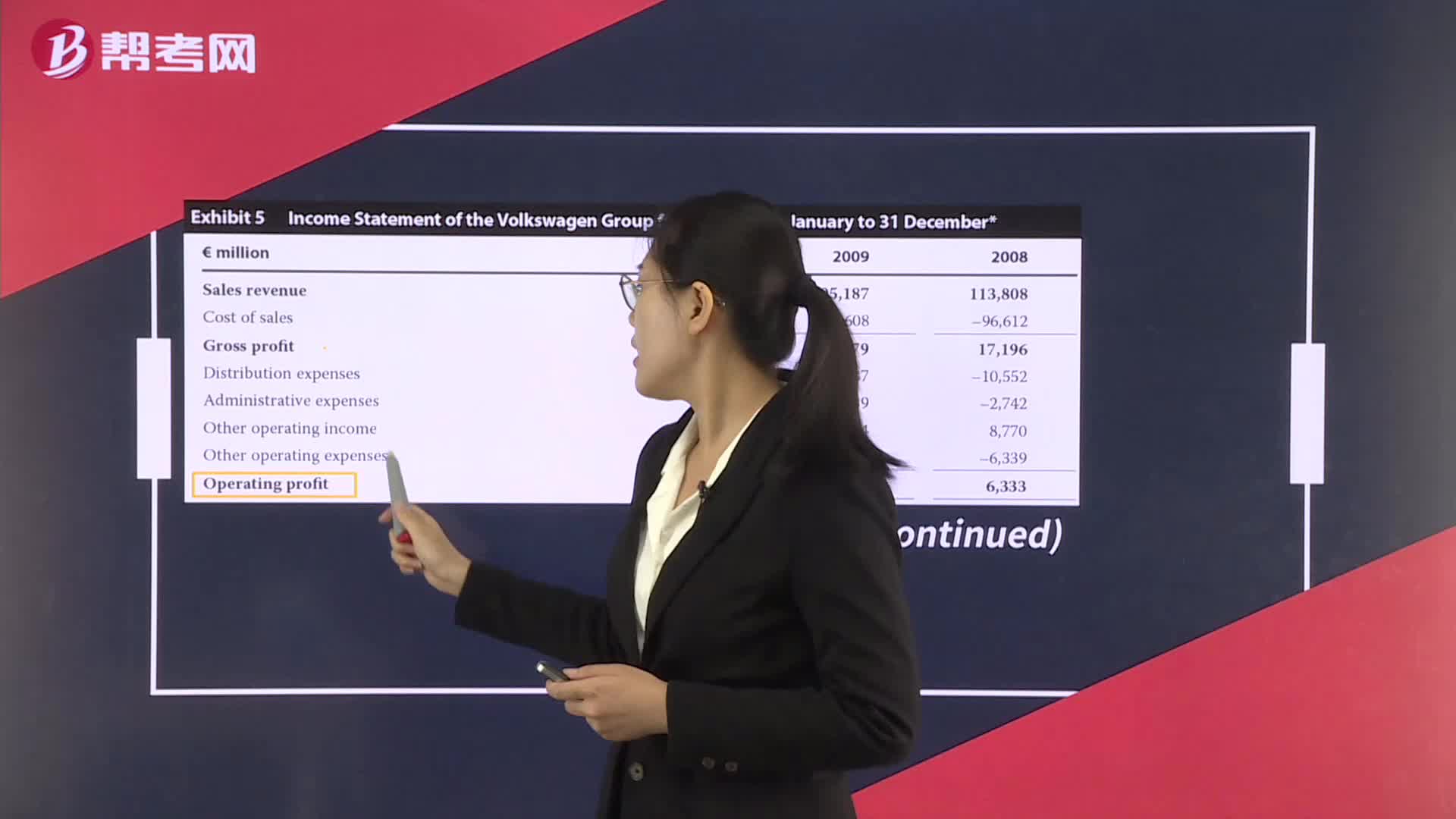

Income Statement– Operating Profit:and taxes EBIT.

05:07

05:07

Financial Notes and Supplementary Schedules:methodsoperating segments’ performance.

02:04

02:04

Examination of a Company’s Financial Position:comparing the resources controlled by the company assets in relation to the claims against those resources liabilities and equity.

07:16

07:16

Cash Flow Statement:Financial,Cash flows from operating activities are those cash flows not classified as:associated with the acquisition and disposal of long-term assetsstatementin cash during the fiscal year.

02:02

02:02

Demand Analysis in Monopoly:ARis the same as the market demand schedule.

04:14

04:14

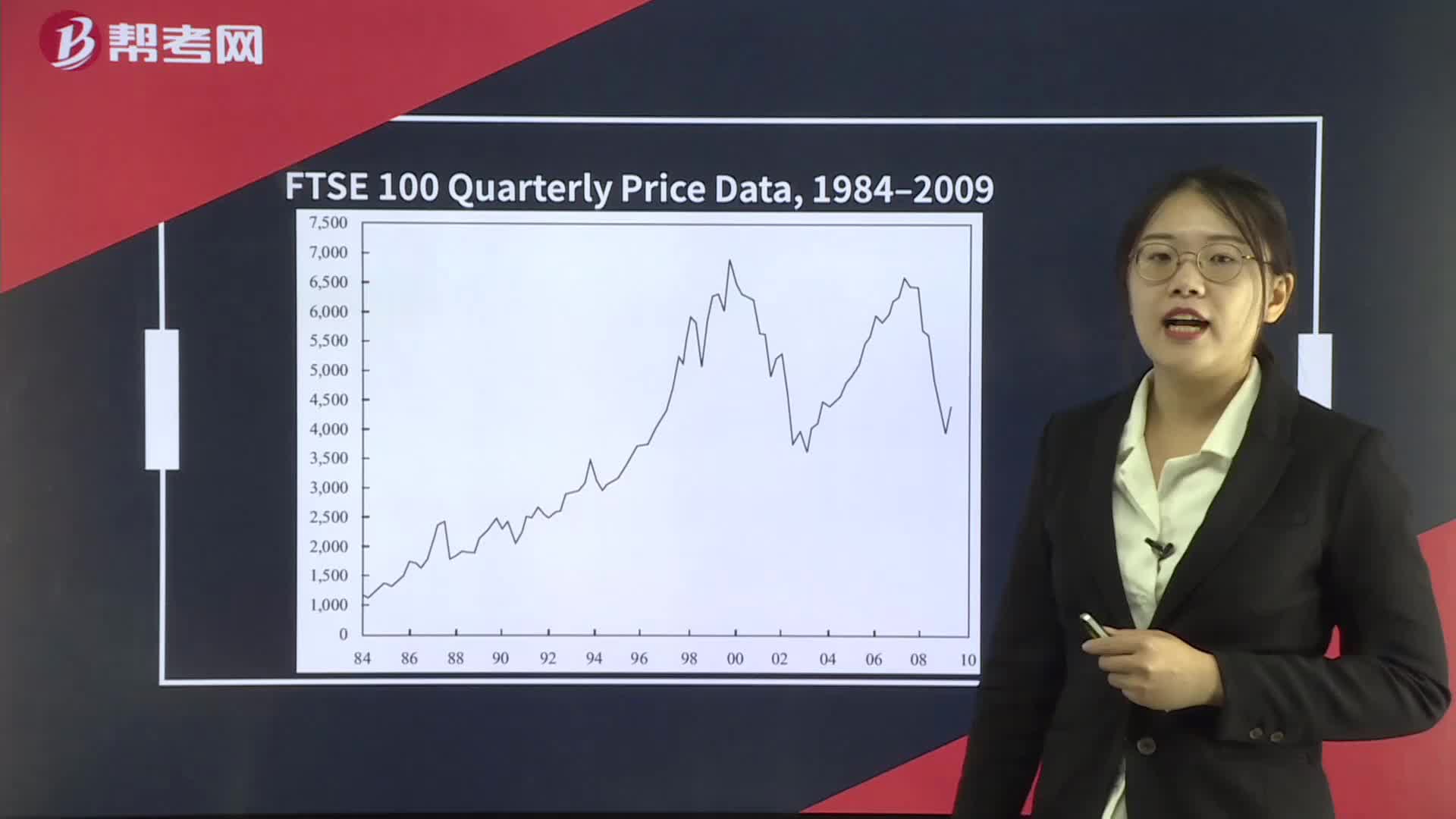

Technical Analysis Tools— Trend:line,draw a line connecting the highs of the price chart.:price.[PracticeLtd.price.Change

11:31

11:31

Technical Analysis:Technical:selling activity in a particular security.:appearsanalysisTechnicalanalysis

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日