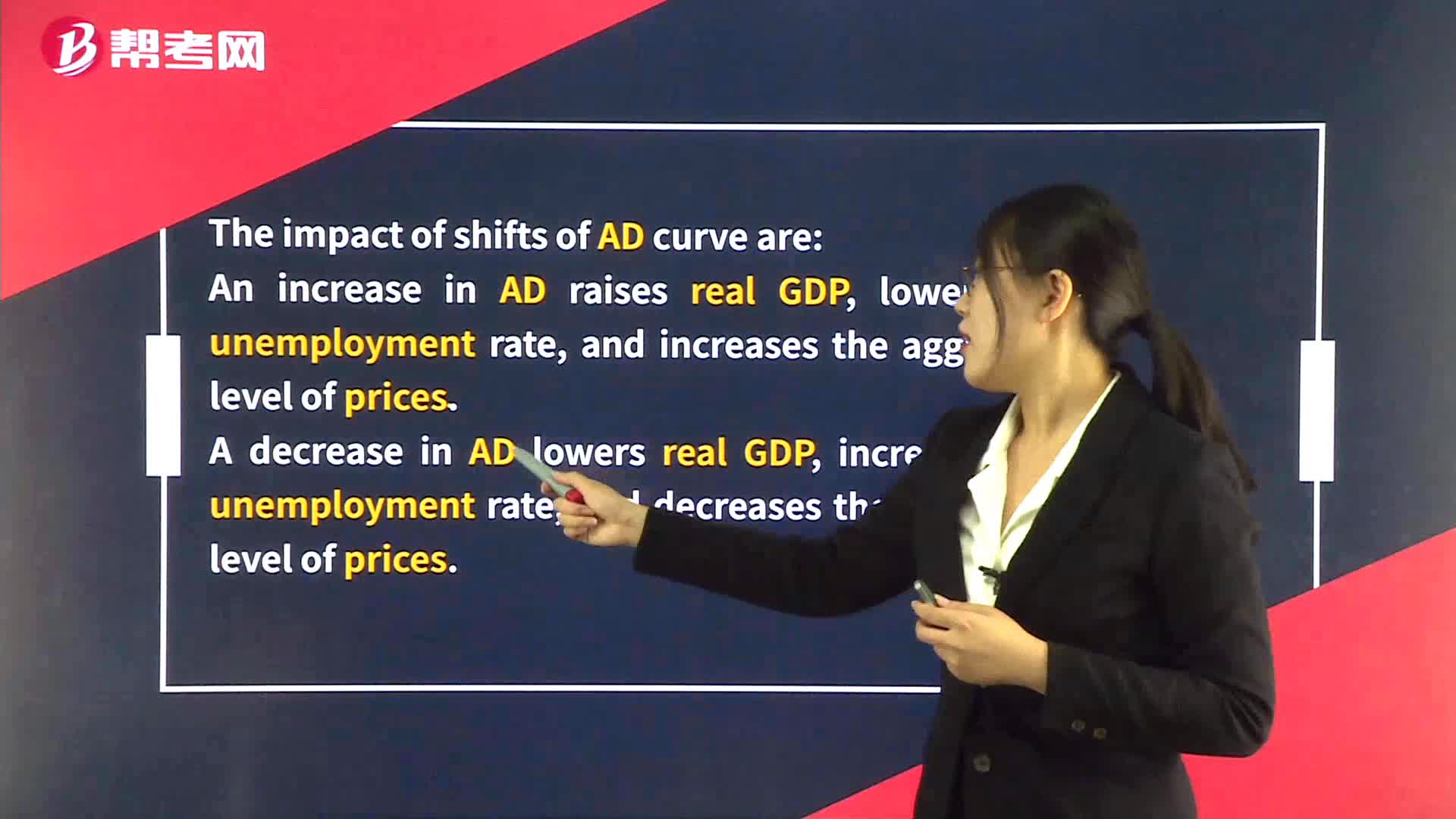

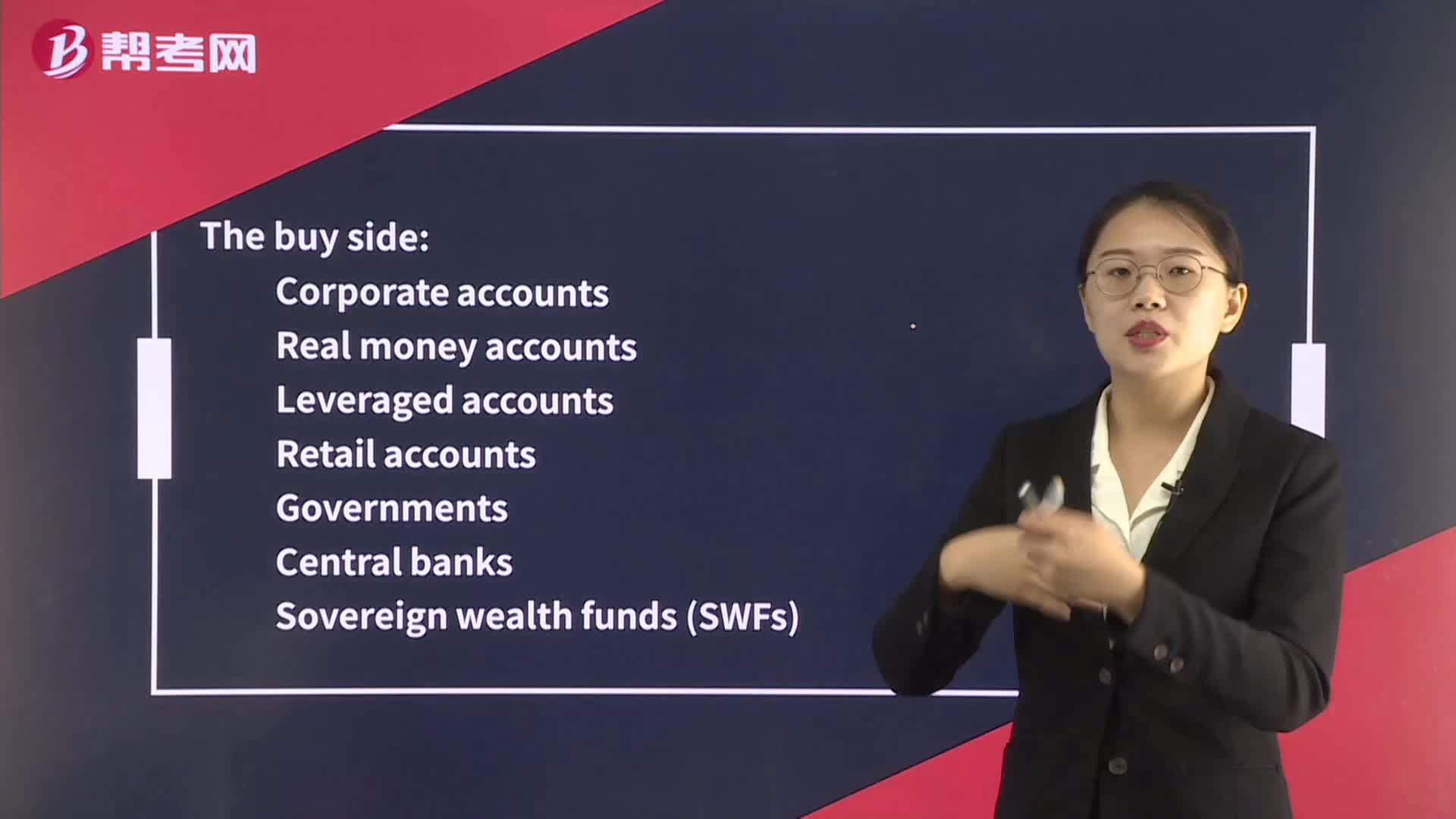

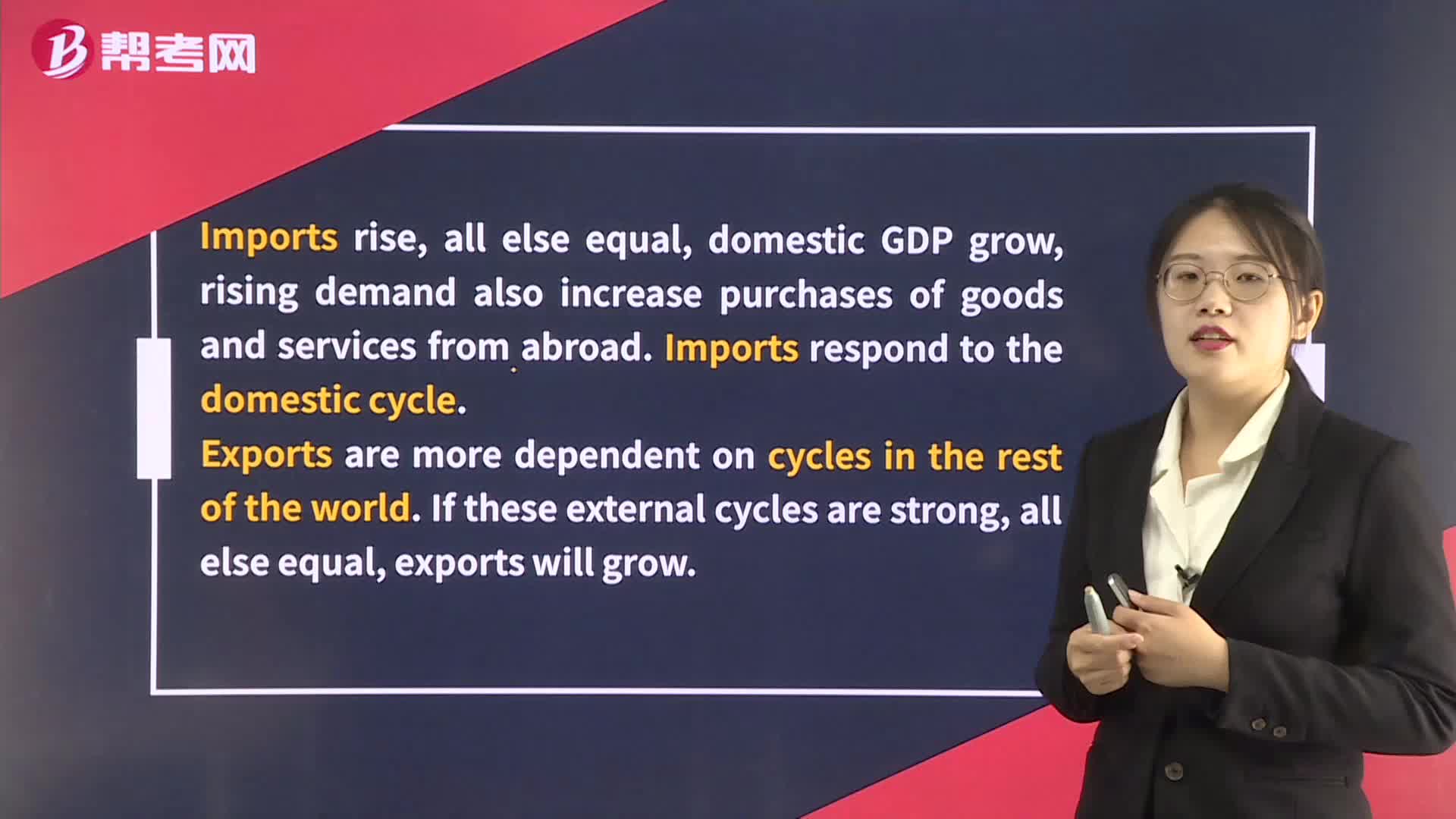

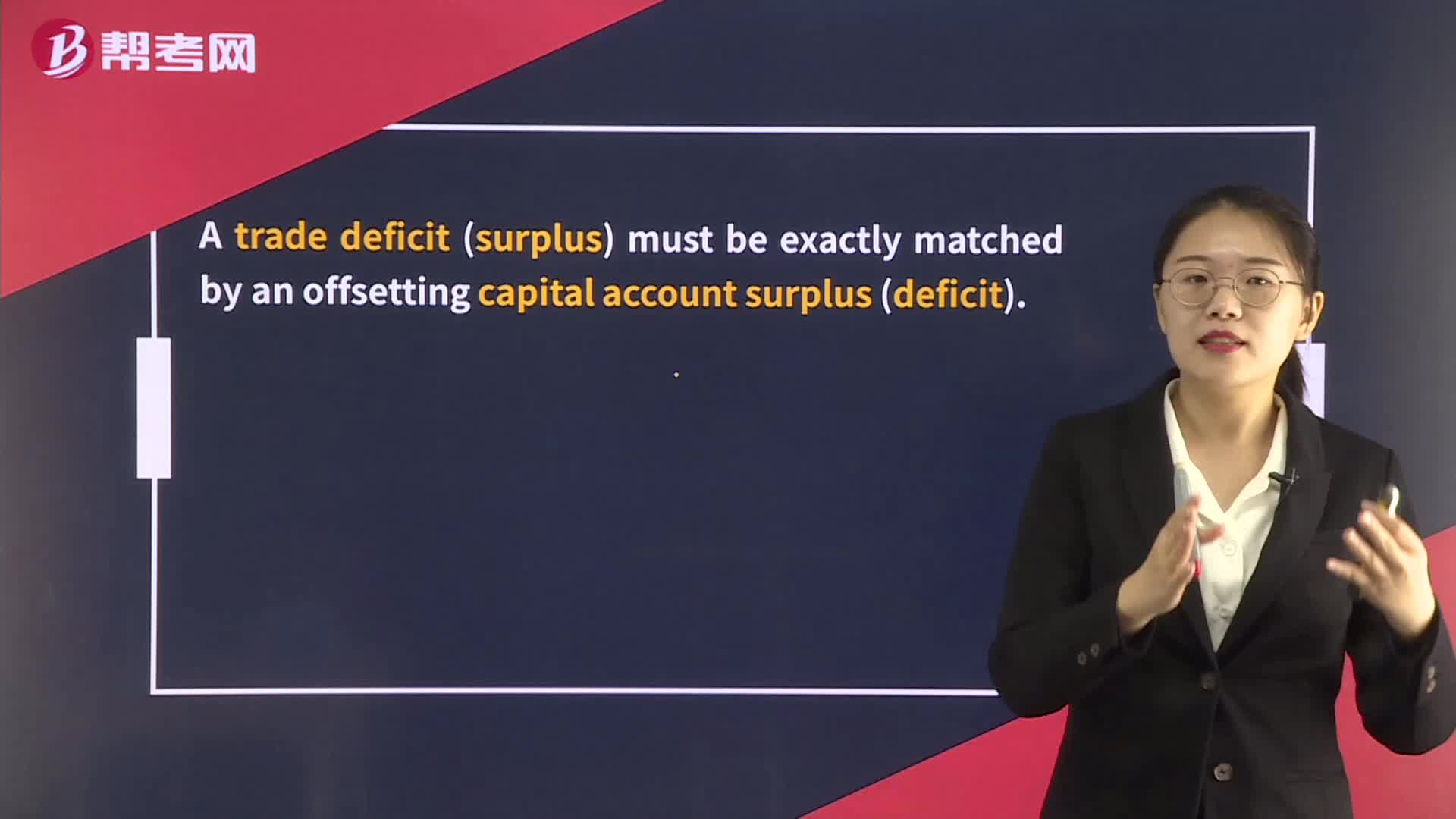

Exchange Rates, International Trade, and Capital Flows

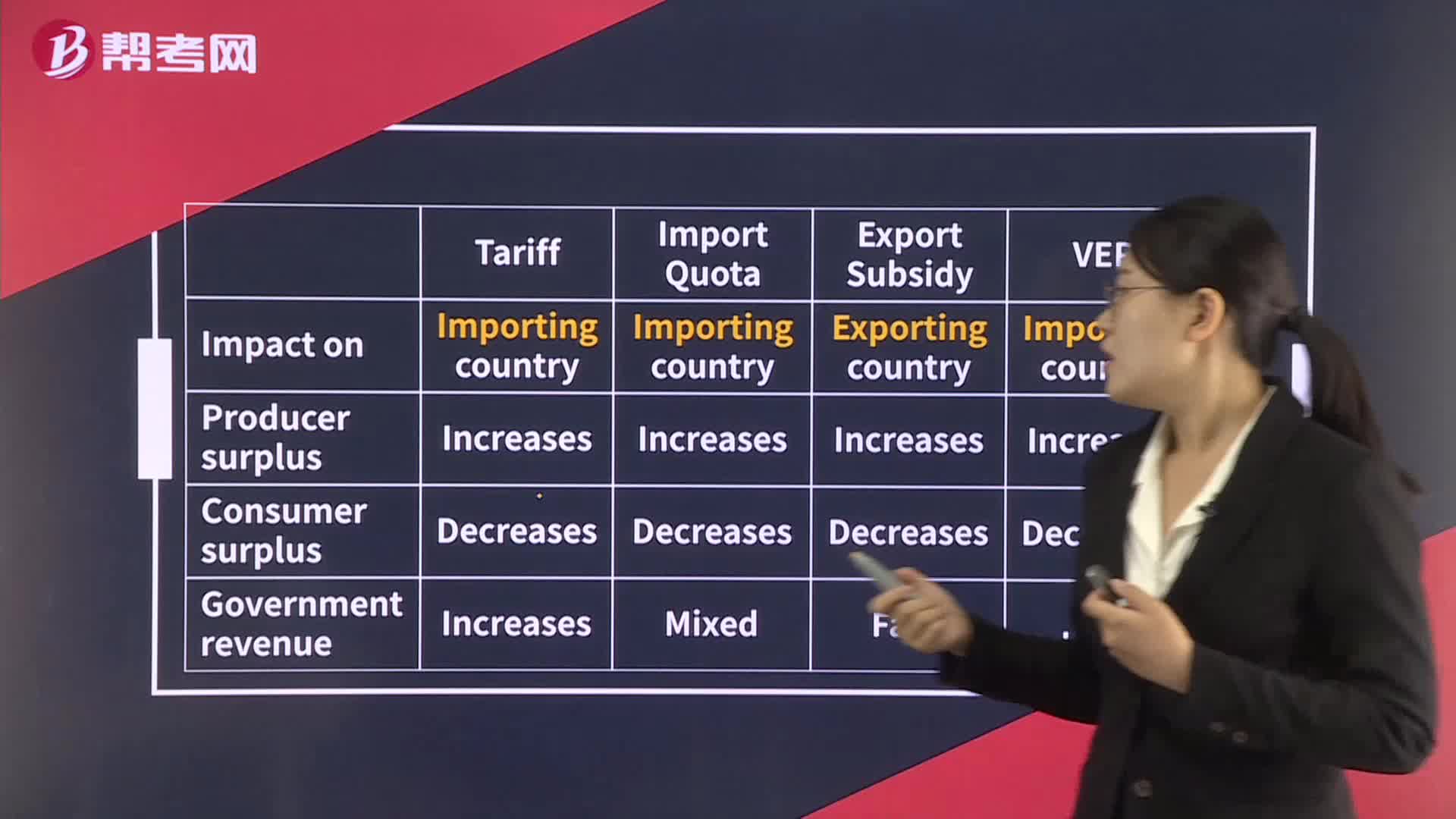

Effects of Alternative Trade Policies

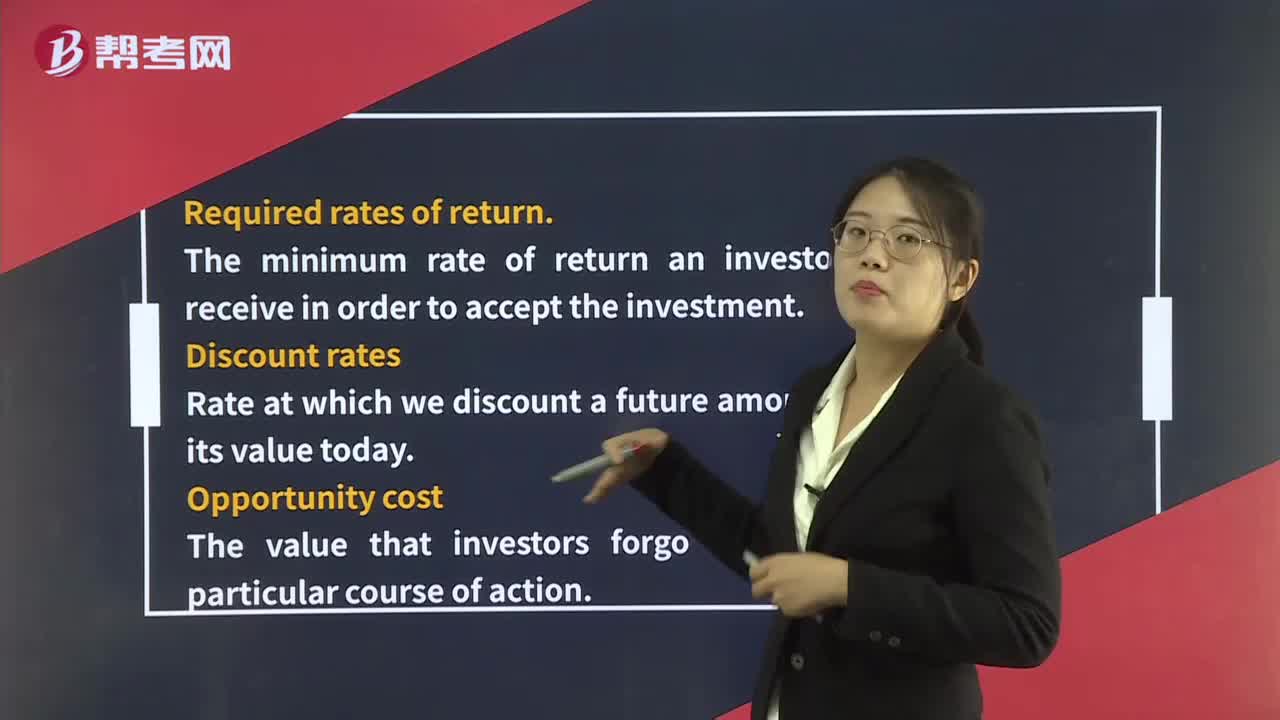

Interest Rates

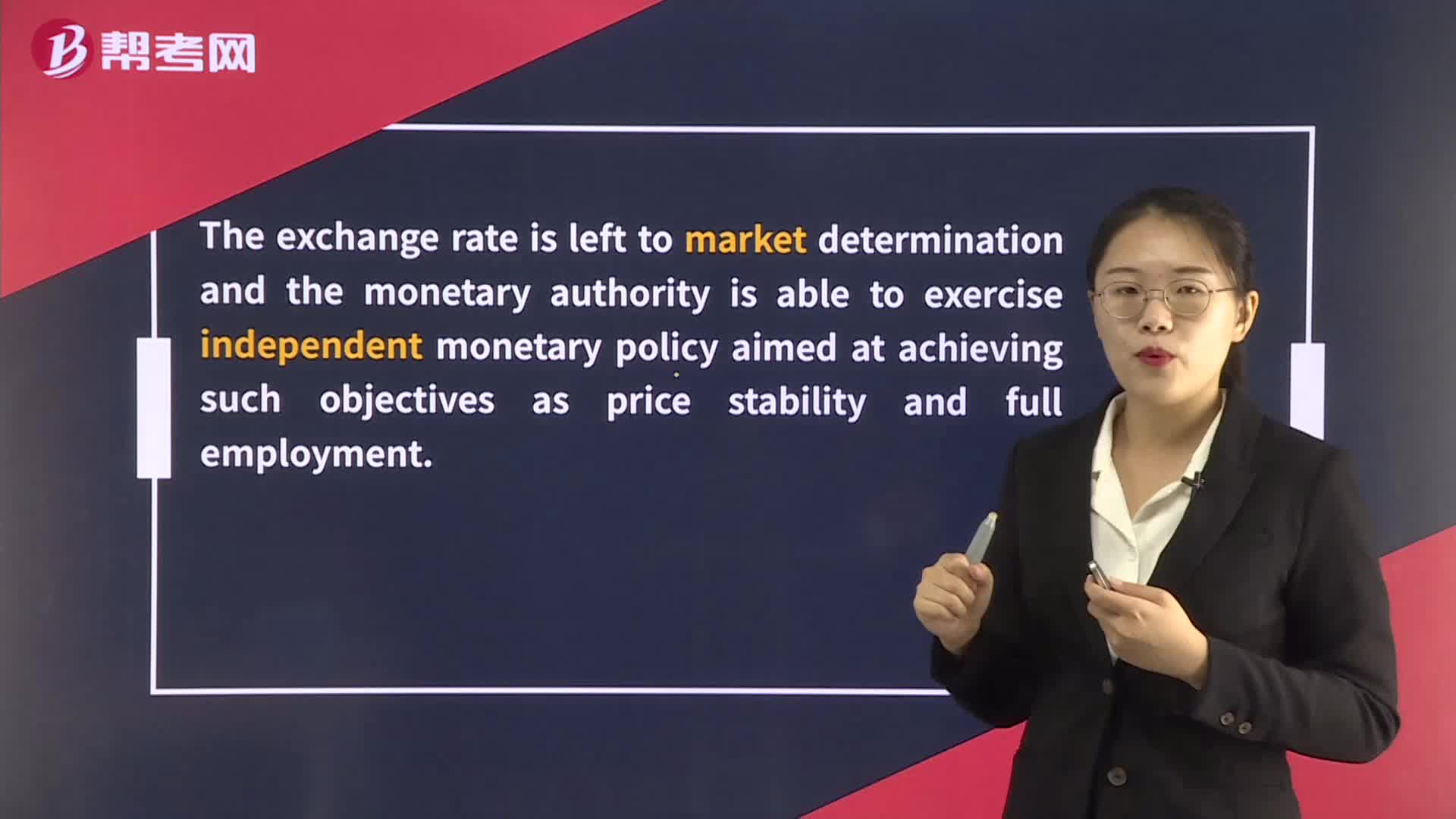

Currency Regimes – Independently Floating Rates

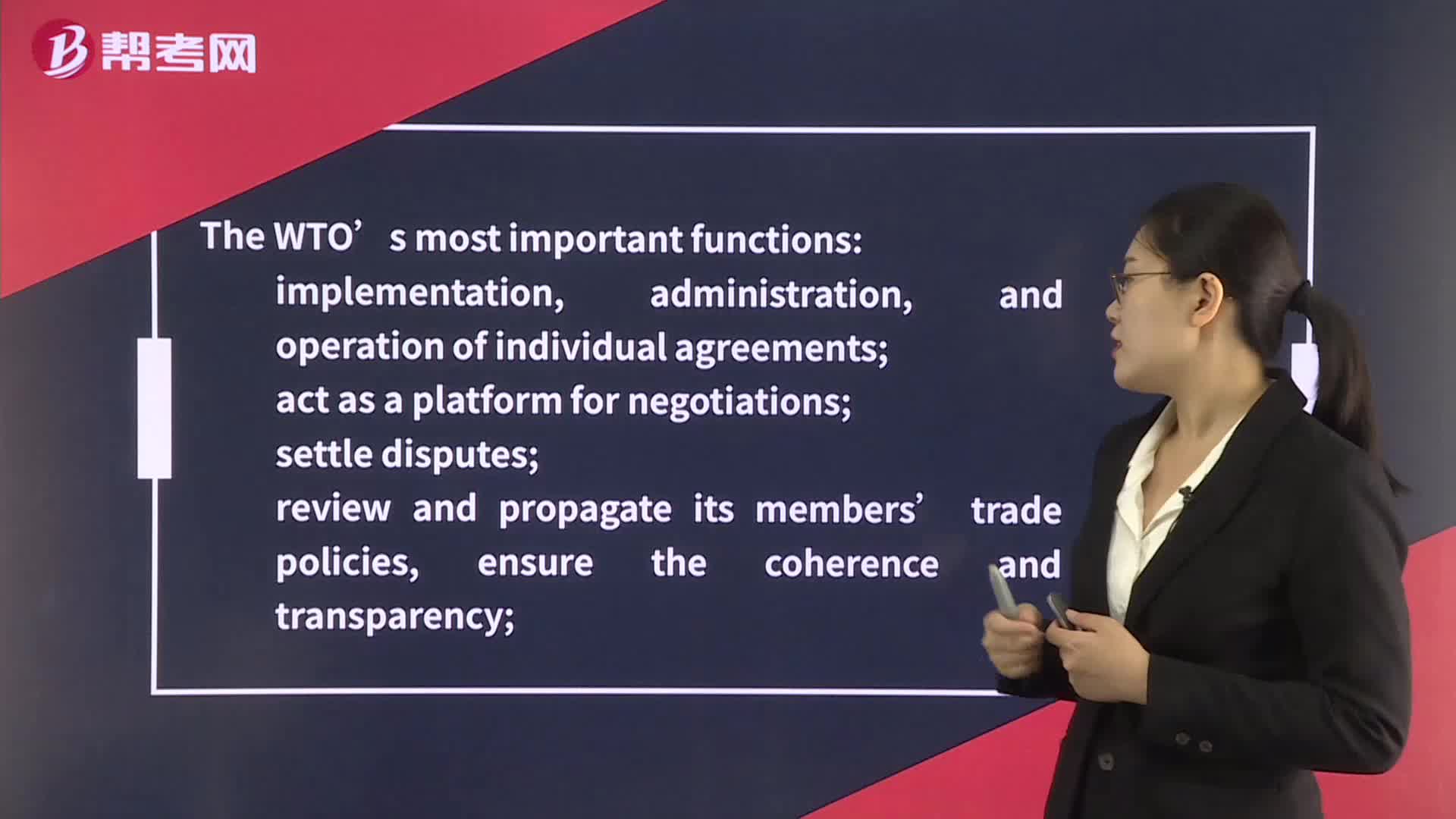

World Trade Organization

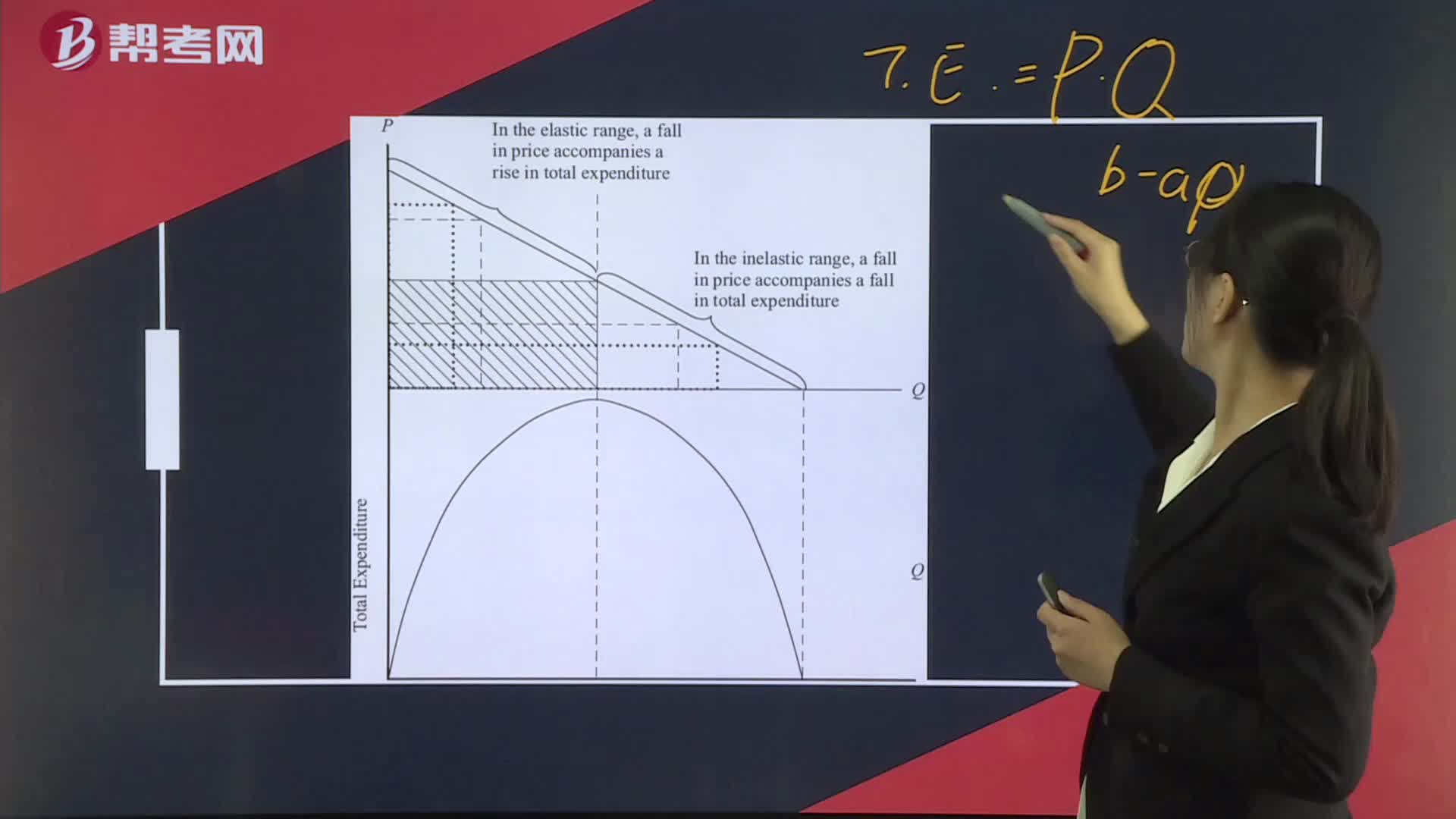

Elasticity and Total Expenditure

Trade Organizations

Absolute and Comparative Advantage

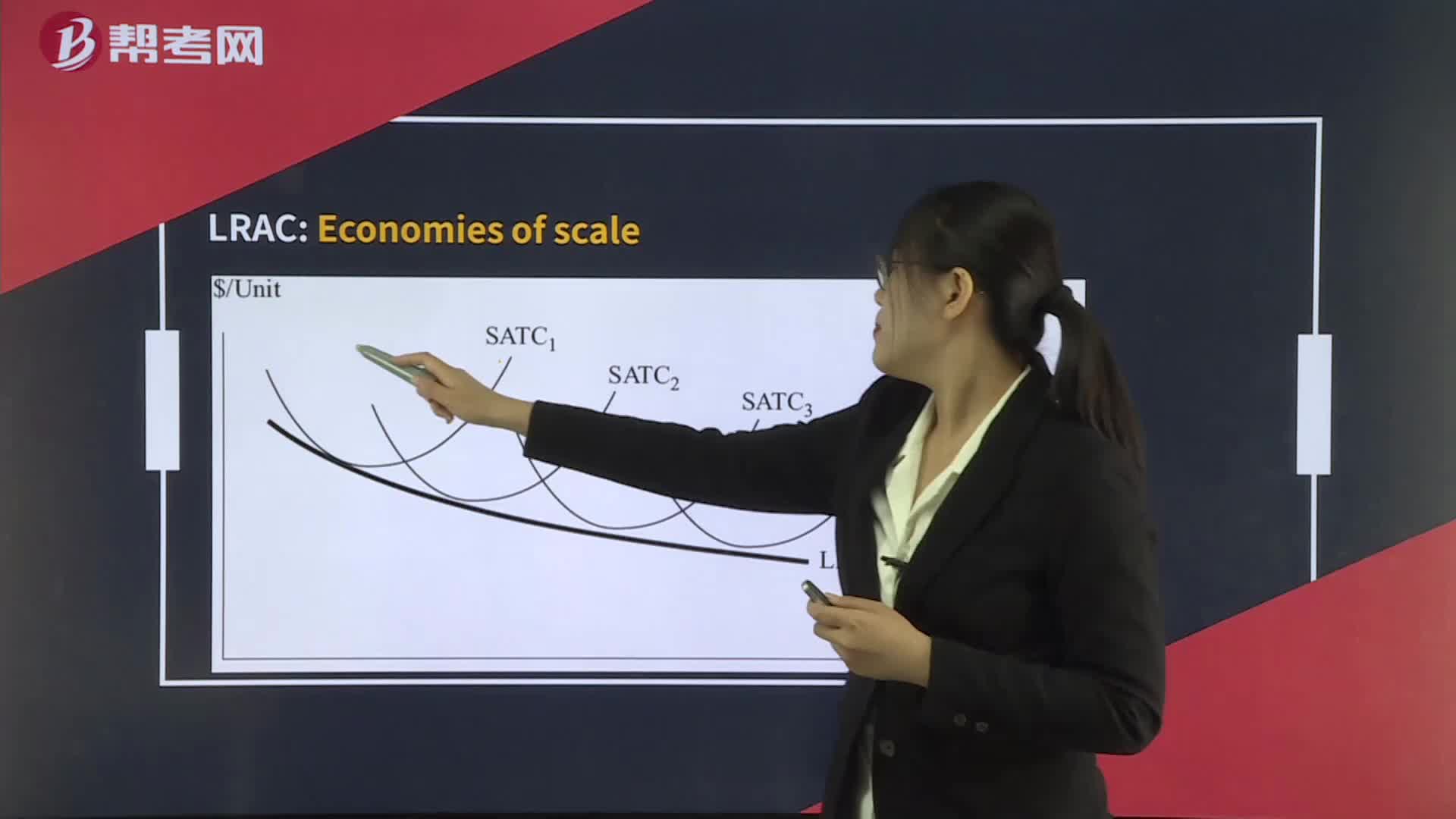

Economies of Scale and Diseconomies of Scale

International Monetary Fund

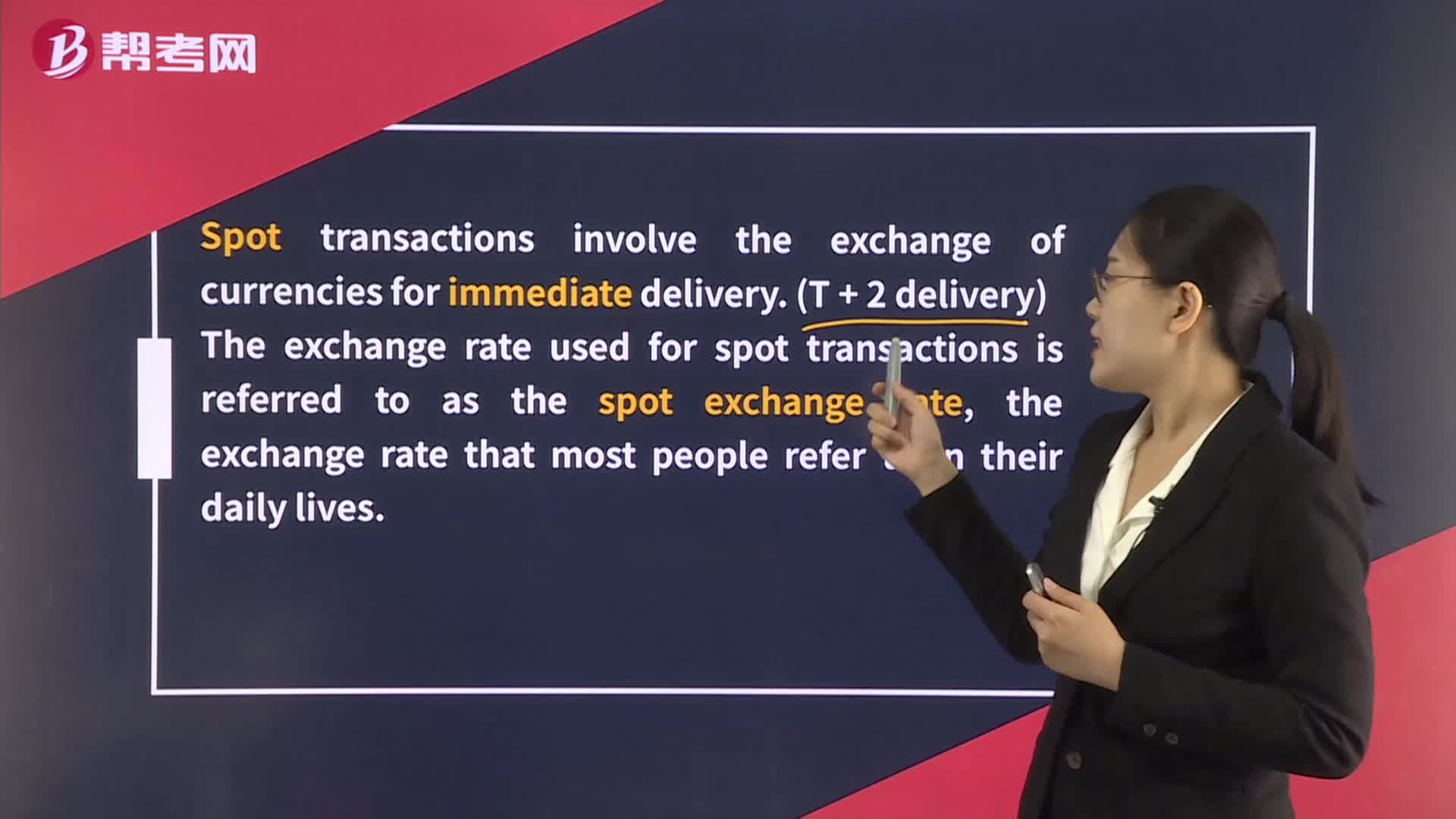

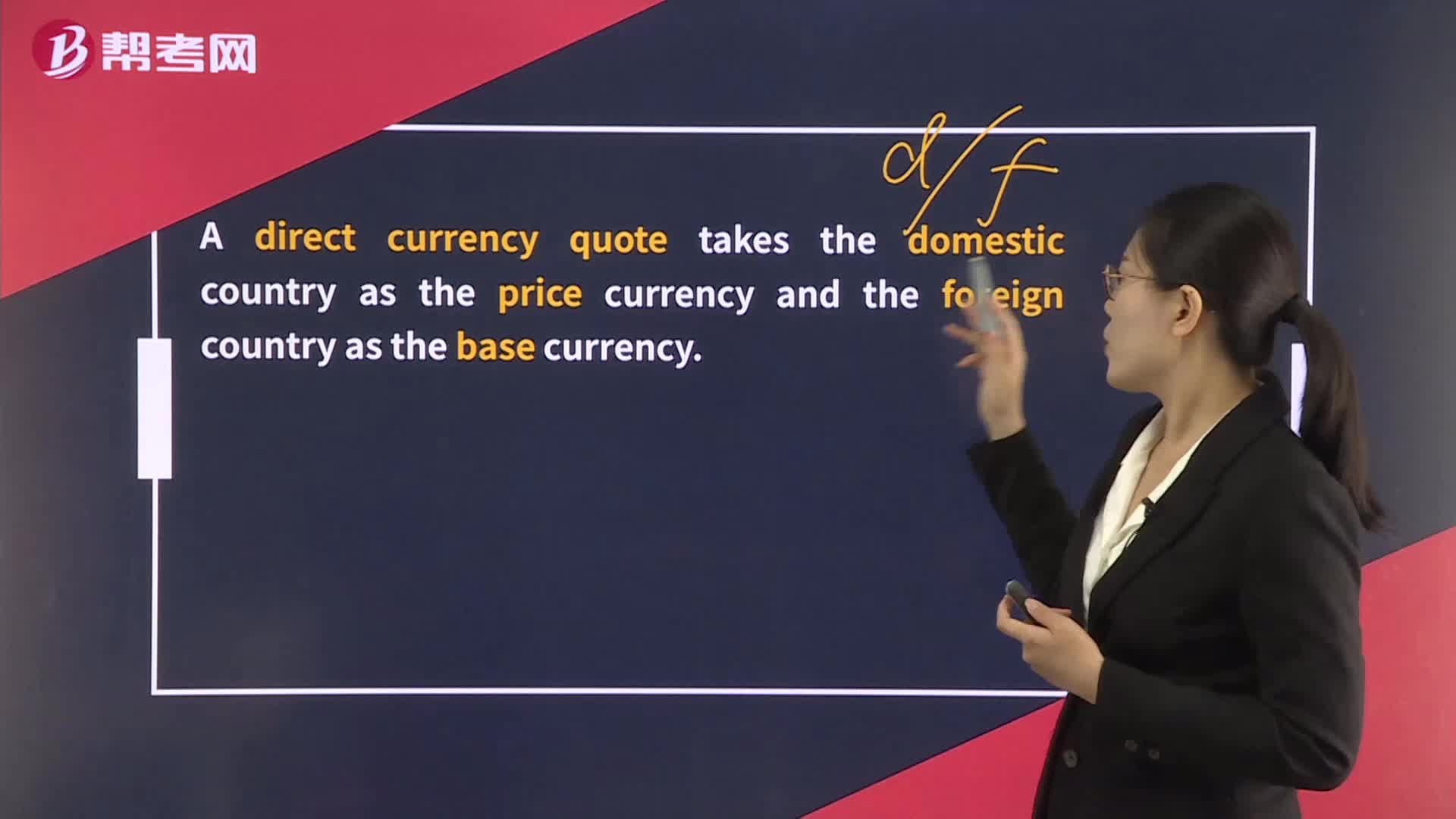

Nominal and Real Exchange Rates

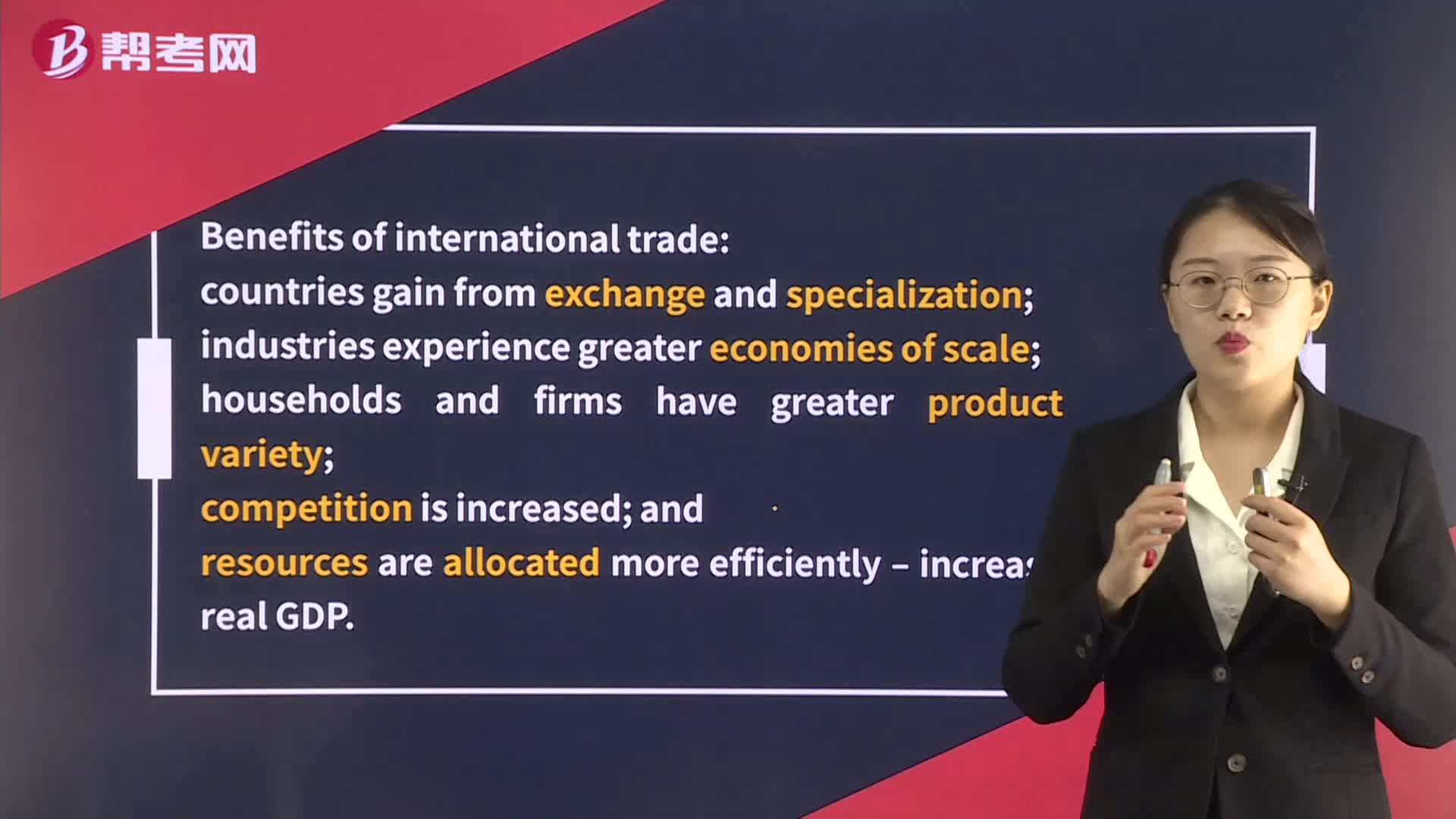

Benefits and Costs of International Trade

下载亿题库APP

联系电话:400-660-1360