下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、Which of the following is NOT an example of the Standards of Professional Conductrelating to market manipulation?【单选题】

A.Disseminate material nonpublic information to public.

B.Spread false rumors to induce trading by others.

C.Secure a controlling position in afinancial instrument to exploit the price of arelated derivative.

正确答案:A

答案解析:公开发布重大非公开信息并没有违反市场操纵的条款,而散布虚假的谣言来引诱其他人交易,以及利用对于证券控制来操纵其相关衍生品的价格,都是属于市场操纵的行为。

2、An analyst does research about a company's earnings and gathers the followinginformation about the company:

● Earnings per share is $1.20

● Price-to-earnings ratio is 17

● Book value per share is $16

● Market value per share is $18

All else being equal, if the company funds a share repurchase using debt with anafter-tax cost of 6.5% , the company's EPS will most likely:【单选题】

A.decrease.

B.remain the same.

C.increase.

正确答案:A

答案解析:公司回购股票依资金来源可分为两类:一是使用公司的剩余现金进行回购,二是举债进行回购。

当使用剩余现金时,只要多余现金的回报率低于留存收益的资金成本,就会使EPS上升。

当举债回购股票时会产生利息费用(interest expense),导致净利润下降,但回购股票会使得发行在外的股份数量减少,即计算EPS时的分子分母会同时下降,EPS的变化取决于earnings yield(earnings yield = EPS/ stock price)和after-tax cost of debt之间的大小比较。

当after-tax cost of debt小于earnings yield时,回购股票使EPS上升;

当after-tax cost of debt大于earnings yield时,回购股票使EPS下降。

题目中,after-tax cost = 6.5% > earnings yield = 1/17 = 5.9%,所以EPS会下降。

3、Roger Clement, CFA, is a public fund manager at Morgan Capital and doesresearch about z-value.The first step for Clement in the process of standardizinga random variable from a given normal distribution to obtain the z-value is:【单选题】

A.to subtract the population mean from the observation obtained.

B.to multiple the observation obtained by the reliability factor assumed.

C.to divide the population mean by the standard deviation.

正确答案:A

答案解析:根据定义可知,z-值是将观察值减去总体平均值后,再除以标准差。

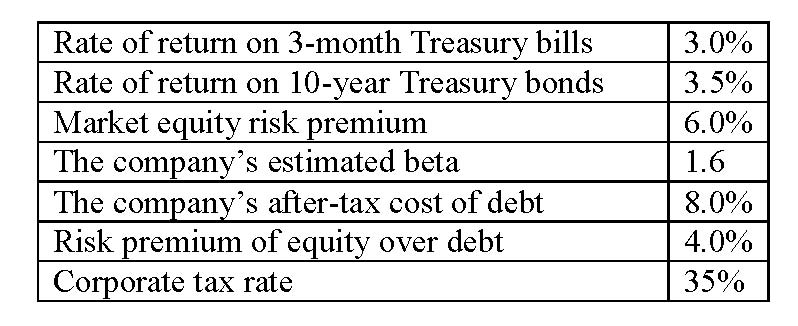

4、A company wants to determine the cost of equity to use in calculating its weighted average cost of capital. The controller has gathered the following information

Using the capital asset pricing model (CAPM) approach, the cost of equity (%) for the company is closest to:【单选题】

A.7.5.

B.12.6.

C.13.1.

正确答案:C

答案解析:“Cost of Capital,” Yves Courtois, CFA, Gene C. Lai, and Pamela P. Peterson, CFA

2010 Modular Level I, Vol. 4, p. 52

Study Session 11-45-h

Calculate and interpret the cost of equity capital using the capital asset pricing model approach, the dividend discount model approach, and the bond-yield-plus risk-premium approach.

The cost of equity using the CAPM = Risk Free Rate + Beta x Market Equity Risk Premium= 3.5 + 1.6 x (6.0) = 13.1%.

5、Which of the following is most likely a depreciation method in which the allocationof cost corresponds to the actual use of an asset in a particular period?【单选题】

A.Accelerated method.

B.Weighted average method.

C.Units-of-production method.

正确答案:C

答案解析:折旧(depreciation)费用的3种计算方法如下:

● 直线折旧法[ straight-line(sl) method]:[初始成本(original cost) - 残值(residualvalue)]/应折旧年限(depreciable life)。

● 加速折旧法(accelerated method):例如,双倍余额递减法[double-declining balance(DDB) method],其计算公式中没有残值(salvage value),故在计算最后一年折旧费用时要注意折旧费用不能超过残值,depreciation in year × = (2/ depreciable life) ×book value at the beginning of year × ,如果此公式中2改为1,就是单倍余额递减法。

● 单位产出法(units-of-production method):生产中耗用了多少,就按其比例计算多少折旧费用。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料