下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Fixed Income Investments5道练习题,附答案解析,供您备考练习。

1、Which of these is the best example of an embedded option granted to bondholders?【单选题】

A.A prepayment option

B.A floor on a floating rate security

C.An accelerated sinking fund provision

正确答案:B

答案解析:“Features of Debt Securities,” Frank J. Fabozzi, CFA

2011 Modular Level I, Vol. 5, p. 337

Study Session 15-61-e

Identify the common options embedded in a bond issue, explain the importance of embedded options, and state whether such options benefit the issuer or the bondholder.

B is correct because the floor benefits the bondholder by keeping the coupon from falling below a certain threshold if market rates decline to very low levels.

1、If the price of a U.S. Treasury security is higher than its arbitrage-free value, a dealer can generate an arbitrage profit by:【单选题】

A.shorting the U.S. Treasury security and calling it from the issuer.

B.shorting the U.S. Treasury security and reconstituting it from strips.

C.buying the U.S. Treasury security, stripping it and selling the strips.

正确答案:B

答案解析:“Introduction to the Valuation of Debt Securities,” Frank J. Fabozzi, CFA

2011 Modular Level I, Vol. 5, pp. 507-510

Study Session 16-65-f

Explain the arbitrage-free valuation approach and the market process that forces the price of a bond toward its arbitrage-free value, and explain how a dealer can generate an arbitrage profit if a bond is mispriced.

B is correct because strips can be purchased to create a synthetic U.S. Treasury security to cover the short at a price lower than the price at which the U.S. Treasury security was shorted, generating a profit.

1、An analyst does research about a floating rate securities.All else being equal, theprice of a floating-rate security is most likely to react in the same way to changesin market interest rates as a fixed-rate coupon bond if market rates:【单选题】

A.increase between coupon reset dates.

B.are substantially below the floating rate security's cap rate.

C.are substantially above the floating rate security's cap rate.

正确答案:C

答案解析:浮动利率证券的利率会随着市场利率的变化而进行调整,从而使利率风险减少,但是并不能完全消除。因为存在调整的时间间隔,如果时间间隔变长的话,浮动利率证券的利率风险就会升高。同时,还存在利率顶,限制利率调整的最高幅度,如果市场利率大大超过利率顶的话,该浮动利率证券只能一直提供利率顶的息票率,将使得浮动利率证券就像一个固定利率证券一样。

1、When are credit spreads most likely to narrow? During:【单选题】

A.economic expansions.

B.economic contractions.

C.a period of flight to quality.

正确答案:A

答案解析:“Understanding Yield Spreads,” Frank J. Fabozzi, CFA

2013 Modular Level I, Vol. 5, Reading 55, Section 4.3

Study Session 15-55-f

Describe credit spreads and relationships between credit spreads and economic conditions.

A is correct. Credit spreads narrow during economic expansions and widen during economic contractions. During an economic expansion, corporate revenues and cash flows rise, making it easier for corporations to service their debt, and investors purchase corporates instead of Treasuries, thus causing spreads to narrow.

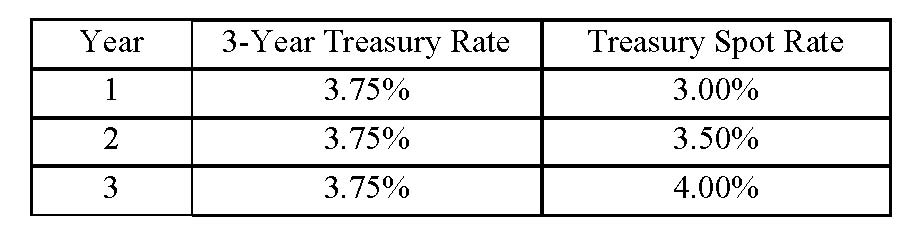

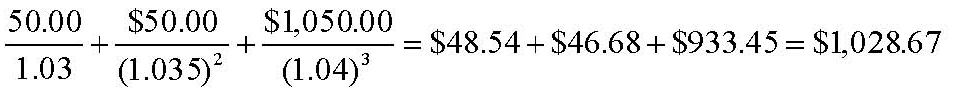

1、An analyst has gathered the following information:

Based on the arbitrage-free valuation approach, a $1,000 face value bond that pays a 5 percent annual coupon and matures in 3 years has a current market value closest to:【单选题】

A.$1,027.75.

B.$1,028.67.

C.$1,034.85.

正确答案:B

答案解析:“Introduction to the Valuation of Debt Securities,” Frank J. Fabozzi

2010 Modular Level I, Vol. 5, pp. 401-402; 416-422

Study Session 16-64-c, f

Compute the value of a bond and the change in value that is attributable to a

change in the discount rate.

Explain the arbitrage-free valuation approach and the market process that forces

the price of a bond toward its arbitrage-free value and explain how a dealer can

generate an arbitrage profit if a bond is mispriced.

Each cash flow is discounted by the appropriate spot rate:

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料