下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

Popular Economic Indicators – Lagging

Lagging

1 Average Duration of Unemployment

Because businesses wait until downturns look genuine to lay off, and wait until recoveries look secure to rehire, this measure is important because it lags the cycle on both the way down and the way up.

2 Inventory–sales ratio

Because inventories accumulate as sales initially decline and then, once a business adjusts its ordering, become depleted as sales pick up, this ratio tends to lag the cycle.

3 Change in unit labor costs

Because businesses are slow to fire workers, these costs tend to rise into the early stages of recession as the existing labor force is used less intensely. Late in the recovery when the labor market gets tight, upward pressure on wages can also raise such costs. In both cases, there is a clear lag at cyclical turns.

4 Average bank prime lending rate

Because this is a bank administered rate, it tends to lag other rates that move either before cyclical turns or with them.

5 Commercial and industrial loans outstanding

Because these loans frequently support inventory building, they lag the cycle for much the same reason that the inventory–sales ratio does.

6 Ratio of consumer installment debt to income

Because consumers only borrow heavily when confident, this measure lags the cyclical upturn, but debt also overstays cyclical downturns because households have trouble adjusting to income losses, causing it to lag in the downturn.

7 Change in consumer price index for services

Inflation generally adjusts to the cycle late, especially the more stable services area.

328

328Technical Indicators— Sentiment indicators:Exchange.debt.Shortinterest as an indicator.

400

400Technical Indicators— Price-based Indicators:Simple moving average:moving-average linestrategyLong-term investors might buy on a significantthe lower band.

264

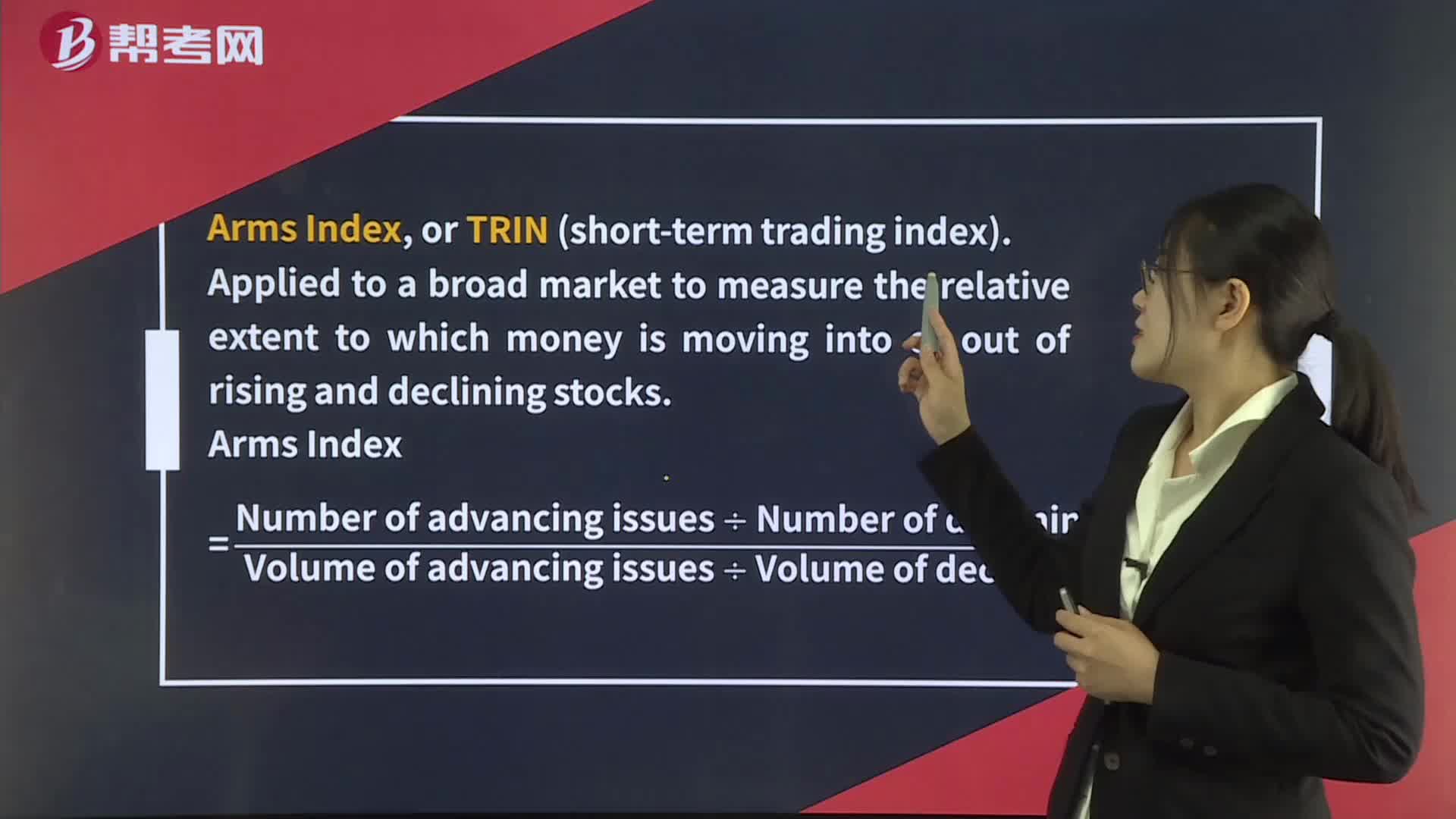

264Technical Indicators— Flow-of-Funds Indicators:Flow-of-Funds;NewSecondaryof shares have the potential to change the supply-and-demand equation as muchas IPOs do.

微信扫码关注公众号

获取更多考试热门资料