下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、Companies pursuing cost leadership will most likely:【单选题】

A.invest in productivity-improving capital equipment.

B.engage in defensive pricing when the competitive environment is one of high rivalry.

C.establish strong market research teams to match customer needs with product development.

正确答案:A

答案解析:“Introduction to Industry and Company Analysis,” Patrick W. Dorsey, Anthony M. Fiore, and Ian Rossa O’Reilly

2012 Modular Level I, Vol. 5, pp. 250–251

Study Session 14-51-k

Describe the elements that should be covered in a thorough company analysis.

A is correct. Companies pursuing cost leadership must be able to invest in productivity-improving capital equipment in order to be low-cost producers and maintain efficient operating systems.

2、In setting the confidence interval for the population mean of a normal or approximately normal distribution and given that the sample size is small, Student’s t-distribution is the preferred approach when the variance is:【单选题】

A.large.

B.known.

C.unknown.

正确答案:C

答案解析:“Sampling and Estimation,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 10, Section 4.2, Table 3

Study Session 3-10-i

Describe the properties of Student’s t-distribution and calculate and interpret its degrees of freedom.

C is correct. When the sample size is small, the Student’s t-distribution is preferred if the variance is unknown.

3、A company issued shares to acquire a large tract of undeveloped land for future development. The most likely recording of this transaction in the cash flow statement is as a(n):【单选题】

A.disclosure in a note or supplementary schedule.

B.outflow from investing activities, and an inflow from financing activities.

C.outflow from operating activities, and an inflow from financing activities.

正确答案:A

答案解析:“Understanding the Cash Flow Statement,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, R. Elaine Henry, CFA and Michael A. Broihahn, CFA

2010 Modular Level 1, Vol. 3, p. 254

Study Session 8-34-b

Describe how noncash investing and financing activities are reported.

Non-cash transactions are not reported in the cash flow statement but if they are significant they are reported in a note or supplementary schedule.

4、Under IFRS, which of the following financial statement elements most accurately represents inflows of economic resources to a company?【单选题】

A.Assets.

B.Equity.

C.Revenues.

正确答案:C

答案解析:"Financial Reporting Mechanics," Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Karen O'Connor Rubsam, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2011 Modular Level I, Vol.3, pp.35-36, 39

Study Session: 7-30-a

Explain the relationship of financial statement elements and accounts, and classify accounts into the financial statement elements.

The financial statement elements under International Financial Reporting Standards (IFRS) are: Assets, Liabilities, Owners’ Equity, Revenue, and Expenses. Revenues are inflows of economic resources. Assets are economic resources, but not inflows.

5、A firm’s estimated costs of debt, preferred stock, and common stock are 12%, 17%, and 20%, respectively. Assuming equal funding from each source and a 40% tax rate, the weighted average cost of capital is closest to:【单选题】

A.13.9%.

B.14.7%.

C.16.3%.

正确答案:B

答案解析:“Cost of Capital,” Yves Courtois, Gene C. Lai, and Pamela Peterson Drake

2012 Modular Level I, Vol. 4, pp. 41–42

Study Session 11-37-a, b

Calculate and interpret the weighted average cost of capital (WACC) of a company.

Describe how taxes affect the cost of capital from different capital sources.

B is correct:

6、An investor does research about margin transaction and gathers the followinginformation about the purchase of 1 000 shares on the margin in which maximumamount allowed is borrowed.The purchase price is $ 18.50 and the initialmargin requirement is 45%.The annual margin interest rate is 8.5%.Thecommission on purchase and sale is $ 35.One year later, the investor receivesa dividend of $ 0.40 per share sells the shares for $ 26.50 per share.The rateof return on margin transaction is closest to:【单选题】

A.80.1%

B.89.7%

C.90.1%

正确答案:B

答案解析:( $26.50 × 1 000 - $ 18.50 × 1 000 × 0.45 - $ 18.50 × 1 000 × 0.55 + $ 0.40 × 1 000 - $ 18.50× 1 000 × 0.55 × 8.5% - $ 35)/( $ 18.50 × 1 000 × 0.45 + $ 35) =(26 500 - $ 8 325 - $ 10 175+ $ 400 - $ 864.875 - $ 35)/( $ 8 325 + $ 35) =89.7%。

7、In a three-step process for converting cash flow from the indirect to directpresentation, which of the following statements is most accurate? The last stepin the process is to:【单选题】

A.aggregate all revenues and all expenses.

B.convert accrual amounts to cash flow amounts by adjusting for working capitalchanges.

C.remove all noncash items from aggregated revenues and expenses and breakout remaining items into relevant cash flow items.

正确答案:B

答案解析:现金流量表从间接法调整为直接法共分为以下3步:

(1) 加总所有收入和所有费用。

(2) 将非现金项目从总收入和总费用中移除,拆分剩余的项目到相关的现金流项目中。

(3) 通过调整营运资金将应计的数量转变为现金流量。

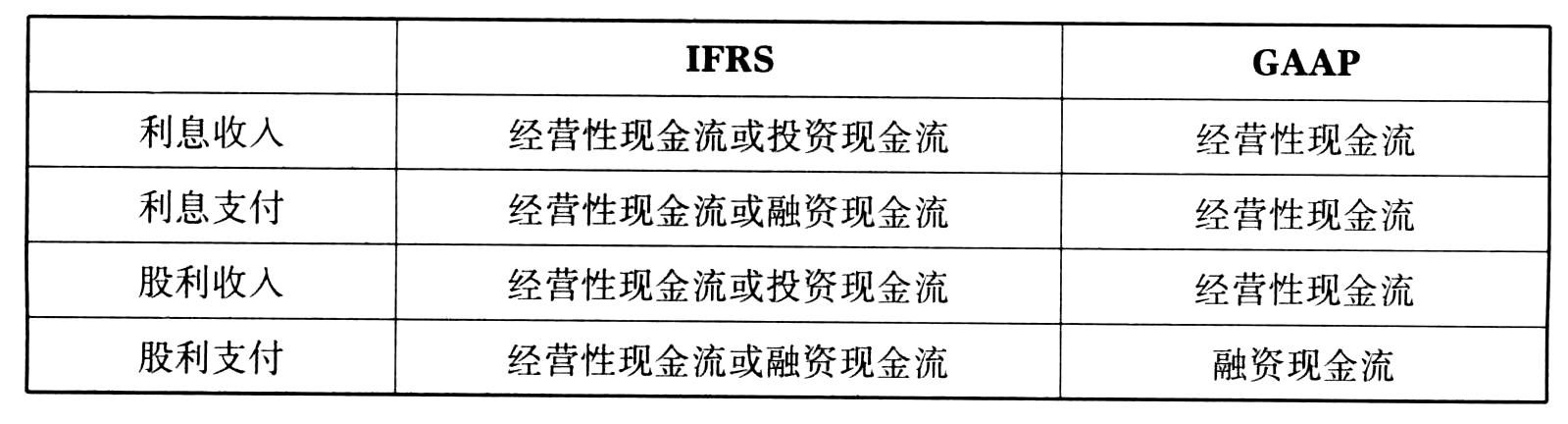

8、An analyst does research about the difference between International FinancialReporting Standards (IFRS) and U.S.generally accepted accounting principles(GAAP).With respect to the classification of interests received on the statementof cash flows, U.S.GAAP is:【单选题】

A.less flexible than IFRS.

B.equally flexible as IFRS.

C.more flexible than IFRS.

正确答案:A

答案解析:IFRS中允许股利分红记在运营现金流或者融资现金流中,而GAAP只允许其分类为融资现金流。

GAAP和IFRS体现在现金流量表中的差异如下:

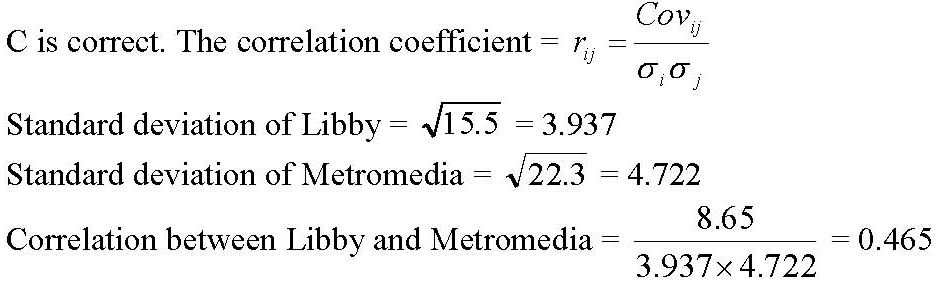

9、An analyst gathered the following information about two common stocks:

·Variance of returns for the Libby Company = 15.5

·Variance of returns for the Metromedia Company = 22.3

·Covariance between returns of Libby Company and Metromedia Company =

8.65

The correlation coefficient between returns for the two common stocks is closest

to:【单选题】

A.0.025.

B.0.388.

C.0.465.

正确答案:C

答案解析:“An Introduction to Portfolio Management,” Frank K. Reilly and Keith C. Brown

2010 Modular Level I, Vol. 4, pp. 248-249

Study Session 12-50-d

Compute and interpret the covariance of rates of return, and show how it is related

to the correlation coefficient.

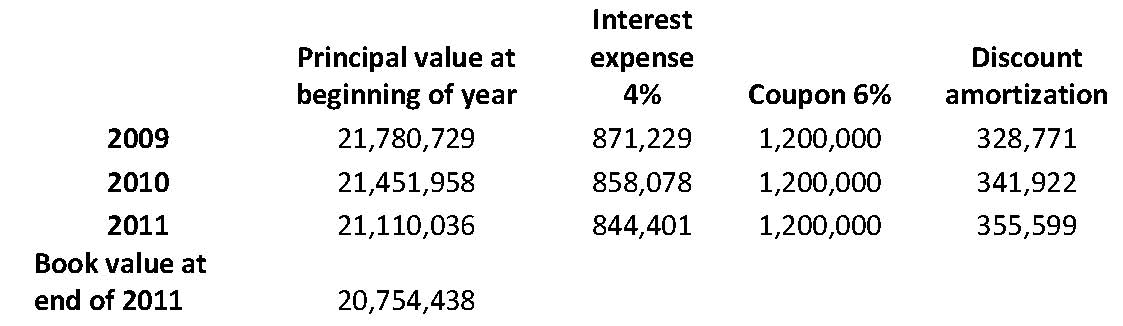

10、On 1 January 2009, a company that prepares its financial statements according to IFRS issued bonds with the following features:

·Face value £20,000,000

· Term 5 years

· Coupon rate 6% paid annually on December 31

· Market rate at issue 4%

The company did not elect to carry the bonds at fair value. In December 2011 the market rate on similar bonds had increased to 5% and the company decided to buy back (retire) the bonds after the coupon payment on December 31. As a result, the gain on retirement reported on the 2011 statement of income is closest to:【单选题】

A.£340,410.

B.£371,882.

C.£382,556.

正确答案:C

答案解析:“Non-Current (Long-Term) Liabilities,” Elizabeth A. Gordon and Elaine Henry

2012 Modular Level I, Vol. 3, pp. 537, 539–540, 544

Study Session 9-32-c

Explain the derecognition of debt.

C is correct.

Gain =Book value of debt – Market value both at time of retirement, calculations20,754,438 – 20,371,882 = 382,556 below

The market value of debt at retirement can be determined by discounting the future cash flows at the current market rate (5%) using a financial calculator:

FV = 20,000,000; i = 5%; PMT = 1,200,000; N = 2; Compute PV = 20,371,882

The book value after the third interest payment (two payments remaining) can be found either using a financial calculator and the market rate at the time of issue (4%) or an amortization table (shown below).

FV = 20,000,000; i = 4%; PMT = 1,200,000; N = 2; Compute PV = 20,754,438.

The bond’s initial value (required for amortization) can be found using a financial calculator:

FV = 20,000,000; i = 4%; PMT = 1,200,000; N = 5; Compute PV = 21,780,729.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料