下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Derivative Investments5道练习题,附答案解析,供您备考练习。

1、The tenor of a swap is best described as the:【单选题】

A.size of the contract.

B.original time to maturity.

C.net amount owed by one party to the other.

正确答案:B

答案解析:“Swap Markets and Contracts,” Don M. Chance, CFA

2013 Modular Level I, Vol. 6, Reading 64, Section 1.1

Study Session 17-64-a

Describe the characteristics of swap contracts and explain how swaps are terminated.

B is correct. The original time to maturity is referred to as the tenor of the swap.

2、When the underlying stock price is $95, an investor pays $2 for a call option with an exercise price of $95. If the stock price moves to $96, the intrinsic value of the call option would be closest to:【单选题】

A.-$1.

B.$0.

C.$1.

正确答案:C

答案解析:“Option Markets and Contracts”, Don M. Chance

2010 Modular Level I, Vol. 6, pp. 98-101

Study Session 17-70-g

Define intrinsic value and time value and explain their relationship.

The intrinsic value of a call option is the stock price less the strike price if that difference is positive, and zero otherwise. The stock trading at $96 can be purchased for $95, so the intrinsic value is $1.

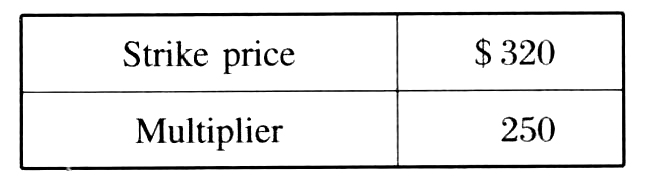

3、An investor does research about option and purchases a call option with the followingterms:

If the price of the underlying is $ 306.94 at expiration, the option payoff to thisinvestor is closest to:【单选题】

A.$0

B.$13

C.$3 265

正确答案:A

答案解析:所针对的股票到期价格低于行权价,看涨期权没有任何价值。

4、An investor who holds a long position in a futures contract will most likely receive a margin call if the ending balance in his margin account falls below the:【单选题】

A.variation margin.

B.initial margin requirement.

C.maintenance margin requirement.

正确答案:C

答案解析:A margin call is due whenever the ending balance in the margin account falls below the maintenance margin requirement.

2014 CFA Level I

"Futures Markets and Contracts," by Don M. Chance

Section 3

5、An analyst does research about forward products.Which of the following statementsis the most effective way to terminate a forward contract prior to expiration?【单选题】

A.One party of the forward contract closes the position with a local exchange.

B.One party of the forward contract closes the position with the same counterparty.

C.One party of the forward contract closes the position with the other counterpartywith AAA credit rating.

正确答案:B

答案解析:远期合约提前终止不会与交易所,因为远期合约都在场外交易,最有效的是原来对手方签定反向头寸的协议以终止,此时没有额外的信用风险,如果与其他第三方签定反向头寸的协议会增加信用风险。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料