下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理Corporate Finance5道练习题,附答案解析,供您备考练习。

1、With respect to capital project, if the discount rate decrease, which of the followingabout the internal rate of return (IRR) and net present value (NPV) aremost accurate?【单选题】

A.Both IRR and NPV increase.

B.IRR remains unchanged and NPV increases.

C.Both IRR and NPV remain unchanged.

正确答案:B

答案解析:IRR的定义是,使得NPV = 0时的折现率,计算时与项目的必要回报率无关。而项目的必要回报率下降,会导致项目的净现值上升。

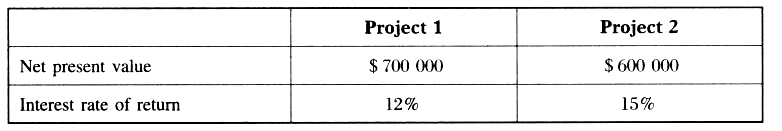

1、An analyst gathers the following information about two mutually exclusive projectsof a company:

If the cost of capital used is 10% , the most appropriate decision for the companyis to accept:【单选题】

A.Project 1 only.

B.Project 2 only.

C.both Project 1 and Project 2.

正确答案:A

答案解析:对于独立项目(independent project),如果NPV > 0,就可以接受该项目;如果NPV 0的项目中选择NPV最大的项目。

当IRR与NPV对作决策有冲突时,以NPV为准。

1、A trader buys 500 shares of a stock on margin at $36 a share using an initial leverage ratio of 1,66.The maintenance margin requirement for the position is 30%. The stock price at which the margincall will occur is closest to:【单选题】

A.$25.20.

B.$30.86.

C.$20.57.

正确答案:C

答案解析:Initial equity (%) in the margin transaction=1/Leverage ratio=1/1.66=0.60;

Initial equity per share at the time of purchase=$36 × 0.60=$21.60;

Price (P) at which margin call occurs:

Equity per share/Price per share=Maintenance margin (%)

=($21.60+P-$36)/P=0.30;

0.7P=$14.40;

P=$20.57.

CFA Level I

"Market Organization and Structure," Larry Harris

Section 5.2

1、An analyst does research about the cost of capital and gathers the followinginformation about a company:

● Current share price is $60

● Current annual dividend per share is $1.50

● Stable retention ratio is 40%

● Historical return on equity is 12%

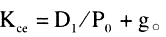

Using the dividend discount model approach, the cost of equity is closest to:【单选题】

A.7.30%

B.7.42%

C.9.88%

正确答案:B

答案解析:使用股利贴现模型(Dividend Discount Model)的计算公式:

g = (return on equity)x(retention ratio),由此得:

g = 12% × 0.4 = 4.8%,所以 = $1.5 × (1 + 4.8%)/$60 + 4.8% = 7.42%.

= $1.5 × (1 + 4.8%)/$60 + 4.8% = 7.42%.

1、A firm is uncertain about both the number of units the market will demand and the price it will receive for them. This type of risk is best described as:【单选题】

A.sales risk.

B.business risk.

C.operating risk.

正确答案:A

答案解析:“Measures of Leverage,” Pamela Peterson Drake, CFA, Raj Aggarwal, CFA, Cynthia Harrington, CFA, and Adam Kobor, CFA

2013 Modular Level I, Vol. 4, Reading 38, Section 3.1, 3.2

Study Session 11-38-a

Define and explain leverage, business risk, sales risk, operating risk, and financial risk, and classify a risk, given a description.

A is correct. Sales risk is associated with uncertainty with respect to total revenue, which in turn, depends on price and units sold.

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料