-

下载亿题库APP

-

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

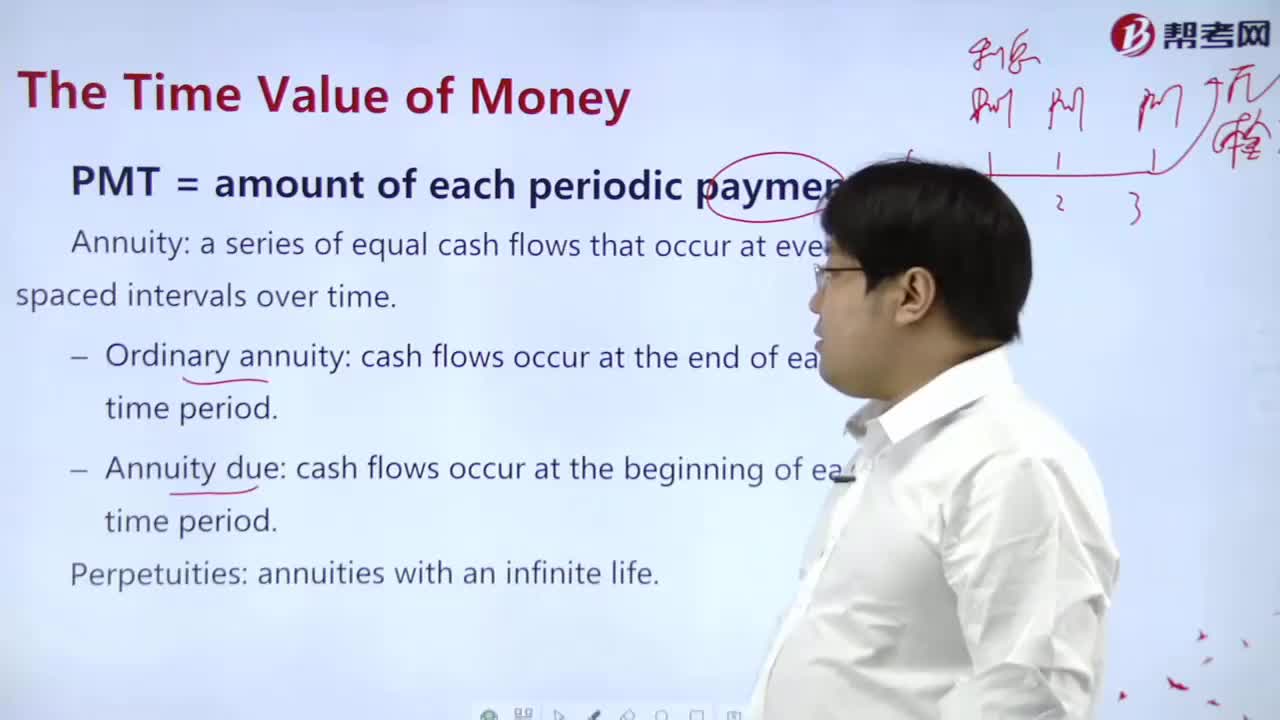

How to use PMT to calculate the amount of periodic payment?

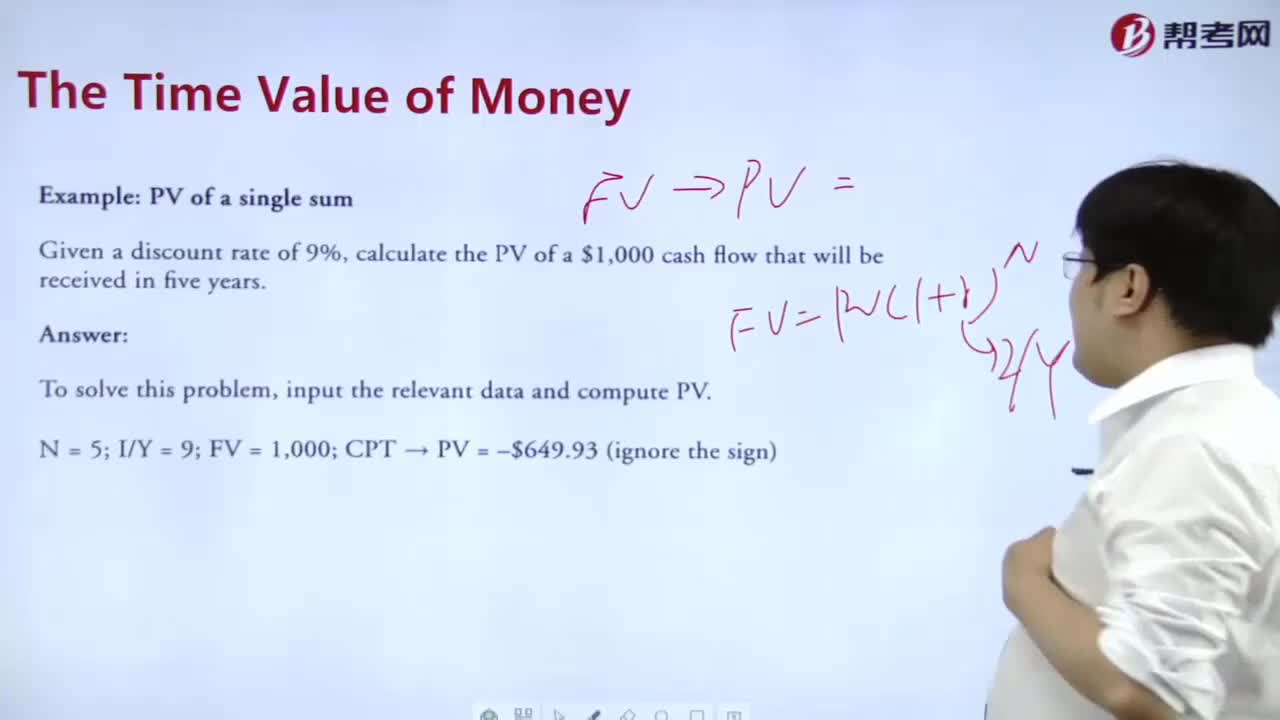

How to calculate the present value of the time value of money?

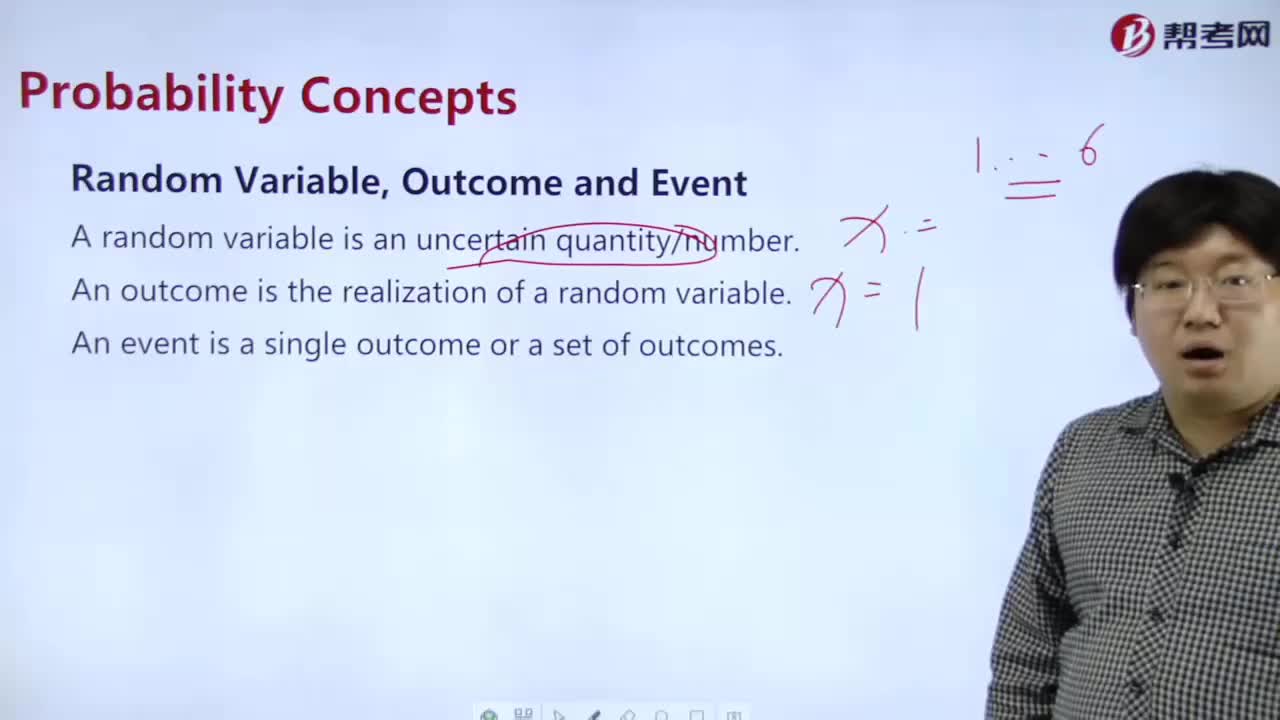

How to understand the probability of random variables, outcomes and events?

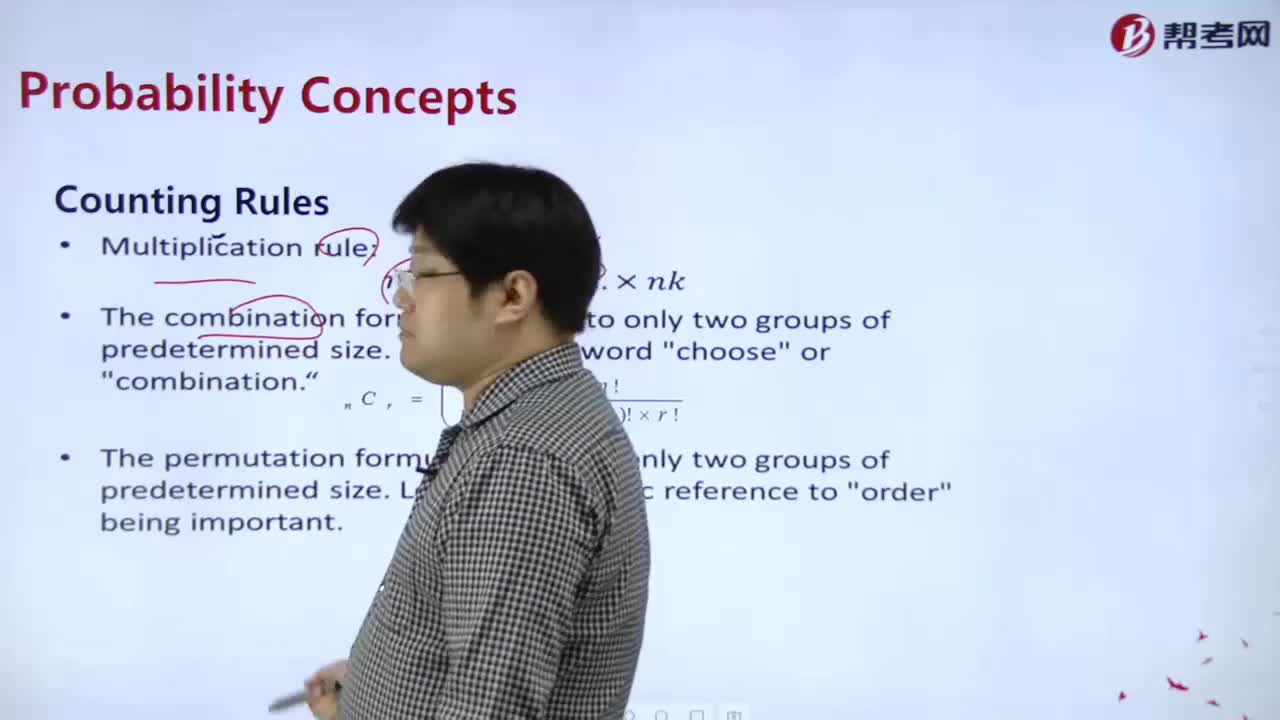

How to understand the counting rules of probability theory?

How to understand Functions of money?

How to master Classification of Money?

How to understand Theories of the Business Cycle?

How to understand Classification of leases?

How to master Characteristics of Oligopoly?

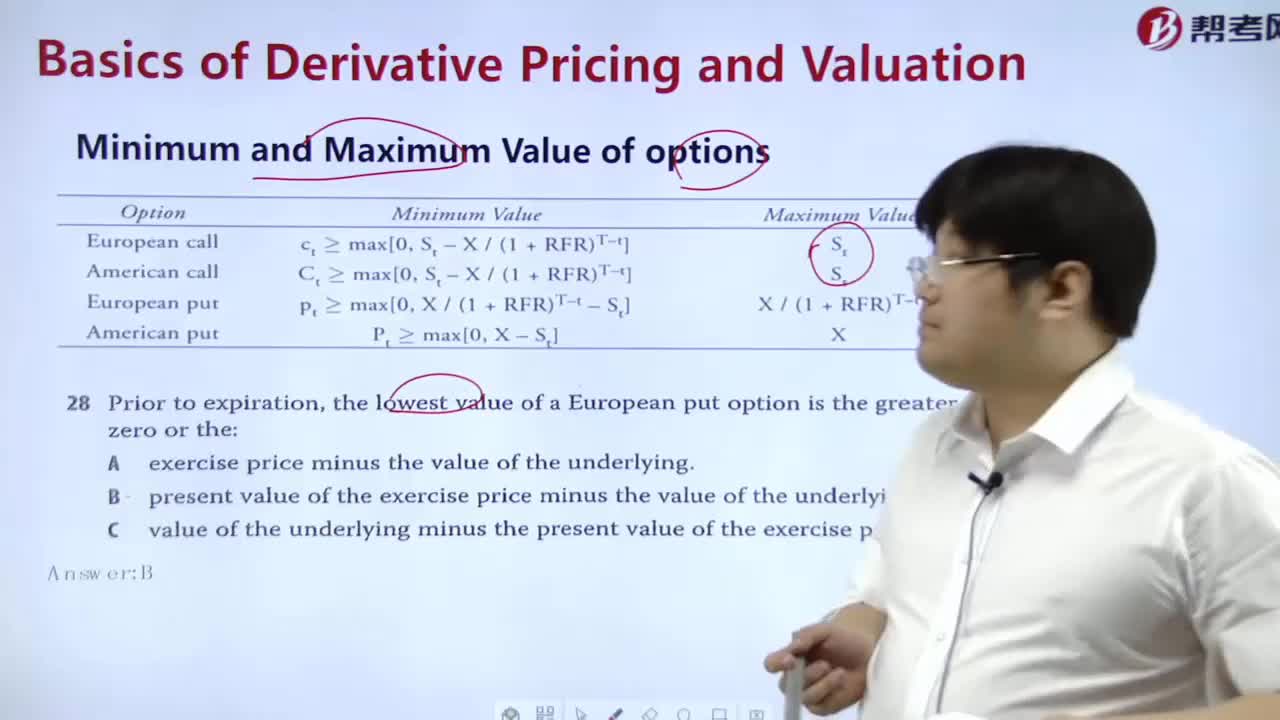

How to calculate the minimum and maximum value of the option?

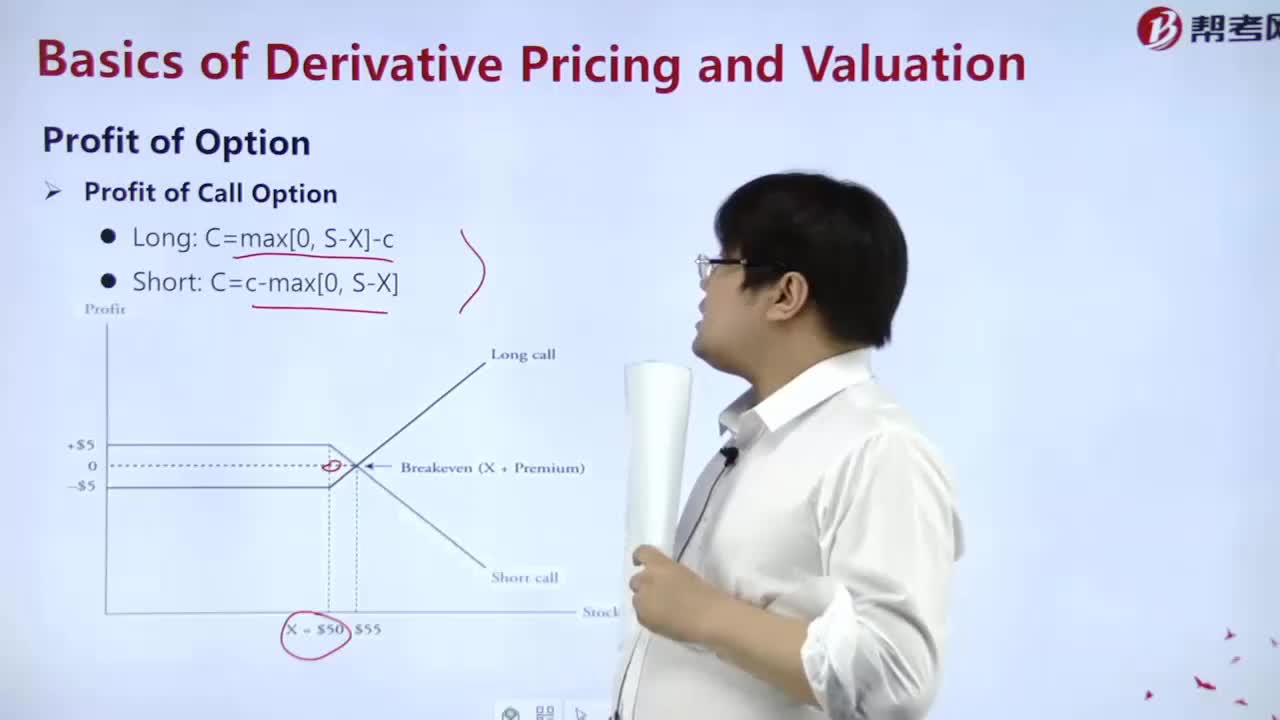

How to calculate the option profit?

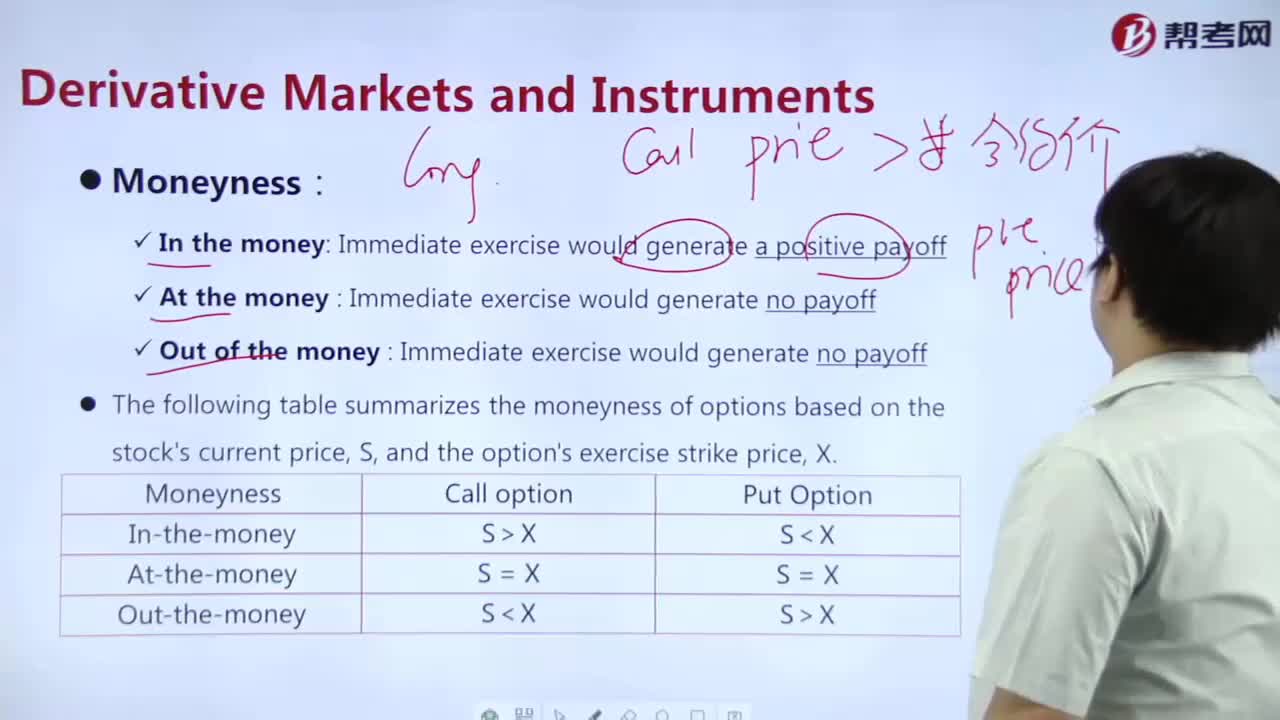

How to determine the value of an option purchased?

06:05

06:05

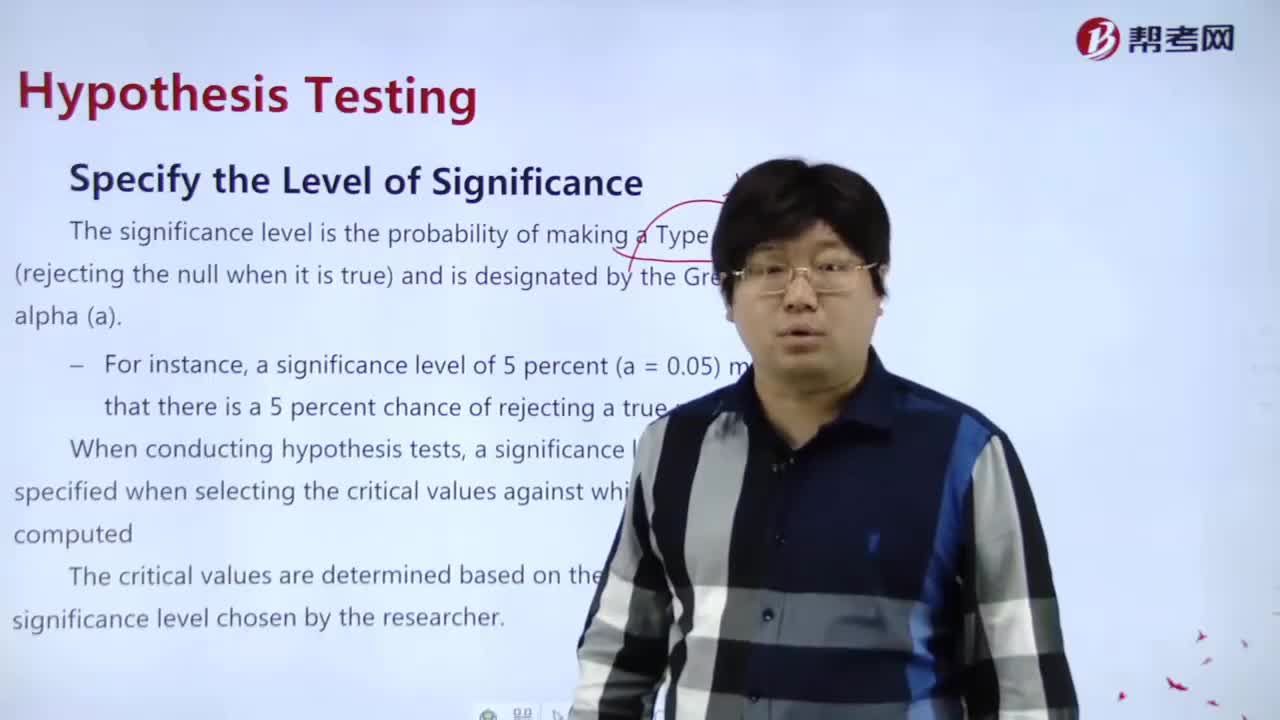

How to specify the level of significance?:How to specify the level of significance?

07:25

07:25

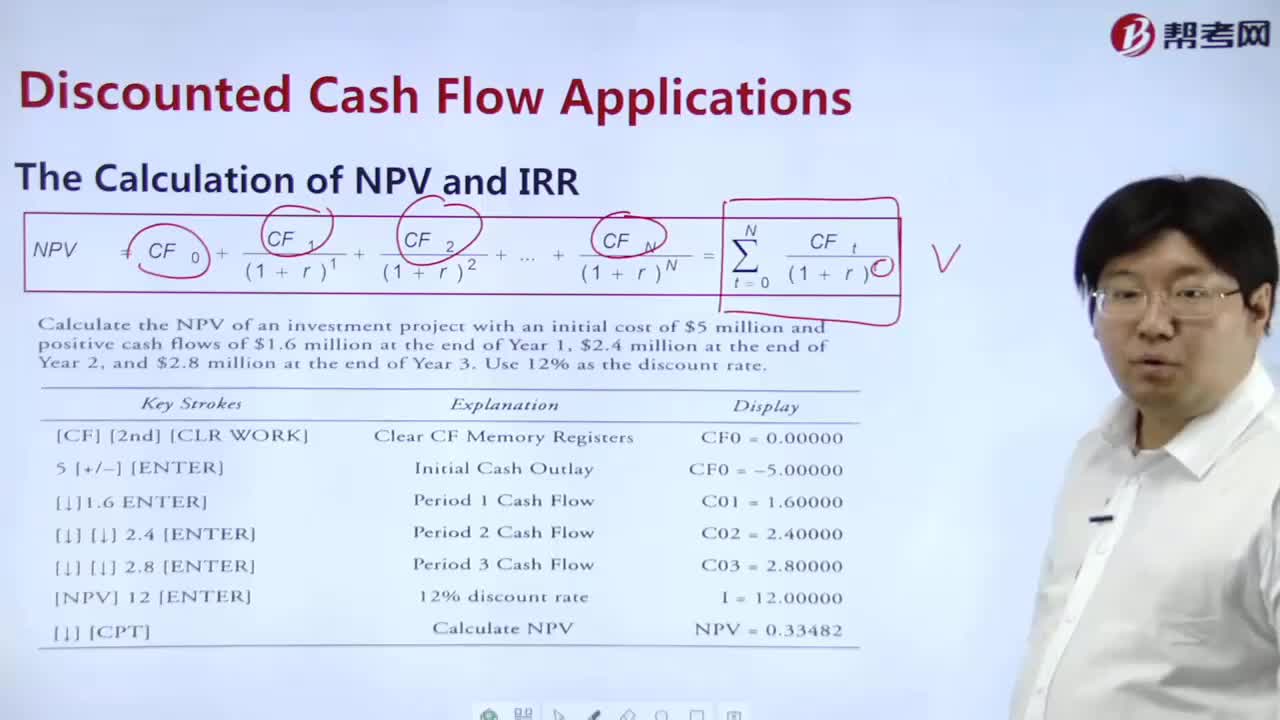

How to calculate NPV and IRR?:How to calculate NPV and IRR?

01:45

01:45

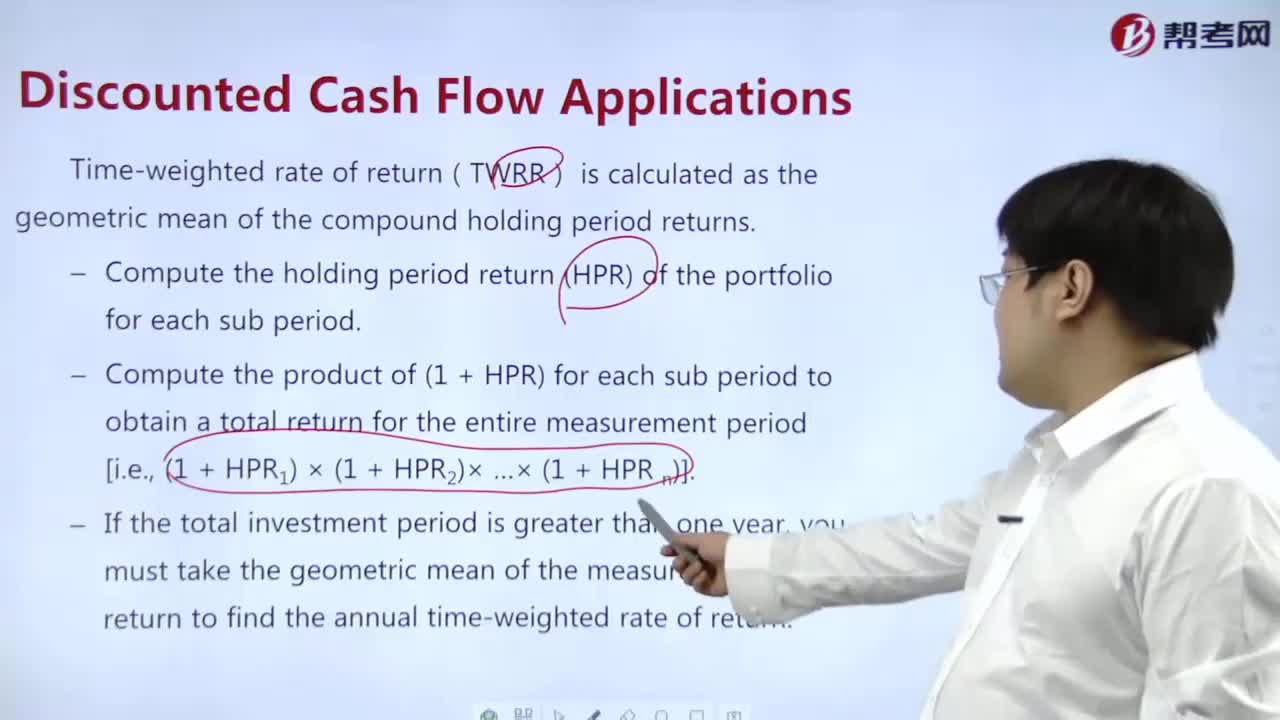

How to calculate MWRR?:How to calculate MWRR?

01:49

01:49

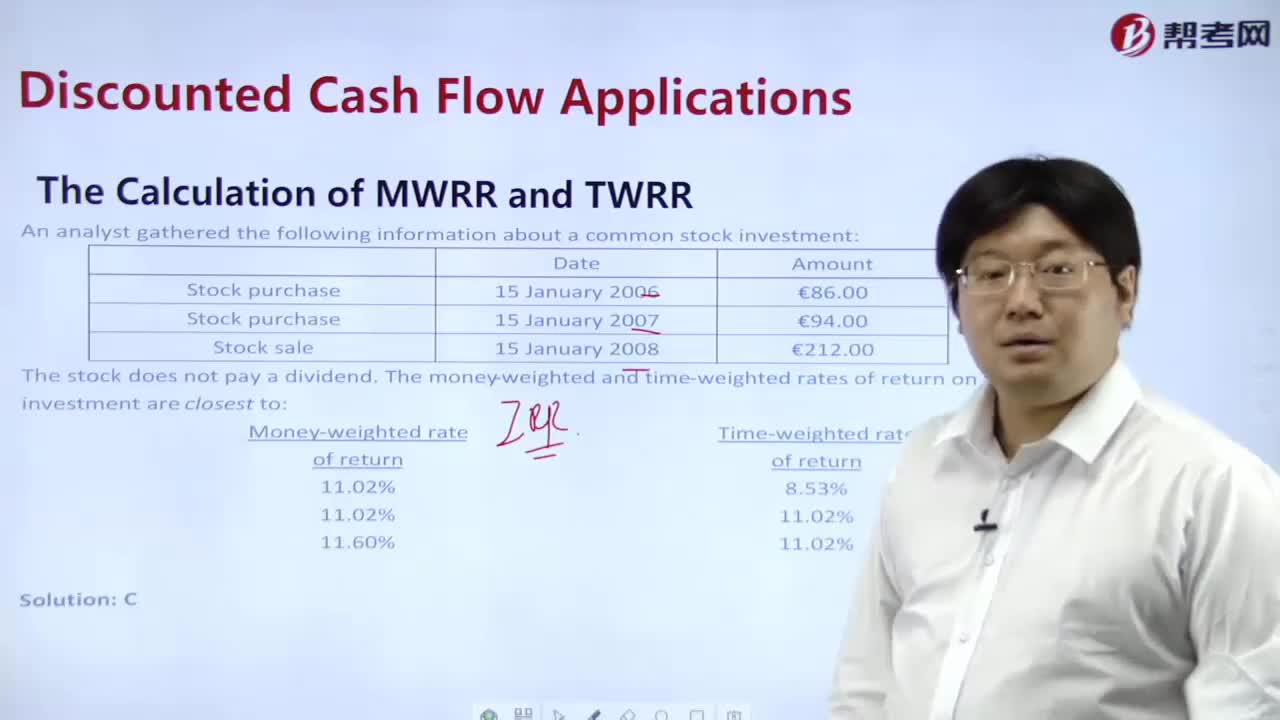

How to calculate MWRR and TWRR?:How to calculate MWRR and TWRR?

04:13

04:13

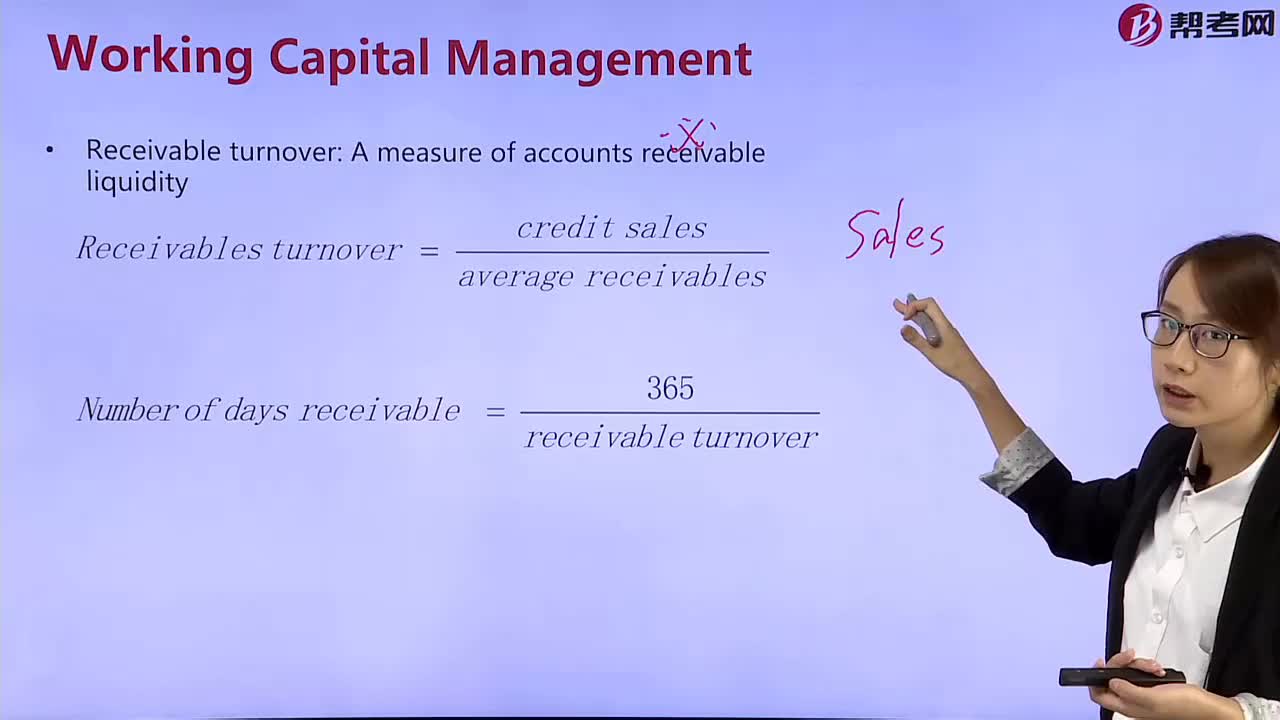

How to calculate the turnover of accounts receivable?:How to calculate the turnover of accounts receivable?

03:40

03:40

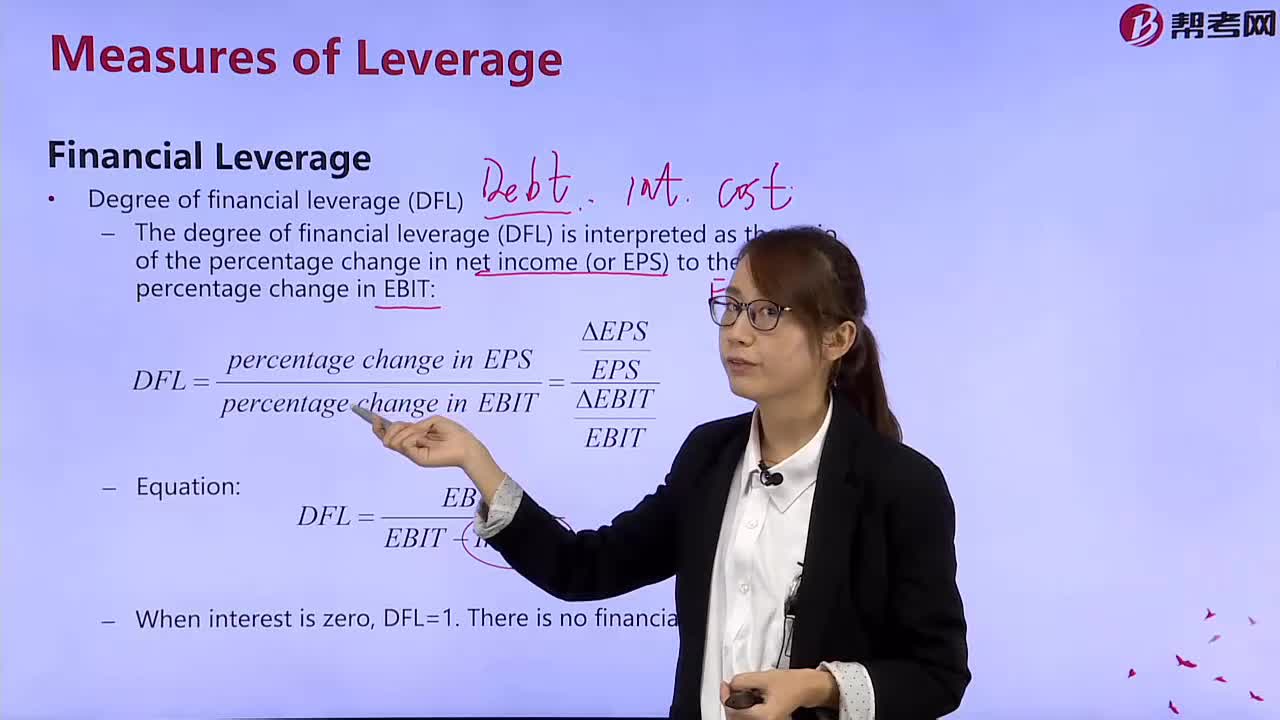

How to calculate the degree of financial leverage?:How to calculate the degree of financial leverage?

05:59

05:59

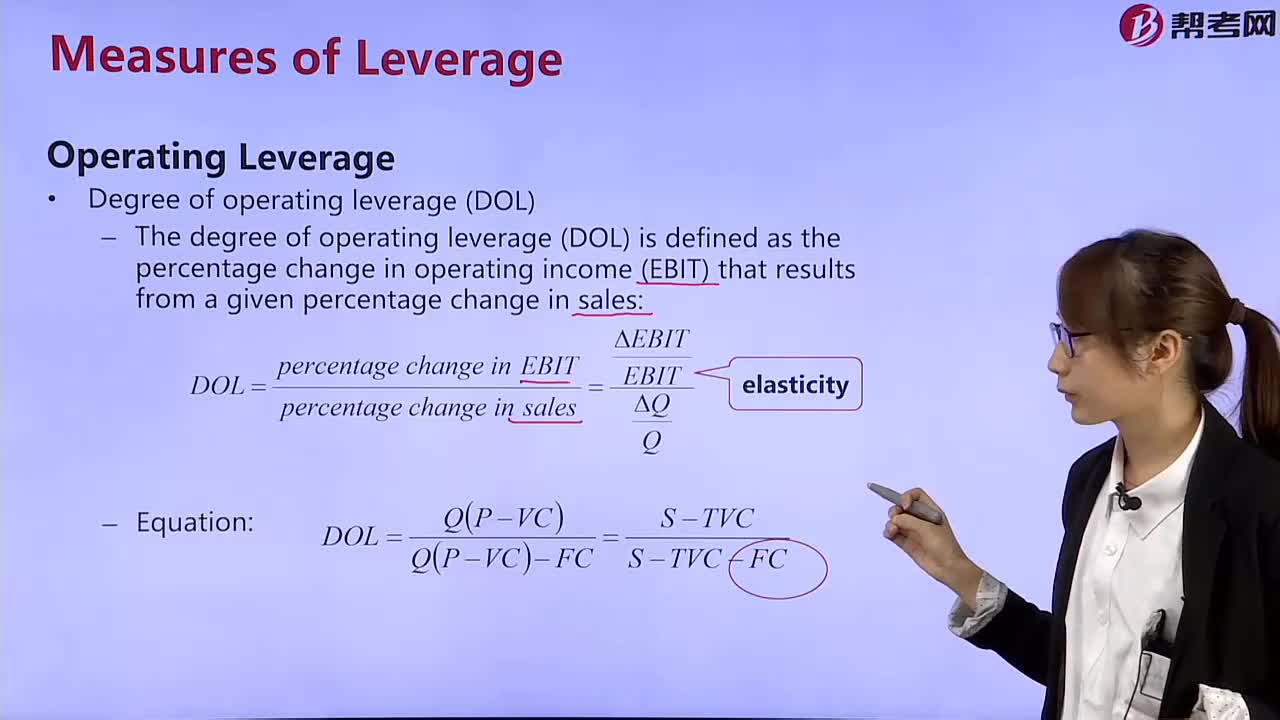

How to calculate the degree of operating leverage?:How to calculate the degree of operating leverage?

02:12

02:12

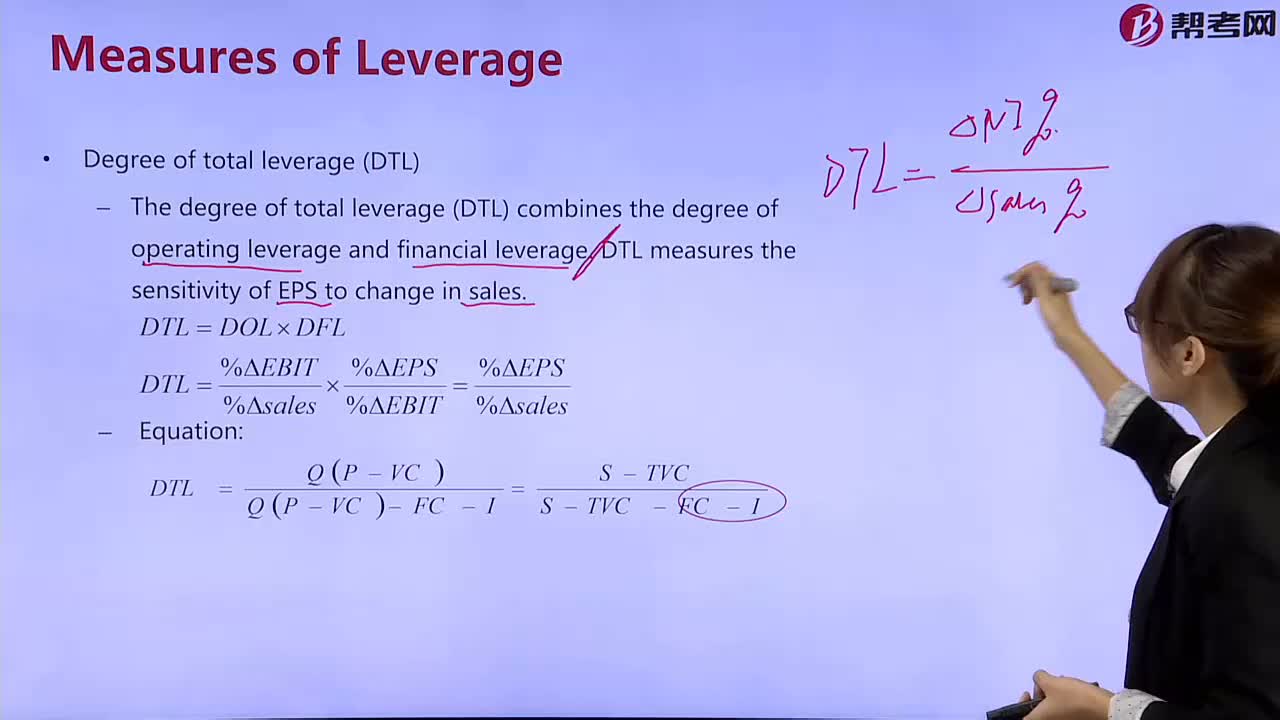

How To calculate total leverage?:How To calculate total leverage?

03:01

03:01

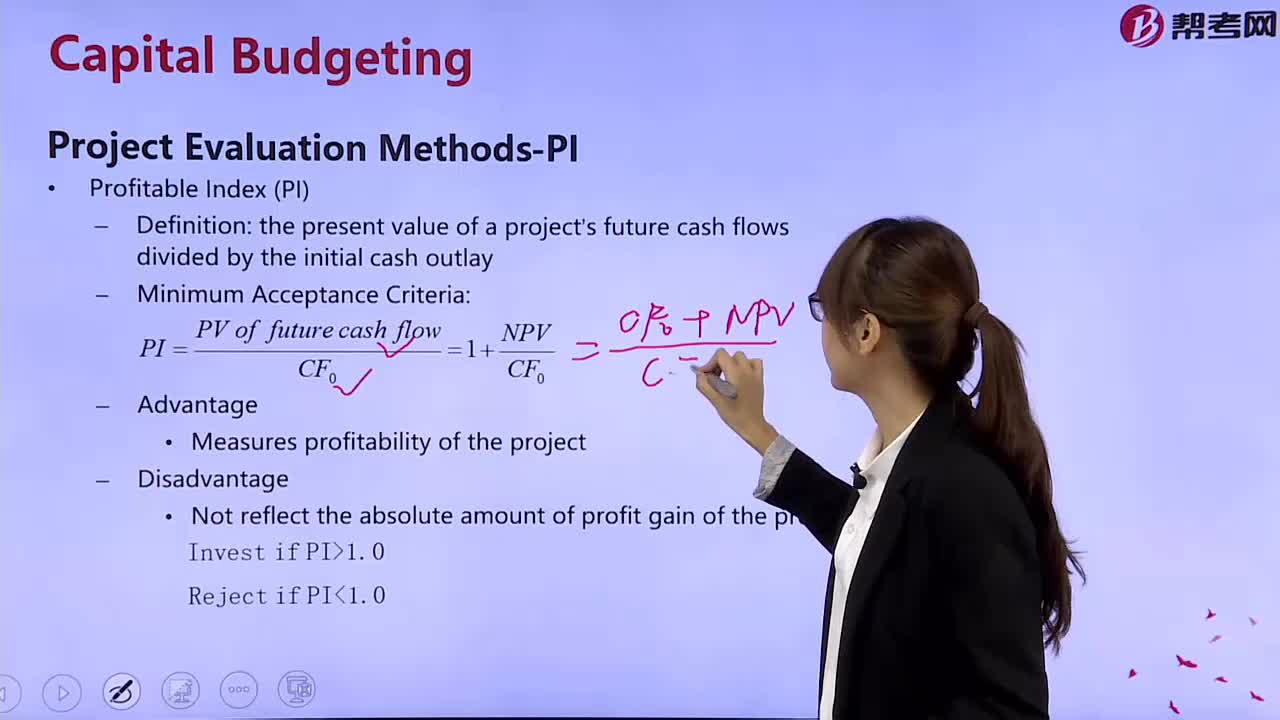

How to calculate a favorable index?:How to calculate a favorable index?

04:58

04:58

How to calculate the value of preferred stock?:How to calculate the value of preferred stock?

13:18

13:18

How to understand the meaning of misrepresentation?:advertising,书面报告即使没有发布也不行)”tablesstatisticsMay use other people’s work within the same firm without committing a violation. (同一公司的报告不用引用)

06:50

06:50

How to understand the Code of ethics and trust in the investment profession?:I,Professionalism:II:IIIIVVVIVIIResponsibilities as a CFA member or candidate