下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Equity Investments5道练习题,附答案解析,供您备考练习。

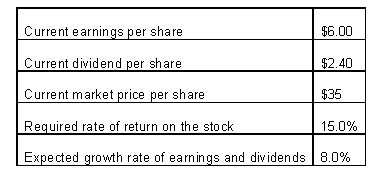

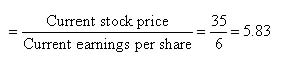

1、An analyst gathered the following information about a company:

Which of the following statements best describes the company’s price-to-earnings ratio (P/E)? Compared with the company’s trailing P/E, the P/E based on the Gordon growth dividend discount model is:【单选题】

A.the same.

B.higher.

C.lower.

正确答案:C

答案解析:The P/E based on the Gordon growth dividend discount model is lower:

Trailing P/E

P/E based on the Gordon growth dividend discount model

2014 CFA Level I

“Equity Valuation: Concepts and Basic Tools,” by John J. Nagorniak and Stephen E. Wilcox

Section 5

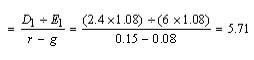

2、An equity analyst follows two industries with the following characteristics.

Based on the above information, the analyst will most appropriately conclude that compared to the firms in Industry 2, those in Industry 1 would potentially have:【单选题】

A.larger economic profits.

B.over-capacity problems.

C.high bargaining power of customers.

正确答案:A

答案解析:“Introduction to Industry and Company Analysis,” Patrick W. Dorsey, Anthony M. Fiore, and Ian Rossa O’Reilly

2012 Modular Level I, Vol. 5, pp. 208, 223–233

Study Session 14-51-e, h, i

Describe the elements that need to be covered in a thorough industry analysis.

Explain effects of industry concentration, ease of entry, and capacity on return on invested capital and pricing power.

Describe the principles of strategic analysis of an industry.

A is correct. The economic profit (the spread between the return on invested capital and the cost of capital) tends to be larger in industries with differentiated products, greater pricing power, and high switching costs to customers. Industry 1 has these features. Firms in Industry 2, on the other hand, have little pricing power (undifferentiated products and rapid shifts in market shares indicating intense rivalry), which is indicative of potentially smaller economic profits.

3、The index weighting that results in portfolio weights shifting away from securities that have increasedin relative value toward securities that have fallen in relative value whenever the portfolio isrebalanced is most accurately described as:【单选题】

A.float-adjusted market-capitalization weighting.

B.equal weighting.

C.fundamental weighting.

正确答案:C

答案解析:Fundamentally weighted indices generally will have a contrarian "effect" in that the portfolio weightswill shift away from securities that have increased in relative value and toward securities that havefallen in relative value whenever the portfolio is rebalanced.

CFA Level I

"Security Market Indices," Paul D. Kaplan and Dorothy C. Kelly

Section 3.2.4.

4、The type of voting in board elections that is most beneficial to shareholders with a small number of shares is best described as:【单选题】

A.statutory voting.

B.voting by proxy.

C.cumulative voting.

正确答案:C

答案解析:“The Corporate Governance of Listed Companies: A Manual for Investors,” Kurt Schacht, James C. Allen, and Matthew Orsagh

2012 Modular Level I, Vol. 4, pp. 263–266“Overview of Equity Securities,” Ryan C. Fuhrmann and Asjeet S. Lamba

2012 Modular Level I, Vol. 5, p. 171

Study Session 11-42-g, 14-50-b

Evaluate, from a shareowner’s perspective, company policies related to voting rules, shareowner-sponsored proposals, common stock classes, and takeover defenses.

Describe differences in voting rights and other ownership characteristics among different equity classes.

C is correct. Cumulative voting allows shareholders to direct their total voting rights to specific candidates, as opposed to having to allocate their voting rights evenly among all candidates. Thus, applying all of the votes to one candidate provides the opportunity for a higher level of representation on the board than would be allowed under statutory voting.

5、After the public announcement of the merger of two firms an investor makes abnormal returns by going long on the target firm and short on the acquiring firm. This most likely violates which form of market efficiency?【单选题】

A.Semi-strong form only

B.Weak and semi-strong forms

C.Semi-strong and strong forms

正确答案:B

答案解析:“Market Efficiency,” W. Sean Cleary, CFA, Howard J. Atkinson, CFA, and Pamela Peterson Drake, CFA.

2013 Modular Level I, Vol. 5, Reading 48, Section 3.2

Study Session 13-48-d

Contrast weak-form, semi-strong-form, and strong-form market efficiency.

B is correct. In a semi-strong efficient market, prices adjust quickly and accurately to new information. In this case, prices would quickly adjust to the merger announcement and if the market is semi-strong efficient market, investors acting after the merger announcement would not be able to earn abnormal returns. Therefore, it is a violation of the semi-strong form of market efficiency. Note that the semi-strong form of market efficiency encompasses the weak form. Therefore, both weak and semi-strong forms of market efficiency are violated.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料