下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Corporate Finance5道练习题,附答案解析,供您备考练习。

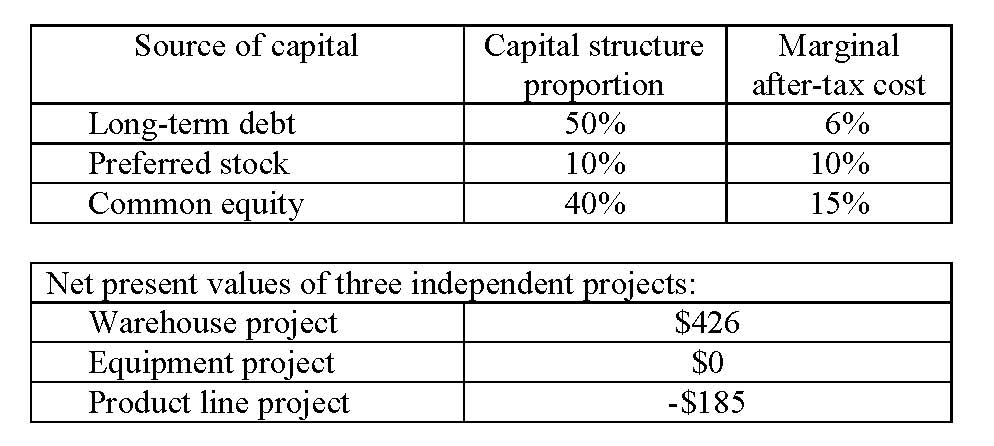

1、An analyst gathered the following information about a company that expects to fund its capital budget without issuing any additional shares of common stock:

If no significant size or timing differences exist among the projects and the projects all have the same risk as the company, which project has an internal rate of return that exceeds 10 percent?【单选题】

A.All three projects

B.The warehouse project only

C.The warehouse project and the equipment project

正确答案:B

答案解析:“Capital Budgeting,” John D. Stowe, CFA and Jacques R. Gagné, CFA

2010 Modular Level I, Vol. 4 pp. 10-13

“Cost of Capital,” Yves Courtois, CFA, Gene C. Lai, and Pamela P. Peterson, CFA

2010 Modular Level I, Vol. 4, pp. 40-41

Study Session 11-44-d, 11-45-a

Calculate and interpret the results using each of the following methods to evaluate a single capital project: net present value (NPV), internal rate of return (IRR), payback period, discounted payback period, and profitability index (PI).

Calculate and interpret the weighted average cost of capital (WACC) of a company.

The WACC of the company is calculated as 0.5(6%) + 0.1(10%) + 0.4(15%) = 10%. To have a positive NPV, a project must have an IRR greater than the WACC used to calculate the NPV. Only the warehouse project has a NPV greater than $0 (at the company’s WACC of 10%), therefore only the warehouse project has an IRR that exceeds 10%.

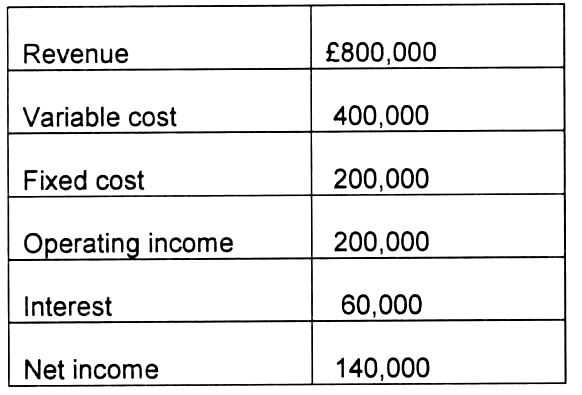

2、The following information is available for a firm:

The firm's degree of total leverage (DTL) is closest to:【单选题】

A.1.43.

B.2.86.

C.2.00.

正确答案:B

答案解析:DTL=Revenue-Variable cost/Net income=£800,000-£400,000/£140,000=2.86.

CFA Level I

"Measures of Leverage, Pamela Peterson Drake, Raj Aggarwal, Cynthia Harrington, and AdamKobor

Section 3.5

3、An analyst does research about asset beta and gathers the following informationabout a company:

·Market value of equity is $ 900 000

·Book value of equity is $ 1 100 000

·Market value of debt is $ 1 000 000

·Book value of debt is $ 950 000

·Equity beta is 2.3

·Marginal tax rate is 40%

Assuming the company's debt has no market risk, the company's asset beta isclosest to:【单选题】

A.1.36

B.1.38

C.1.49

正确答案:B

答案解析:asset beta =2.3 × {1 / [1 + (1 -0.4) × (1 000 000/900 000) ]}=1.38,这里要用市场价值(market value)来计算。

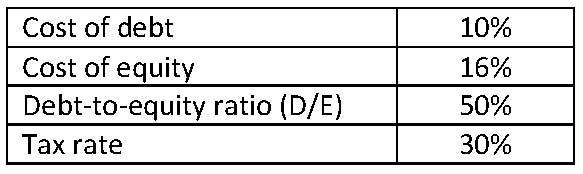

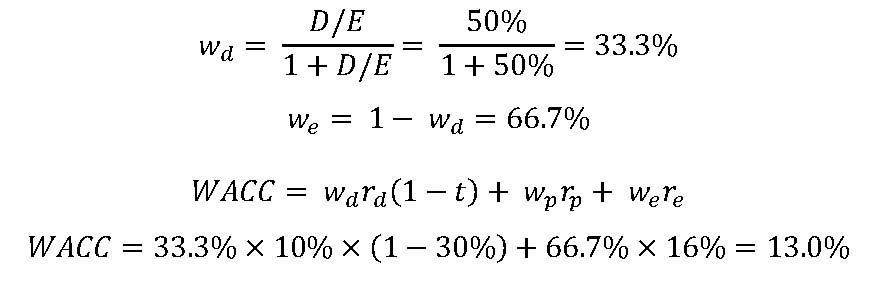

4、A company’s data are furnished below:

The weighted average cost of capital (WACC) is closest to:【单选题】

A.11.5%.

B.13.0%.

C.14.0%.

正确答案:B

答案解析:“Cost of Capital,” Yves Courtois, Gene C. Lai, and Pamela Peterson Drake

2012 Modular Level I, Vol. 4, pp. 40–43

Study Session 11-37-a, b

Calculate and interpret the weighted average cost of capital (WACC) of a company.

Describe how taxes affect the cost of capital from different capital sources.

B is correct:

5、With respect to liquidity management, which of the following is most likely aprimary source of liquidity?【单选题】

A.Trade credit from vendors.

B.Renegotiating debt contracts.

C.Filing for bankruptcy protection and reorganization.

正确答案:A

答案解析:首选流动性资源(primary source of liquidity)来自供应商的商业信贷和来自银行的信贷。选项B和C都是次选流动性资源(second source of liquidity)。使用首选流动性资源不会影响到企业的日常运作,但使用次选流动性资源会影响到企业的财务和运营结构,这意味着企业的财务状况将恶化,即只能以更高的价格来获取流动性。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料