下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、William Wong, CFA, is an equity analyst with Hayswick Securities. Based on his fundamental analysis, Wong concludes the stock of a company he follows, Nolvec Inc., is substantially undervalued and will experience a large price increase. He delays revising his recommendation on the stock from “hold” to “buy” to allow his brother to buy shares at a lower price. Wong is least likely to have violated the CFA Institute Standards of Professional Conduct related to:【单选题】

A.duty to clients.

B.reasonable basis.

C.priority of transactions.

正确答案:B

答案解析:“Guidance for Standards I-VII”, CFA Institute

2010 Modular Level I, Vol. 1, pp. 48-50, 80-81, 94-95

Study Session 1-2-a

Demonstrate a thorough knowledge of the Code of Ethics and Standards of Professional Conduct by applying the Code and Standards to situations involving issues of professional integrity.

B is correct because there is nothing to suggest that Wong does not have a reasonable basis for his conclusion related to Nolvec. Standard V (A).

2、Tamlorn Mager, CFA, is an analyst at Pyallup Portfolio Management. CFA Institute recently notified Mager that his CFA Institute membership was suspended for a year because he violated the CFA Code of Ethics. A hearing panel also came to the same conclusion. Mager subsequently notified CFA Institute he does not accept the sanction, or the hearing panel’s conclusion. Which of the following actions by Mager is most consistent with the CFA Institute Professional Conduct Program?【单选题】

A.Presenting himself to the public as a CFA charterholder

B.Providing evidence for his position to an outside arbitration panel

C.Using his CFA designation upon expiration of the suspension period

正确答案:C

答案解析:“Code of Ethics and Standards of Professional Conduct”, CFA Institute

2013 Modular Level I, Vol. 1, Reading 1, Code of Ethics and Standards of Professional Conduct CFA Institute Professional Conduct Program

Study Session 1-1-a

Describe the structure of the CFA Institute Professional Conduct Program and the disciplinary review process for the enforcement of the Code of Ethics and Standards of Professional Conduct.

Study Session 1-2-c

Recommend practices and procedures designed to prevent violations of the Code of Ethics and Standards of Professional Conduct

C is correct because the Designated Officer may impose a summary suspension on a member or candidate, which may be rejected or accepted by the member or candidate. If the member or candidate does not accept the proposed sanction, the matter is referred to a hearing panel composed of DRC members and CFA Institute member volunteers affiliated with the DRC. In this case, the hearing panel also affirmed the suspension decision by the Designated Officer, and therefore, the member loses the right to use his designation for a one-year period. Upon expiration of the suspension period, the analyst would be able to use his CFA designation.

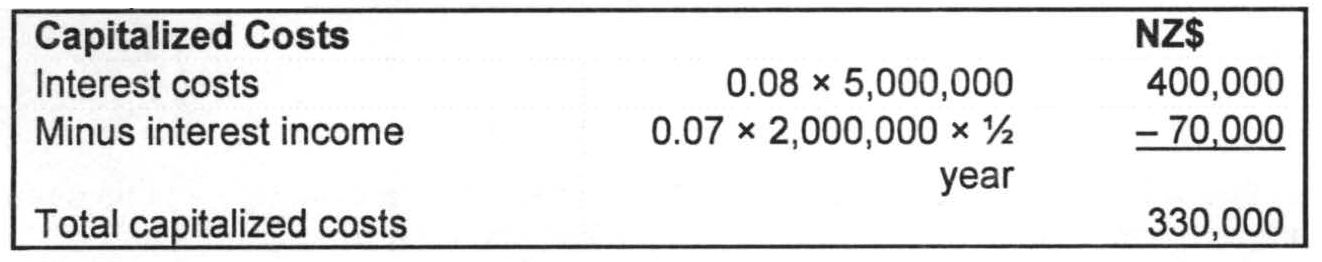

3、On 1 January, a company that prepares its financial statements according to International FinancialReporting Standards (IFRS) arranged financing for the construction of a new plant. The company:

·borrowed NZ$5,000,000 at an interest rate of 8%,

·issued NZ$5,000,000 of preferred shares with a cumulative dividend rate of 6%, and

·temporarily invested NZ$2,000,000 of the loan proceeds during the first six months of constructionand earned 7% on that amount.

The amount of financing costs to be capitalized to the cost of the plant in the first year is closest to:【单选题】

A.NZ$330,000.

B.NZ$400,000.

C.NZ$630,000.

正确答案:A

答案解析:The interest costs can be capitalized, but under IFRS, any amounts earned by temporarily investingthe funds are deducted from the capitalized amount. The costs related to the preferred shares cannotbe capitalized.

CFA Level I

"Long-Lived Assets," Elaine Henry and Elizabeth A. Gordon

Section 2.1

4、Epsilon Inc., a U.S. based company, must pay ¥1,000,000,000 to its Japanese component supplier in 3 months. Epsilon approaches a dealer and enters into a USD/JPY currency forward contract, containing a stipulation for physical delivery, to manage the foreign exchange risk associated with the payment to its supplier. Which of these best describes Epsilon’s currency forward contract?【单选题】

A.The dealer will deliver yen on expiration.

B.The amount of USD exchanged for JPY is determined at expiration.

C.Epsilon may receive or pay JPY, depending on the exchange rate at expiration.

正确答案:A

答案解析:“Forward Markets and Contracts,” Don M. Chance

2011 Modular Level I, Vol. 6, pp. 43–44

Study Session 17-61-h

Describe the characteristics of currency forward contracts.

A is correct because this currency forward contract requires physical delivery; therefore, Epsilon receives 1,000,000,000 JPY from the dealer in exchange for paying USD.

5、In comparison to a forward contract, a futures contract is most likely to be less:【单选题】

A.liquid.

B.publicized.

C.customized.

正确答案:C

答案解析:“Futures Markets and Contracts”, Don M. Chance

2010 Modular Level I, Vol. 6, pp. 51-53

Study Session 17-69-b

Distinguish between futures contracts and forward contracts.

The terms of a forward contract are customized to meet the needs of both parties. A futures contract is not customized rather, the exchange establishes the terms.

6、An analyst does research about net present value and gathers the followinginformation about three capital budgeting projects (in $ thousands):

Which projects has the highest internal rate of return?【单选题】

A.Project 1.

B.Project 2.

C.Project 3.

正确答案:B

答案解析:Project 1 IRR = 17.24%。

Project 2 IRR = 22.57%。

Project 3 IRR = 19.70%。

7、An investor purchases a 5% coupon bond maturing in 15 years for par value. Immediately after purchase, the yield required by the market increases. The investor would then most likely have to sell the bond at:【单选题】

A.par.

B.a discount.

C.a premium.

正确答案:B

答案解析:“Risks Associated with Investing in Bonds,” Frank J. Fabozzi

2012 Modular Level I, Vol. 5, pp. 353

Study Session 15-54-b

Identify the relations among a bond’s coupon rate, the yield required by the market, and the bond’s price relative to par value (i.e., discount, premium, or equal to par).

B is correct because the bond would sell below par or at a discount if the yield required by the market rises above the coupon rate. Because the bond initially was purchased at par, the coupon rate equals the yield required by the market. Subsequently, if yields rise above the coupon, the bond’s market price would fall below par.

8、Several years ago, Leo Peek, CFA, co-founded an investment club. The club is fully invested but has not actively traded its account for at least a year and does not plan to resume active trading of the account. Peek’s employer requires an annual disclosure of employee stock ownership. Peek discloses all of his personal trading accounts, but does not disclose his holdings in the investment club. Peek’s actions are least likely to be a violation of which of the CFA Institute Standards of Professional Conduct?【单选题】

A.Misrepresentation.

B.Transaction priority.

C.Conflicts of interest.

正确答案:B

答案解析:CFA Institute Standards

2010 Modular Level I, Vol. 1, pp. 29-30, 89-92

Study Session 1-2-a

Demonstrate a thorough knowledge of the Code of Ethics and Standards of Professional Conduct by applying the Code and Standards to situations involving issues of professional integrity.

B is correct as there is no indication that the investment club is trading ahead of clients. Standard I (C).

9、When a company issues common stock as part of the conversion of a convertible bond, the cash flow statement will most likely:【单选题】

A.omit the transaction but disclose it in a separate note or supplementary statement.

B.include the transaction because it materially affects the company's financial position.

C.omit the transaction without disclosure.

正确答案:A

答案解析:Significant non-cash transactions, such as the exchange of non-monetary assets or issuance of stock as part of a stock dividend or conversion are not incorporated in the cash flow statement. They are required to be disclosed, however, in either a separate note or a supplementary schedule to the cash flow statement.

2014 CFA Level I “Understanding Cash Flow Statements,” by Elaine Henry, Thomas R. Robinson, Jan Hendrik van Greuning, and Michael A. Broihahn

Section 2.1

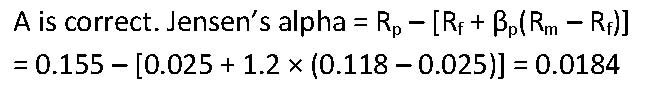

10、A portfolio manager generated a rate of return of 15.5% on a portfolio with beta of 1.2. If the risk-free rate of return is 2.5% and the market return is 11.8%, Jensen’s alpha for the portfolio is closest to:【单选题】

A.1.84%.

B.3.70%.

C.4.34%.

正确答案:A

答案解析:“Portfolio Risk and Return Part II”, Vijay Singal, CFA

2013 Modular Level I, Vol. 4, Reading 44, Section 4.3.2

Study Session 12-44-h

Describe and demonstrate applications of the CAPM and the SML.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料