下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

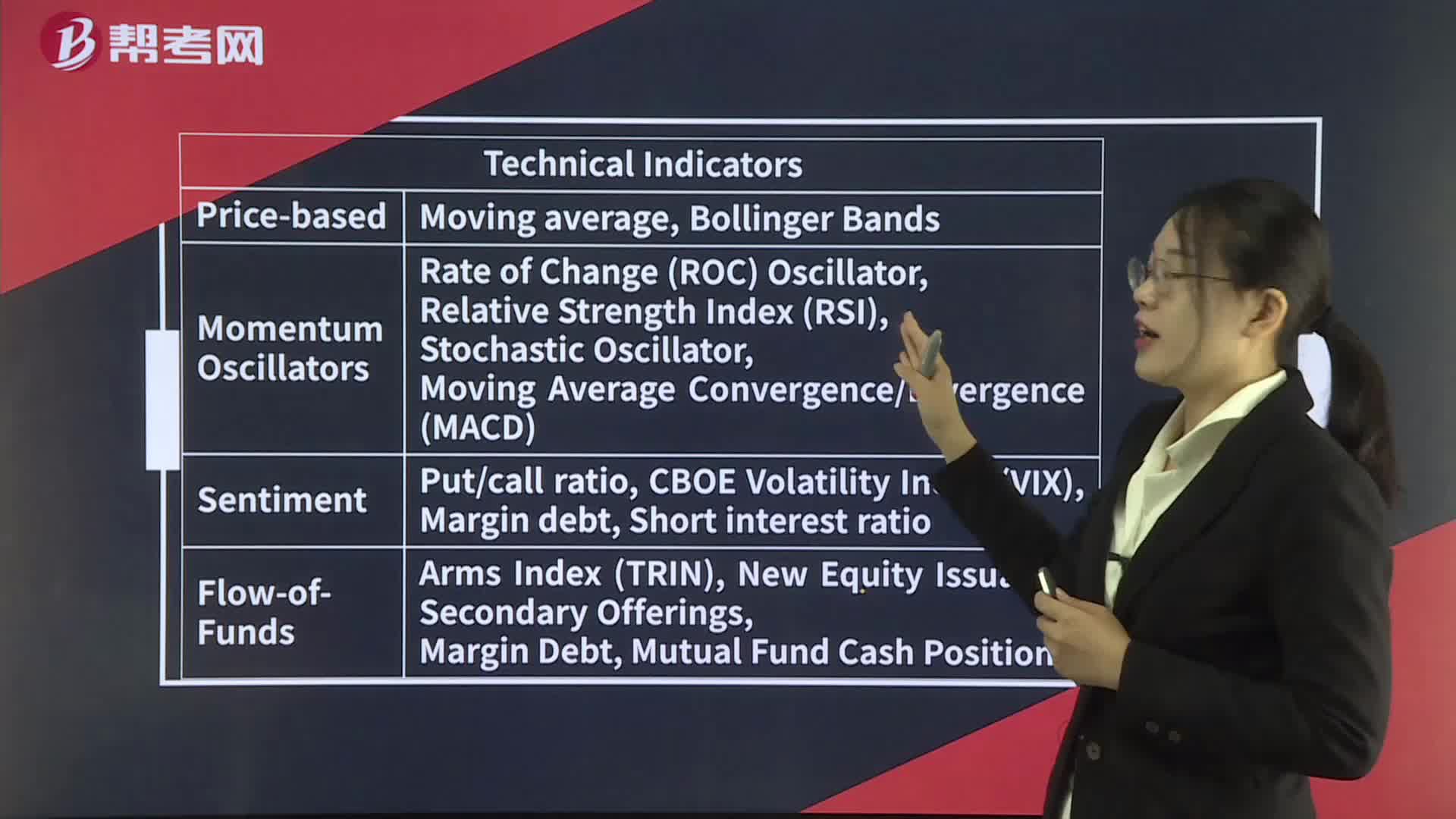

Technical Indicators— Price-based Indicators

Price-based indicators

A moving average is the average of the closing price of a security over a specified number of periods.

Simple moving average: weigh each price equally in the calculation of the average price. (commonly used)

Exponential moving average (exponentially smoothed moving average): greatest weight to recent prices while giving exponentially less weight to older prices.

A security that has been trending down in price will trade below its moving average. A security that has been trending up will trade above its moving average.

Once price begins to move back up toward its moving-average line, this line can serve as a resistance level.

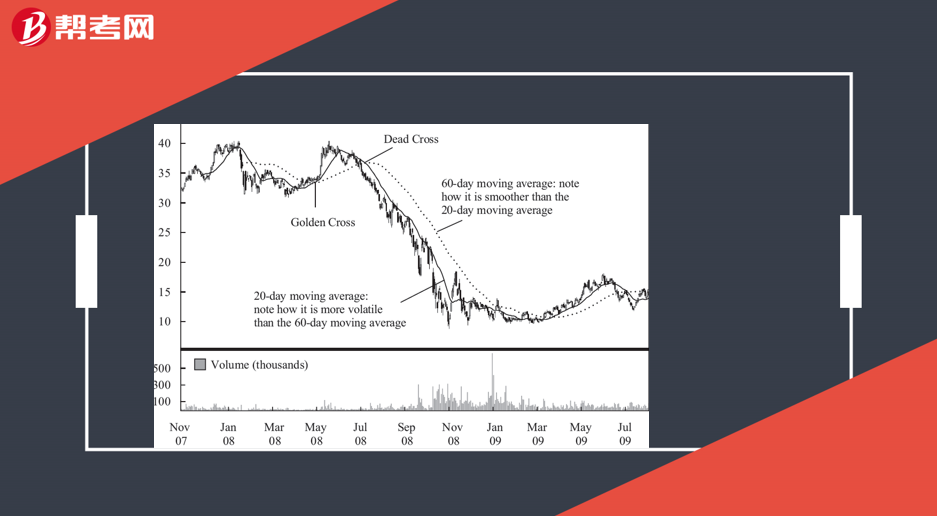

When a short-term moving average crosses from underneath a longer-term average, this movement is considered bullish and is termed a golden cross.

When a short-term moving average crosses from above a longer-term moving average, this movement is considered bearish and is called a dead cross.

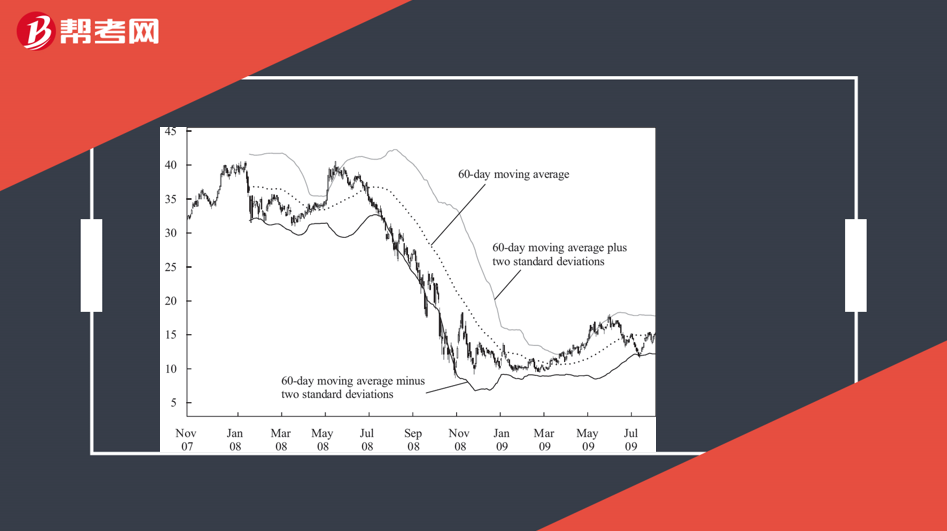

Bollinger Bands consist of a moving average plus a higher line representing the moving average plus a set number of standard deviations from average price (for the same number of periods as used to calculate the moving average) and a lower line that is a moving average minus the same number of standard deviations.

Contrarian strategy: sell when a security price reaches the upper band and buy when it reaches the lower band.

Long-term investors might buy on a significant breakout above the upper boundary band and sell on a significant breakout below the lower band.

183

183Technical Indicators— Summary:Technical Indicators— Summary:C. a moving-average line with[Practiceconstructed so that they oscillate between a high and a low or around 0 or 100.

328

328Technical Indicators— Sentiment indicators:Exchange.debt.Shortinterest as an indicator.

400

400Technical Indicators— Price-based Indicators:Simple moving average:moving-average linestrategyLong-term investors might buy on a significantthe lower band.

微信扫码关注公众号

获取更多考试热门资料