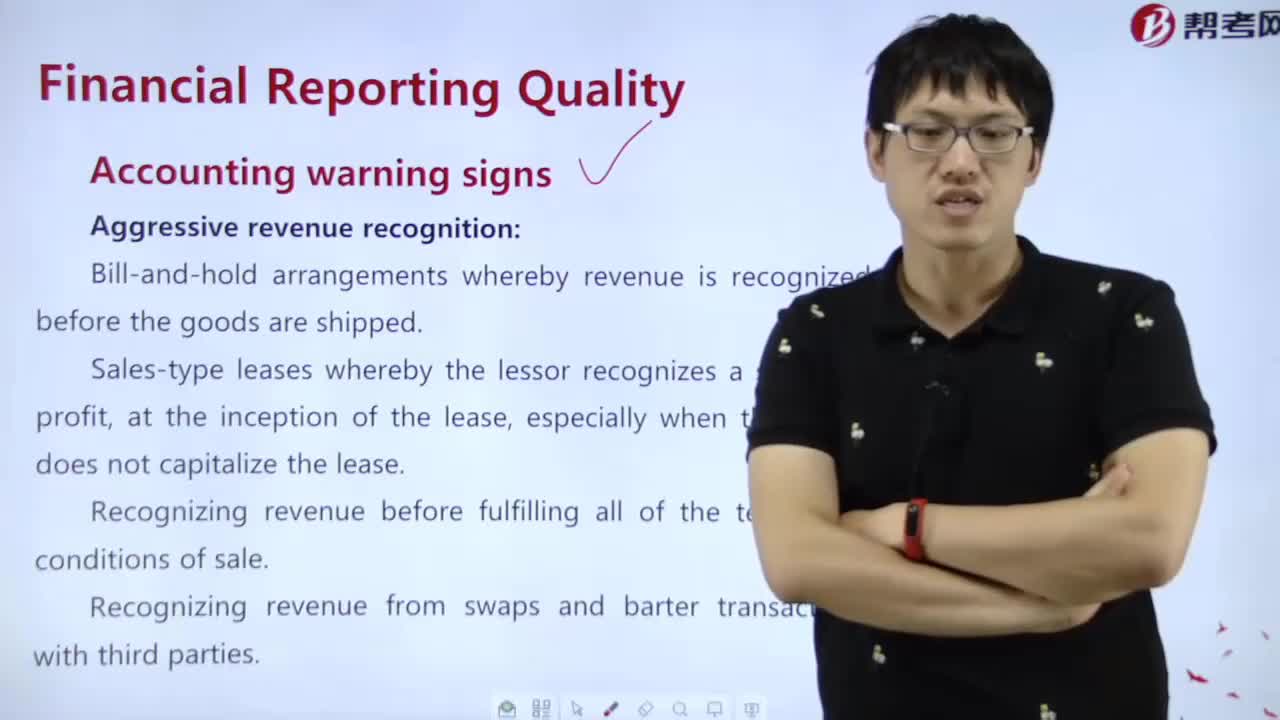

How to master Accounting warning signs?

How to understand Inventory accounting?

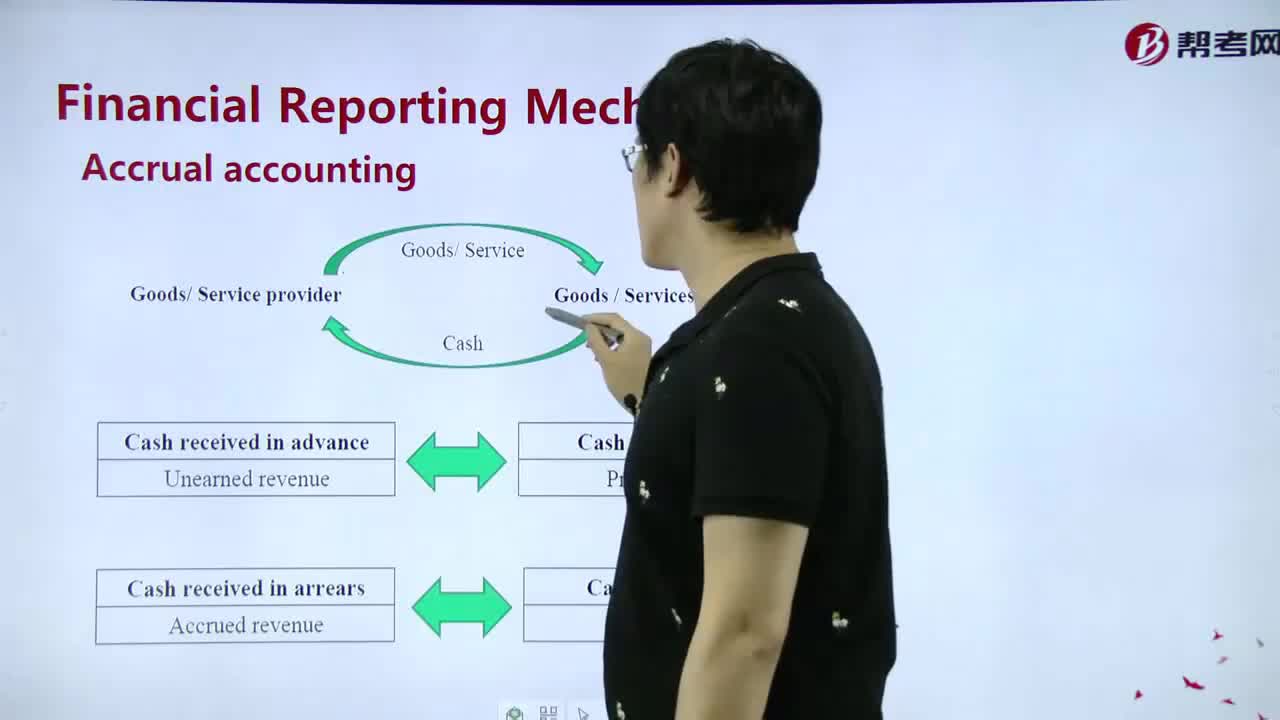

How to understand Accrual accounting?

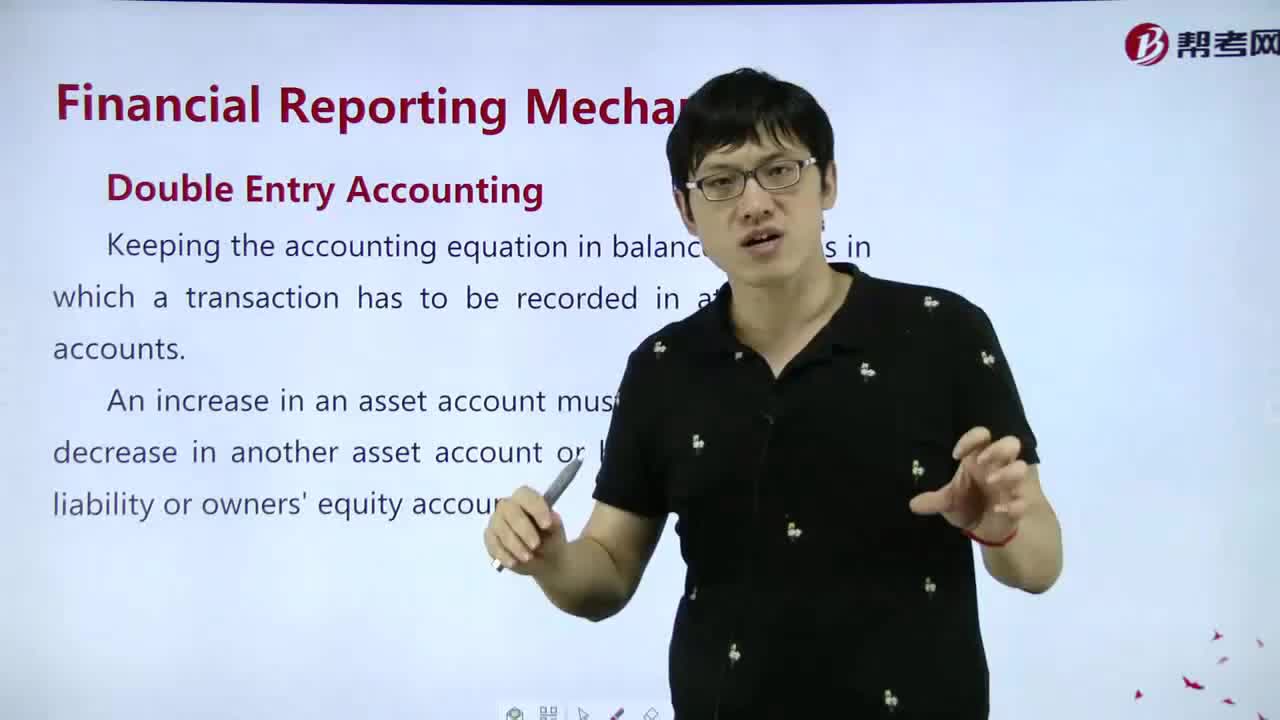

How to master Double Entry Accounting?

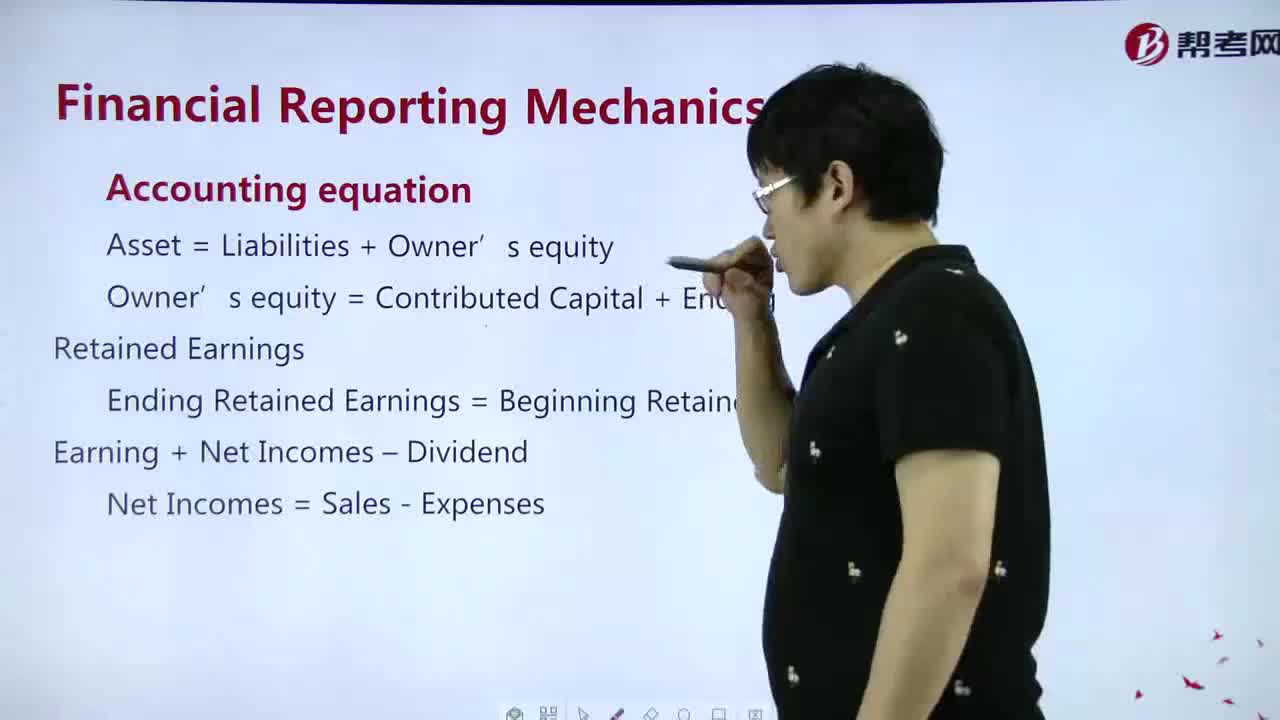

What's the meaning of Accounting equation?

Technical and Fundamental Analysis

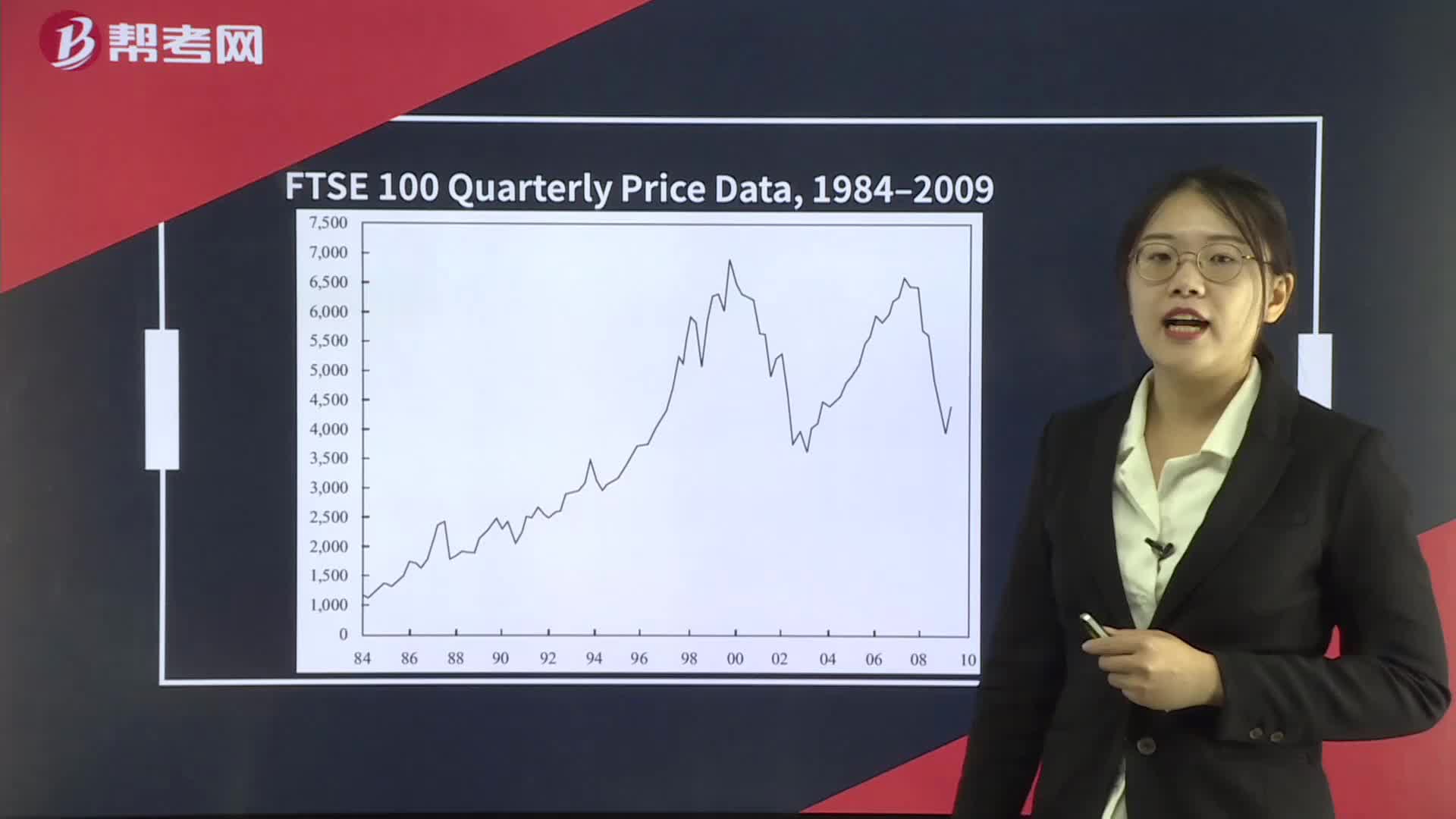

Technical Analysis

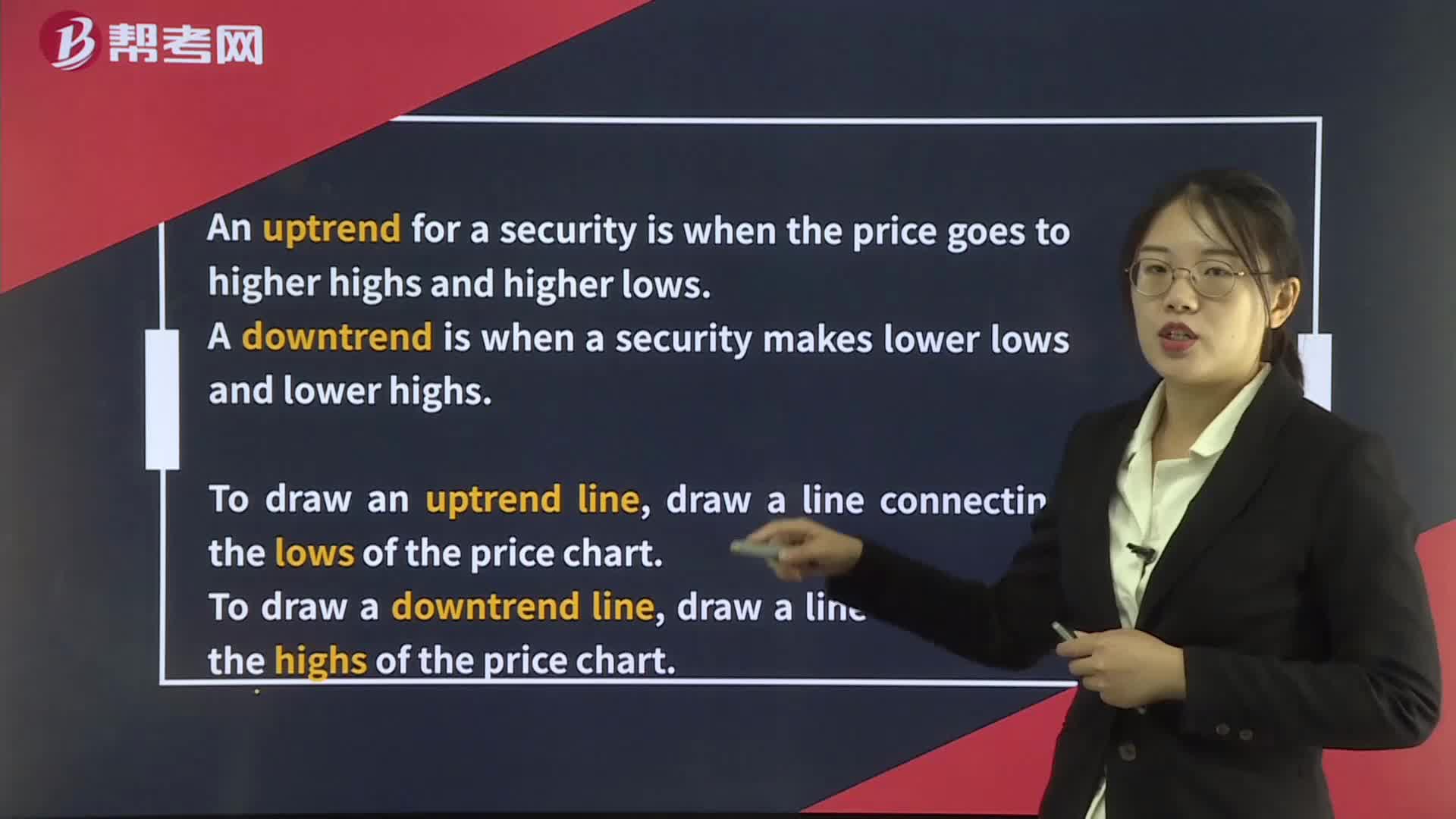

Technical Analysis Tools— Trend

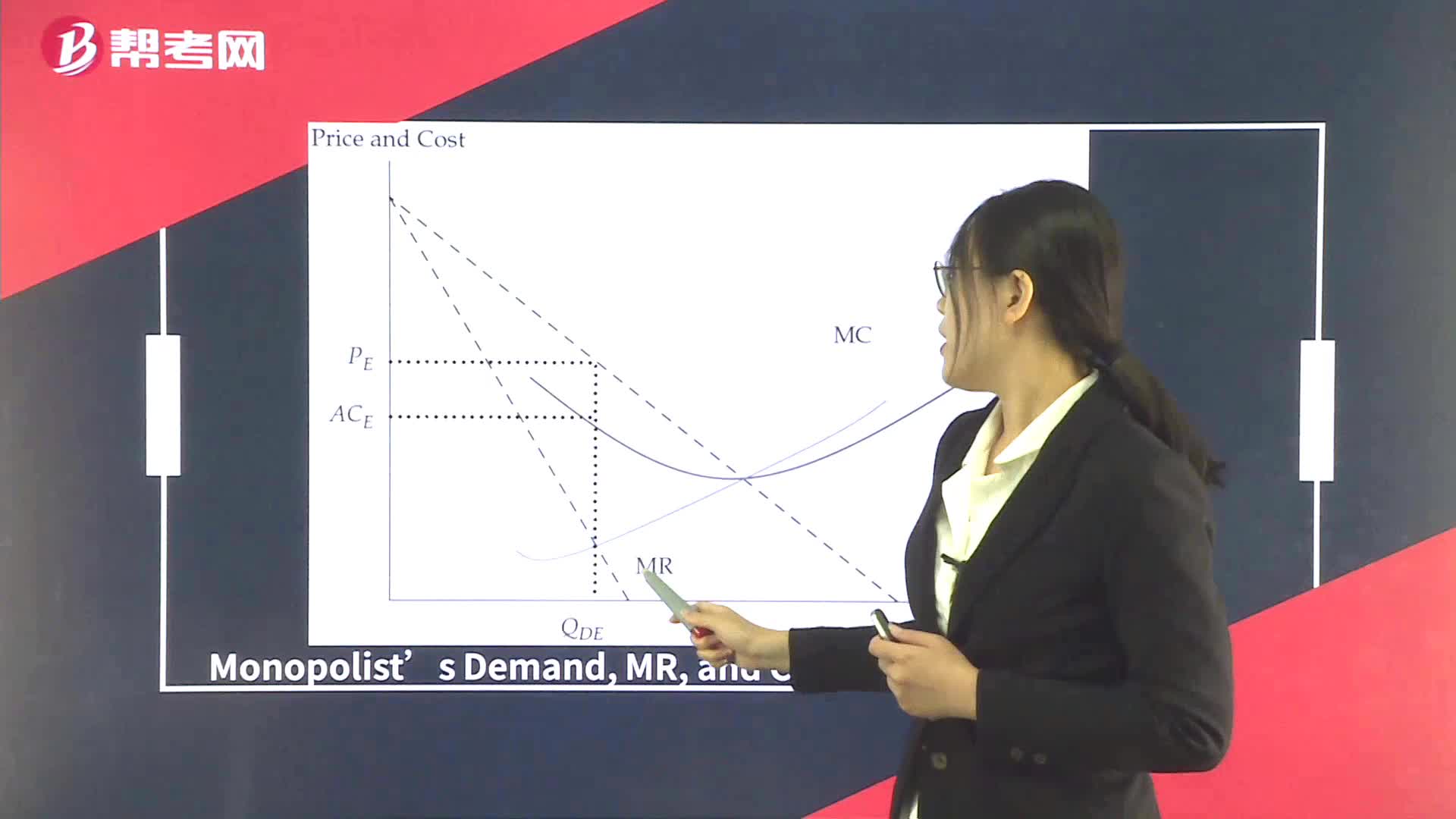

Supply Analysis in Monopoly

Technical Analysis Tools— Charts

Intermarket analysis

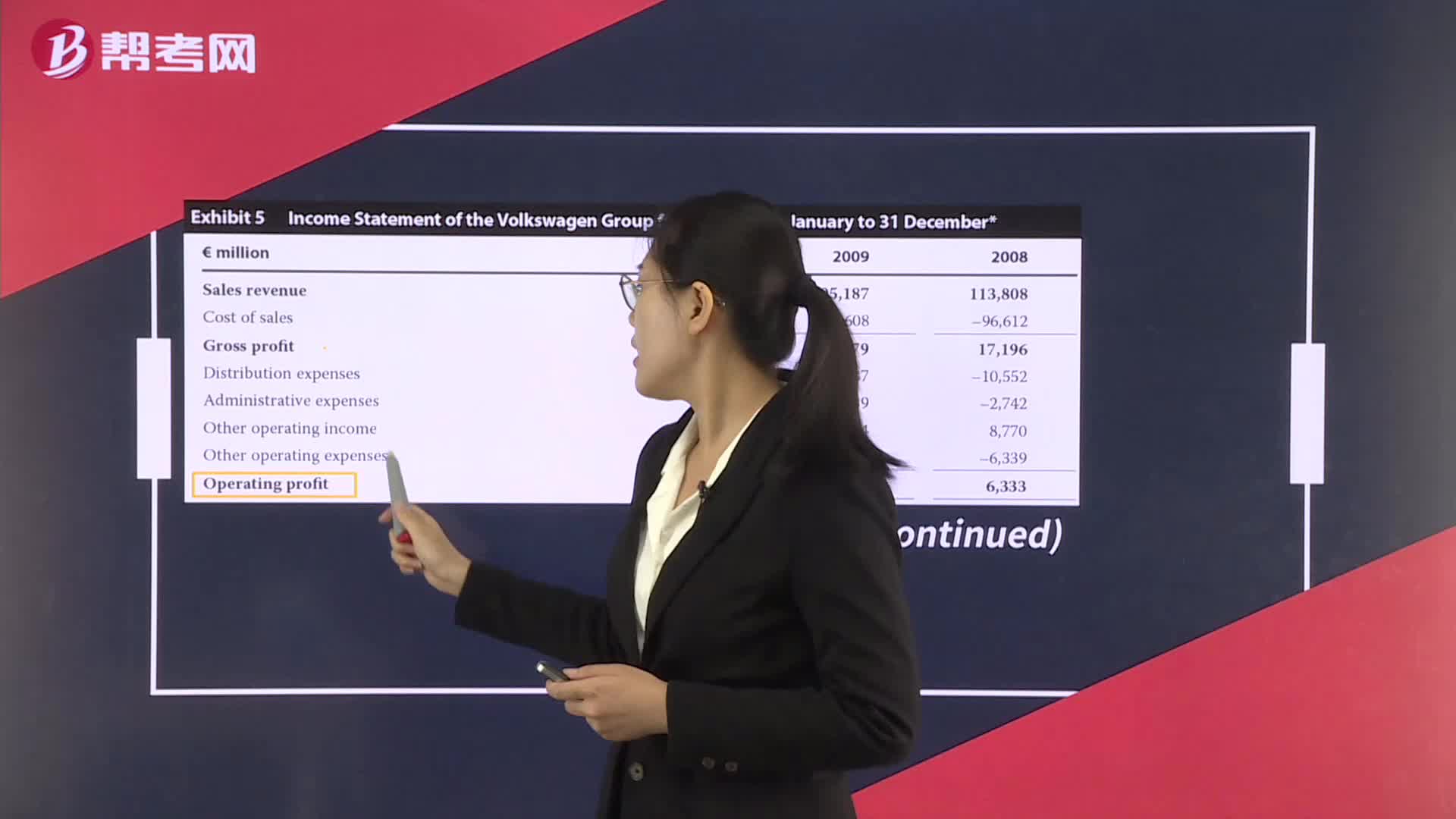

Economic Profit and Accounting Profit

下载亿题库APP

联系电话:400-660-1360