下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Fixed Income Investments5道练习题,附答案解析,供您备考练习。

1、All else being equal, in a rising interest rate environment, the price of a floating-ratesecurity will most likely decline if:【单选题】

A.there is no cap.

B.the margin required by investors declines.

C.the coupon is reset every six months rather than monthly.

正确答案:C

答案解析:如果没有利率顶(CAP)就会降低利率风险,利率上升,息票率也随之上升,价格不会下跌。如果投资者要求的收益差(margin)减少,会提高浮动利率债券的价格,而不是降低。息票每6个月设定一次而不是每个月设定一次,在利率上升的情况下,浮动利率证券无法反映最新的市场利率,会造成其价格下跌。

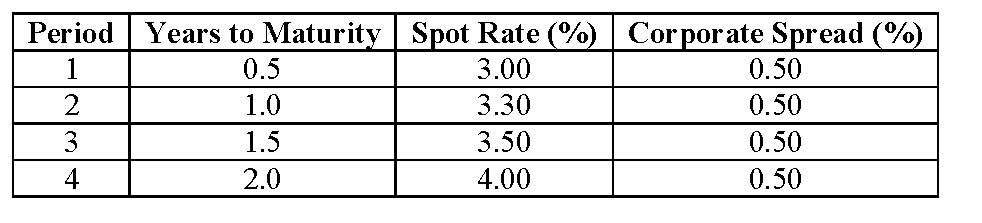

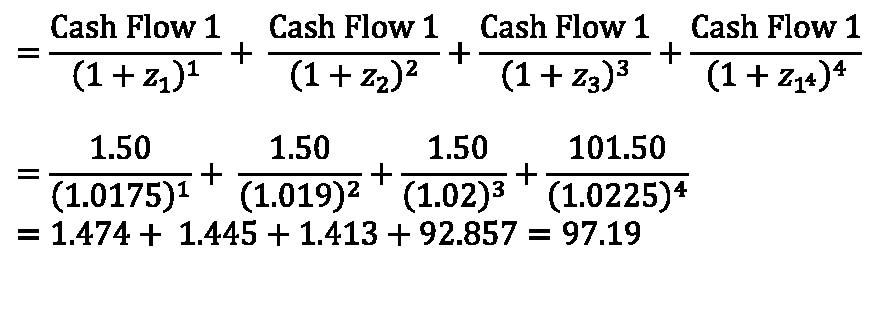

1、Given the data in the table below, the price of a 3% coupon corporate bond maturing in 2 years is closest to: 【单选题】

【单选题】

A.$97.19.

B.$98.12.

C.$100.04.

正确答案:A

答案解析:“Yield Measures, Spot Rates, and Forward Rates,” Frank J. Fabozzi, CFA

2010 Modular Level I, Vol. 5, pp. 468473

Study Session 16-65-e

Describe the methodology for computing the theoretical Treasury spot rate curve and compute the value of a bond using spot rates.

A is correct because the cash flows should be discounted using the appropriate spot rate plus spread :

1、Which of the following is least likely a tool used by the U.S. Federal Reserve Bank to directly influence the level of interest rates?【单选题】

A.Verbal persuasion

B.Open market operations

C.Setting the rate on 30-year bonds

正确答案:C

答案解析:“Understanding Yield Spreads,” Frank J. Fabozzi

2012 Modular Level I, Vol. 5, pp. 448–449

Study Session 15-56-a

Identify the interest rate policy tools available to a central bank.

C is correct because the U.S. Federal Reserve Bank (Fed) uses policy tools to directly influence short-term interest rates. It only indirectly influences long-term interest rates. The market, not the Fed, sets rates on 30-year bonds.

1、The type of residential mortgage least likely to contain a "balloon" payment is a(n):【单选题】

A.fully amortizing mortgage.

B.interest-only mortgage.

C.partially amortizing mortgage.

正确答案:A

答案解析:A fully amortizing mortgage is least likely to contain a balloon payment because the sum of all thescheduled principal repayments during the mortgage's life is such that when the last mortgagepayment is made the loan is paid in full.

CFA Level I

"Introduction to Asset-Backed Securities", Frank J. Fabozzi

Section 4.3

1、Which of these definitions of duration is most relevant to a bond investor? A bond’s duration is its:【单选题】

A.half-life.

B.price sensitivity to yield changes.

C.first derivative of value with respect to its yield.

正确答案:B

答案解析:“Introduction to the Measurement of Interest Rate Risk,” Frank J. Fabozzi, CFA

2011 Modular Level I, Vol. 5, pp. 630-631.

Study Session 15-67-f

Distinguish among the alternative definitions of duration and explain why effective duration is the most appropriate measure of interest rate risk for bonds with embedded options.

B is correct because bond investors are concerned about interest rate risk, and duration is a good measure of interest rate risk.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料