下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Derivative Investments5道练习题,附答案解析,供您备考练习。

1、Which of the following statements is least accurate concerning differences in the pricing of forwardsand futures?【单选题】

A.Pricing differences can arise if futures prices and interest rates are uncorrelated.

B.Interest rate volatility can explain pricing differences.

C.Differences in the pattern of cash flows of forwards and futures can explain pricing differences.

正确答案:A

答案解析:If futures prices and interest rates are uncorrelated, the prices of forwards and futures will beidentical.

CFA Level I

"Basics of Derivative Pricing and Valuation," Don M. Chance

Section 3.2

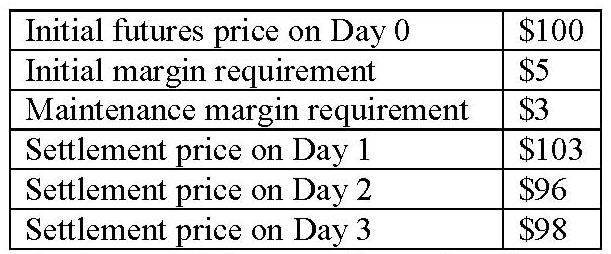

2、The following information relates to a futures contract:

If no funds are withdrawn and margin calls are met at the beginning of the next day, the ending margin account balance on Day 3 for an investor with a short position of 10 contracts is closest to:【单选题】

A.$70.

B.$80.

C.$100.

正确答案:C

答案解析:“Futures Markets and Contracts”, Don M. Chance

2010 Modular Level I, Vol. 6, pp. 55-60

Study Session 17-69-d

Describe price limits and the process of marking to market and compute and interpret the margin balance, given the previous day’s balance and the change in the futures price.

At the end of Day 1, the balance in the investor’s account would be $20.

At the beginning of Day 2, the investor would deposit $30.

At the end of Day 2, the balance in the investor’s account would be $120.

At the end of Day 3, the balance in the investor’s account would be $100.

3、An analyst does research about the put-call parity.With respect to the put-callparity, which of the following positions is equal to a synthetic call position?【单选题】

A.Long a put, long the underlying, and short a risk-free bond.

B.Short a put, long the underlying, and short a risk-free bond.

C.Long a put, short the underlying, and long a risk-free bond.

正确答案:A

答案解析:P + S = C + X/ ,得出 C = P + S - X/

,得出 C = P + S - X/ 。

。

4、An investor purchases 100 shares of common stock at €50 each and simultaneously sells calloptions on 100 shares of the stock with a strike price of €55 at a premium of €1 per option. At theexpiration date of the options, the share price is €58. The investor's profit is closest to:【单选题】

A.€900.

B.€600.

C.€400.

正确答案:B

答案解析:Because the share price  is greater than the strike price (X), the investor collects the premiumplus the difference between the strike price and purchase price:

is greater than the strike price (X), the investor collects the premiumplus the difference between the strike price and purchase price:  In this case, 100 × (€55-€50+€1)=€600.

In this case, 100 × (€55-€50+€1)=€600.

CFA Level I

"Risk Management Applications of Option Strategies," Don M. Chance

Section 2.2.1

5、An analyst does research about option value.Prior to expiration, the maximumvalue of an American call is the:【单选题】

A.excise price.

B.current price of the underlying.

C.present value of the exercise price.

正确答案:B

答案解析:美式看涨期权最大值是股票的当前价格,因为期权是买入股票的权利,不会大于股票价格本身,否则还不如直接购买股票。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料