下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Economics5道练习题,附答案解析,供您备考练习。

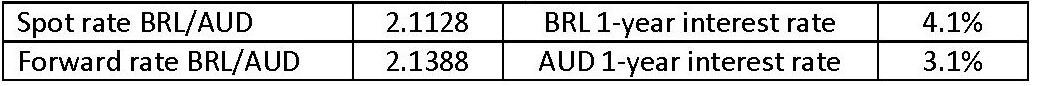

1、An investor examines the following rate quotes for the Brazilian real and the Australian dollar:

If the investor shorts BRL500,000 he will achieve a risk-free arbitrage profit (in BRL) closest to:【单选题】

A.–6,327.

B.1,344.

C.6,405.

正确答案:B

答案解析:“Currency Exchange Rates,” William A. Barker, CFA, Paul D. McNelis, and Jerry Nickelsburg

2013 Modular Level I, Vol. 2, Reading 21, Section 3.3

Study Session 6–21–f, g

Explain the arbitrage relationship between spot rates, forward rates and interest rates.

Calculate and interpret a forward rate consistent with a spot rate and the interest rate in each currency.

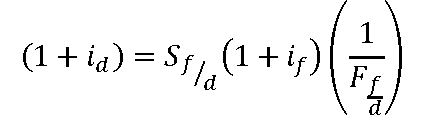

B is correct. If the right side of the following equation is greater than the left, an arbitrage opportunity exists.

= Spot rate: number of units of foreign currency (price currency) per one unit of domestic currency

= Spot rate: number of units of foreign currency (price currency) per one unit of domestic currency =Forward rate: number of units of foreign currency (price currency) per one unit of domestic currency

=Forward rate: number of units of foreign currency (price currency) per one unit of domestic currency = Domestic interest rate

= Domestic interest rate = Foreign interest rate

= Foreign interest rate

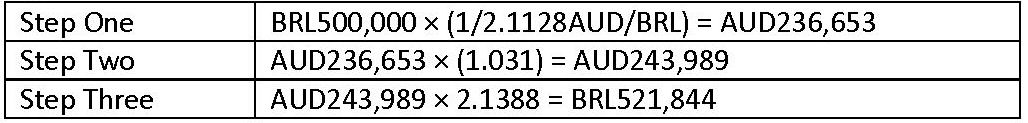

The arbitrage profit is the right side of the equation minus the left side.

Left side of equation: BRL500,000 × (1 + 0.041) = BRL520,500.

Right Side:

Arbitrage profit = BRL521,844 (right side above) – BRL520,500 (left side above) = 1,344.

2、The Nash equilibrium for a duopoly faced with a “Prisoners’ Dilemma” set of choices is most likely to result in:【单选题】

A.both firms earn economic profits.

B.neither firm earns an economic profit.

C.one of the firms earns an economic profit but the other firm does not.

正确答案:B

答案解析:“Monopolistic Competition and Oligopoly,” Michael Parkin

2010 Modular Level I, Vol. 2, pp. 245-247

Study Session 5-20-e

Describe the oligopoly games including the Prisoners’ Dilemma.

The Nash equilibrium for the duopoly is that both firms cheat on their collusive agreement. Prices and quantities produced are the same as those in perfect competition; neither firm earns an economic profit.

3、Assume that at current production and consumption levels, a product exhibits price elasticity of demand equal to 1.20 and elasticity of supply equal to 1.45. The true economic consequences of taxes imposed on the seller of such a product are most likely borne:【单选题】

A.by the seller.

B.by the buyer.

C.partly by the buyer and partly by the seller.

正确答案:C

答案解析:“Elasticity,” Michael Parkin

2011 Modular Level I, Vol. 2, pp. 27-28

“Markets in Action,” Michael Parkin

2011 Modular Level I, Vol. 2, pp. 80-84

Study Session 4-13-a; 4-15-c

Calculate and interpret the elasticities of demand (price elasticity, cross elasticity, and income elasticity) and the elasticity of supply and discuss the factors that influence each measure.

Explain the impact of taxes on supply, demand, and market equilibrium, and describe tax incidence and its relation to demand and supply elasticity.

As the good exhibits neither perfectly elastic nor perfectly inelastic demand or supply (see pp. 27-28), the incidence of taxation will be shared by buyers and sellers regardless of whether the tax is placed on buyers or on sellers.

4、Which of the following statements about a central bank's actions would mostlikely cause an immediate increase of the banking system's excess reserves?【单选题】

A.Decreasing the policy rate.

B.Selling securities in the open market.

C.Decreasing the required reserve ratio.

正确答案:C

答案解析:降低法定存款准备金率会导致商业银行吸收存款后有更多的资金可以用于放贷,从而增加了银行系统的可贷资金余额,这种影响也最为直接。

5、Which of the following is most likely to cause a shift to the right in the aggregate demand curve?【单选题】

A.Increase in taxes

B.Decrease in real estate values

C.Boom in the stock market

正确答案:C

答案解析:A boom in the stock market increases the value of financial assets and household wealth. Anincrease in household wealth increases consumer spending and shifts the aggregate demand curveto the right.

CFA Level I

"Aggregate Output, Prices, and Economic Growth," Paul R. Kutasovic and Richard G. Fritz

Section 3.3.1

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料