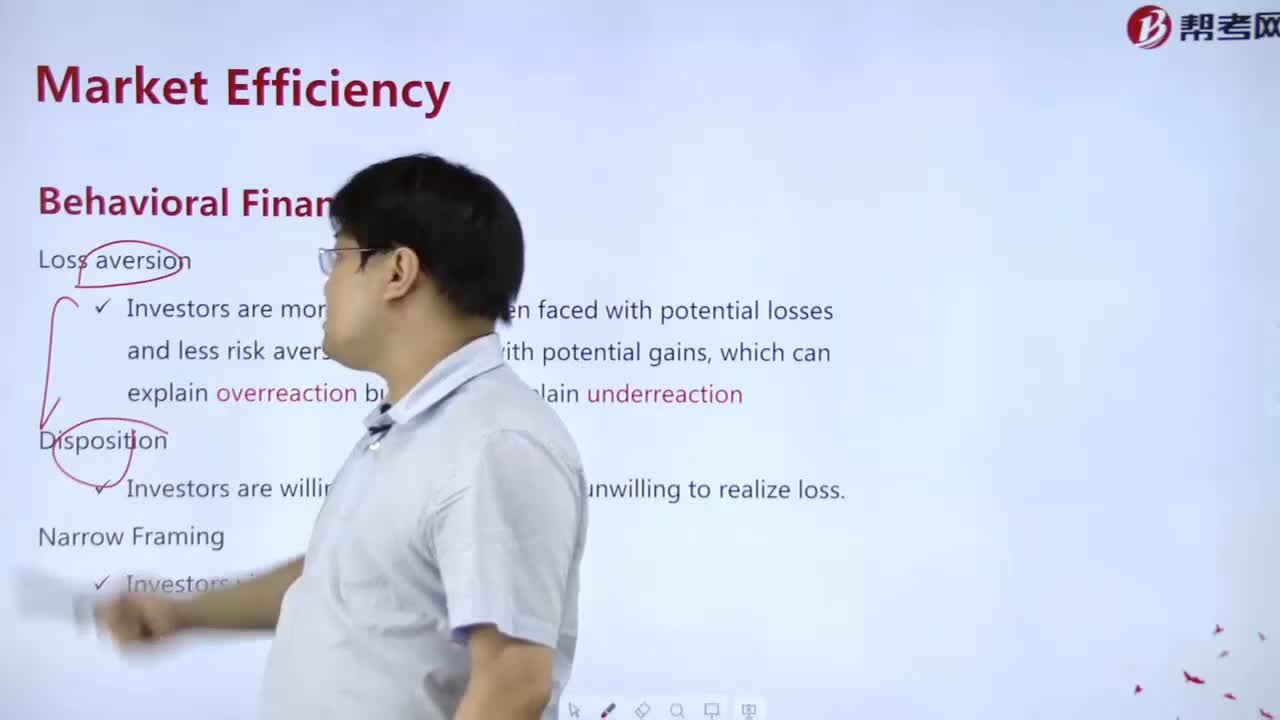

What's in the Behavioral finance?

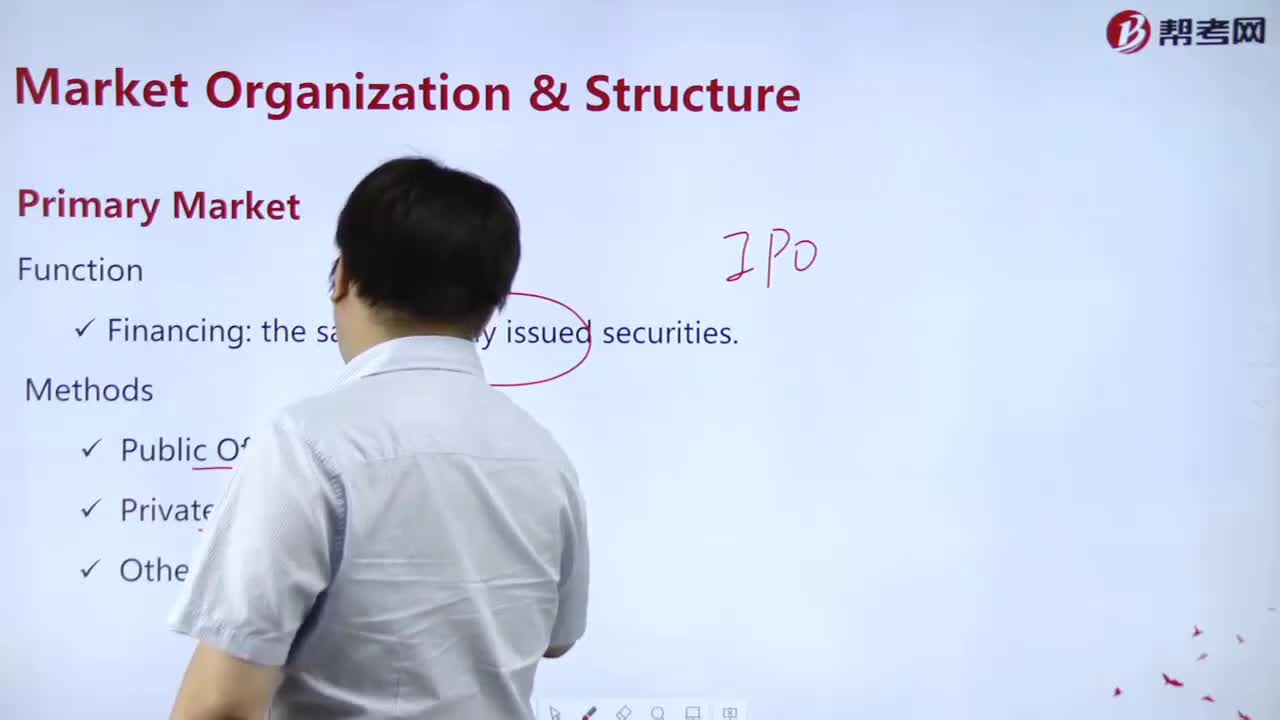

What is the function of the Primary Market?

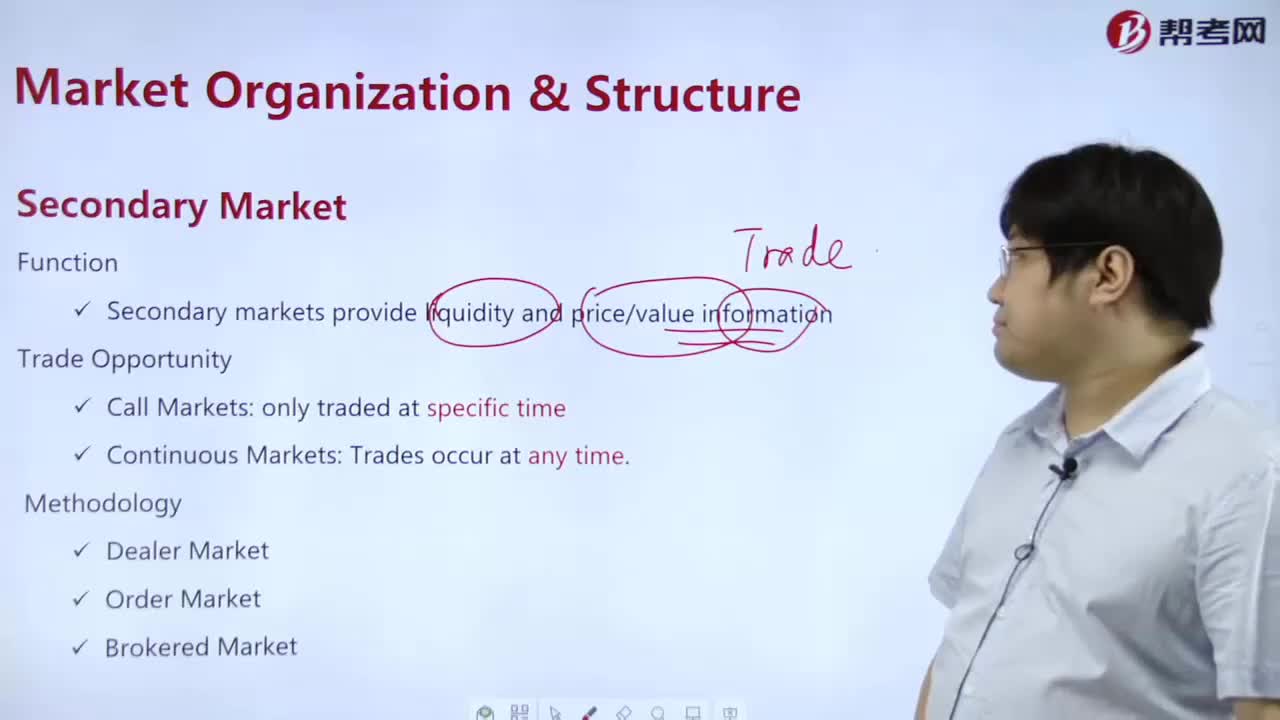

What is the role of the secondary market?

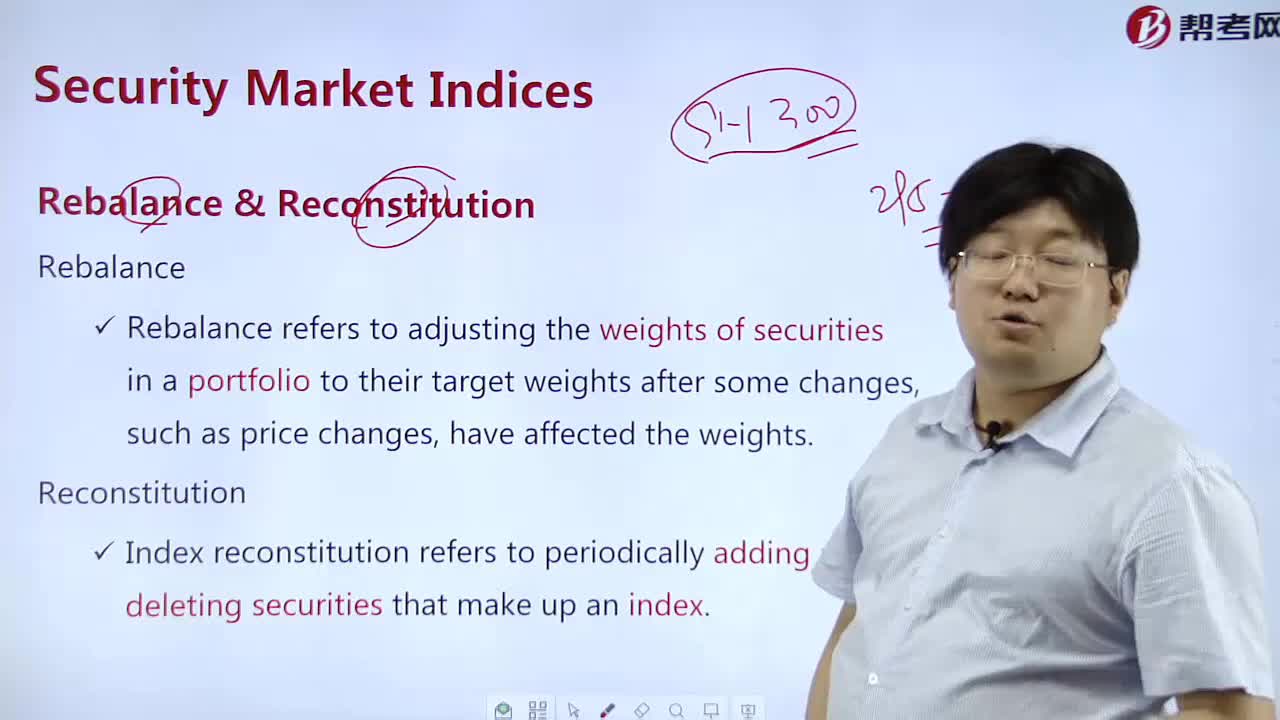

Rebalance and Reconstitution What's the difference?

What are the contents of the stock index?

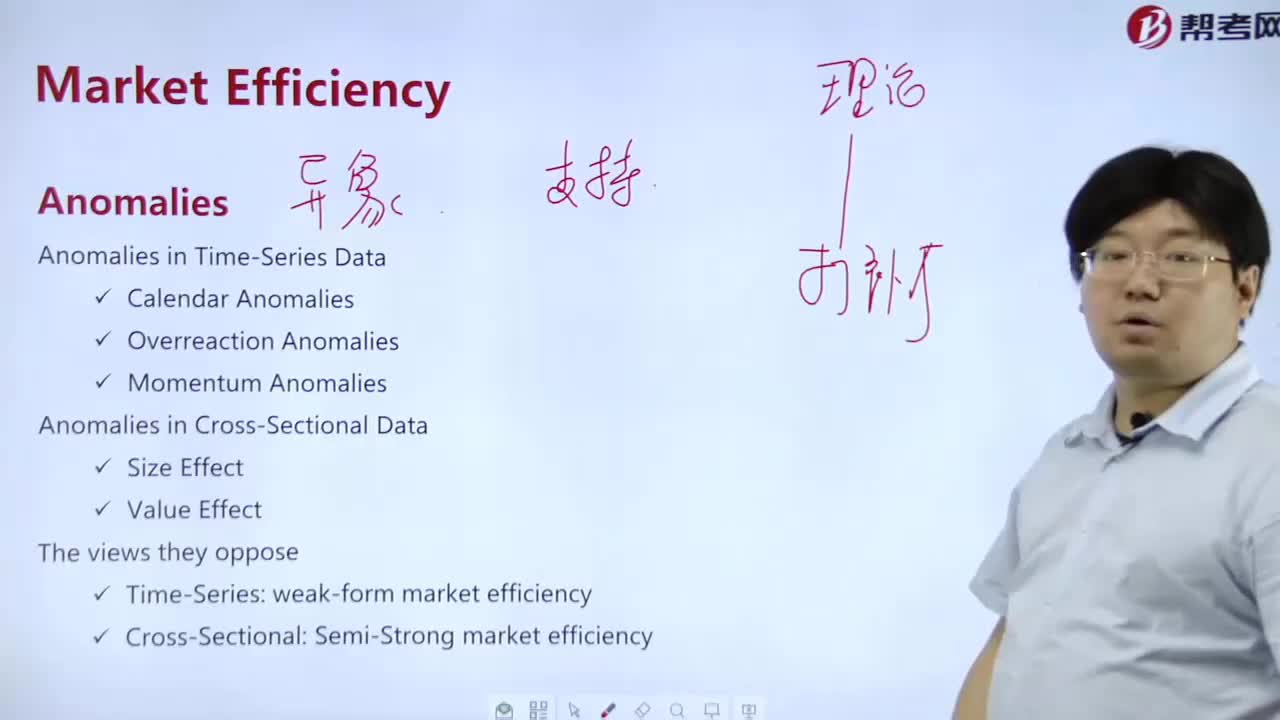

What are the anomalies in the time series data?

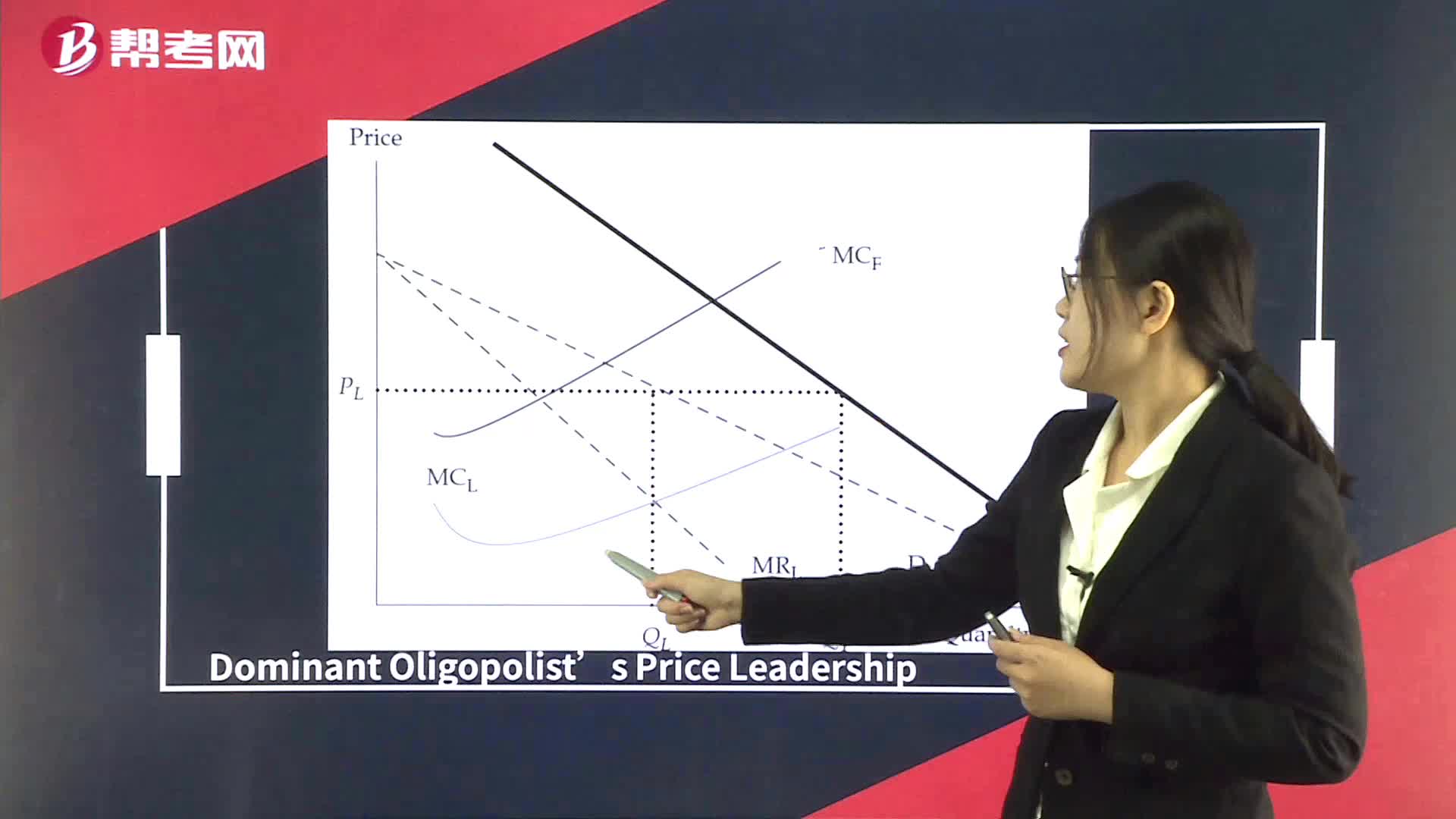

Supply Analysis in Oligopoly Market

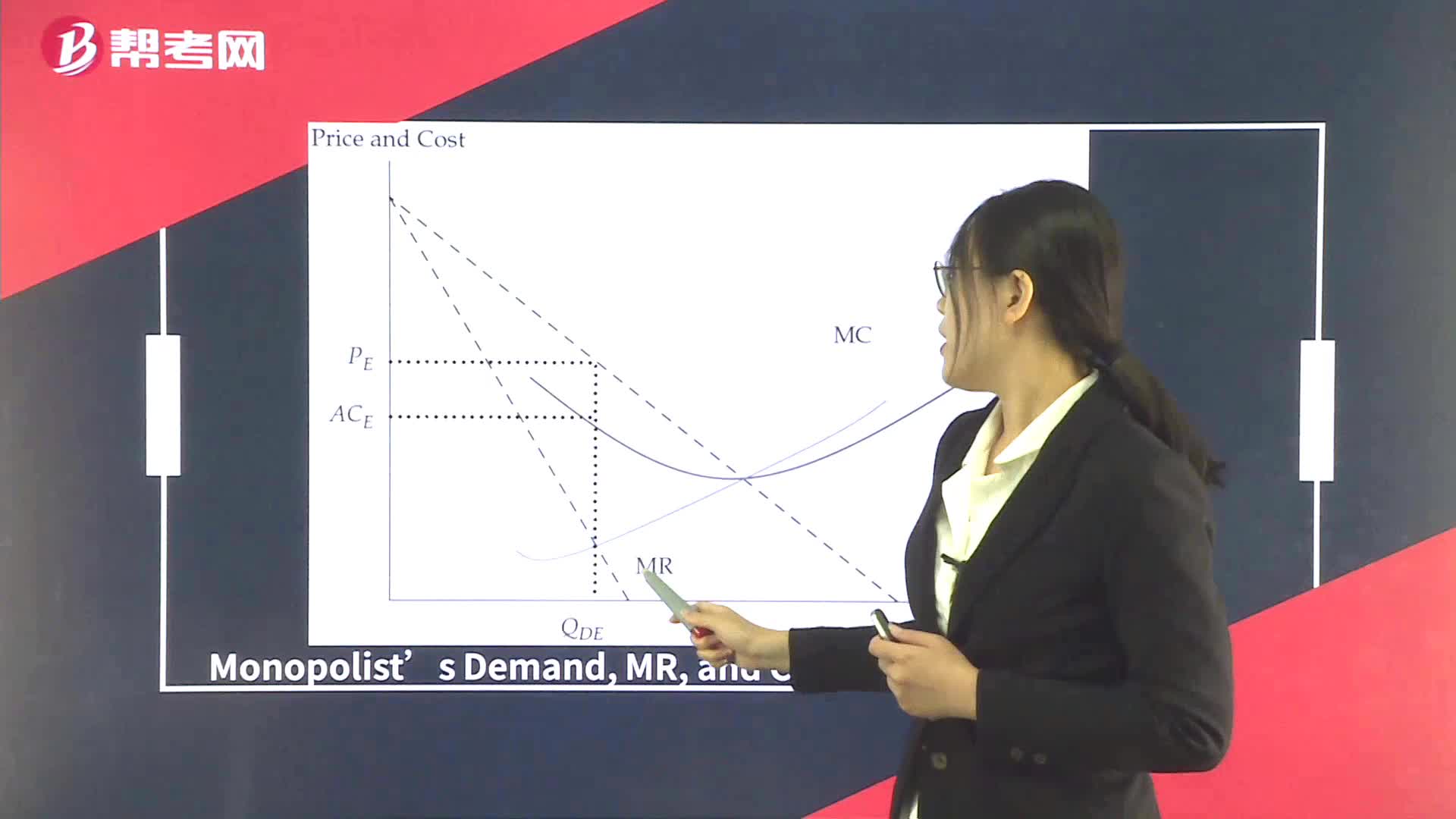

Supply Analysis in Monopoly

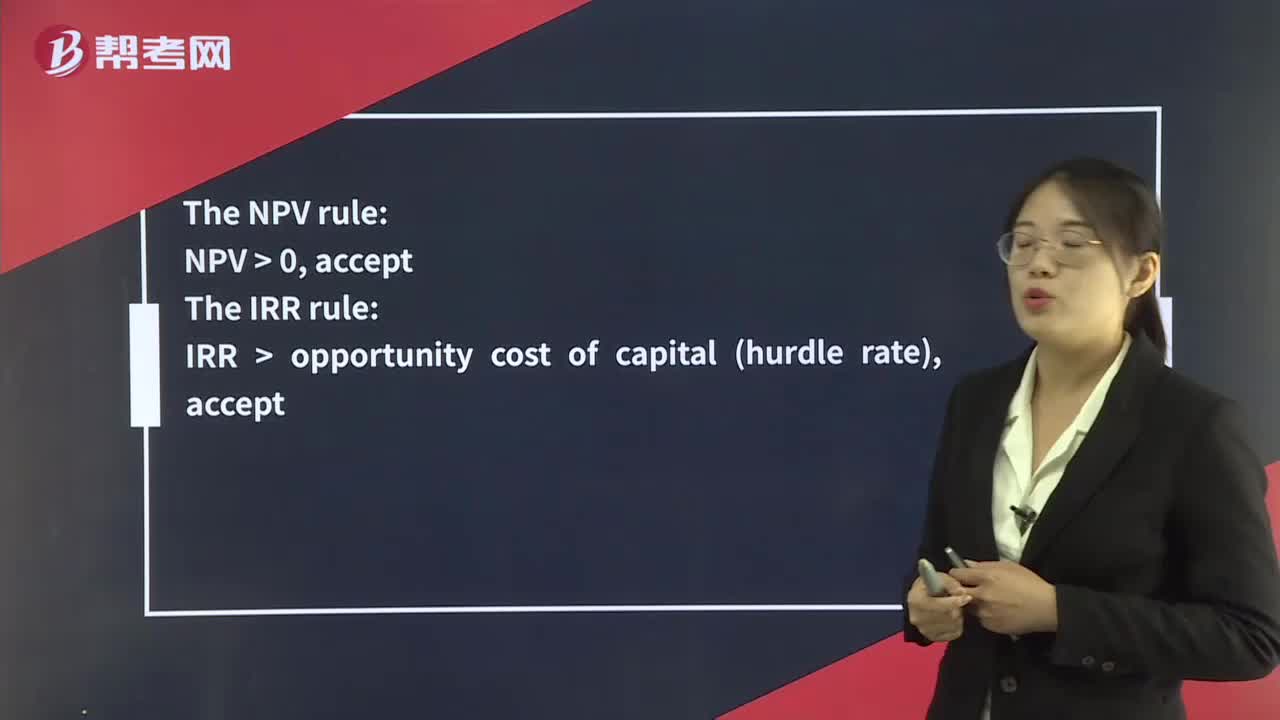

The NPV Rule & The IRR Rule

Pricing strategies in Oligopoly

Long-Run Equilibrium in Perfectly Competitive Markets

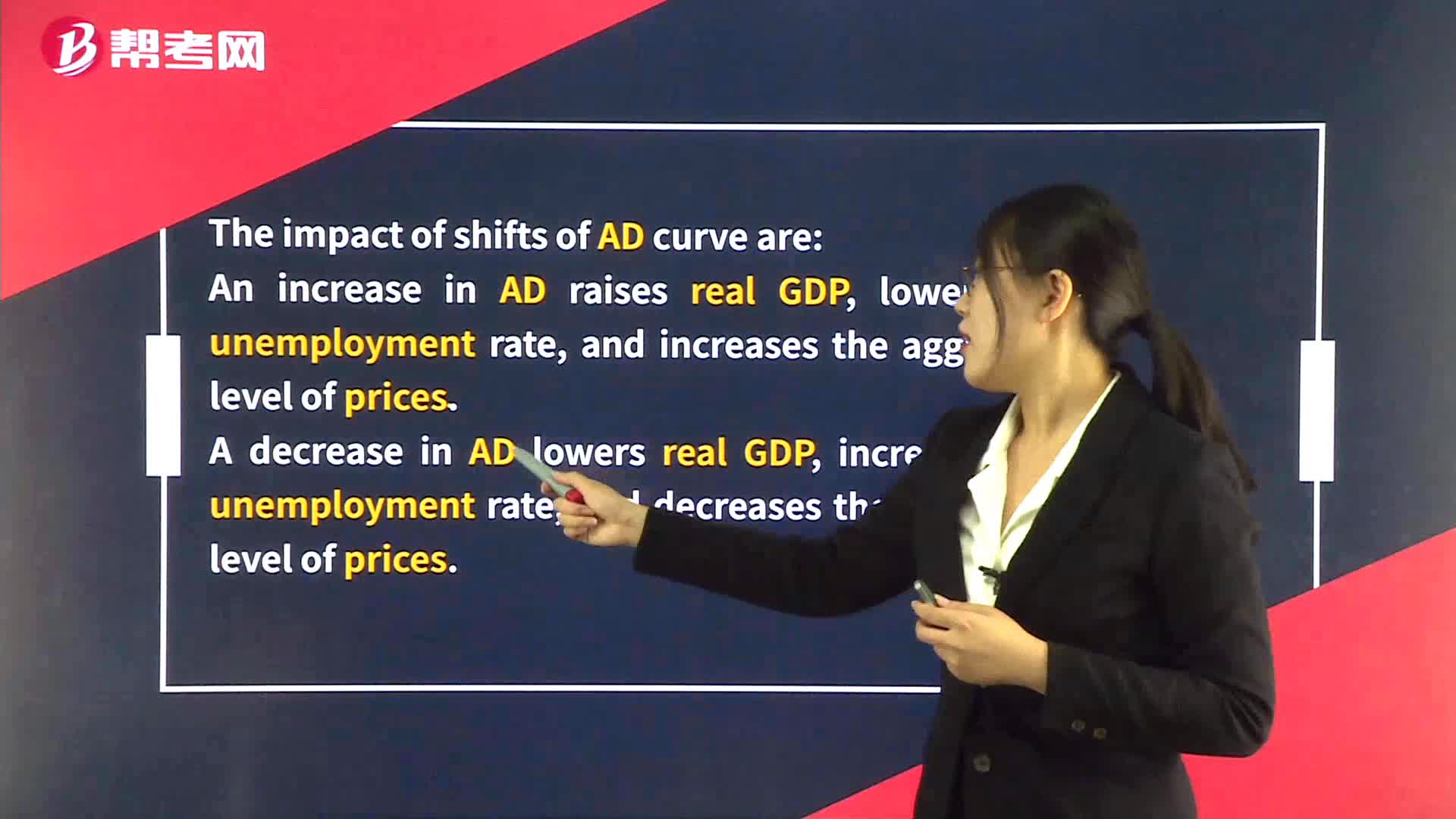

Shifts in the AD and AS curves and Equilibriums

下载亿题库APP

联系电话:400-660-1360