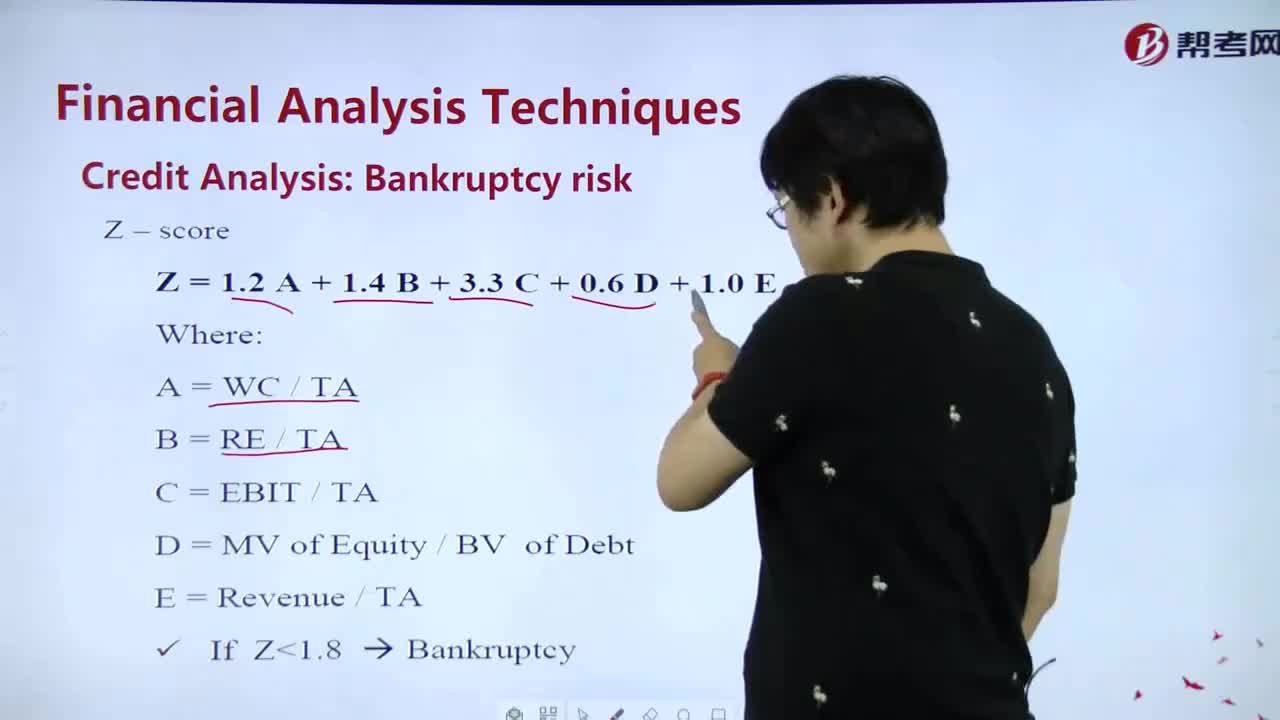

How to master Credit Analysis:Bankruptcy risk?

What is risk measurement?

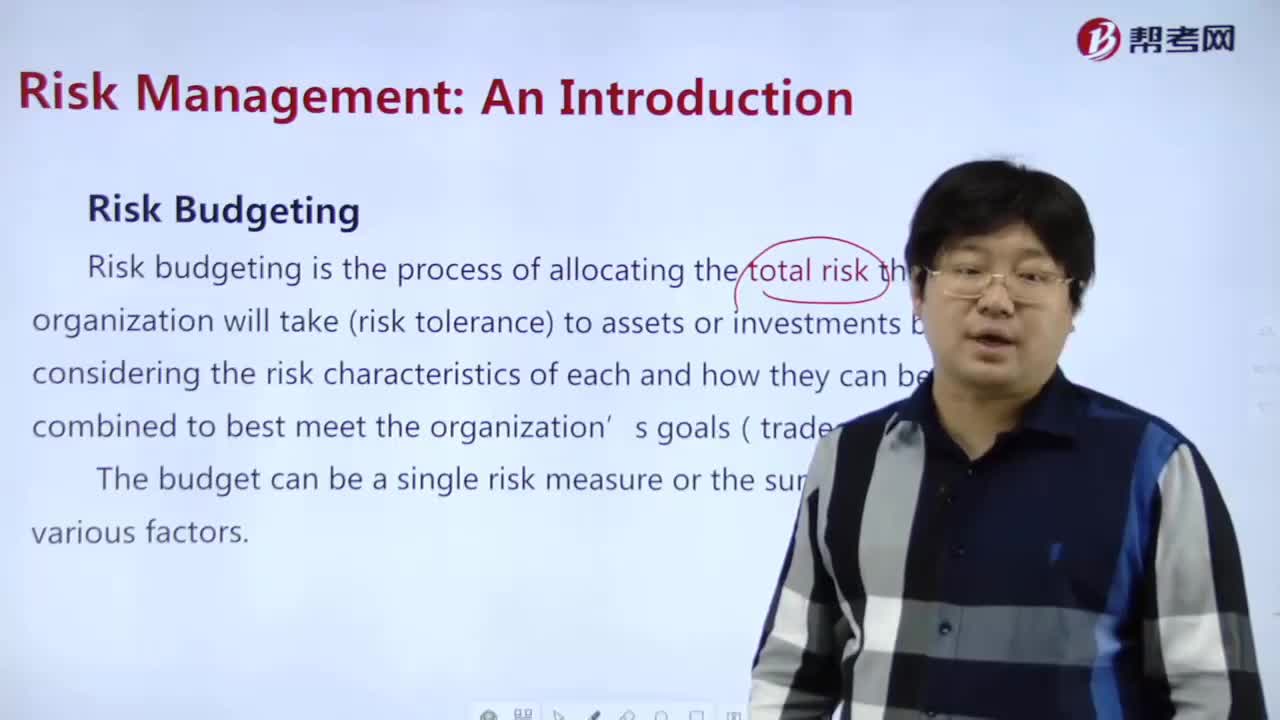

What is risk budgeting?

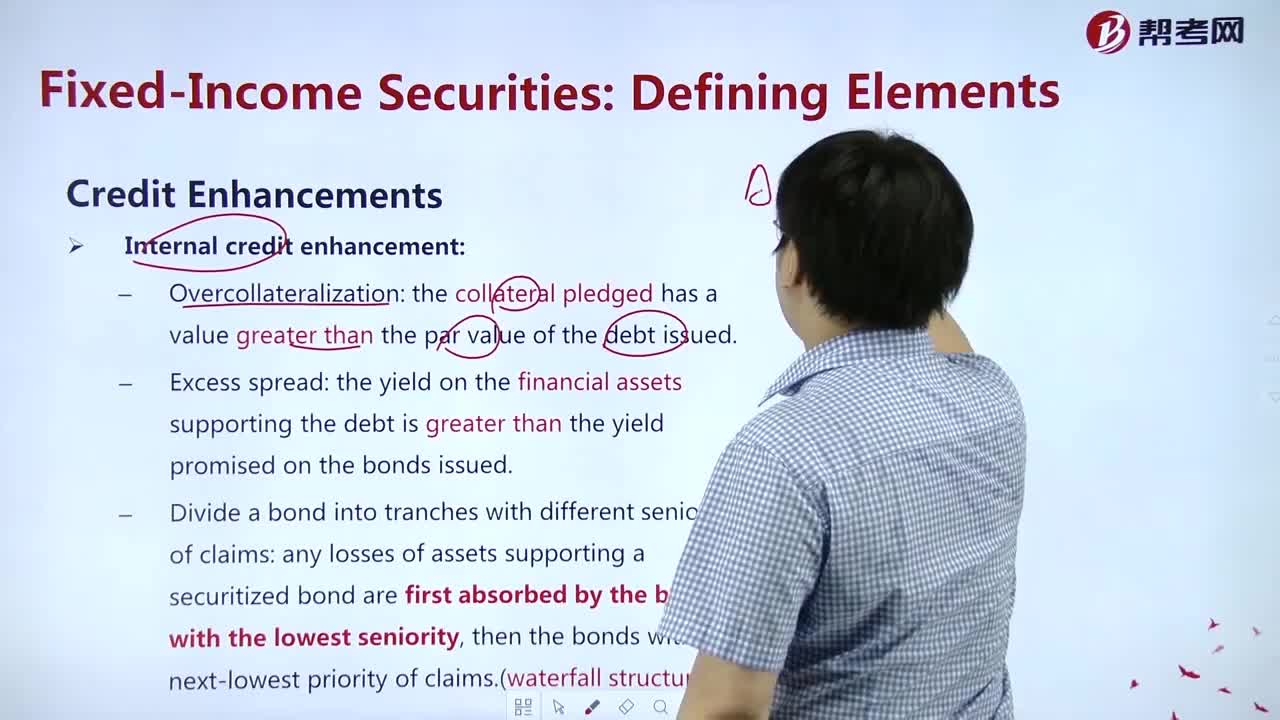

How to master Credit Enhancements?

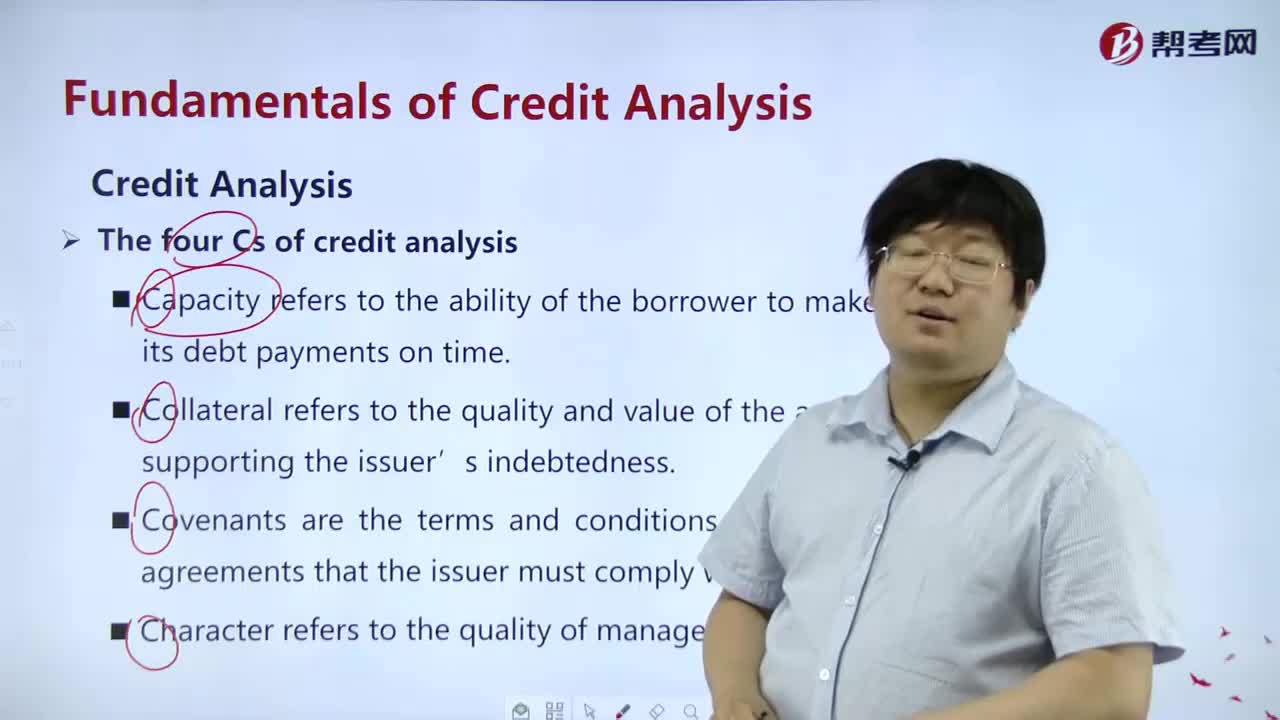

How to master Credit Analysis?

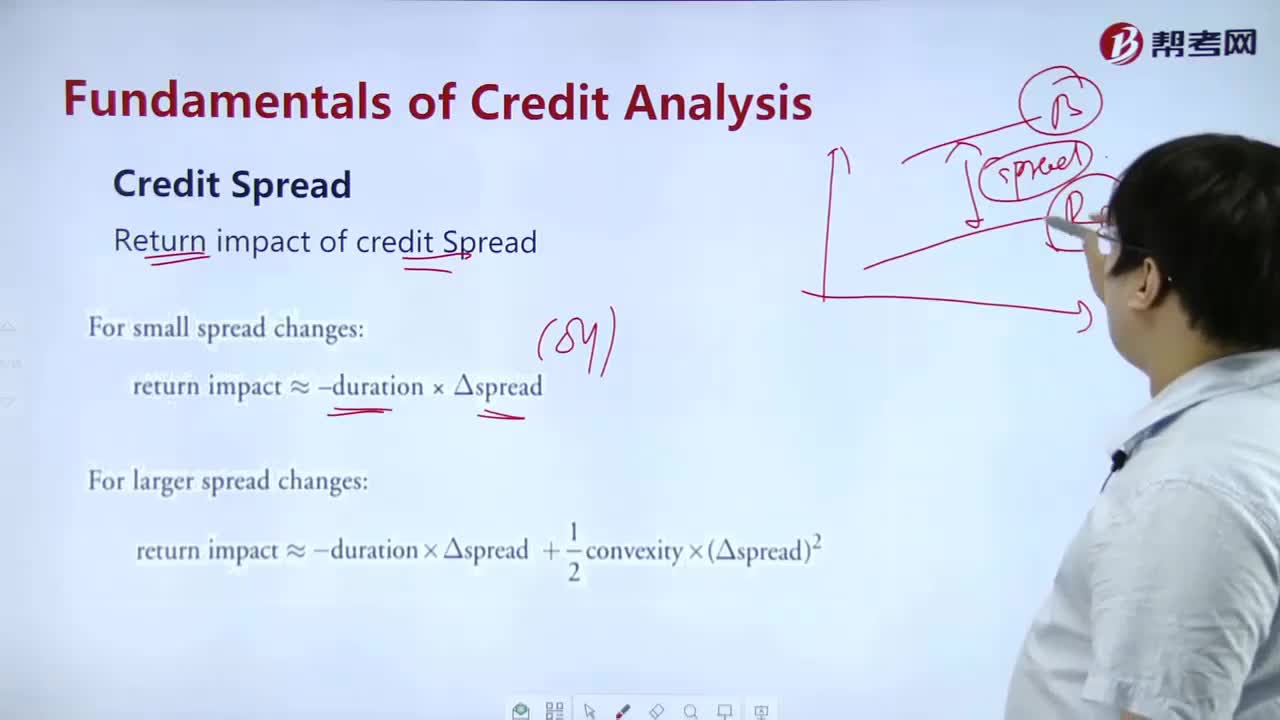

What's the meaning of Credit Spread?

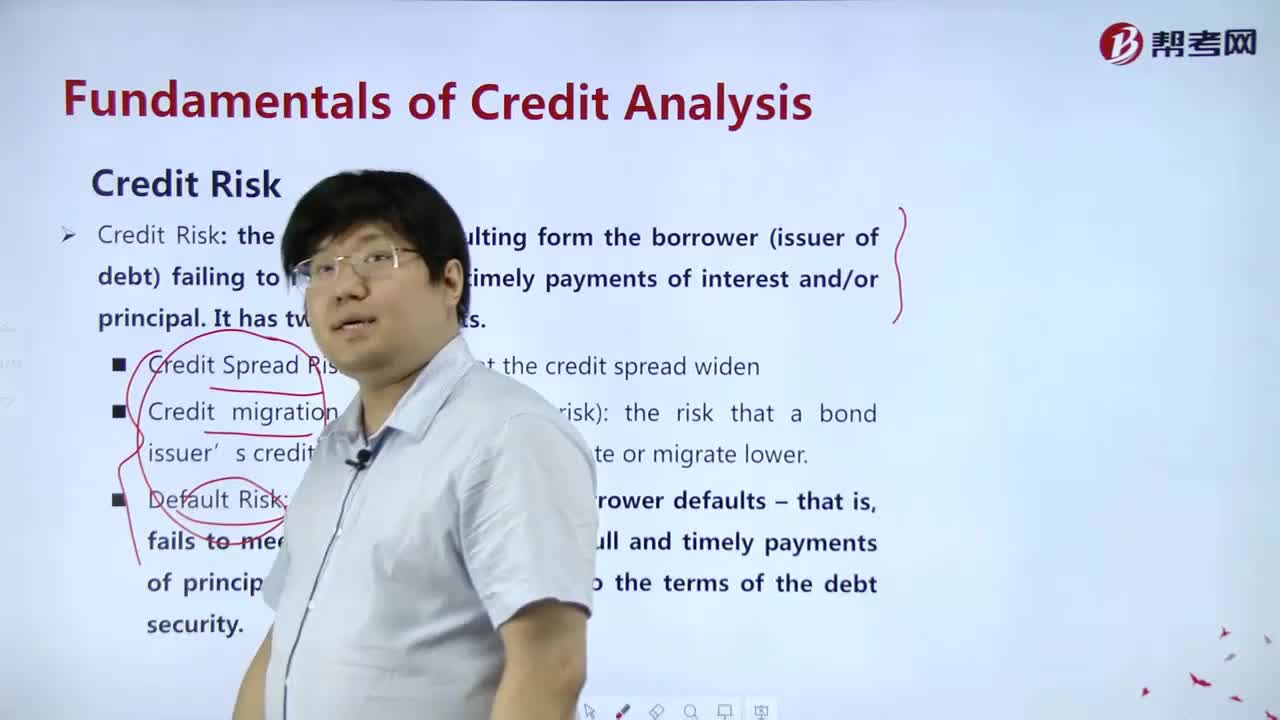

What's the meaning of Credit Risk?

How to understand Risk Mamagement?

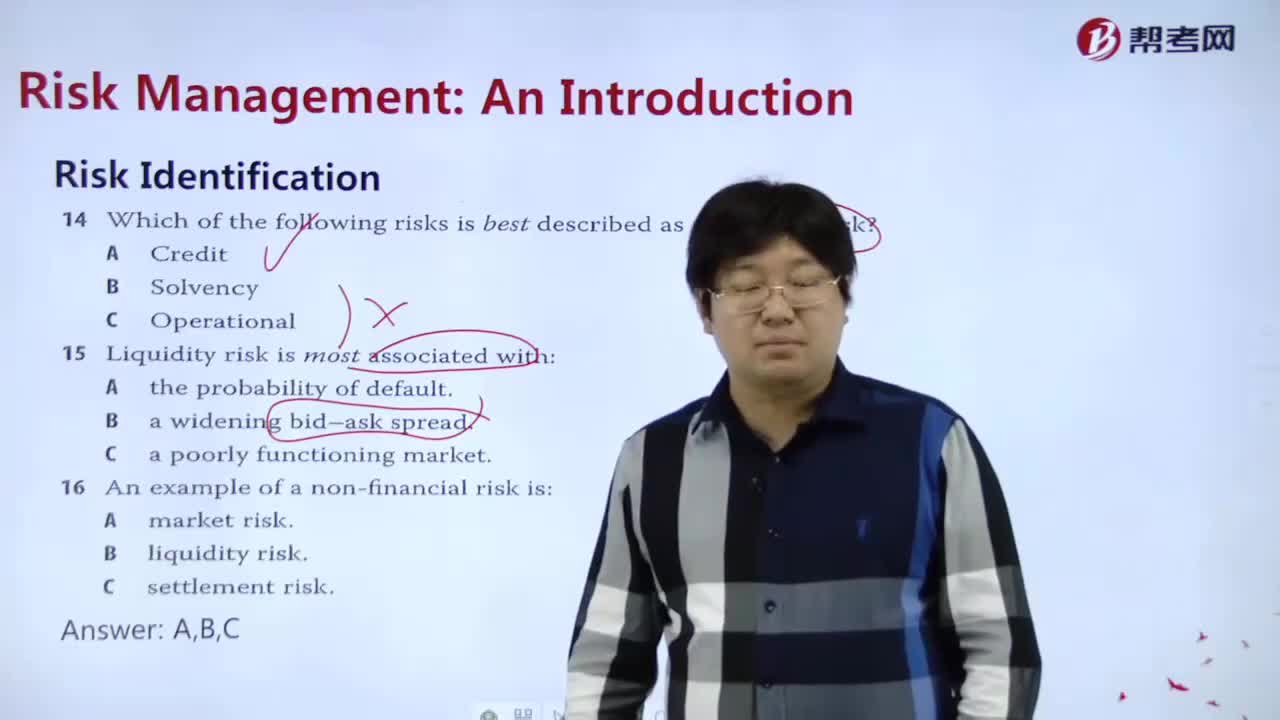

How to master Risk Identification?

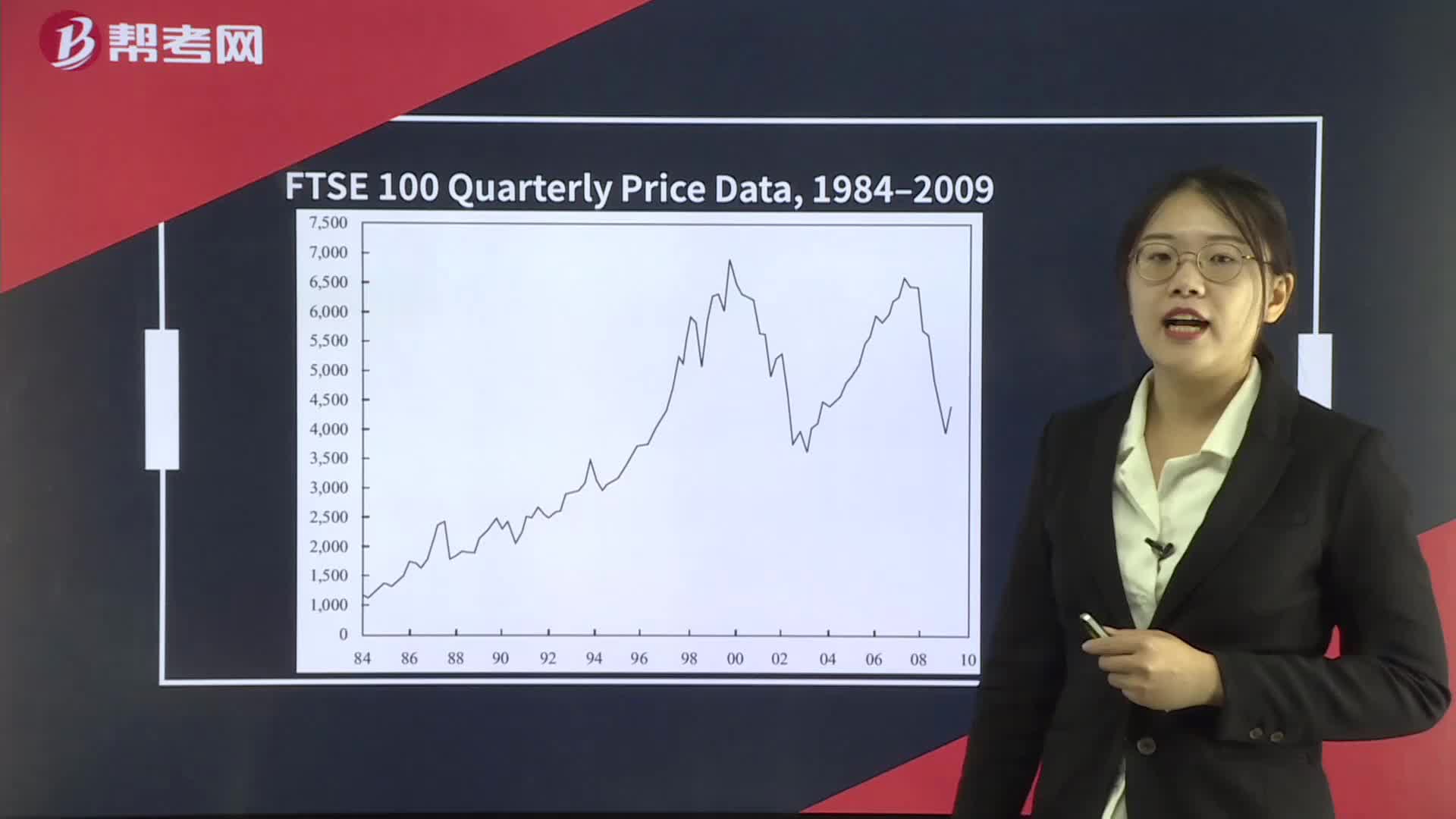

Technical and Fundamental Analysis

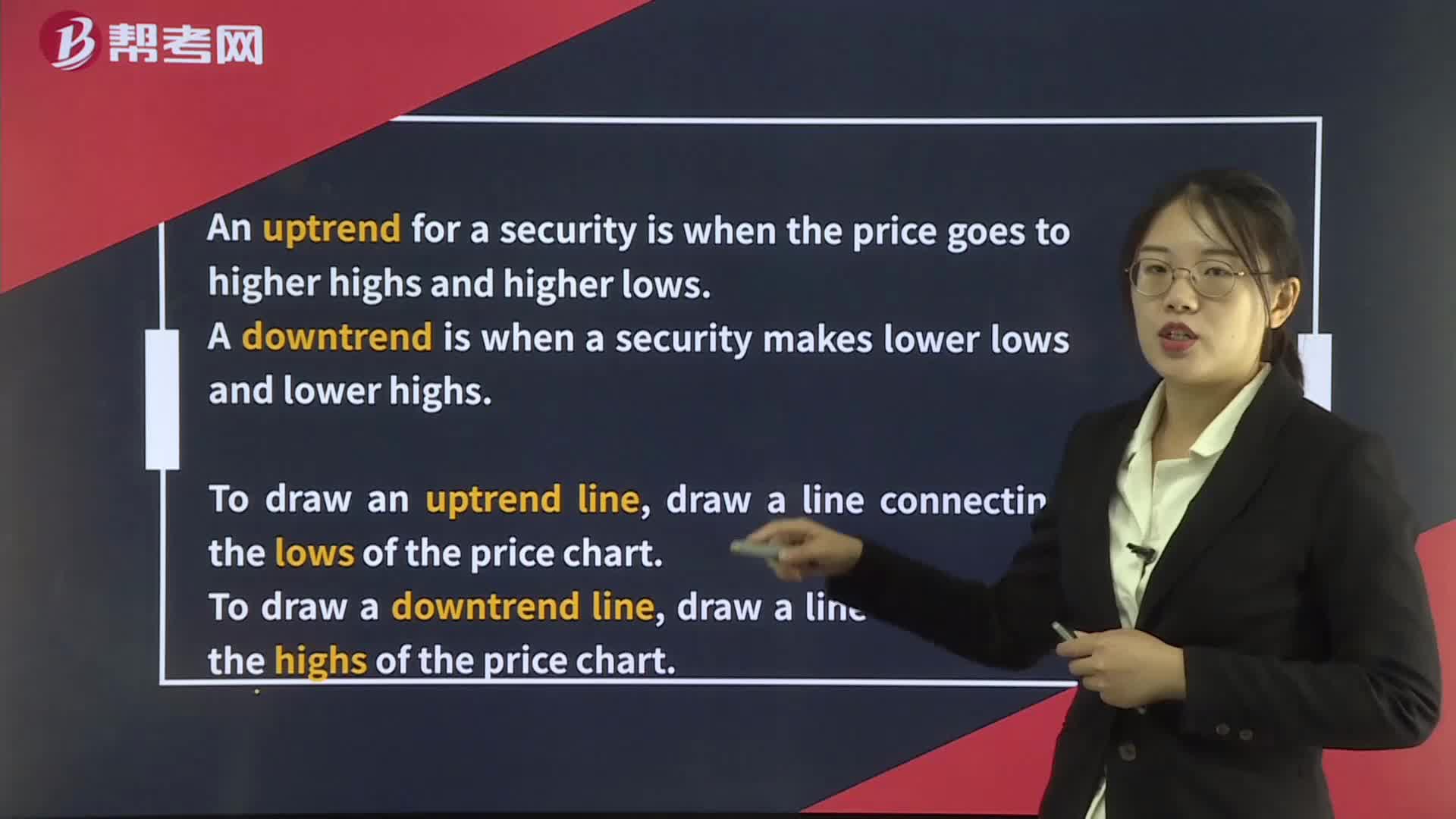

Technical Analysis Tools— Trend

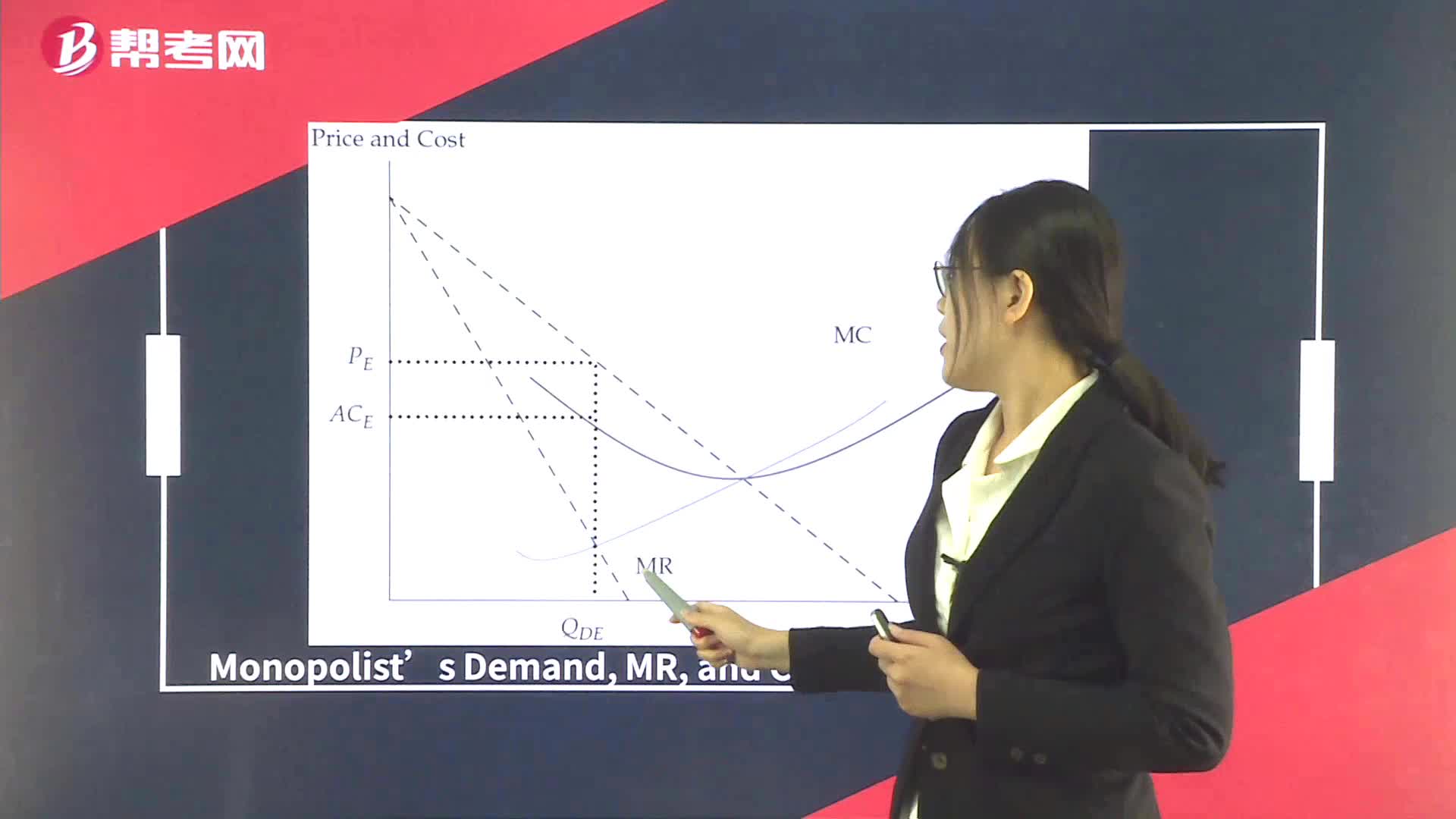

Supply Analysis in Monopoly

下载亿题库APP

联系电话:400-660-1360