下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Corporate Finance5道练习题,附答案解析,供您备考练习。

1、Given two mutually exclusive projects with normal cash flows, the points at which the net present value profiles intersect the horizontal axis are most likely to be the:【单选题】

A.crossover rate for the projects.

B.internal rates of return of the projects.

C.the company’s weighted average cost of capital (WACC).

正确答案:B

答案解析:“Capital Budgeting,” John D. Stowe, CFA and Jacques R Gagné, CFA

2010 Modular Level I, Vol. 4, pp. 17-23

Study Session 11-44-e

Explain the NPV profile, compare and contrast the NPV and IRR methods when evaluating independent and mutually-exclusive projects, and describe the problems associated with each of the evaluation methods.

For a project with normal cash flows, the NPV profile intersects the horizontal axis at the point where the discount rate is equal to the IRR. The crossover rate is the discount rate at which the NPVs of the projects are equal. While it is possible that the crossover rate is equal to each project’s IRR, it is not a likely event. The IRR for both projects being the firm’s WACC will only arise when both projects have a NPV=0.

2、When considering two mutually exclusive capital budgeting projects with conflicting rankings, the most appropriate conclusion is to choose the project with the:【单选题】

A.higher net present value (NPV).

B.shorter payback.

C.higher internal rate of return (IRR).

正确答案:A

答案解析:The project with the higher NPV should be undertaken because it measures the increase in wealth as a result of taking the project. For mutually exclusive projects, IRR may give incorrect decisions as a result of scale and/or cash flow timing effects. Payback is not an economically sound method for evaluation of capital projects.

2014 CFA Level I

“Discounted Cash Flow Applications,” by Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E. Runkle

Section 2.3

“Capital Budgeting,” by John D. Stowe and Jacques R. Gagné

Section 4

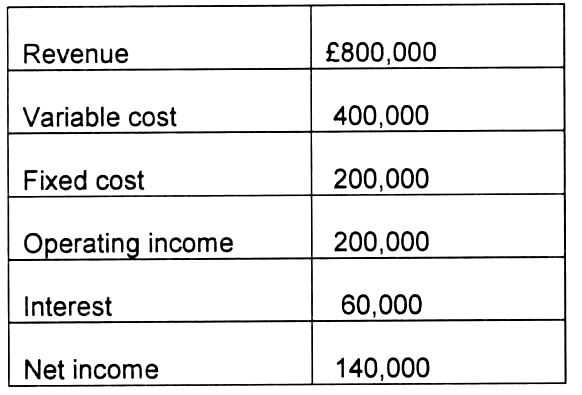

3、The following information is available for a firm:

The firm's degree of total leverage (DTL) is closest to:【单选题】

A.1.43.

B.2.86.

C.2.00.

正确答案:B

答案解析:DTL=Revenue-Variable cost/Net income=£800,000-£400,000/£140,000=2.86.

CFA Level I

"Measures of Leverage, Pamela Peterson Drake, Raj Aggarwal, Cynthia Harrington, and AdamKobor

Section 3.5

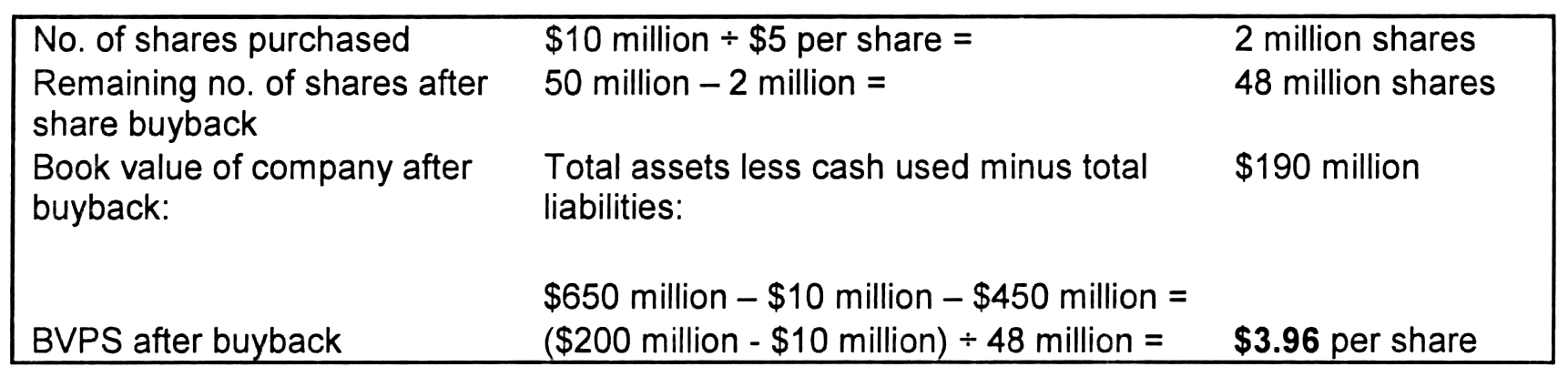

4、The market price of a company's stock is $5 per share with 50 million shares outstanding. Thecompany decides to use its cash reserves to undertake a $10 million share buyback. Just prior to thebuyback, the company reports total assets of $650 million and total liabilities of $450 million. Thecompany's book value per share after the share buyback is closest to:【单选题】

A.$3.96.

B.$4.17.

C.$3.80.

正确答案:A

答案解析:

CFA Level I

"Dividends and Share Repurchases: Basics," George H. Troughton, and Gregory Noronha

Section 4.2.2

5、Which action is most likely considered a secondary source of liquidity?【单选题】

A.Increasing the availability of bank lines of credit

B.Increasing the efficiency of cash flow management

C.Renegotiating current debt contracts to lower interest payments

正确答案:C

答案解析:“Working Capital Management,” Edgar A. Norton, Jr., CFA, Kenneth L. Parkinson, and Pamela Peterson Drake, CFA

2013 Modular Level I, Vol. 4, Reading 40, Sections 2.1.1, 2.1.2.

Study Session 11-40-a

Describe primary and secondary sources of liquidity and factors that influence a company’s liquidity position.

C is correct. Renegotiating debt contracts is a secondary source of liquidity because it may affect the company’s operating and/or financial positions.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料