下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Ethical and Professional Standards5道练习题,附答案解析,供您备考练习。

1、Millicent Plain has just finished taking Level II of the CFA examination. Upon leaving the examination site, she meets with four Level III candidates who also just sat for their exams. Curious about their examination experience, Plain asks the candidates how difficult the Level III exam was and how they did on it. The candidates say the essay portion of the examination was

much harder than they had expected and they were not able to complete all questions as a result. The candidates go on to tell Plain about broad topic areas that were tested and complain about specific formulas they had memorized what did not appear on the exam. The Level III candidates least likely violated the CFA Institute Standards of Professional Conduct by discussing:【单选题】

A.specific formulas.

B.broad topic areas.

C.the examination essays.

正确答案:C

答案解析:“Guidance for Standards I–VII,” CFA Institute

2013 Modular Level I, Vol. 1, Reading 2, Standard VII (A) Confidential Program Information

Study Session 1–2–b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.

C is correct because discussing the level of difficulty of the essay portion of the examination did not violate Standard VII (A) Conduct as Members and Candidates in the CFA Program. Standard VII (A) and the Candidate Pledge were violated by candidates revealing broad topical areas and formulas tested or not tested on the exam.

1、Lee Chu, a CFA candidate, develops a new quantitative security selection model exclusively through back-testing on the Chinese equity market. Chu is asked to review marketing materials that include an overview of the conceptual framework for his model, provide back-tested performance results, and list the top holdings. Chu directs the marketing group to remove the description of his model because of concerns that competitors may attempt to replicate his investment philosophy. He also instructs the marketing group to remove the list of the top holdings because it shows that the top holding represents 30% of the back-tested model. Which of the following actions is least likely to result in a violation of the Code and Standards? Chu's:【单选题】

A.failure to disclose that the top holding represents such a large allocation in the model

B.failure to adequately describe the investment process to prospective clients

C.use of back-tested results in communication with prospective clients

正确答案:C

答案解析:The use of back-tested results is not prohibited, provided it is appropriately disclosed.

2014 CFA Level I

"Guidance for Standards I-VII," CFA Institute

Standard V(B)

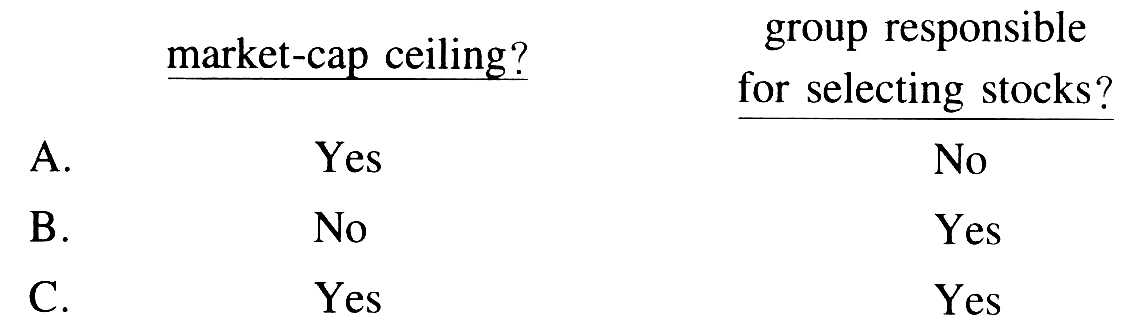

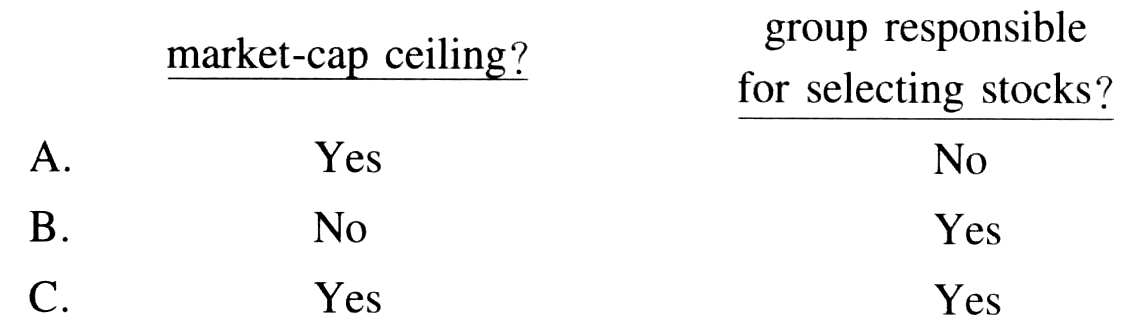

1、Tom Stafford, CFA, is a part of team within Appleton Investment Management(AIM) responsible for managing a pool of assets for Open Air Bank.AIM isrecognized as a specialist in identifying investment opportunities in small-capitalizationstocks.The firm's assets have grown rapidly in recent years, and to enhanceliquidity, senior management recently made the decision to lift the maximumpermissible market-cap ceiling from $ 500 million to $ 2 billion.At thesame time, management changed the group responsible for selecting stocks to beadded to the firm's "approved" list from individual portfolio managers to a committeeconsisting of the firm's chief investment officer and four senior portfoliomanagers.Has Stafford violated the Professional Conduct Standards relating tocommunication with clients and prospective clients if he doesn't notify his clientsabout the changes in the:【单选题】

A.

B.

C.

正确答案:C

答案解析:所列两项都属于重大的投资流程的改变,根据与客户及潜在客户沟通的专业行为标准,需要告知客户这两项变化。

1、Beth Kozniak, a CFA candidate, is an independent licensed real estate broker and a well-known property investor. She is currently brokering the sale of a commercial property on behalf of a client in financial distress. If the client’s building is not sold within 30 days, he will lose the building to the bank. A year earlier, another client of Kozniak’s had expressed interest in purchasing this same property. However, she is unable to contact this client, nor has she discovered any other potential buyers. Given her distressed client’s limited time frame, Kozniak purchases the property herself and foregoes any sales commission. Six months later, she sells the property for a nice profit to the client who had earlier expressed interest in the property. Does Kozniak most likely violate the CFA Institute Standards of Professional Conduct?【单选题】

A.No

B.Yes, she did not disclose her potential conflicts of interest to either client.

C.Yes, she profited on the real estate to the detriment of her financially stressed client.

正确答案:A

答案解析:“Guidance for Standards I–VII,” CFA Institute

2012 Modular Level I, Vol. 1, pp. 63–64, 123–125Study Session 1-2-aDistinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.

A is correct because Kozniak does not appear to have violated any CFA Institute Standards of Professional Conduct. Because she is known in the market for investing and brokering property and both parties have worked with Kozniak in the past, both parties would know of her interests. In addition, in both cases she acts for her own account as a primary investor, not as a broker. She buys the property for her own portfolio and then sells the property from her own portfolio. Therefore, Kozniak did not violate Standard VI (A) Disclosure of Conflicts. When she purchased the property for her portfolio, she saved her client from losing the building to the bank and did not charge a sales commission. Because the sale of the property to her other client did not take place until six months after her purchase and she was unable to contact the client who had earlier expressed interest prior to her purchase, she cannot be accused of violating any loyalty, prudence, or care to either client (Standard III (A) Loyalty, Prudence, and Care).

1、For periods beginning on or after 1 January 2011, the Global Investment PerformanceStandards (GAPS?) require that total firm assets be defined as the aggregatefair value of all:【单选题】

A.discretionary assets in fee-paying portfolios managed by the firm.

B.discretionary and non-discretionary assets in fee-paying portfolios managedby the firm.

C.discretionary and non-discretionary assets in fee-paying and non-fee-payingportfolios managed by the firm.

正确答案:C

答案解析:公司总资产包括公司管理的其自由决断和非自由决断资产,这些自由决断和非自由决断资产包含在真实付费和非真实付费的组合中。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料