下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

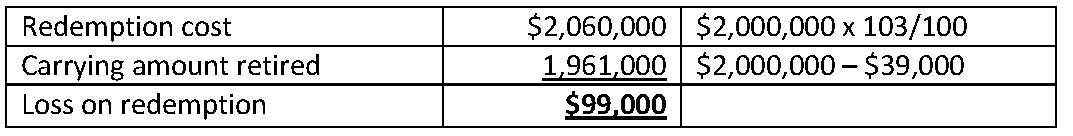

1、A company issued $2,000,000 of bonds with a 20 year maturity at 96. Seven years later, the company called the bonds at 103 when the unamortized discount was $39,000. The company would most likely report a loss of:【单选题】

A.$60,000.

B.$99,000.

C.$138,000.

正确答案:B

答案解析:“Non-Current (Long-term) Liabilities,” Elizabeth A. Gordon and Elaine Henry, CFA

2011 Modular Level I, Vol. 3, pp. 511-514

Study Session: 9-39-a, c

Determine the initial recognition and measurement and subsequent measurement of bonds.

Discuss the derecognition of debt.

2、An analyst does research about sampling and estimation and gathers the followinginformation about the performance of a sample of funds from each of three differentcategories of mutual funds:

The smallest standard error of the sample mean is associated with the samplefrom:【单选题】

A.Category 1.

B.Category 2.

C.Category 3.

正确答案:B

答案解析:样本均值的标准误差 = 总体标准误差(Population Standard Deviation)/。代入已知数据,可计算出3个项目的标准误差分别为2.37%、2.26%和2.36%,所以标准误差最小的是第2个项目。

3、Which of the following is least likely to be directly reflected in the returns on a commodity index?【单选题】

A.Roll yield

B.Changes in the spot prices of underlying commodities

C.Changes in the futures prices of commodities in the index

正确答案:B

答案解析:“Security Market Indices,” Paul D. Kaplan and Dorothy C. Kelly

2012 Modular Level I, Vol. 5, p. 109–110

Study Session 13-48-j

Discuss indices representing alternative investments.

B is correct. Commodity index returns reflect the changes in future prices and the roll yield. Changes in the underlying commodity spot prices are not reflected in a commodity index.

4、When comparing investing in exchanged traded funds (ETFs) to investing in open-end mutual funds, which of these is most likely not an advantage of ETFs? ETFs:【单选题】

A.provide lower exposure to taxes related to capital gains distribution.

B.trade throughout the entire trading day at market prices that are continuously updated.

C.are a more cost effective way for large institutional investors to invest in less liquid markets.

正确答案:C

答案解析:“Alternative Investments,” Bruno Solnik and Dennis McLeavey

2010 Modular Level I, Vol. 6, pp. 195-197

Study Session 18-73-b,c

Distinguish among style, sector, index, global, and stable value strategies in equity investment and among exchange traded funds (ETFs), traditional mutual funds, and closed end funds.

Explain the advantages and risks of ETFs.

Some sector and international ETFs have large bid-ask spreads and substantial expense ratios compared to managed portfolios, which may provide a more cost efficient alternative to ETFs, particularly for large institutional investors.

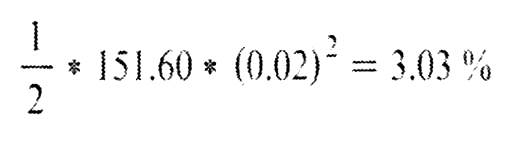

5、The duration and convexity of an option-free bond priced at $90.25 are 10.34 and 151.60,respectively. If yields increase by 200 bps, the percentage price change is closest to:【单选题】

A.-23.71%.

B.-17.65%.

C.-20.68%.

正确答案:B

答案解析:It is calculated as duration effect:

-10.34 * (+0.02)=-20.68%

and convexity effect:

Total perentage change is the sum of duration effect and convexity effect:

-20.68%+3.03%=-17.65%.

CFA Level I

"Understanding Fixed-Income Risk and Return," by James F. Adams and Donald J. Smith

Sections 3.5-3.6

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料