-

下载亿题库APP

-

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

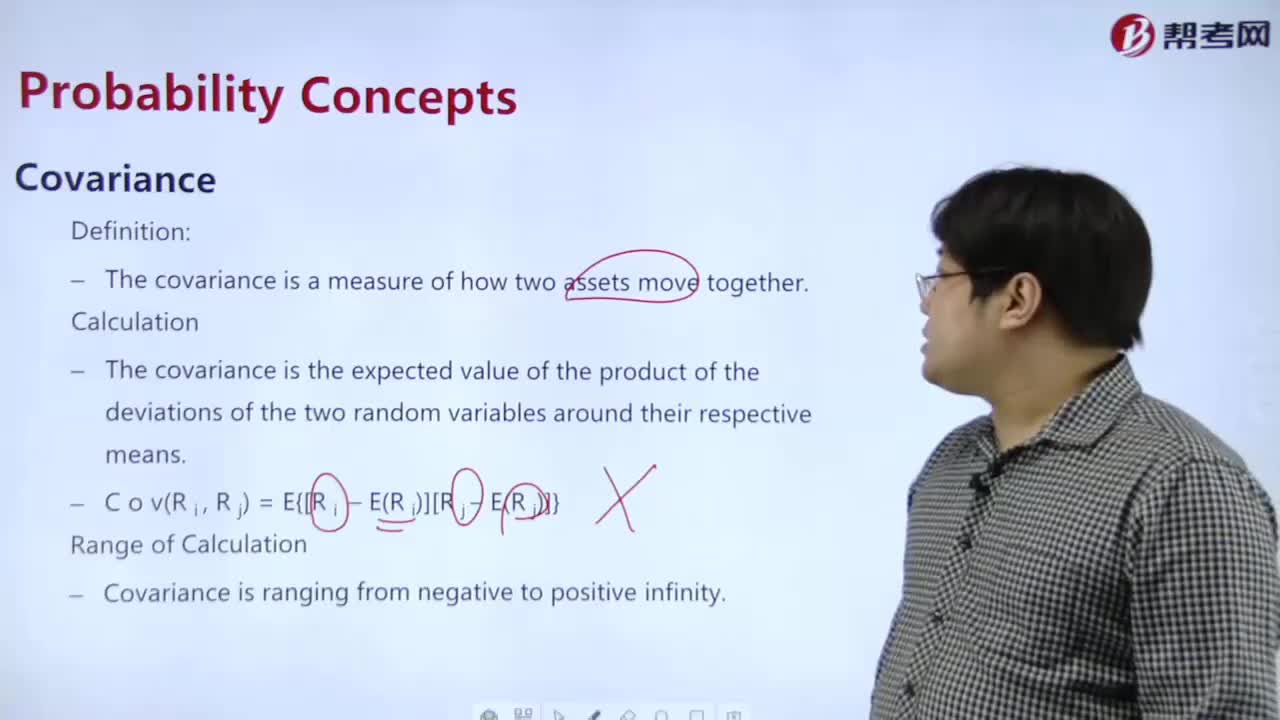

How do you understand covariance?

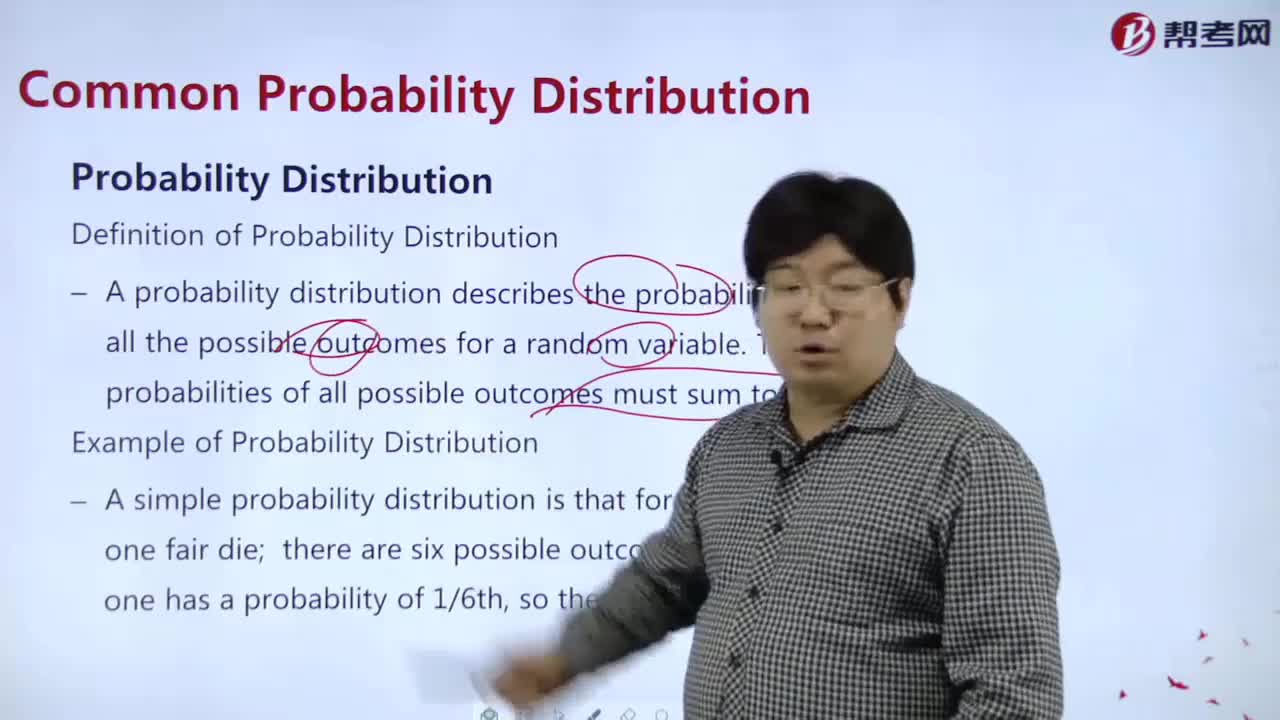

What is probability distribution?

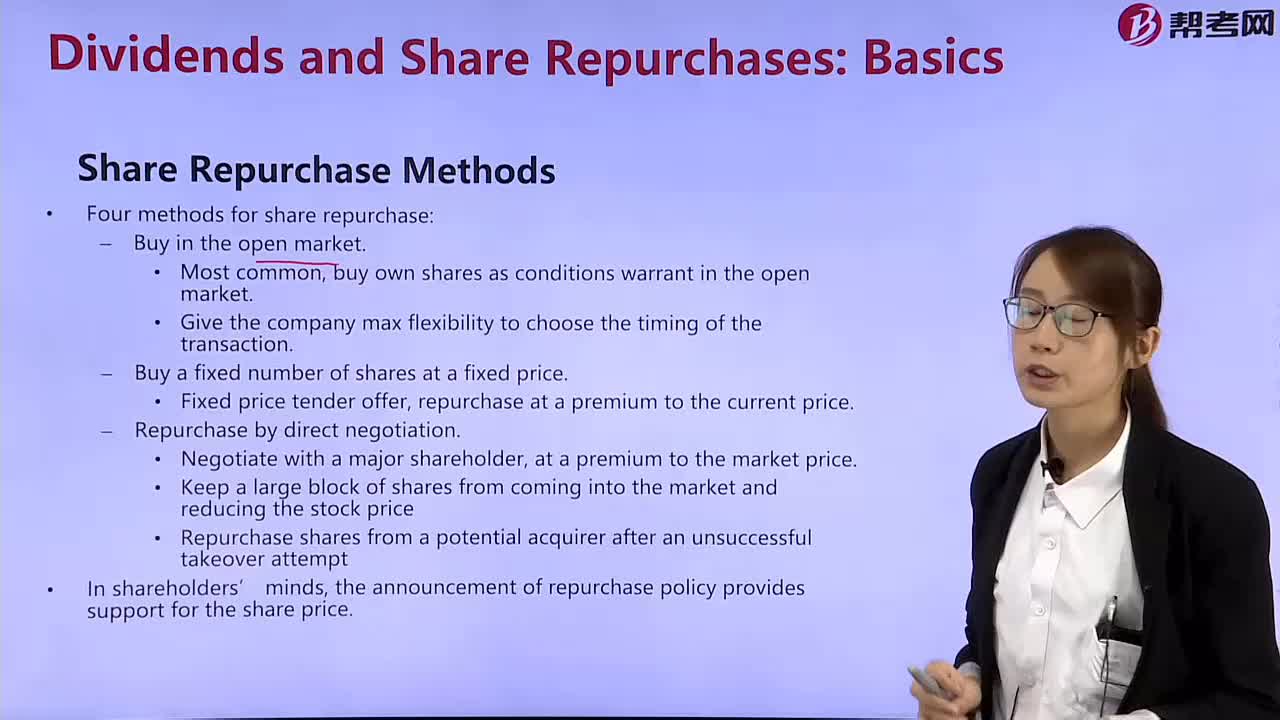

What are the methods of share repurchase?

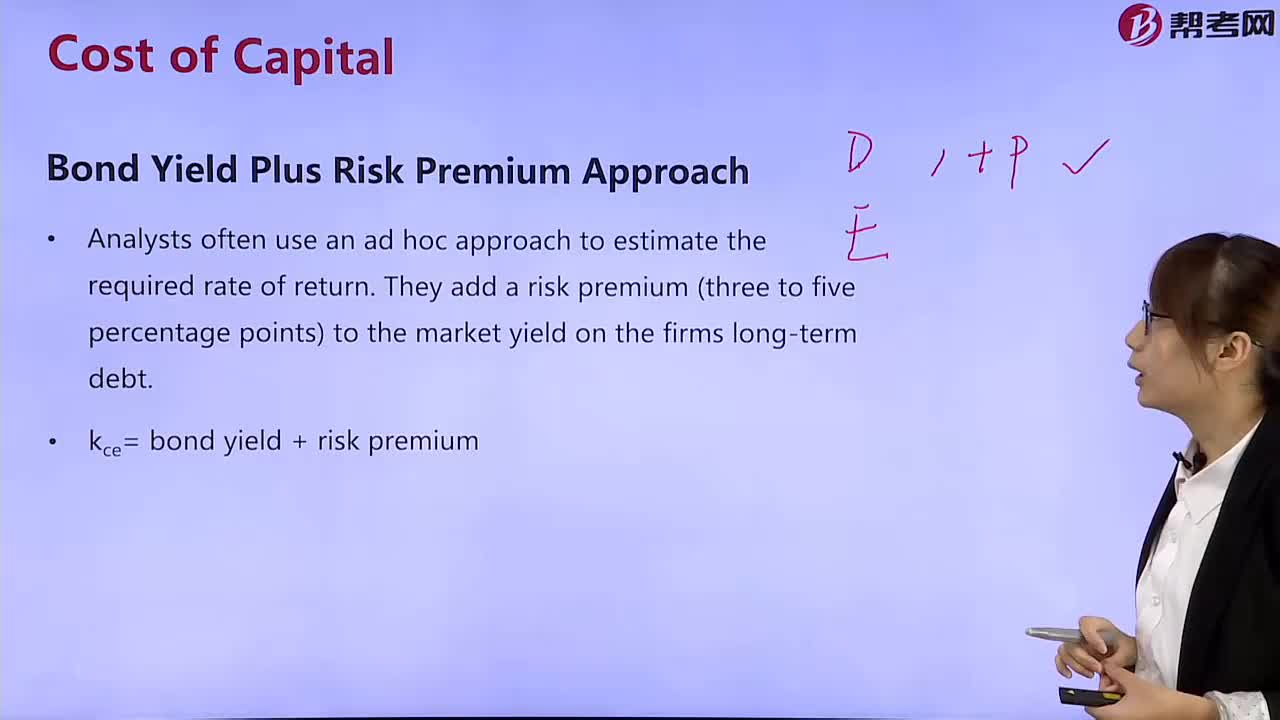

What are the methods of bond yield plus risk premium?

What are the methods of dividend discount model?

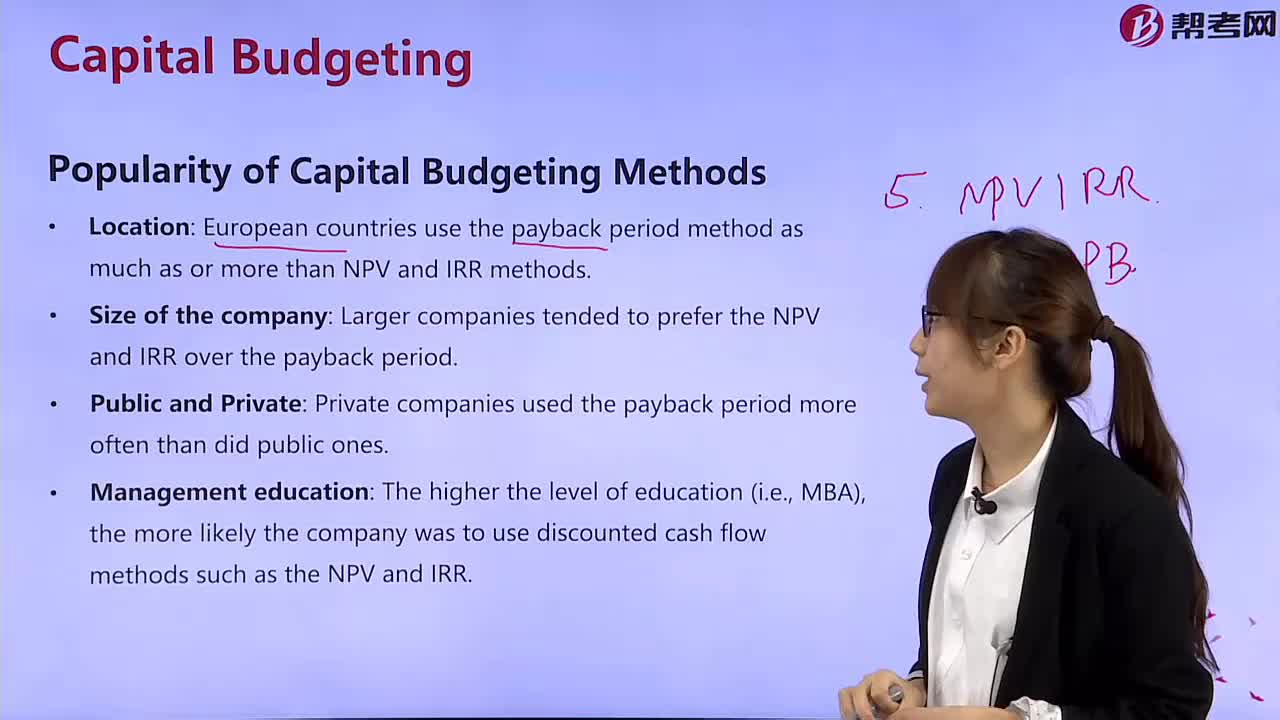

What are the popular capital budgeting methods?

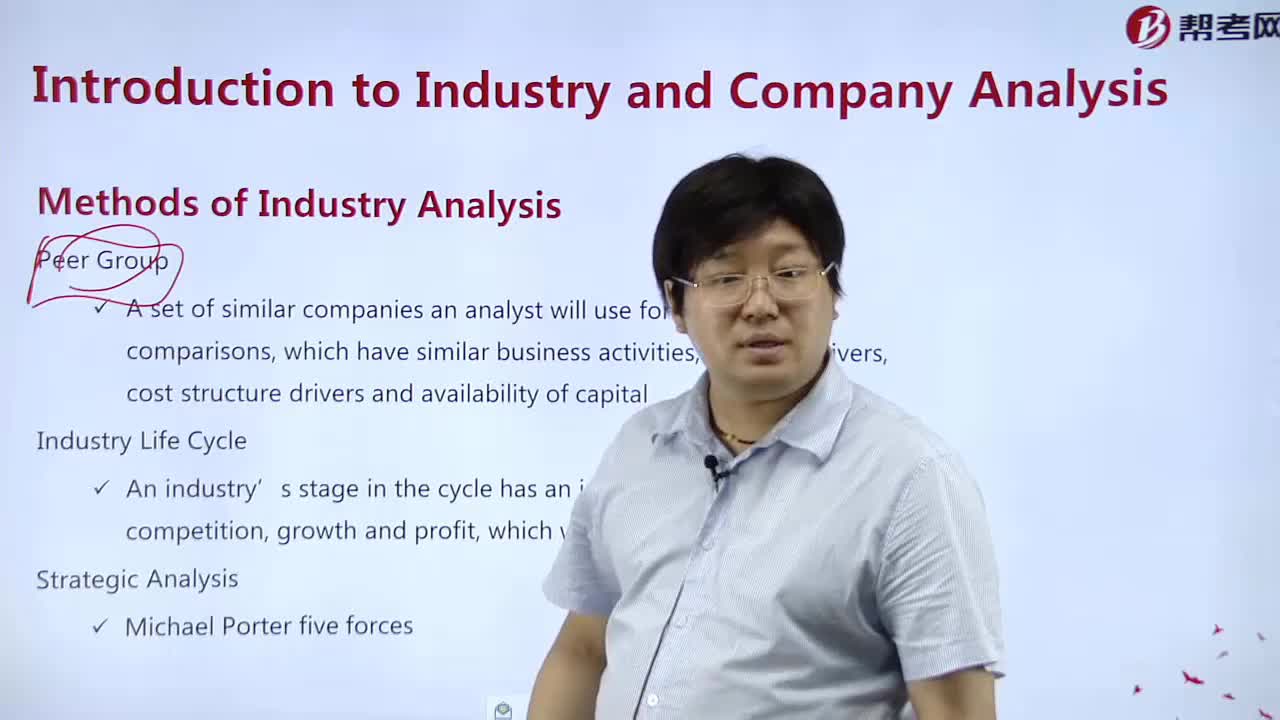

What are the methods of industrial analysis?

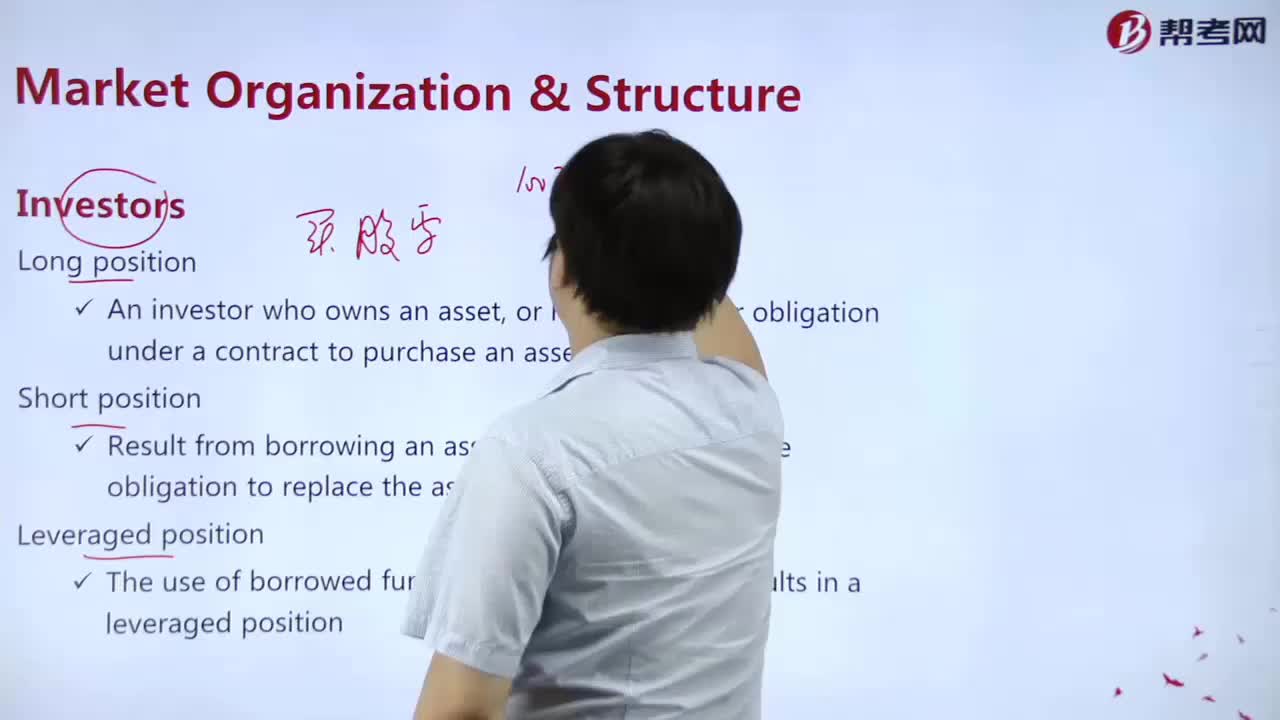

What are the investor's investment methods?

What are the weighting methods?

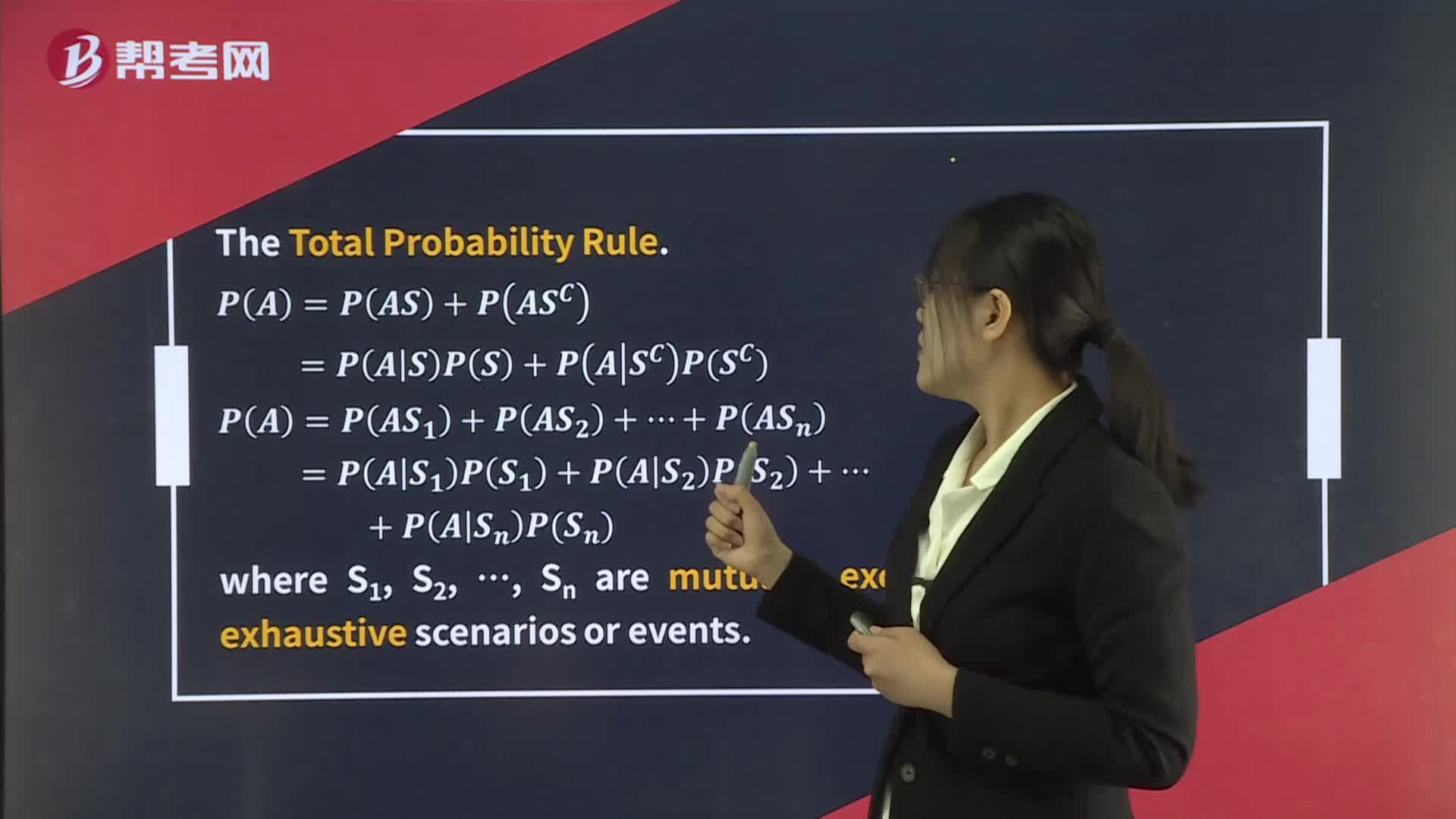

The Total Probability Rule

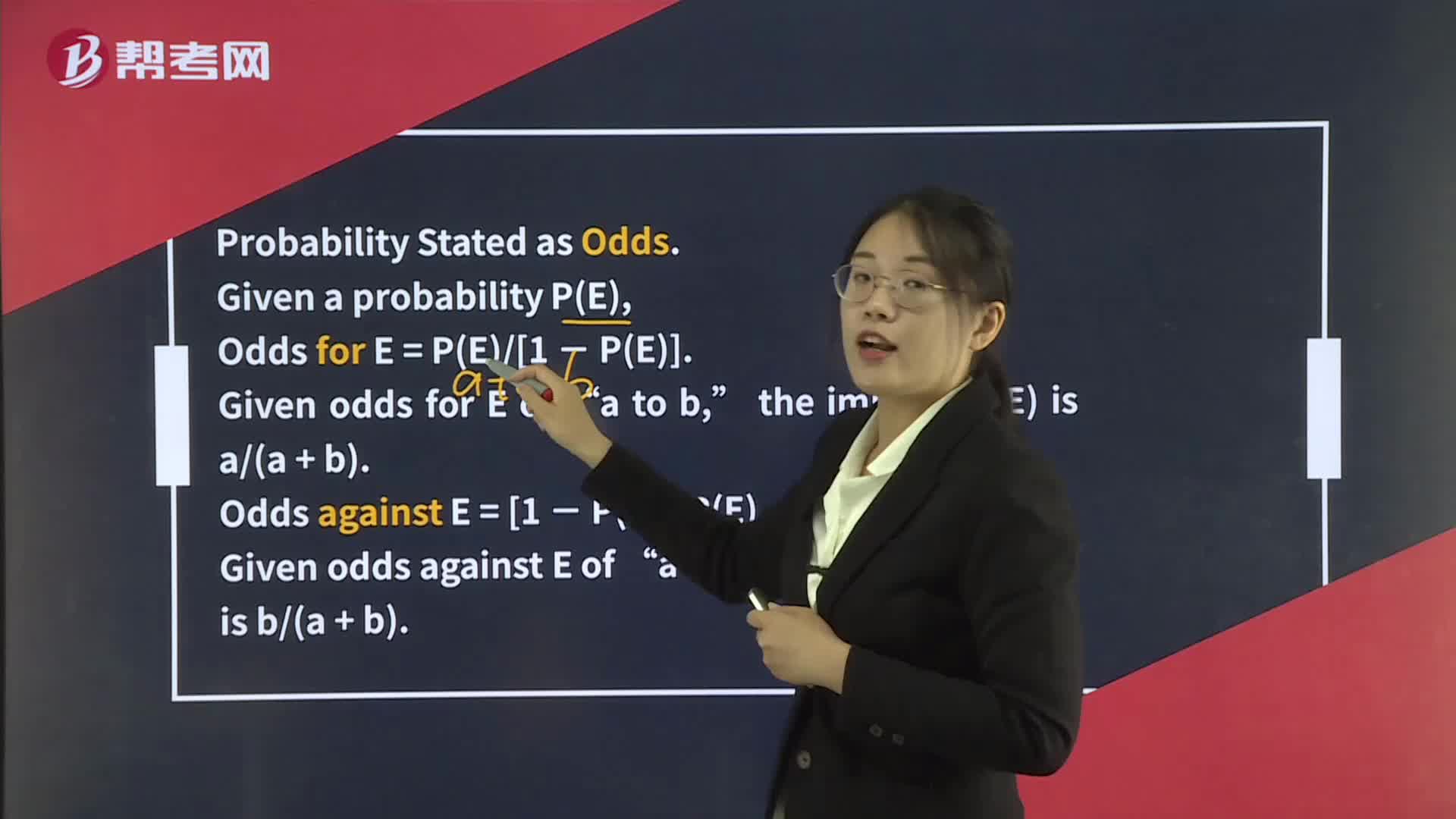

Probability Stated as Odds

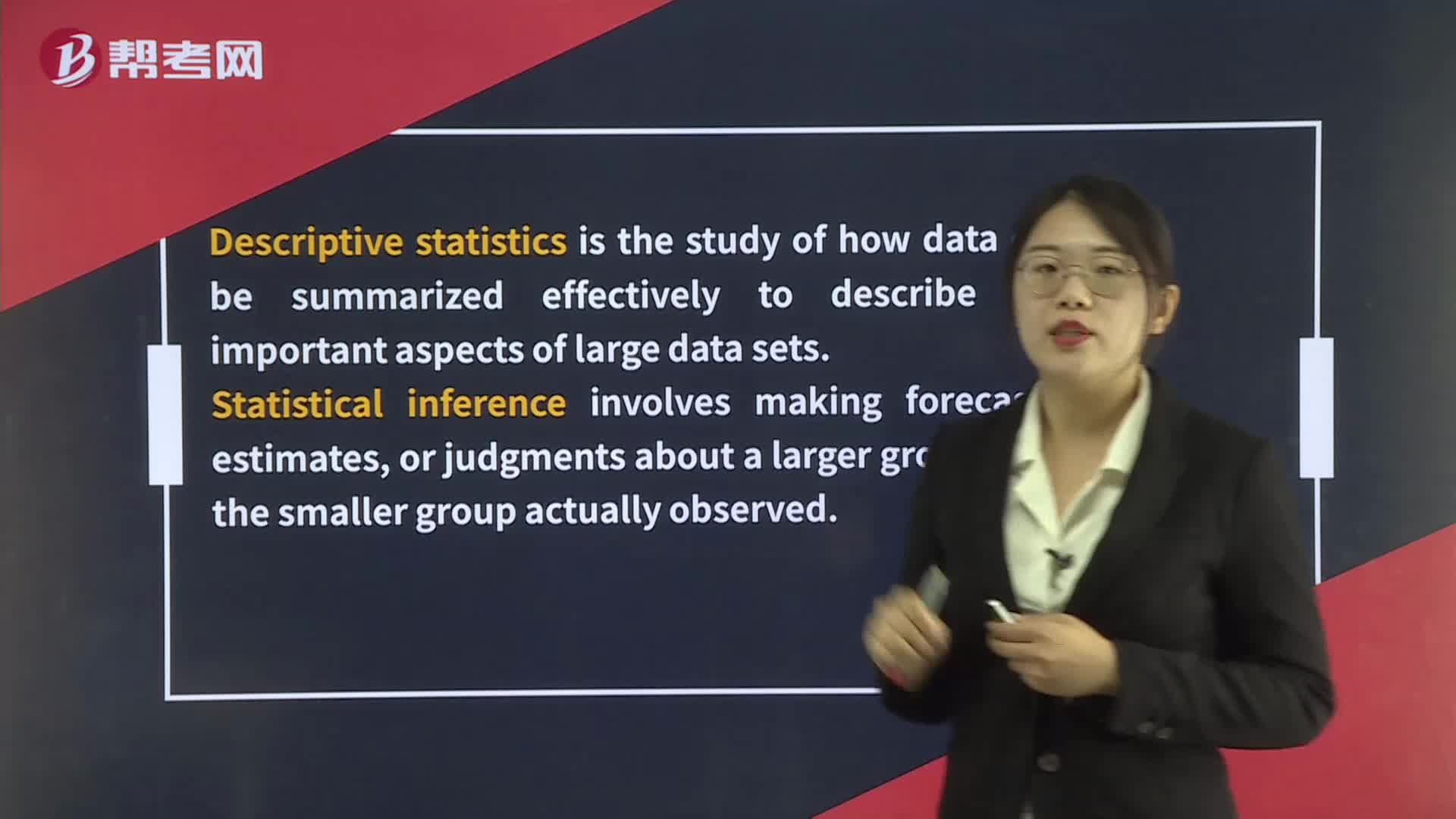

Fundamental Concepts of Statistics

14:19

14:19

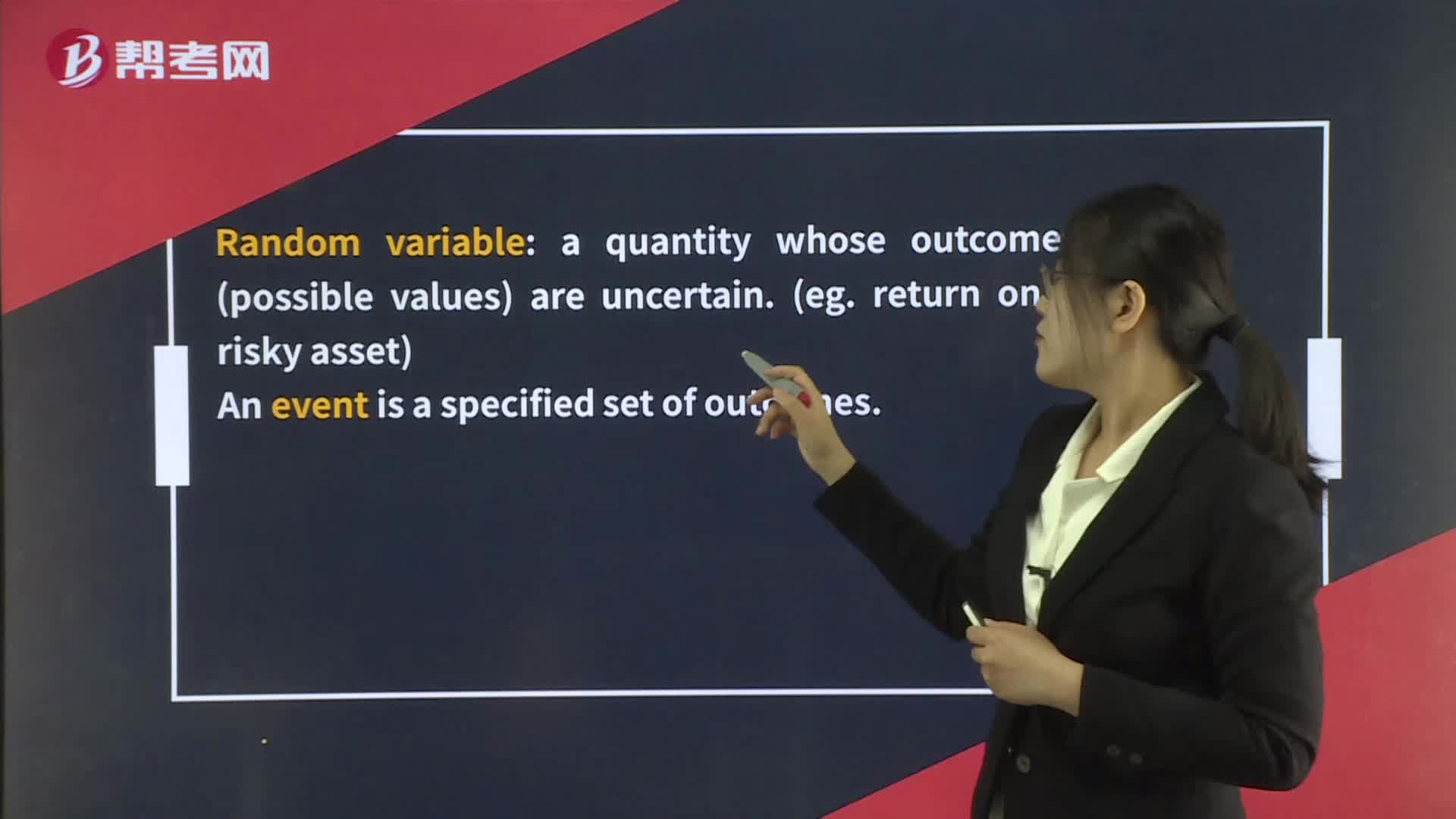

Probability:Probability:Random:variable:Objective,Subjective:probability draws on personal or subjective judgment.;Given a probability PE:Loss

04:25

04:25

What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

10:40

10:40

What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日

帮考网校

2022年06月22日