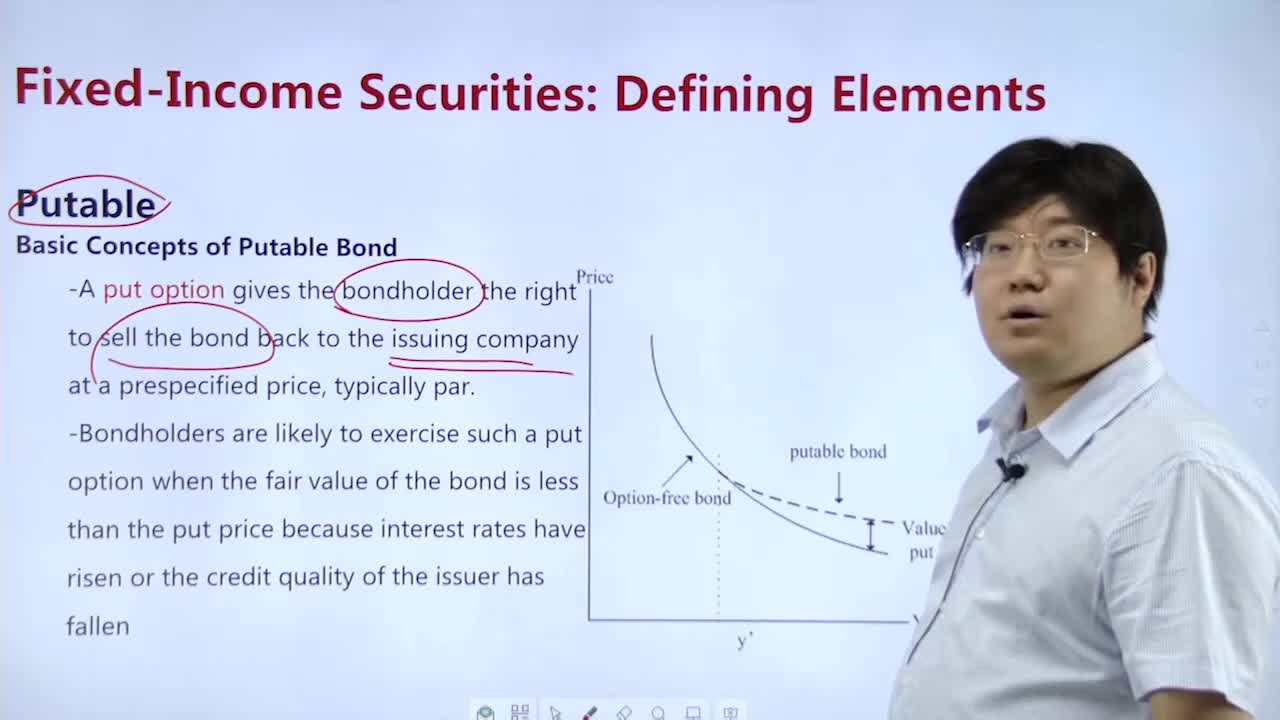

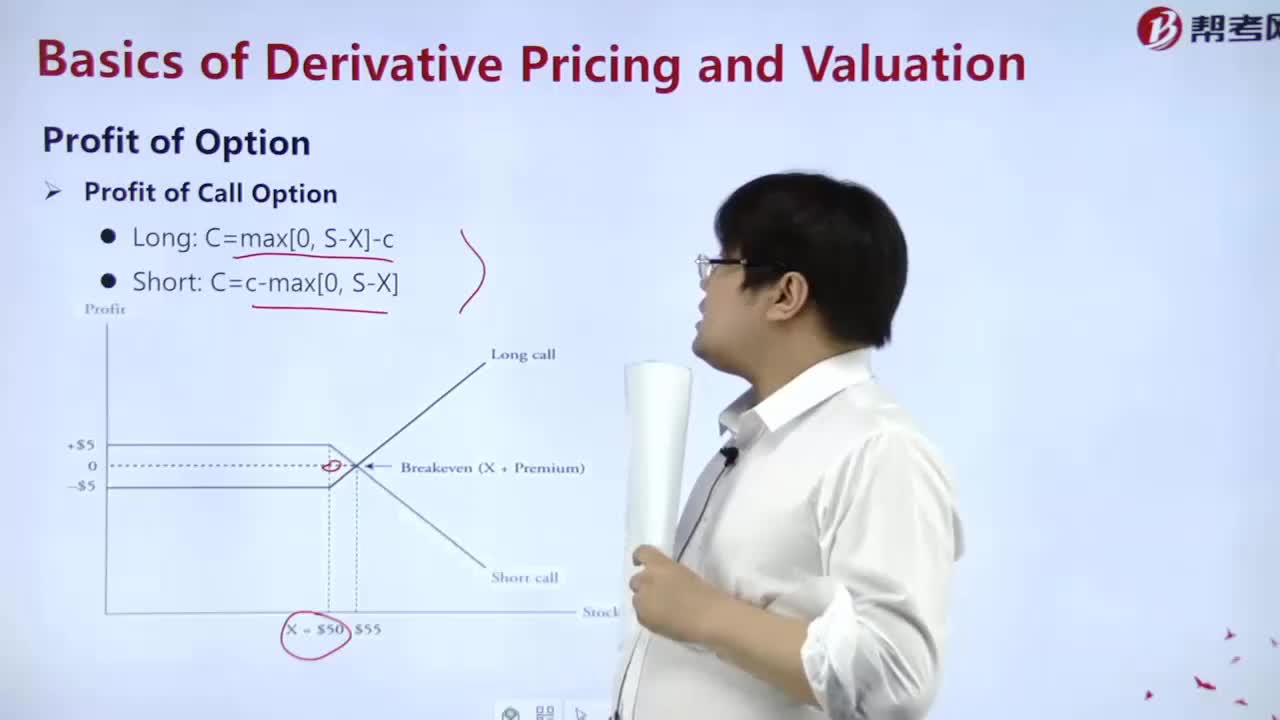

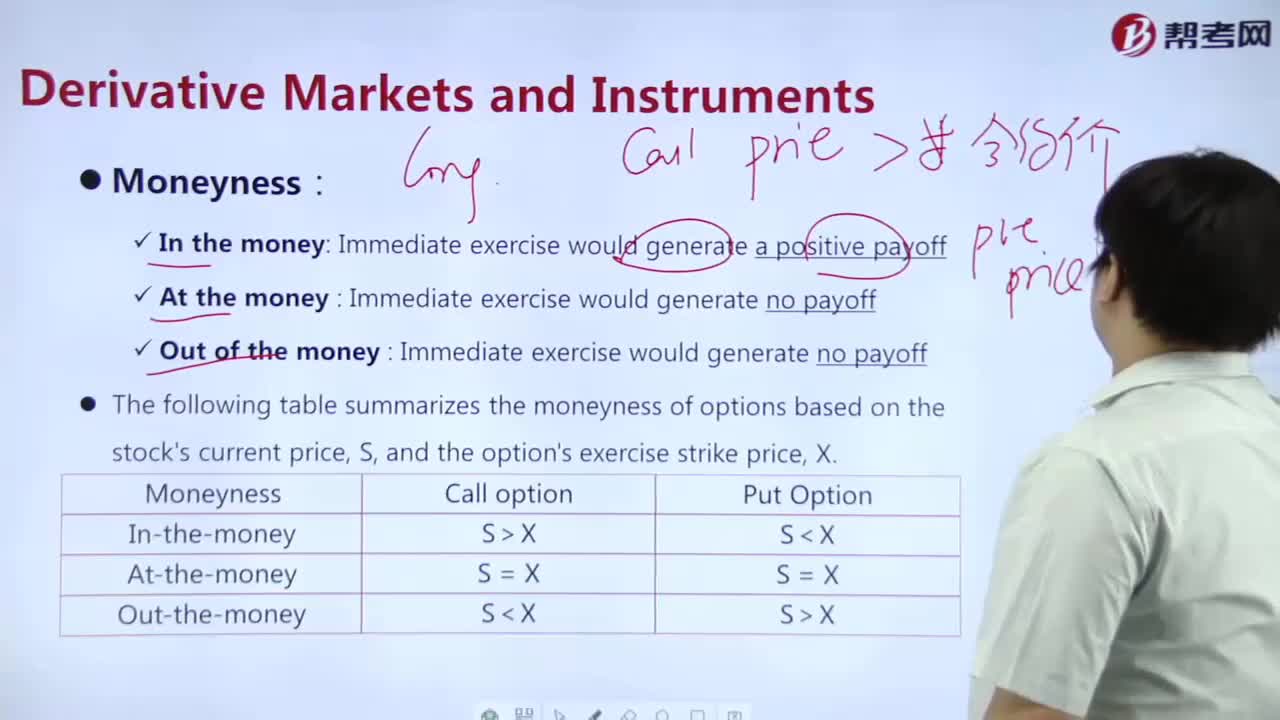

How to calculate the option profit?

How to determine the value of an option purchased?

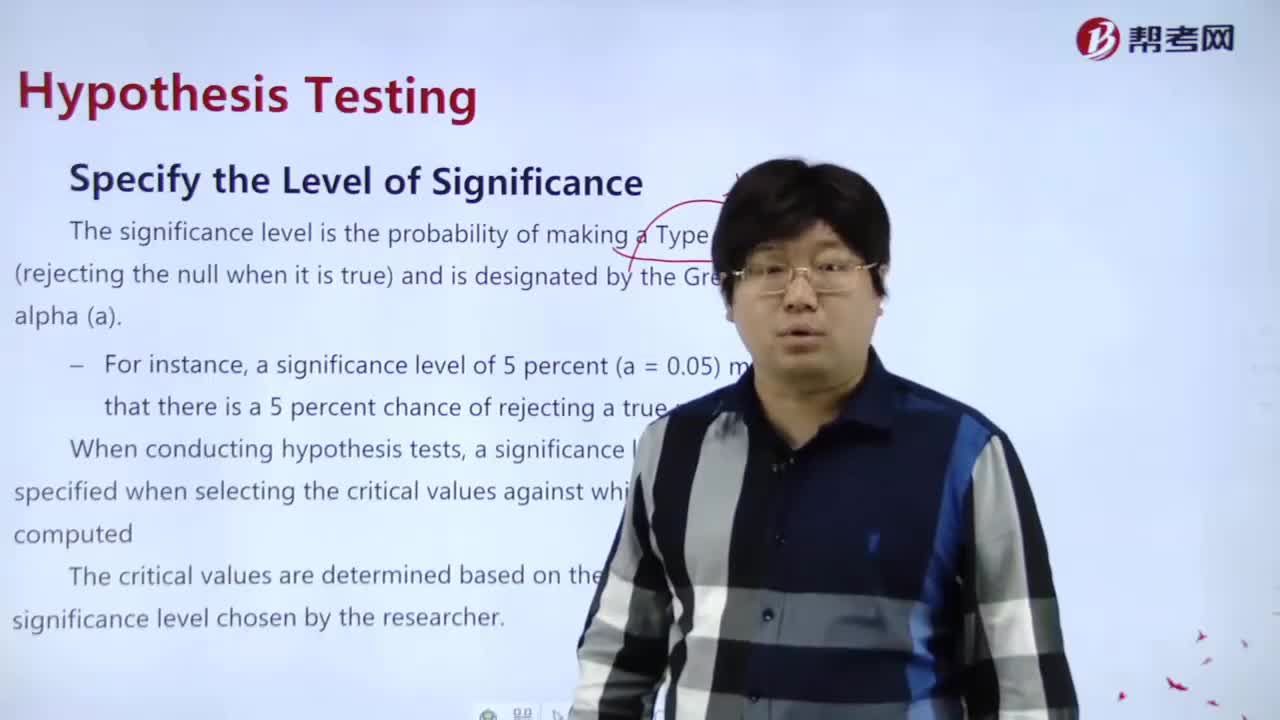

How to specify the level of significance?

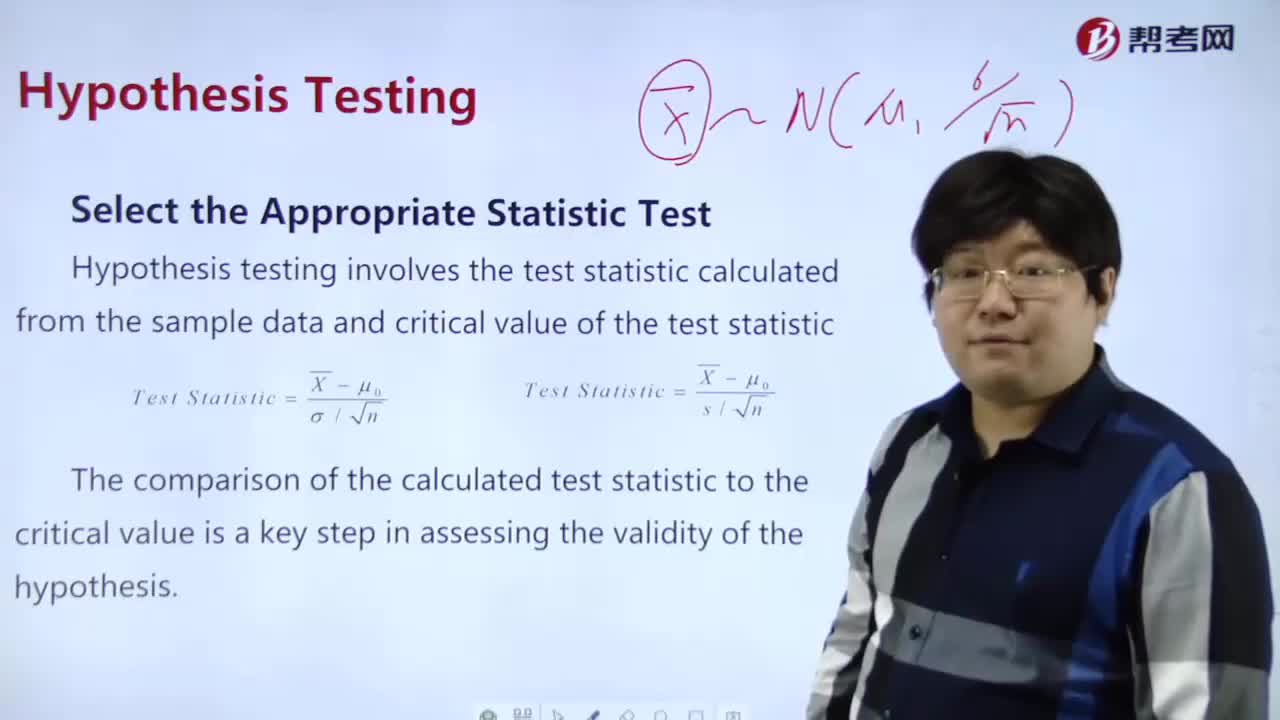

How to select the appropriate statistical test?

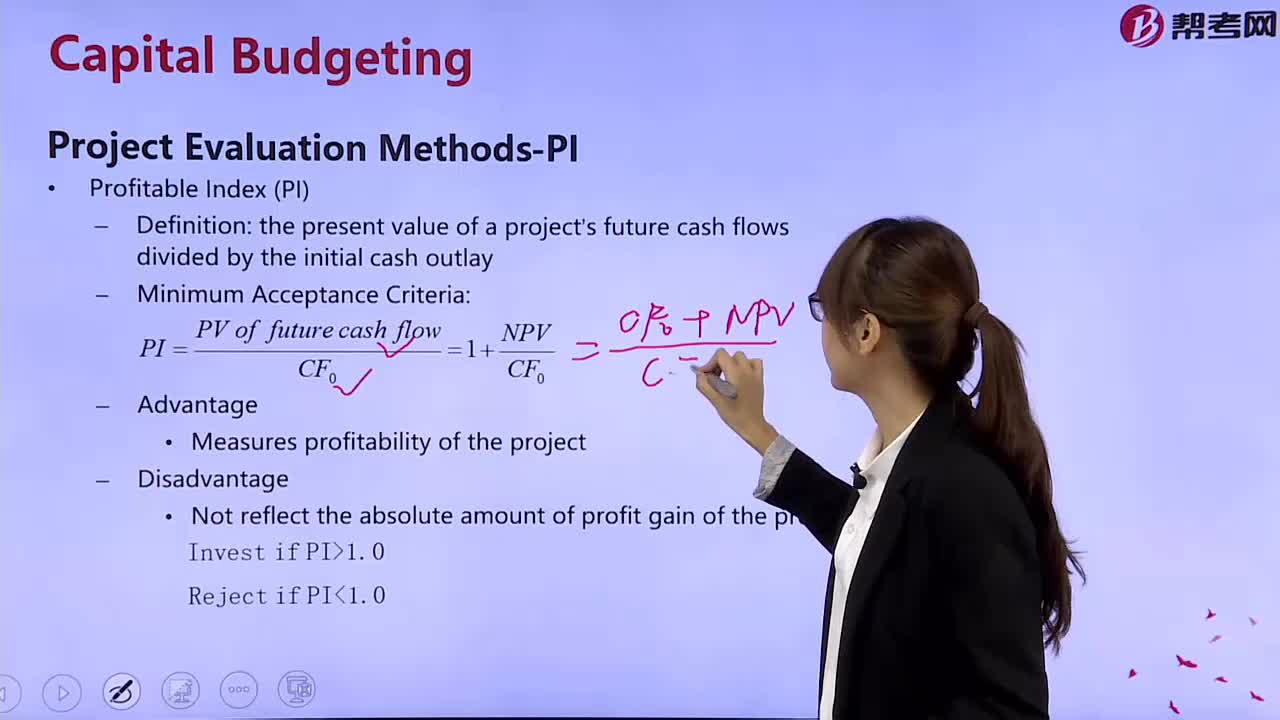

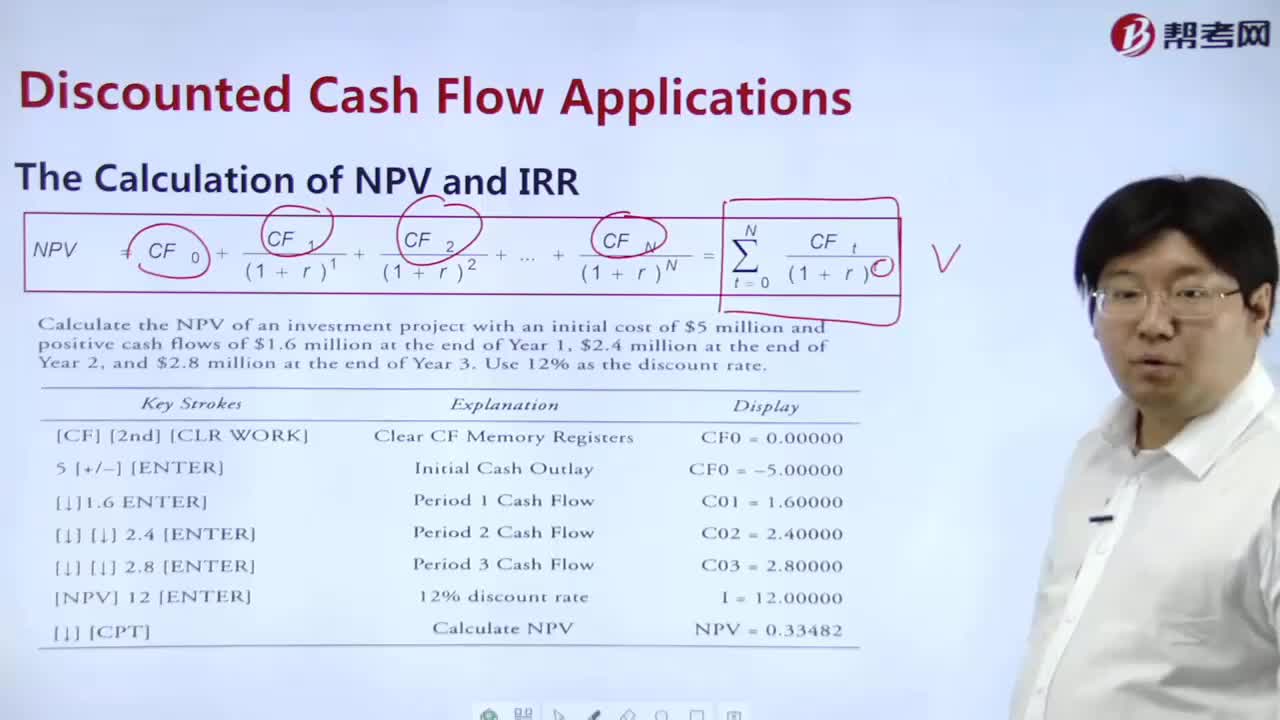

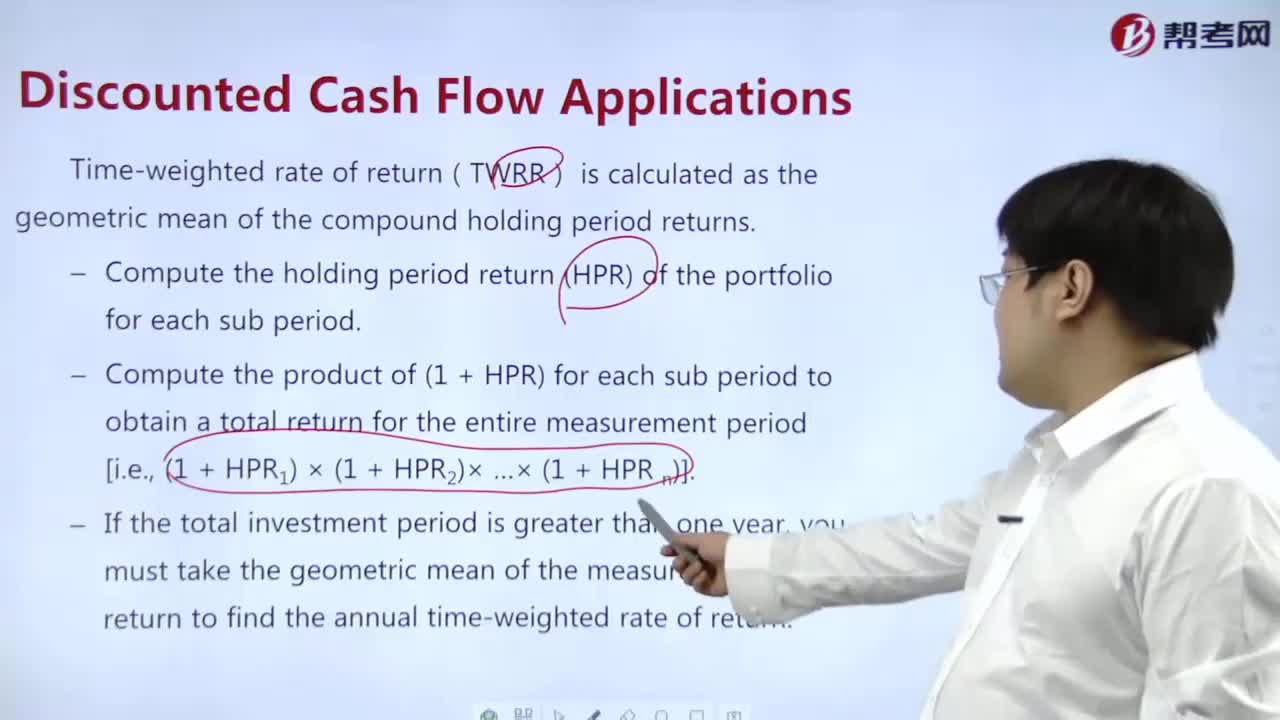

How to calculate NPV and IRR?

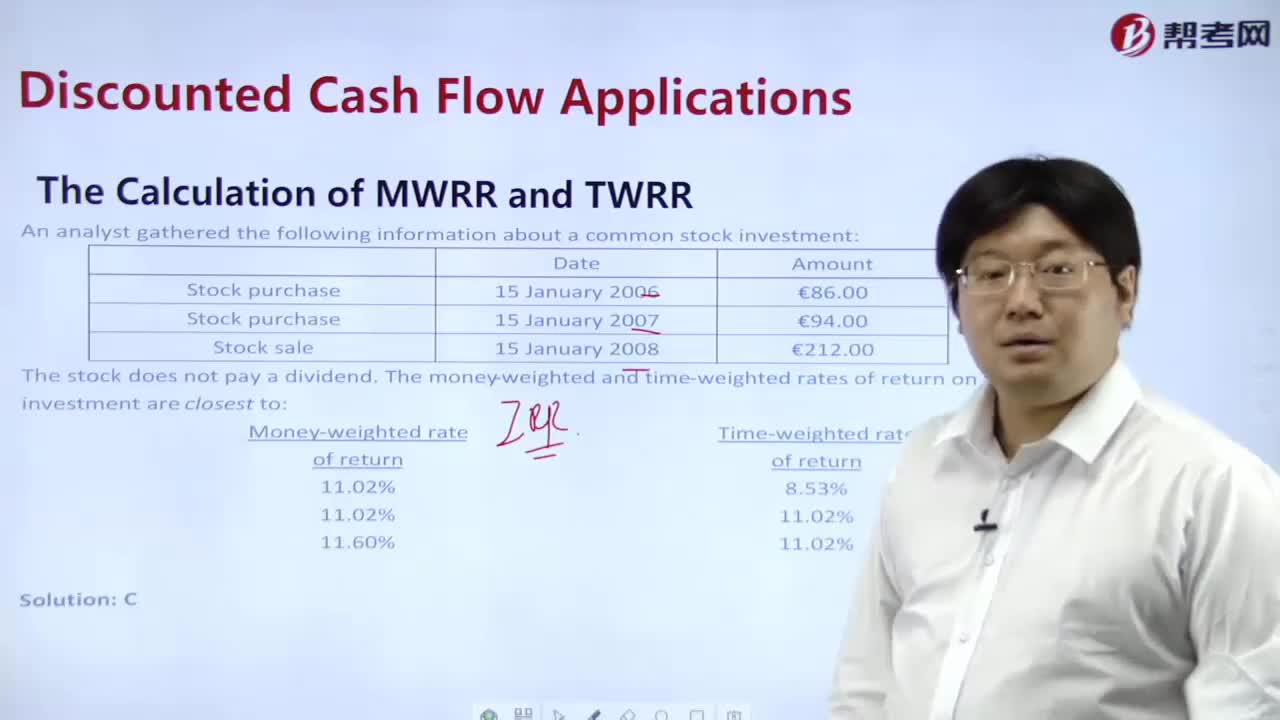

How to calculate MWRR?

How to calculate MWRR and TWRR?

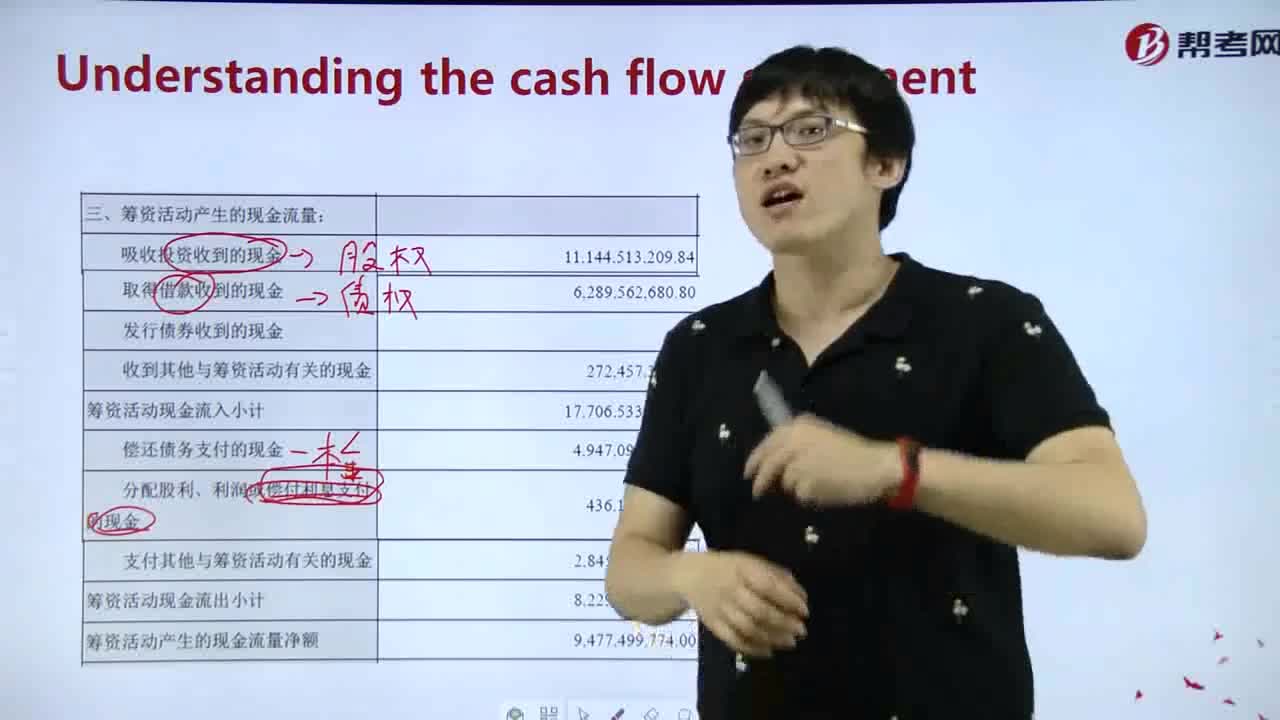

how to explain the CFS information?

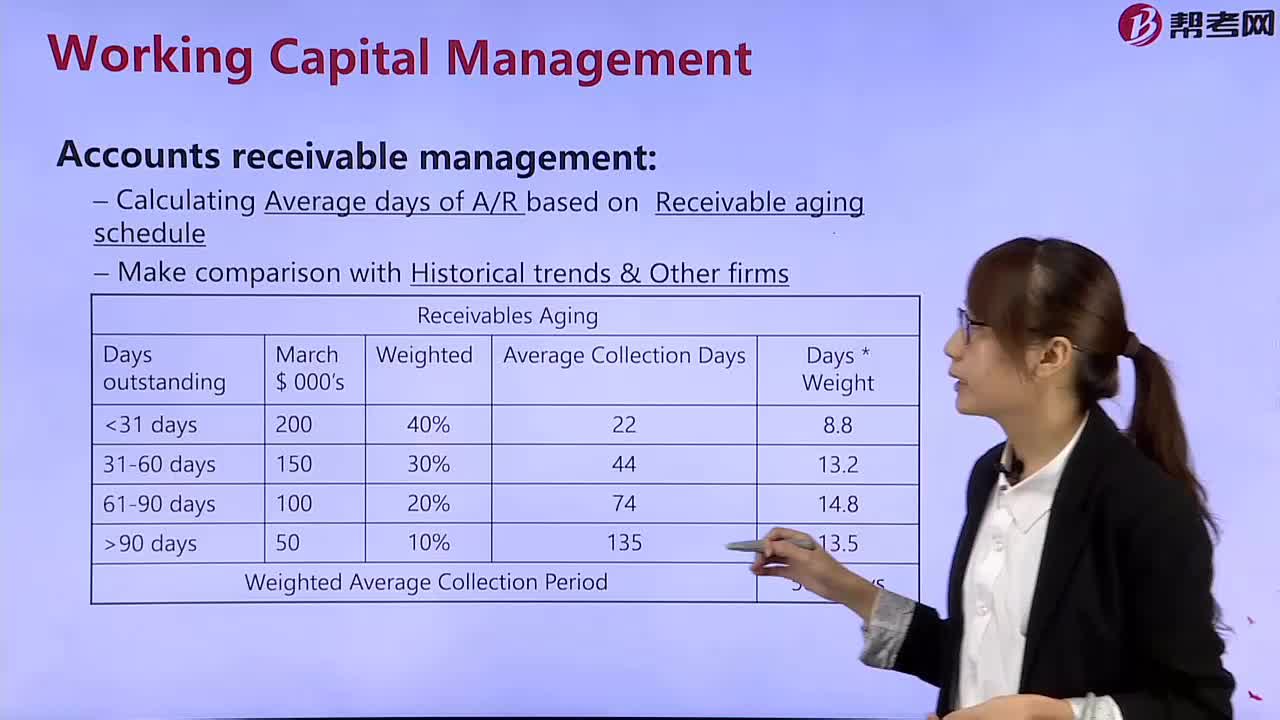

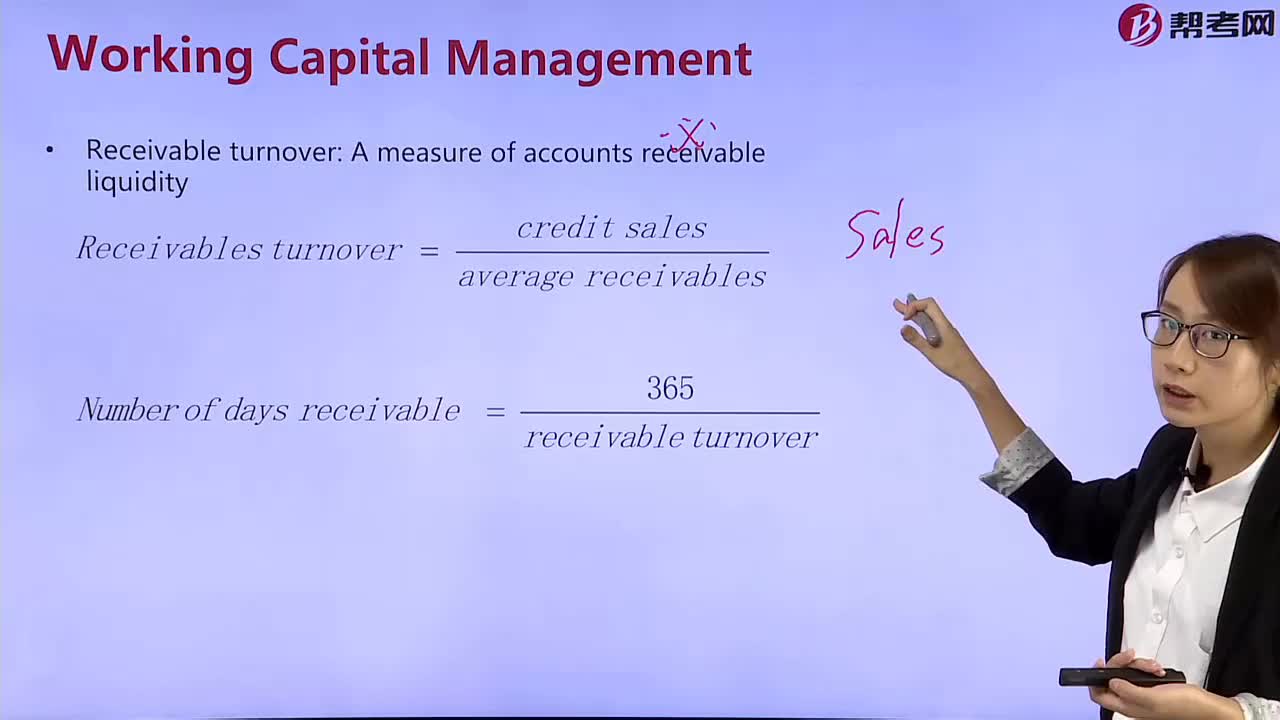

How to manage the accounts receivable?

How to calculate the turnover of accounts receivable?

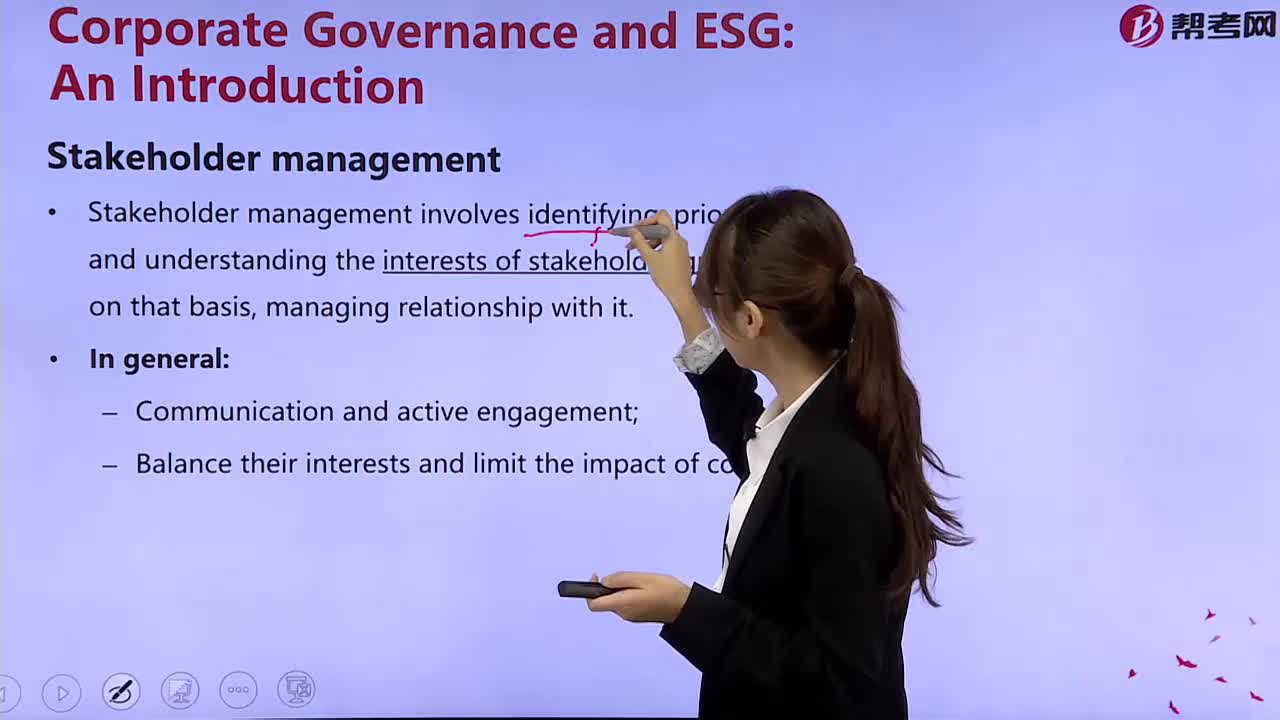

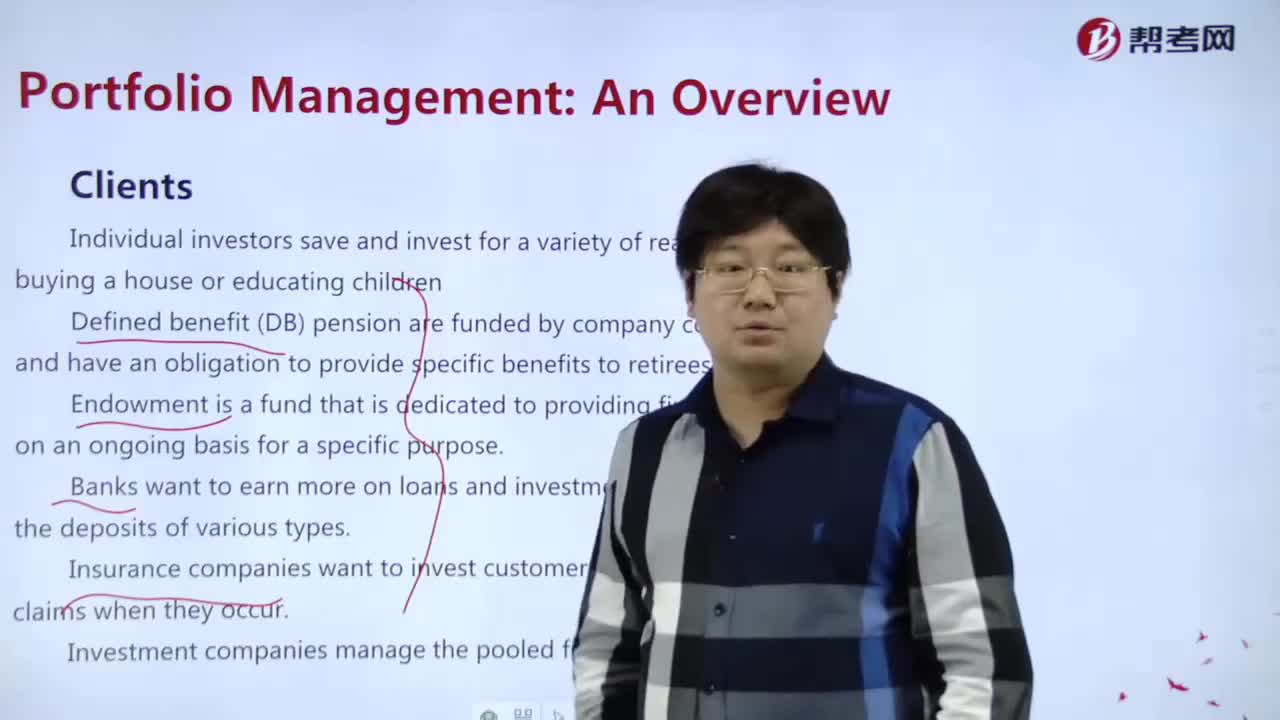

How to manage the client in the project?

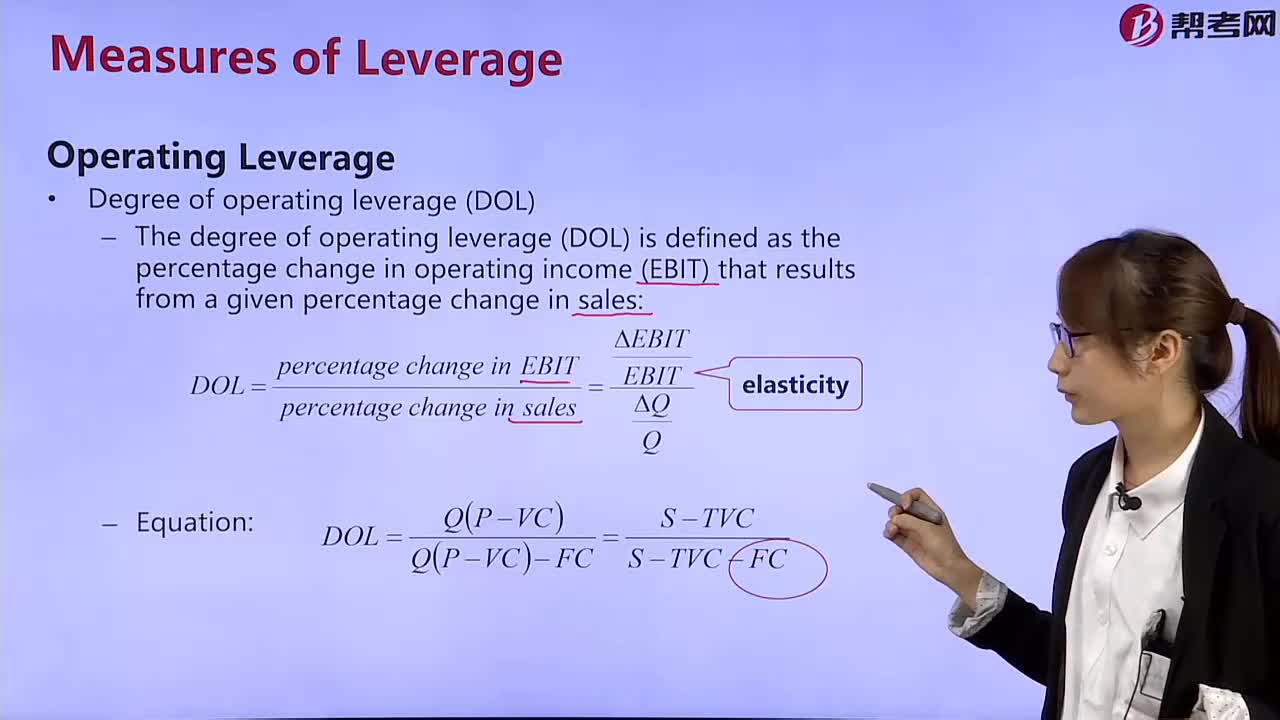

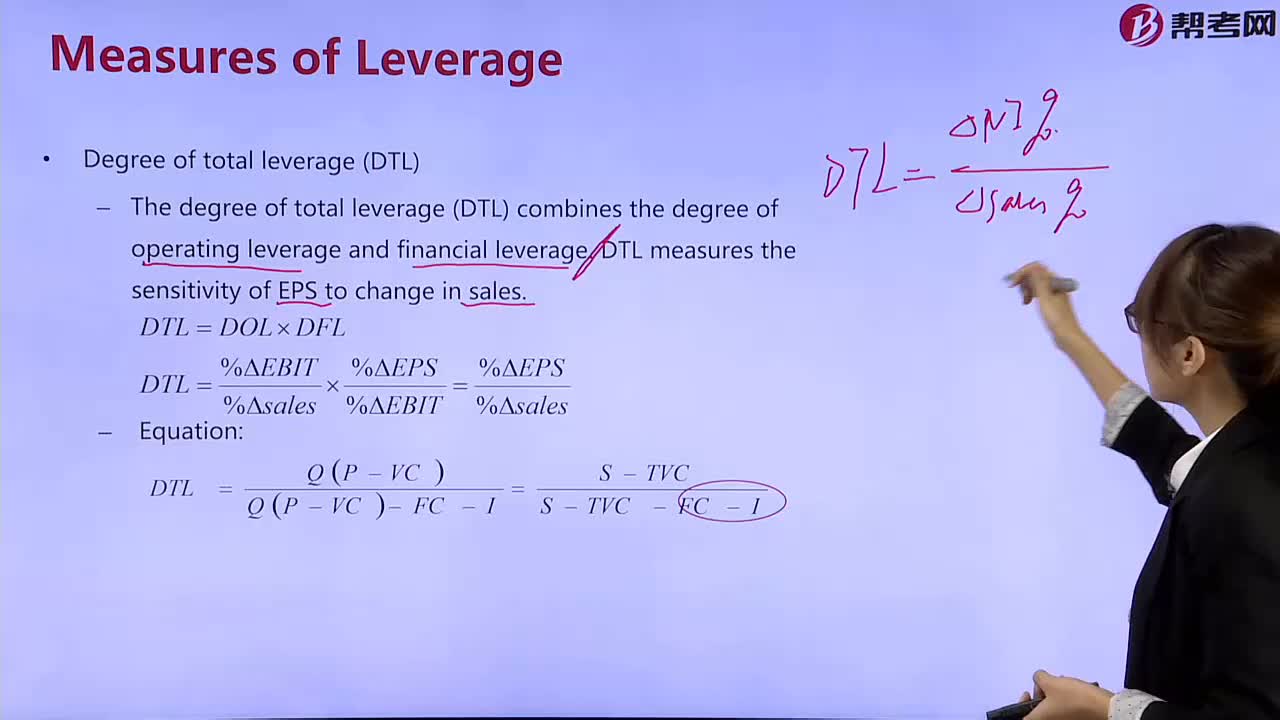

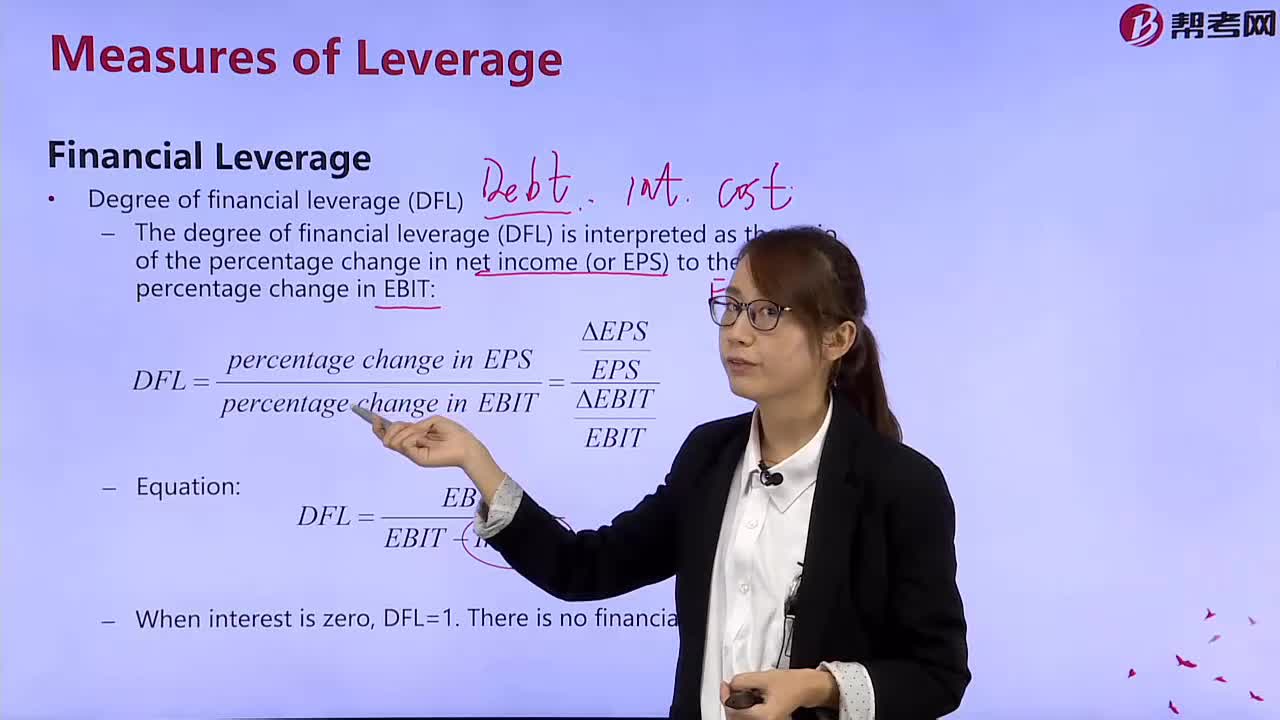

How to calculate the degree of financial leverage?

下载亿题库APP

联系电话:400-660-1360