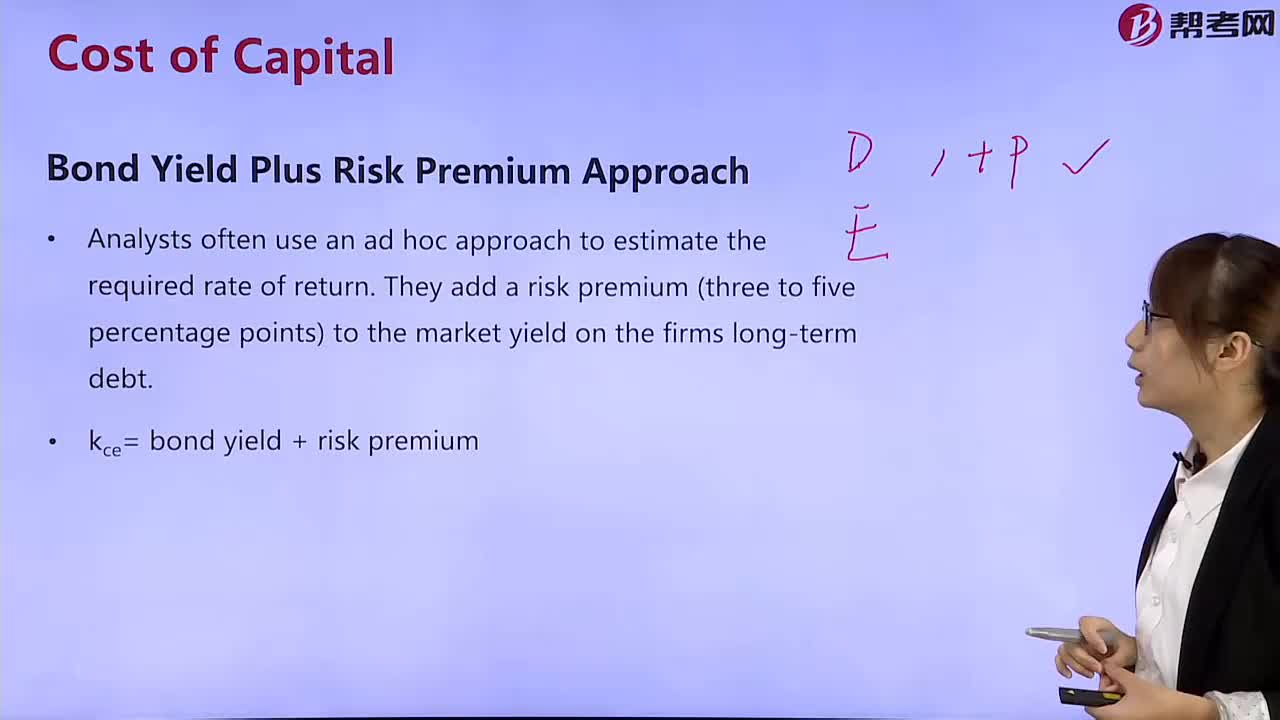

What are the methods of bond yield plus risk premium?

What are the methods of dividend discount model?

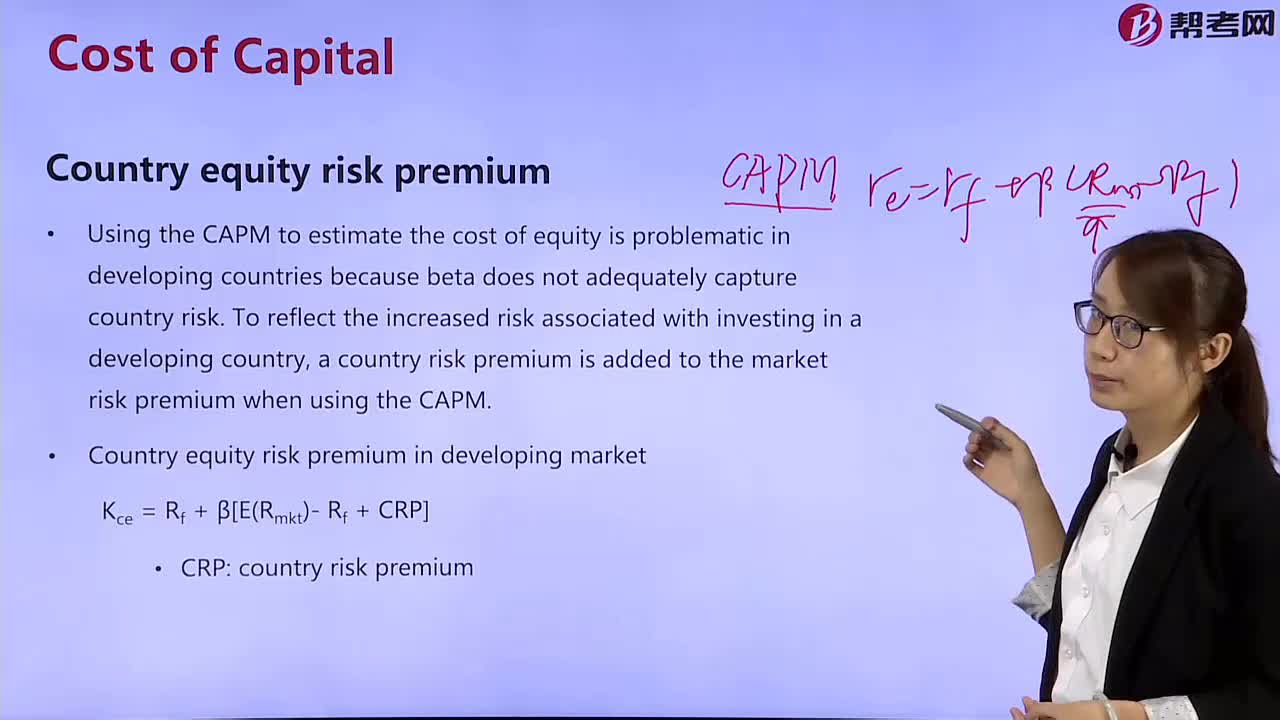

What is the National Equity Risk Premium?

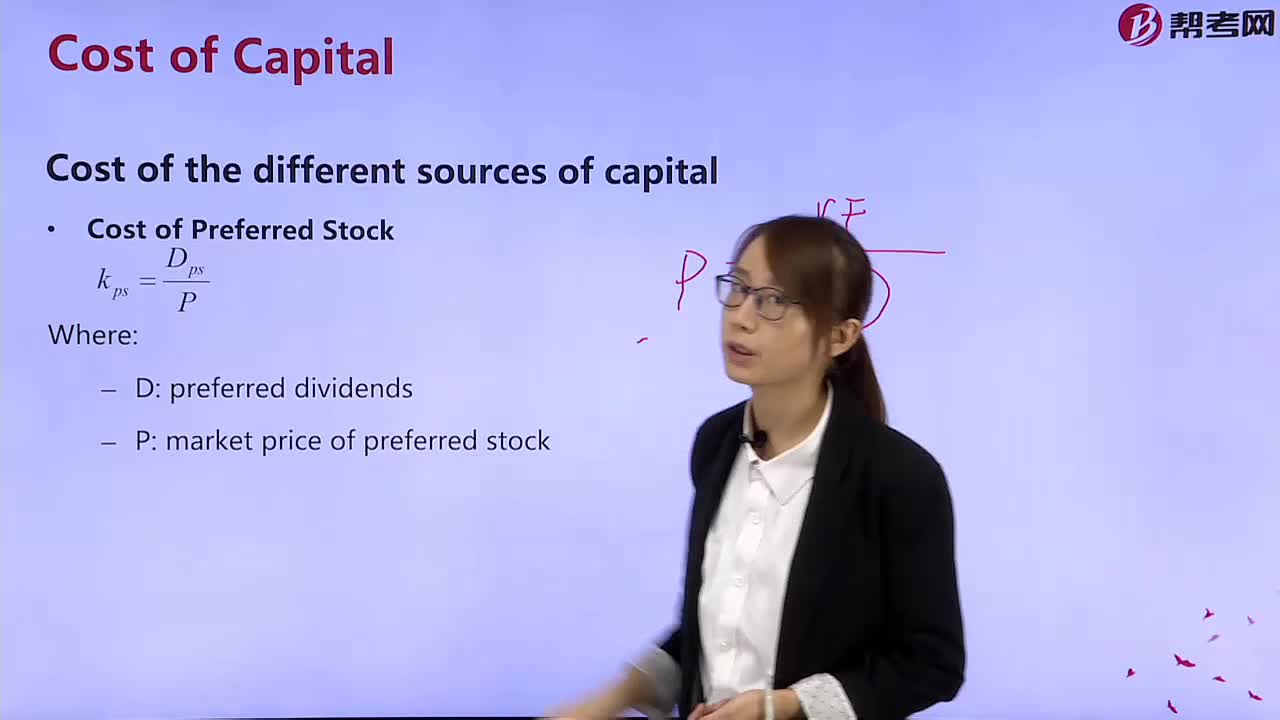

What are the costs of different sources of funding?

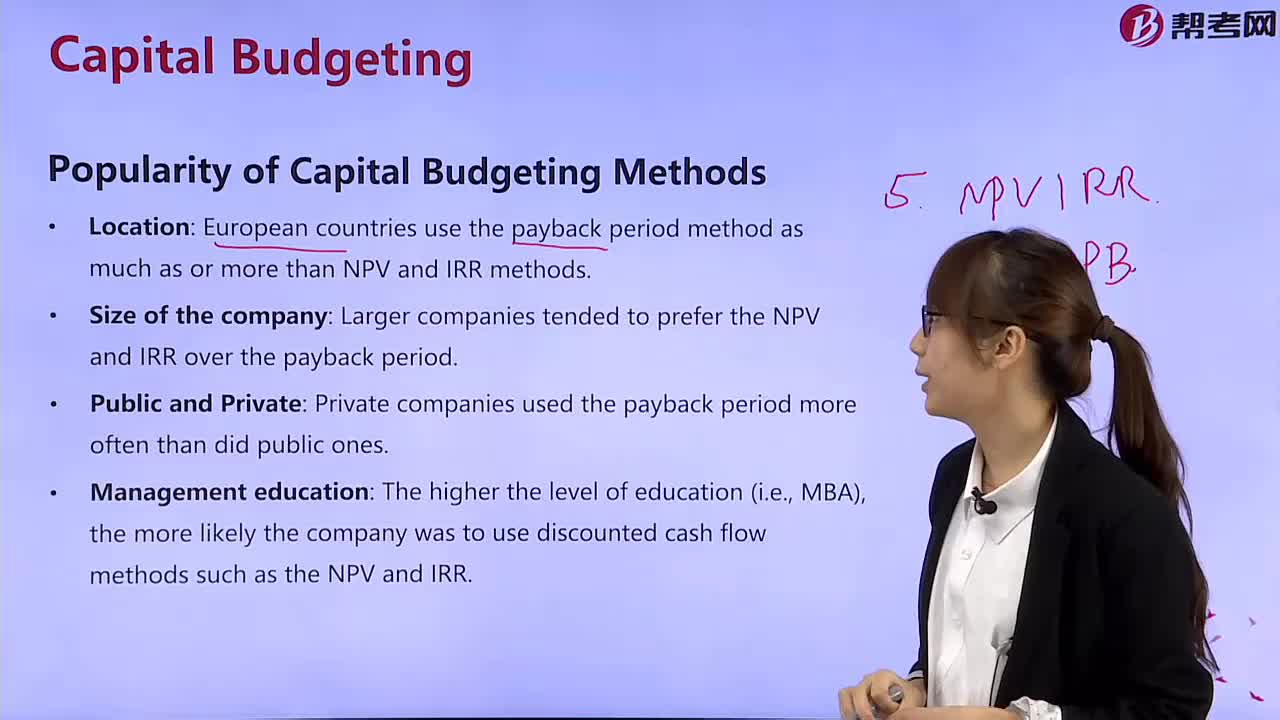

What are the popular capital budgeting methods?

What's the Income Valuation-Yield Measure of Bond?

What are the risks of poor governance?

What are the requirements of the board members?

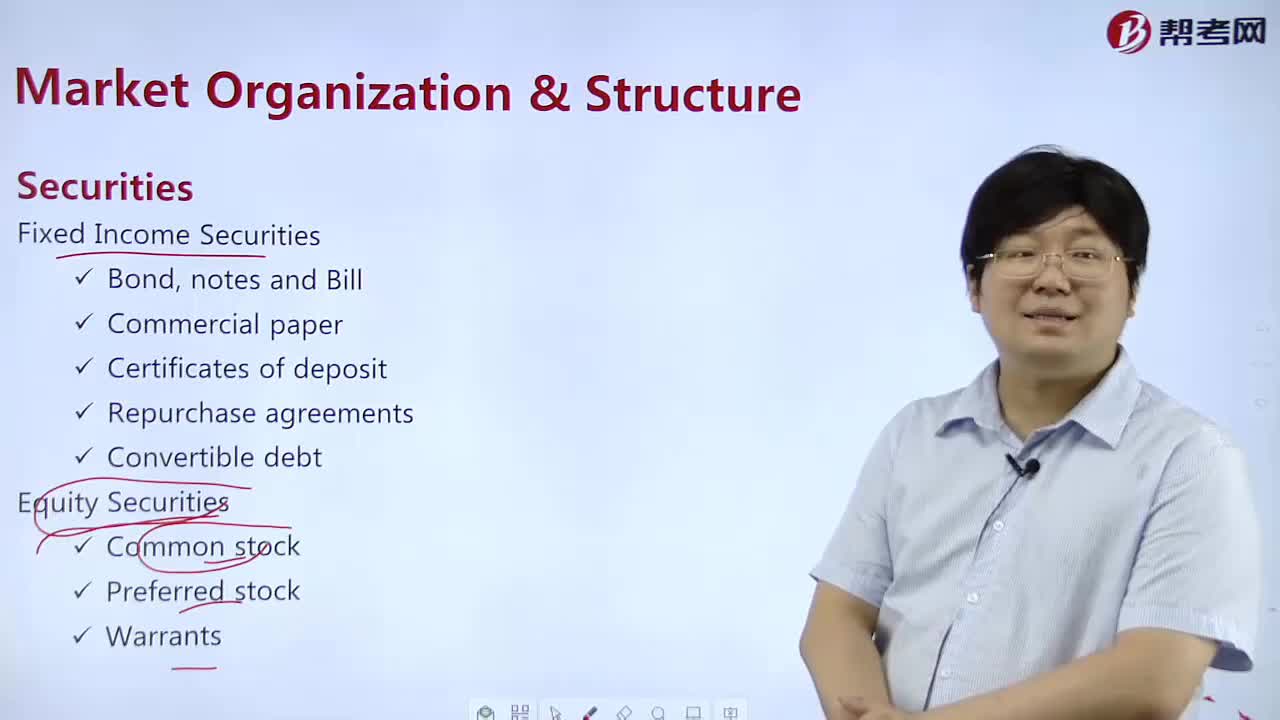

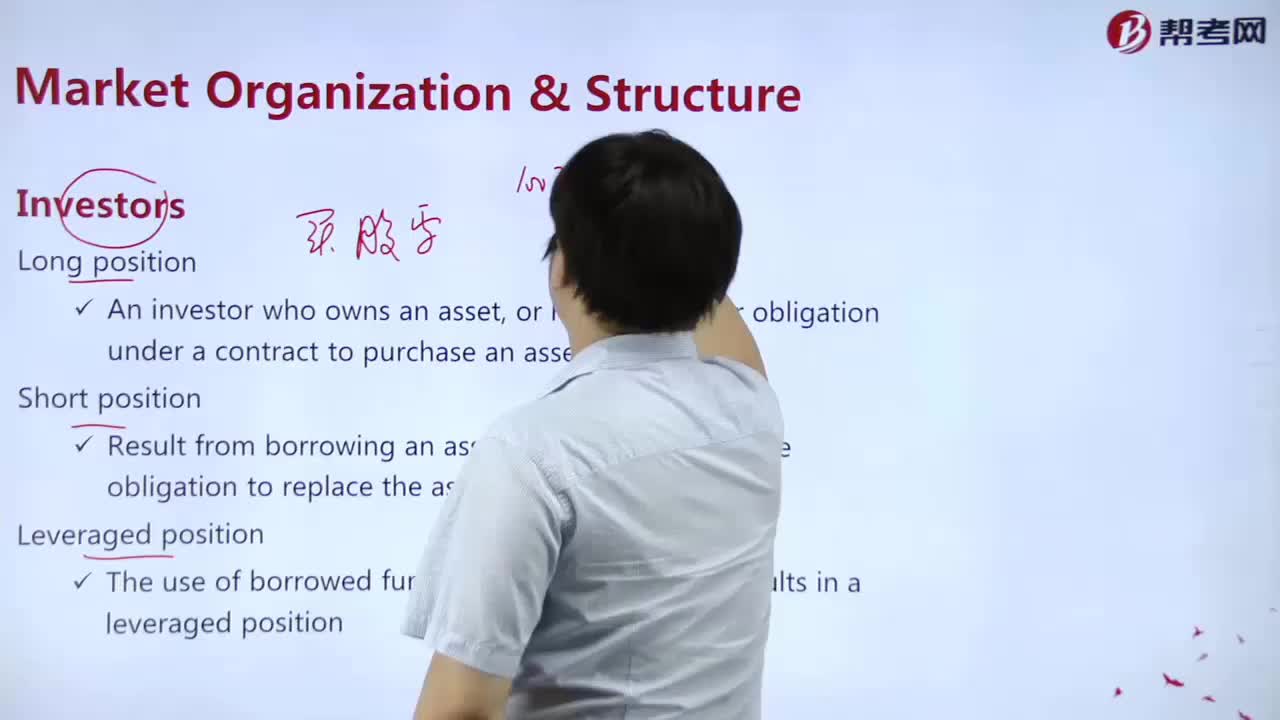

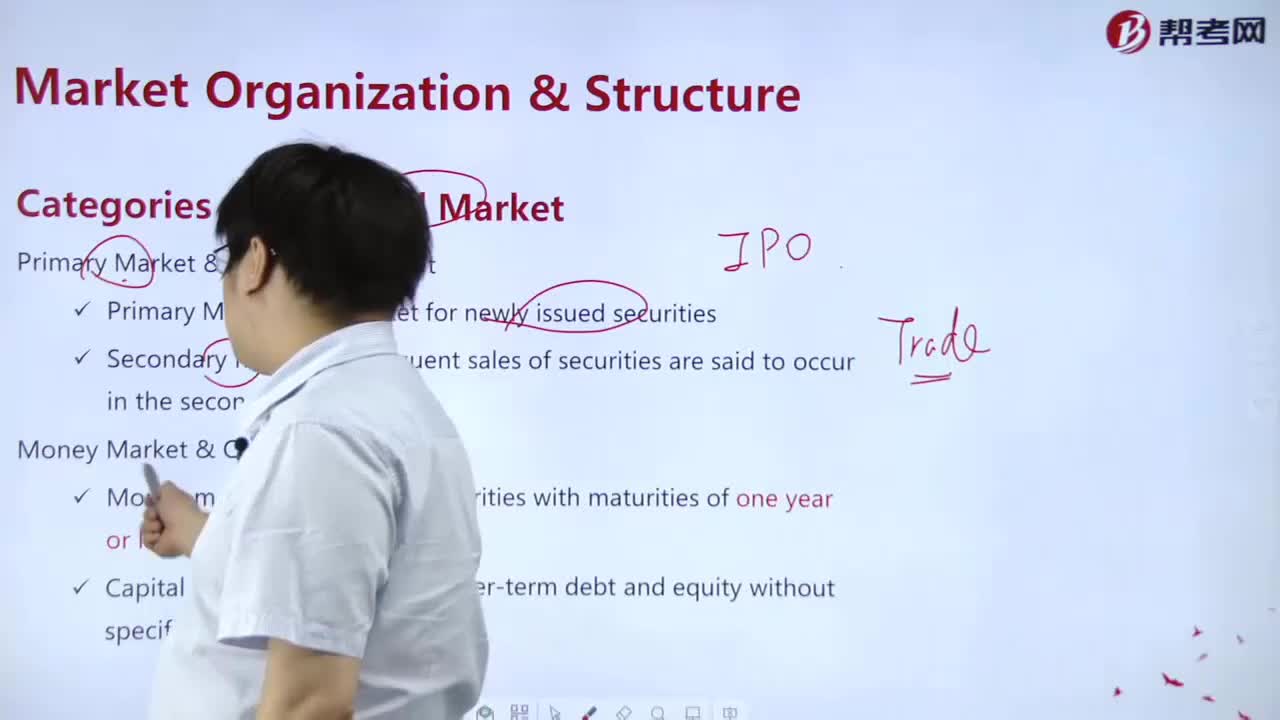

What are the objectives of the Marketing Organization?

What are the different stakeholders in the company?

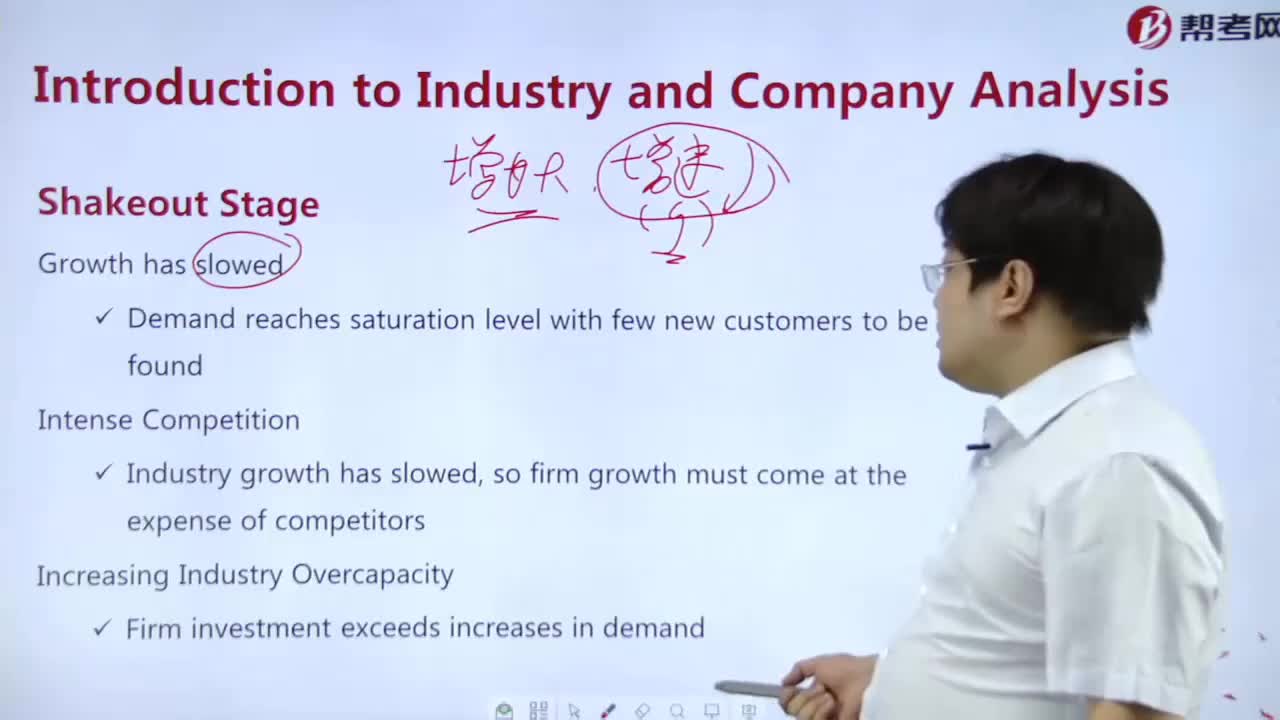

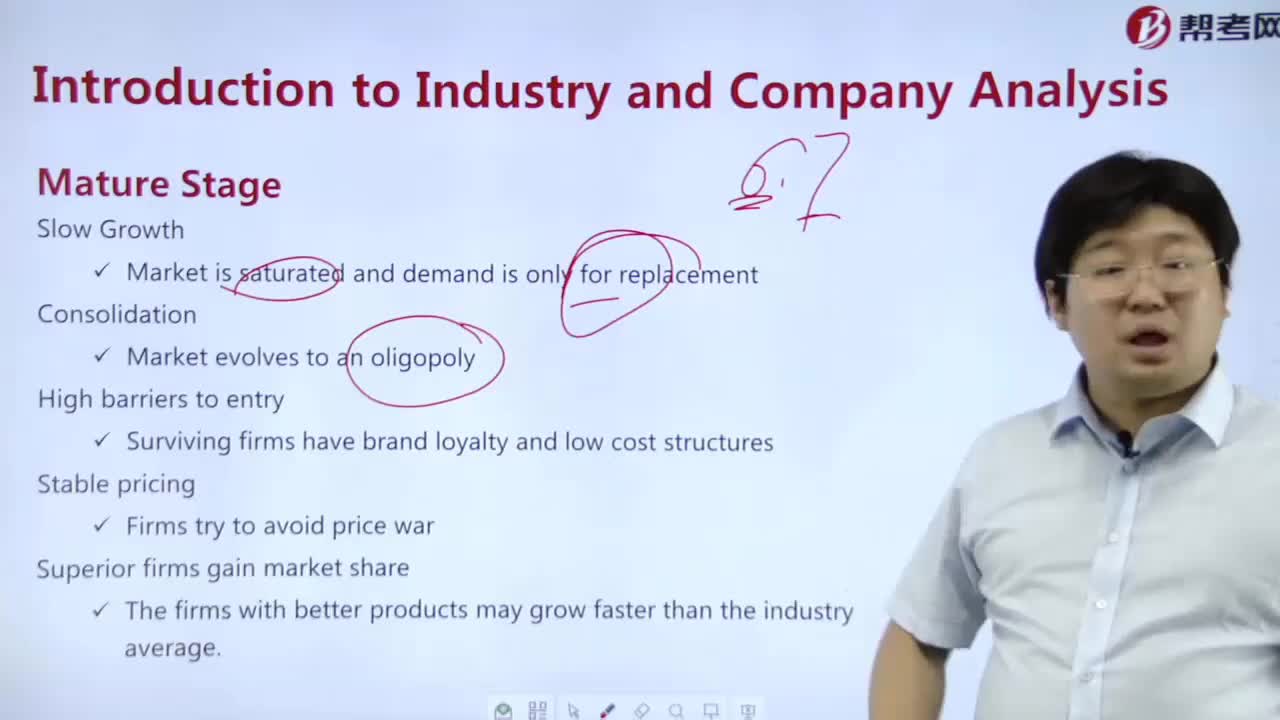

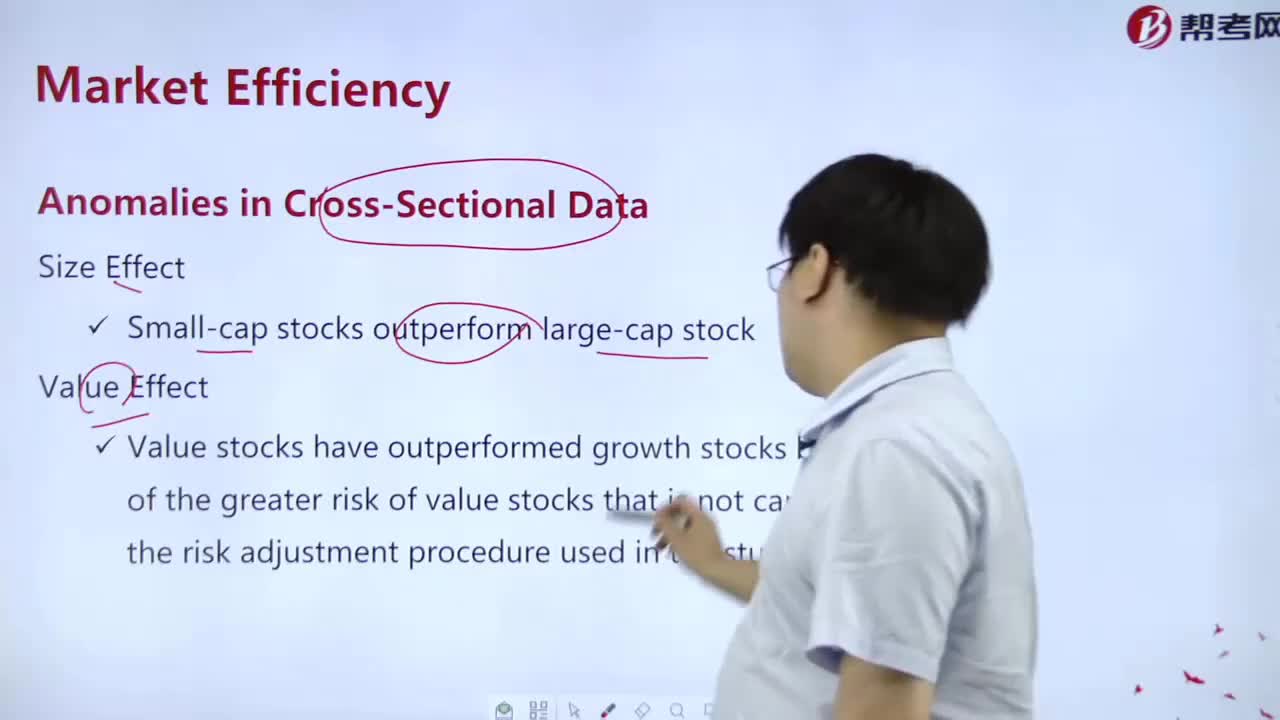

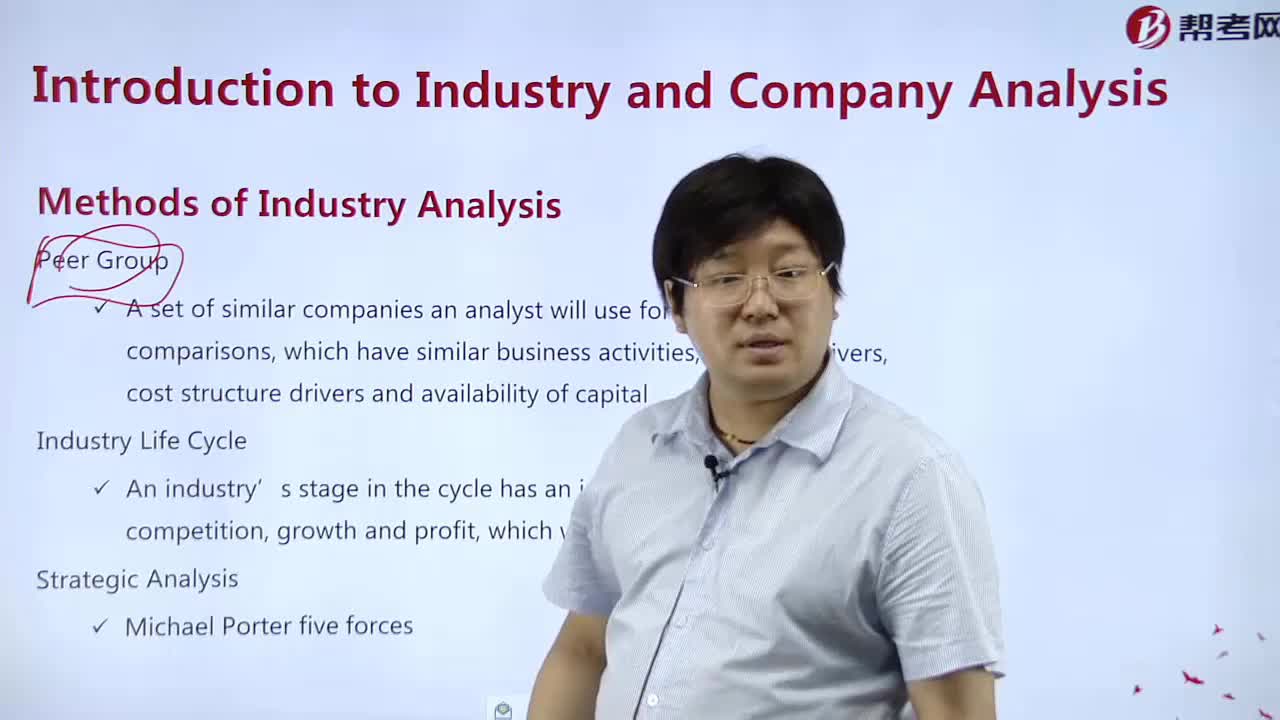

What are the methods of industrial analysis?

What are the elements of a multi-price strategy?

下载亿题库APP

联系电话:400-660-1360