-

下载亿题库APP

-

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

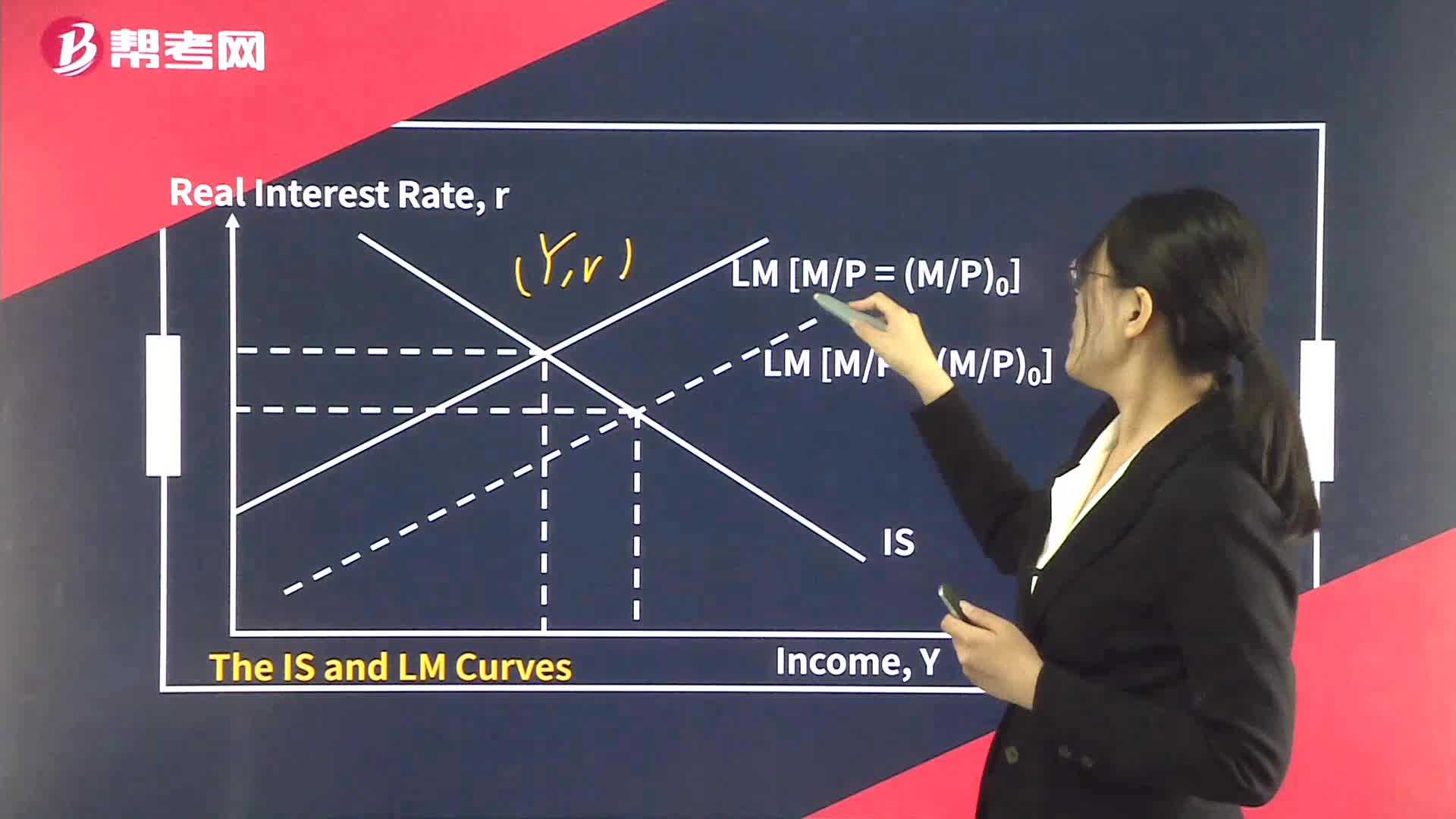

The IS Curve

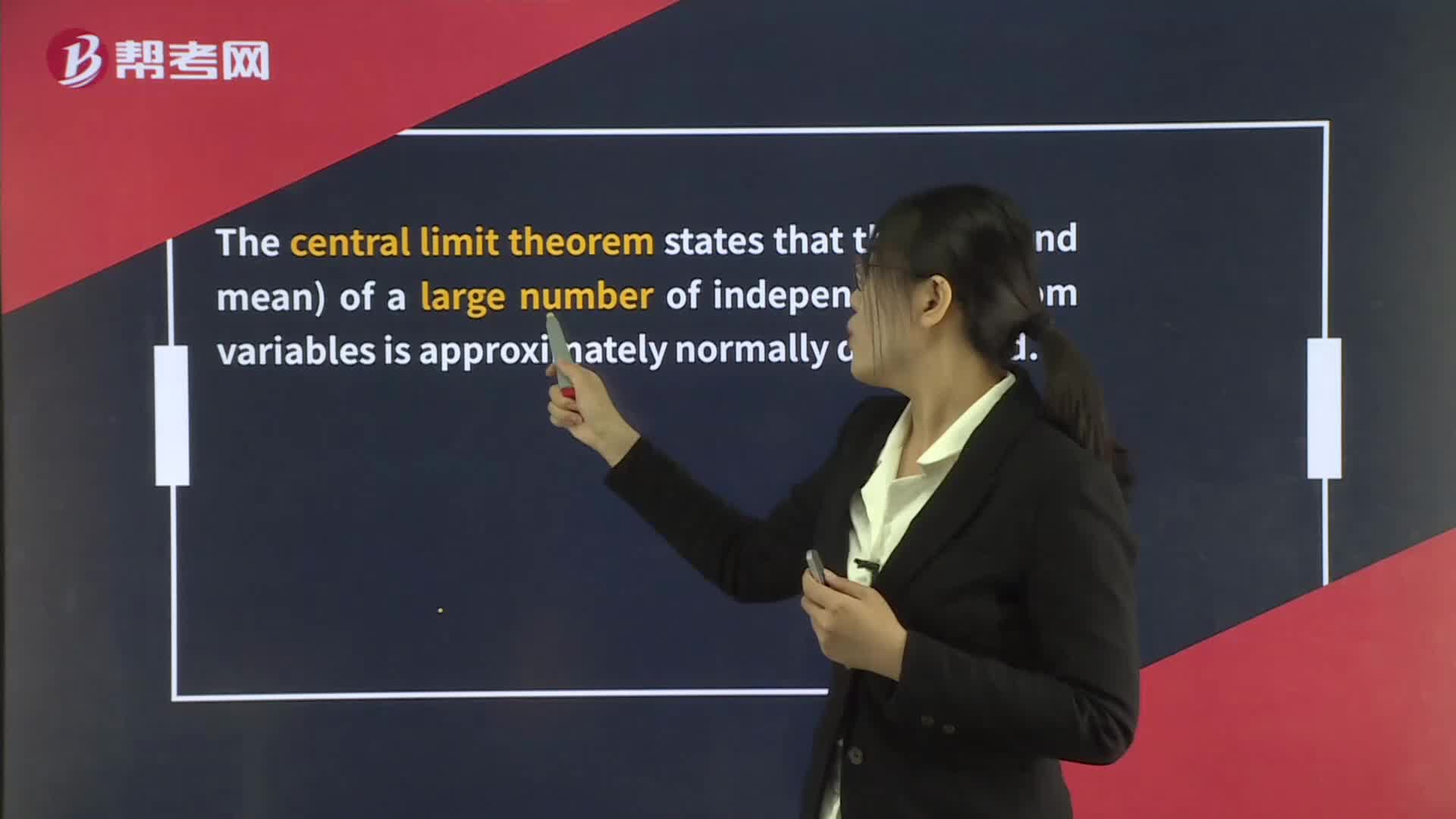

The Normal Distribution

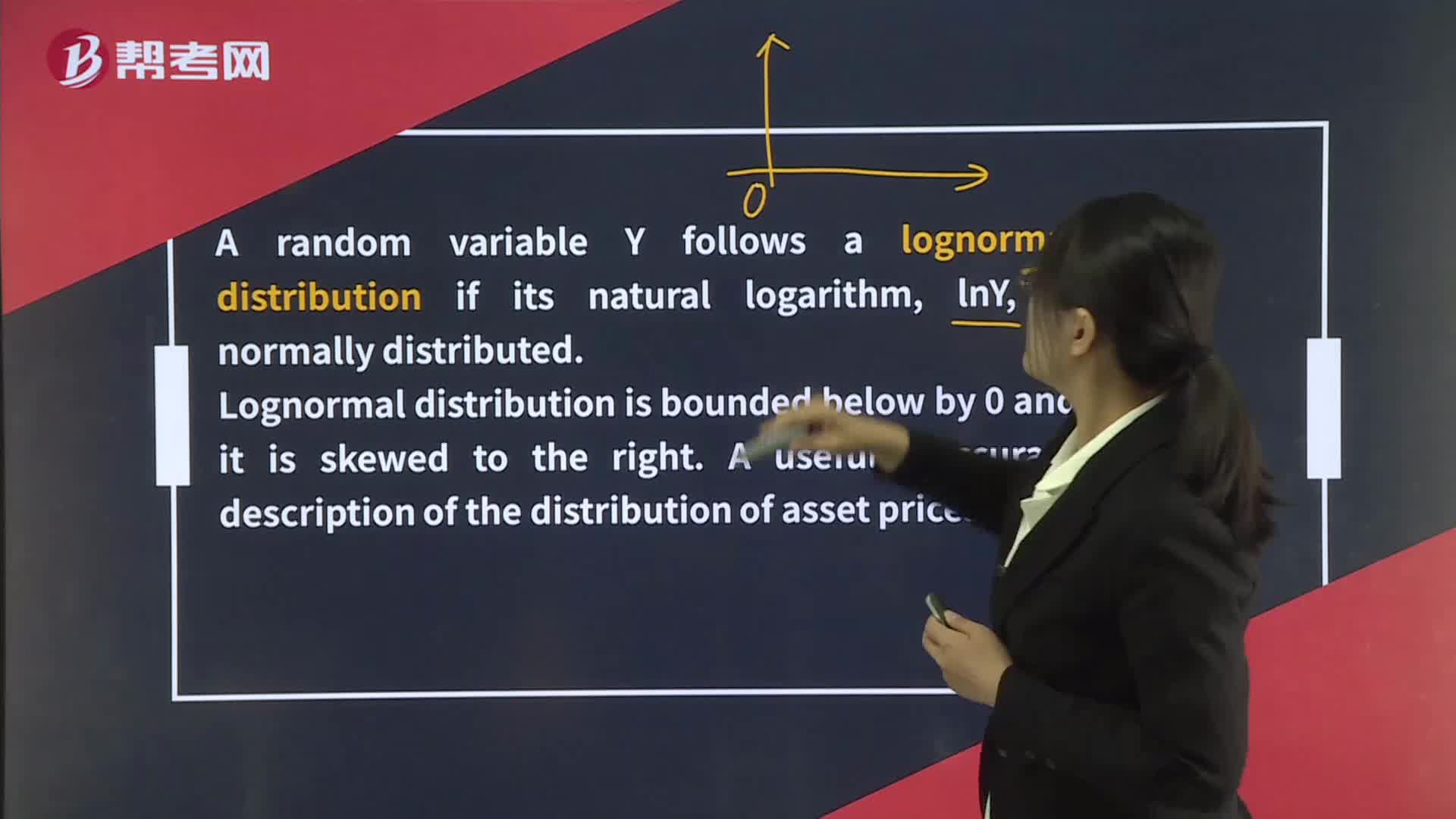

The Lognormal Distribution

The Aggregate Demand Curve

The NPV Rule & The IRR Rule

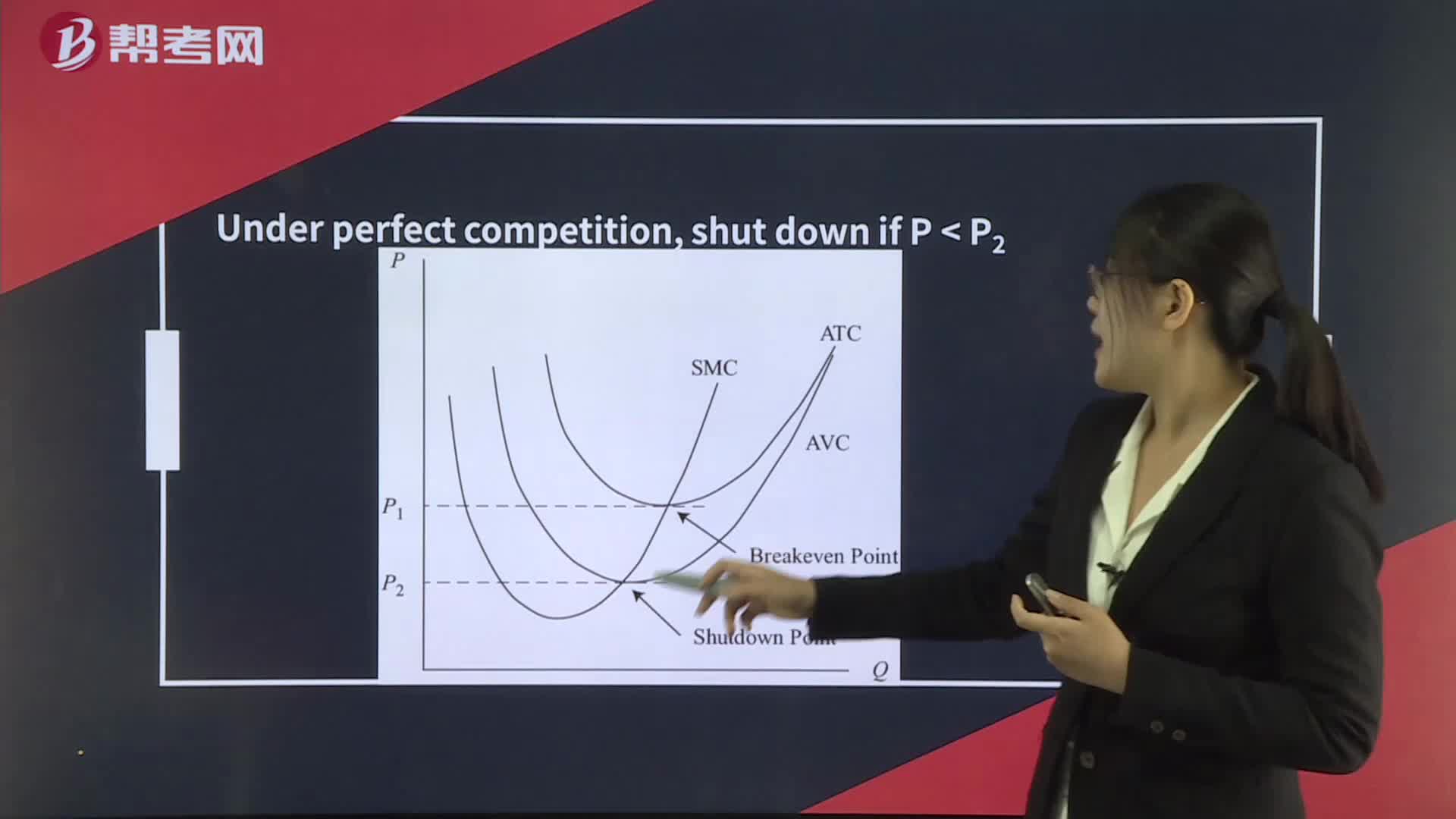

The Shutdown Decision

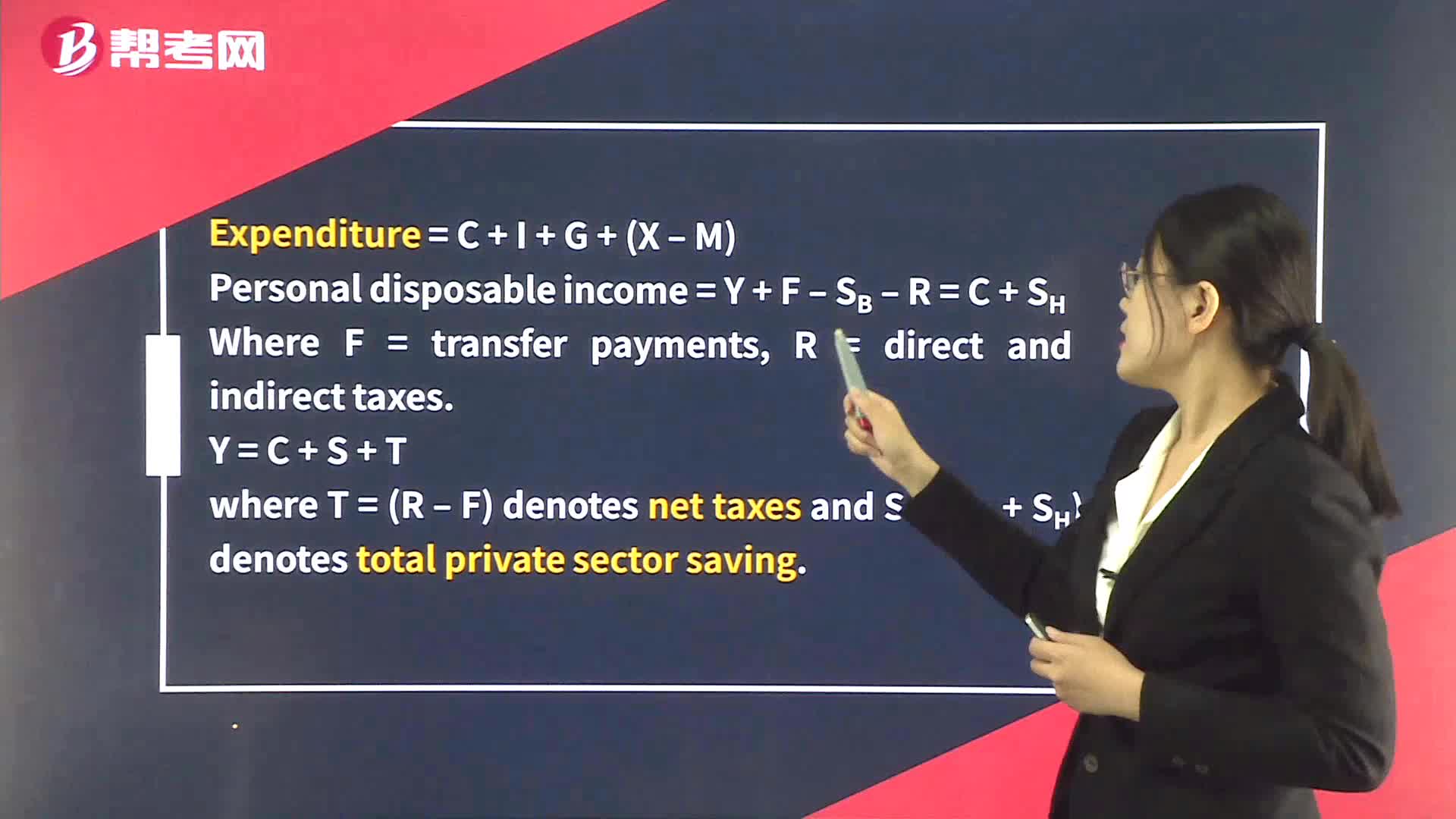

The AbsorptionApproach

The Ideal Currency Regime

Hypothesis Tests Concerning the Mean

The Unemployment Rate

The Quantity Theory of Money

The Objectives of Monetary Policy

02:16

02:16

The Neutral Rate:The neutral;underlying economy.:economyLong-runrates might make a bad situation worse.

03:05

03:05

The Money Creation Process:1 divided by the reserve requirement is the money multiplier.

02:14

02:14

The Functions of Money:iii. be easily divisible;provides society with a convenient measure of value and unit of account.

01:30

01:30

The Fisher Effect:The Fisher:interest in an economy is stable over time so that changes in nominal interest rates are the result;premium.premium to compensate them for uncertainty.

04:02

04:02

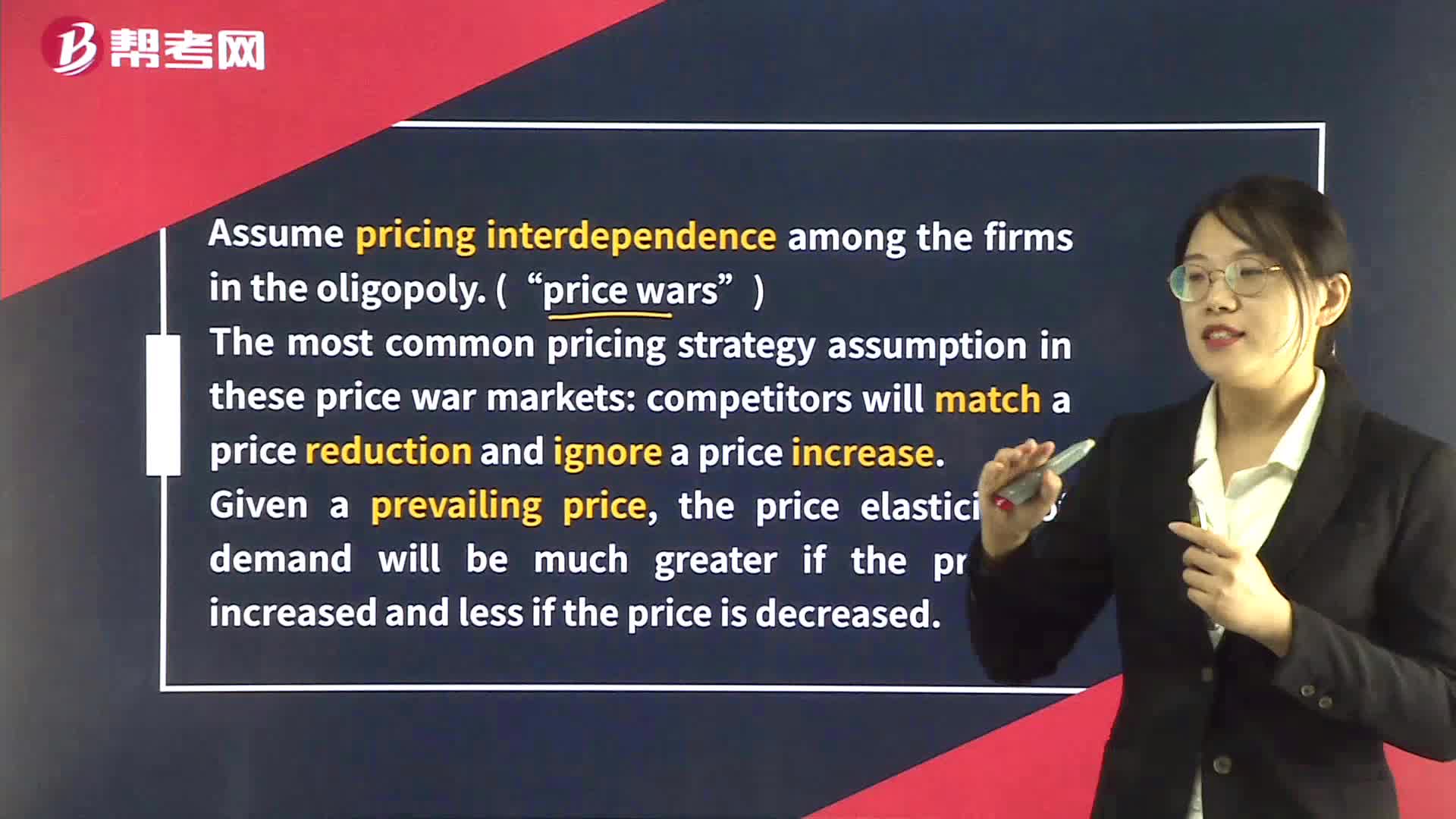

Kinked Demand Curve in Oligopoly Market:priceincomplete pricing analysis.

03:24

03:24

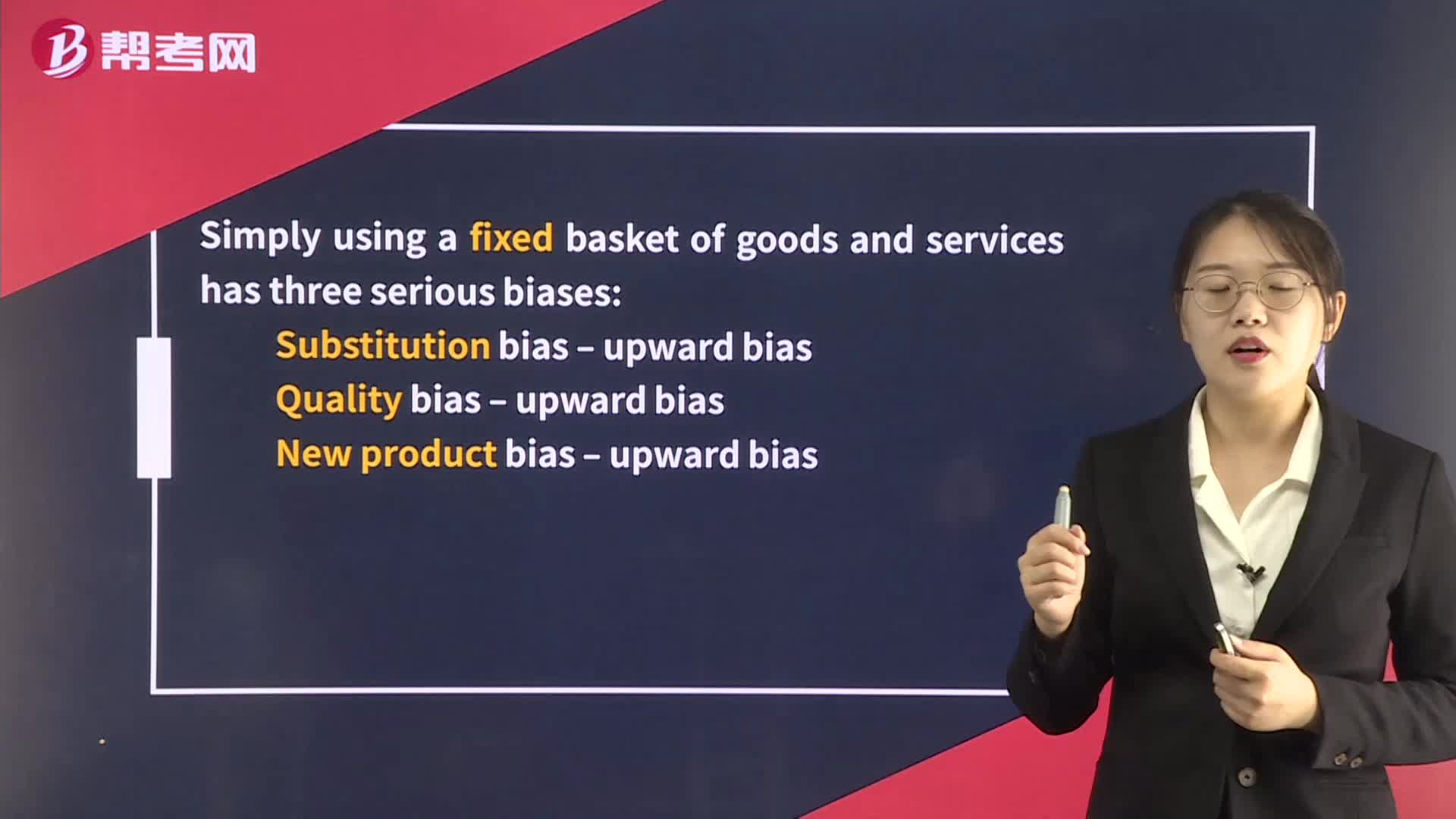

The Construction of Price Indexes:be used to average the different prices.:index.the basket.

04:31

04:31

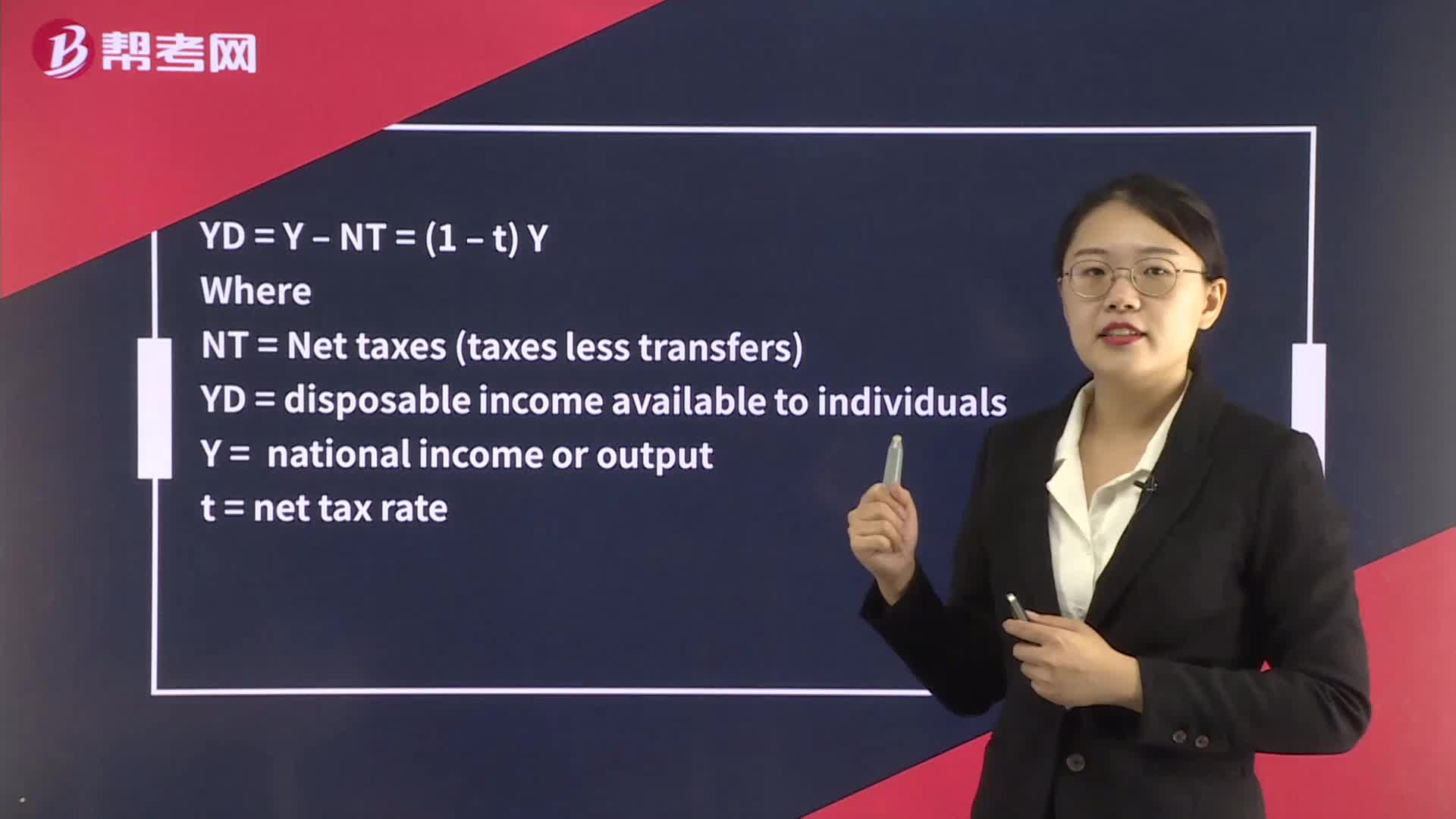

The Fiscal Multiplier:Wheret = tax rate

04:47

04:47

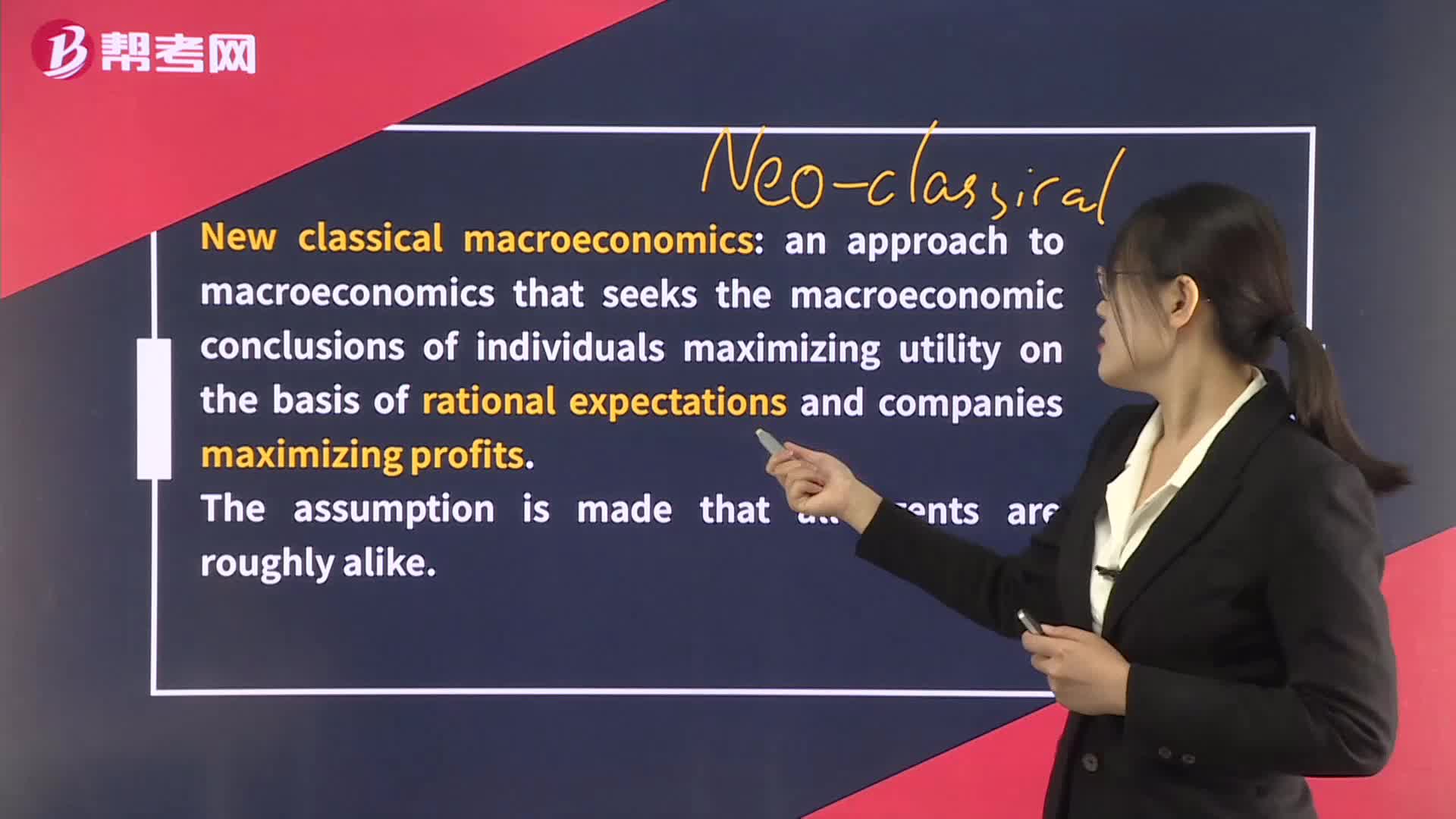

The New Classical School:an approach to macroeconomics that seeks the:Money,technologymodelslow-to-adjusteconomy is weak.

04:25

04:25

What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

08:39

08:39

What aspect is loyalty embodied?:Should abstain from independent competitive activity that could conflict with the interests of their employer.:(从事独立业务需要向雇主披露并获得雇主同意):Misappropriation of trade secrets(盗窃交易秘密)

06:50

06:50

What are the ethics and trust in the investment profession?:Global investment performance standards(GIPS)= 比例低,也并非所有的不道德都是违法君子有所不为的决策是更好的决策更符合stakeholder利益的决策

06:13

06:13

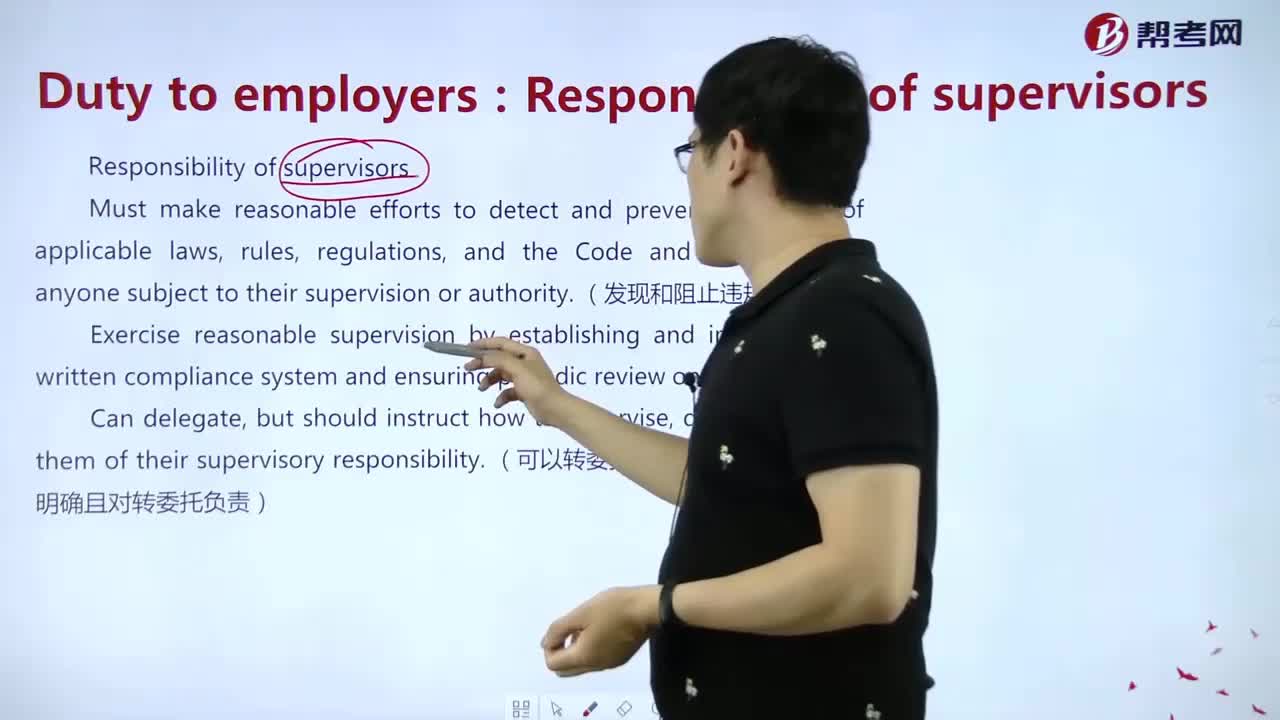

What’s the responsibility of supervisors?:does not relieve them of their supervisory responsibility. (可以转委托他人监管,但必须指示明确且对转委托负责),应拒绝承担监管者责任),