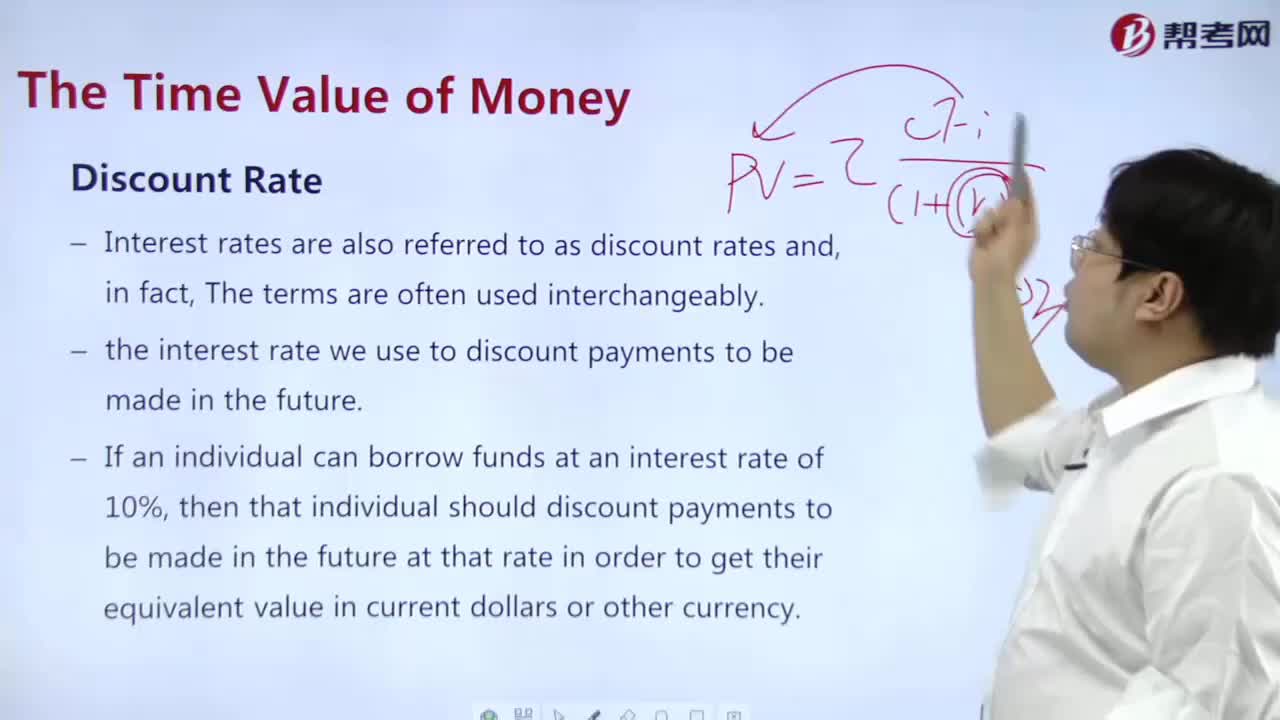

How do you calculate the discount rate?

How do you understand the sampling distribution?

How do you understand probability?

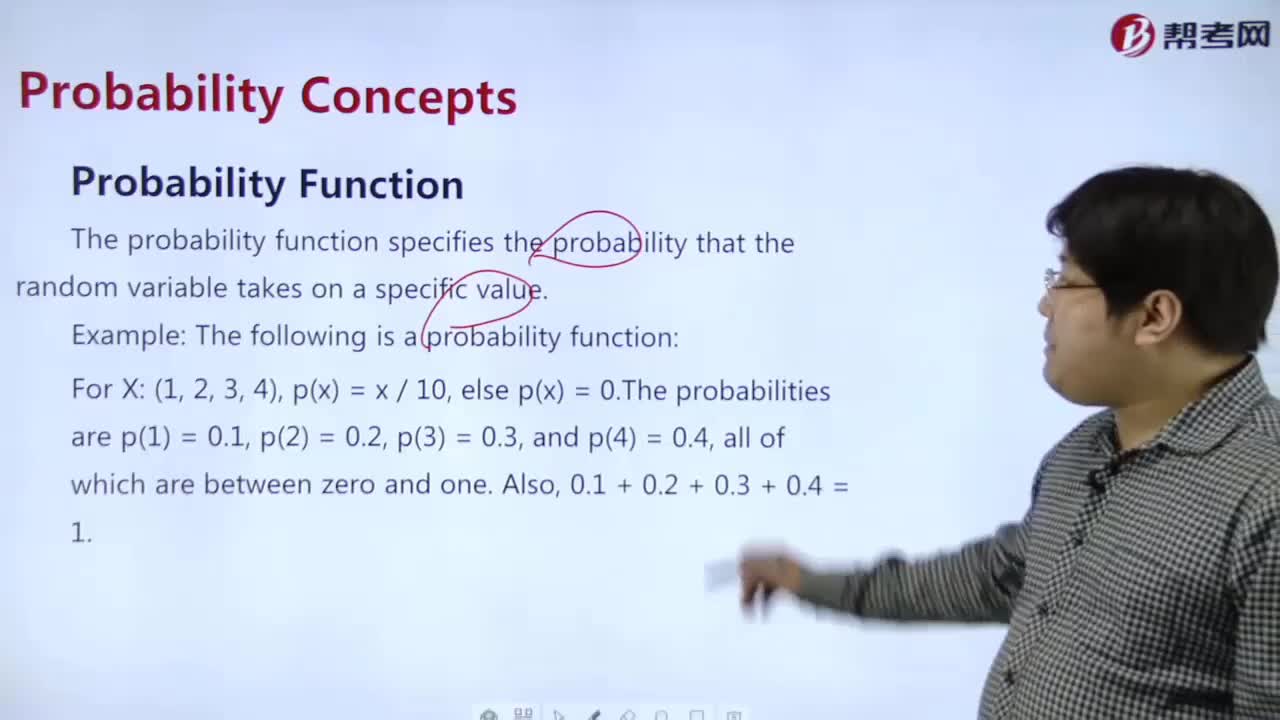

How do you compute the probability function?

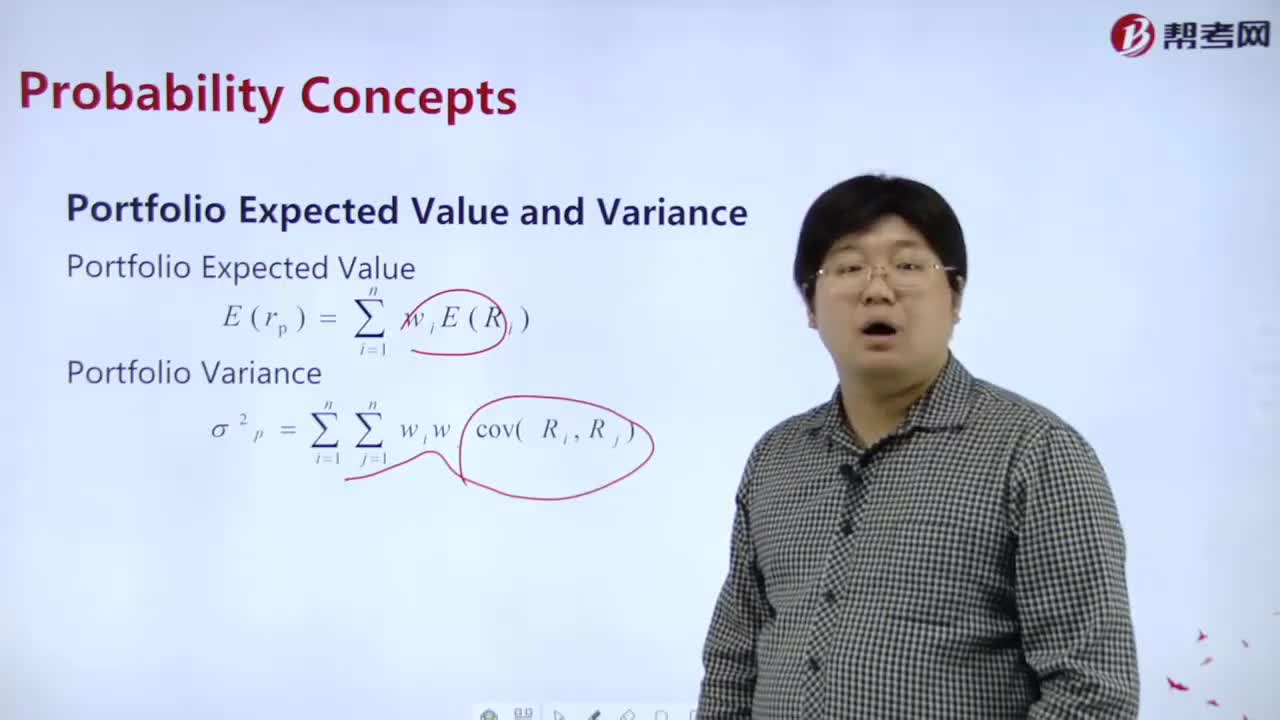

How do you understand the expected value and variance of a portfolio?

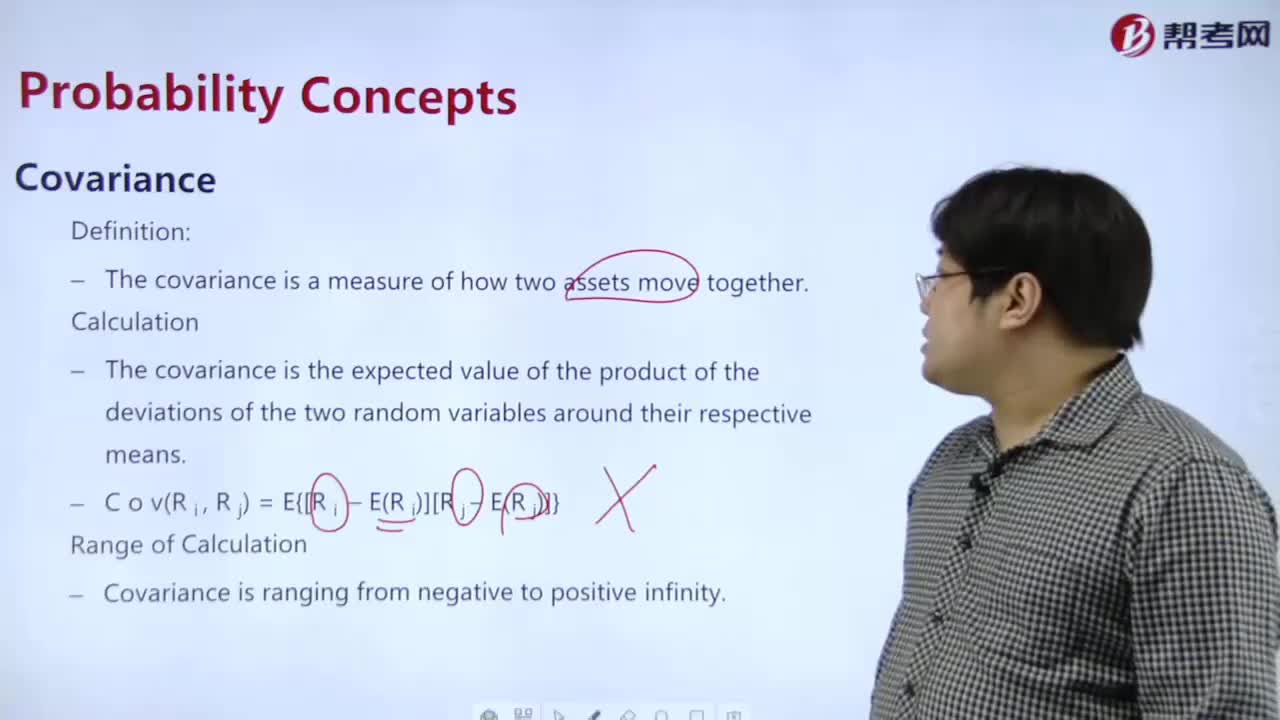

How do you understand covariance?

How to master Spot Rate&Forward Rate?

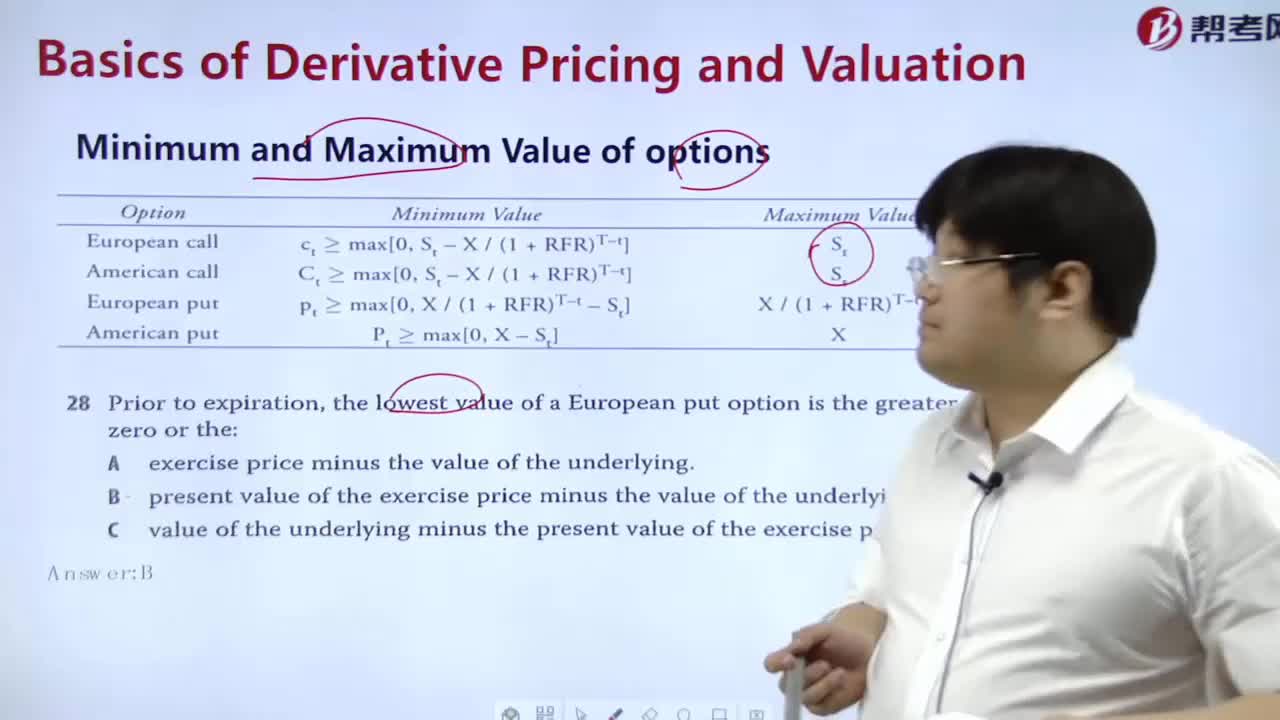

How to calculate the minimum and maximum value of the option?

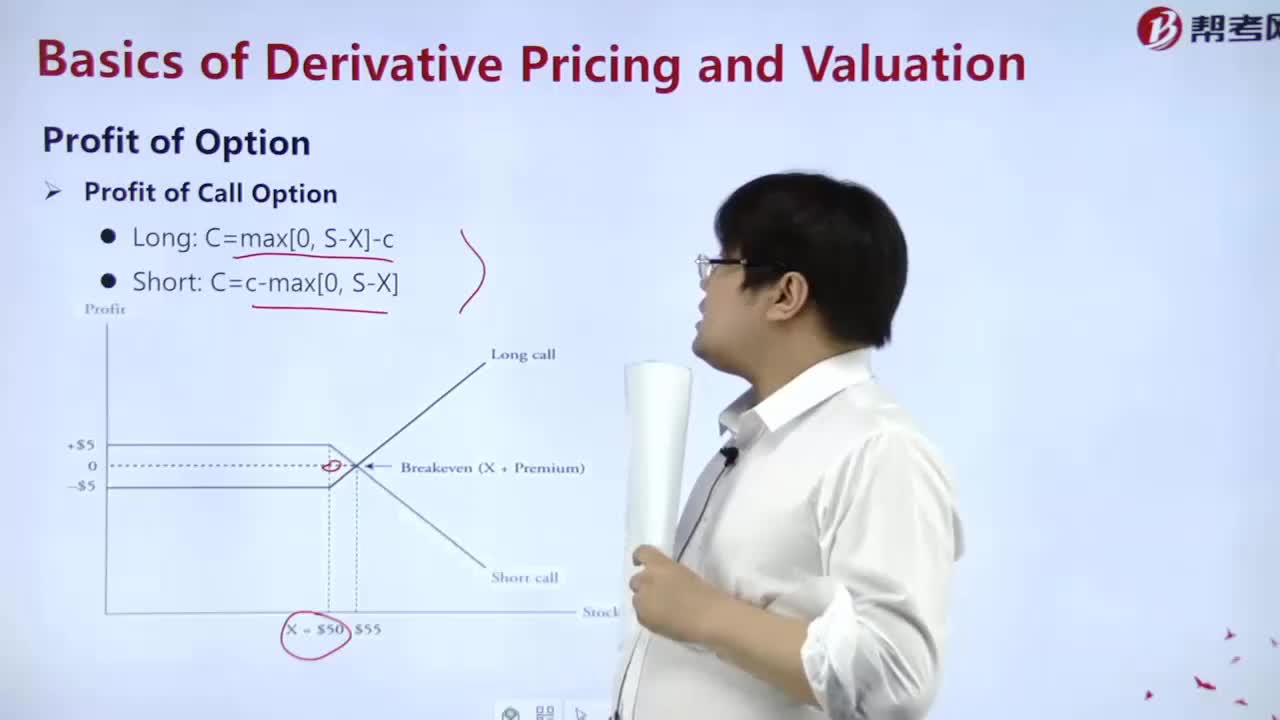

How to calculate the option profit?

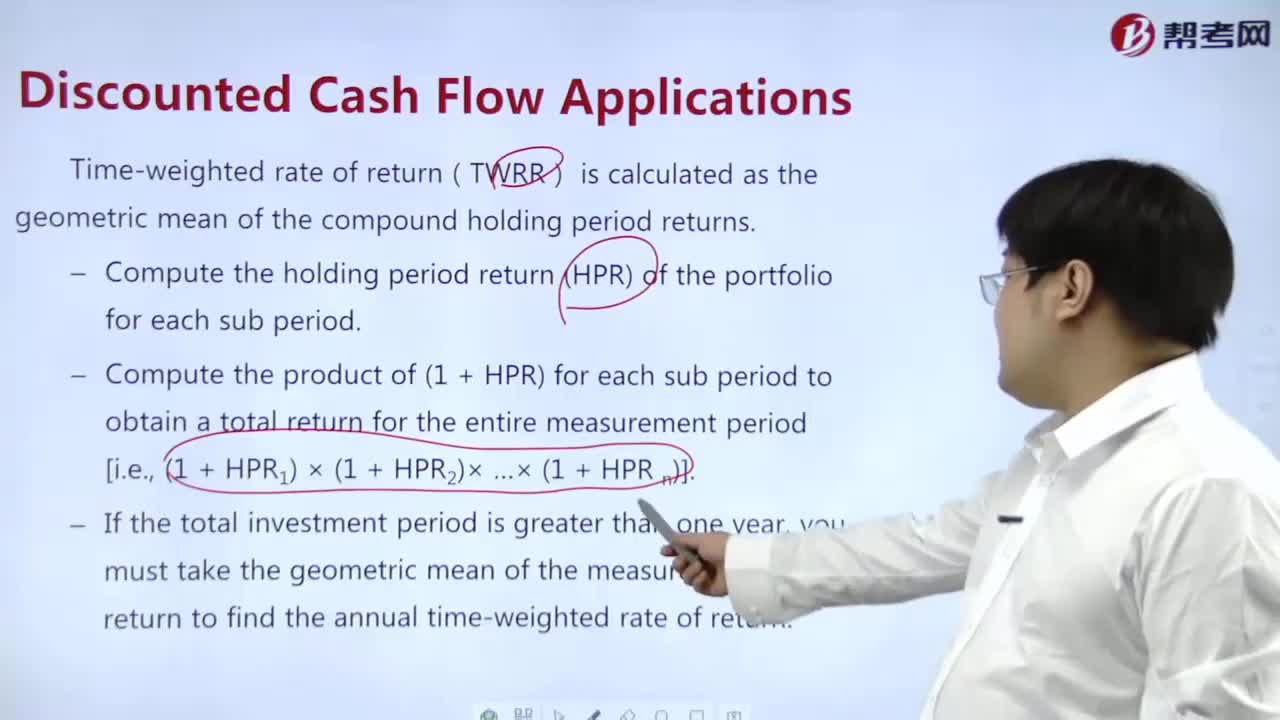

How to calculate MWRR?

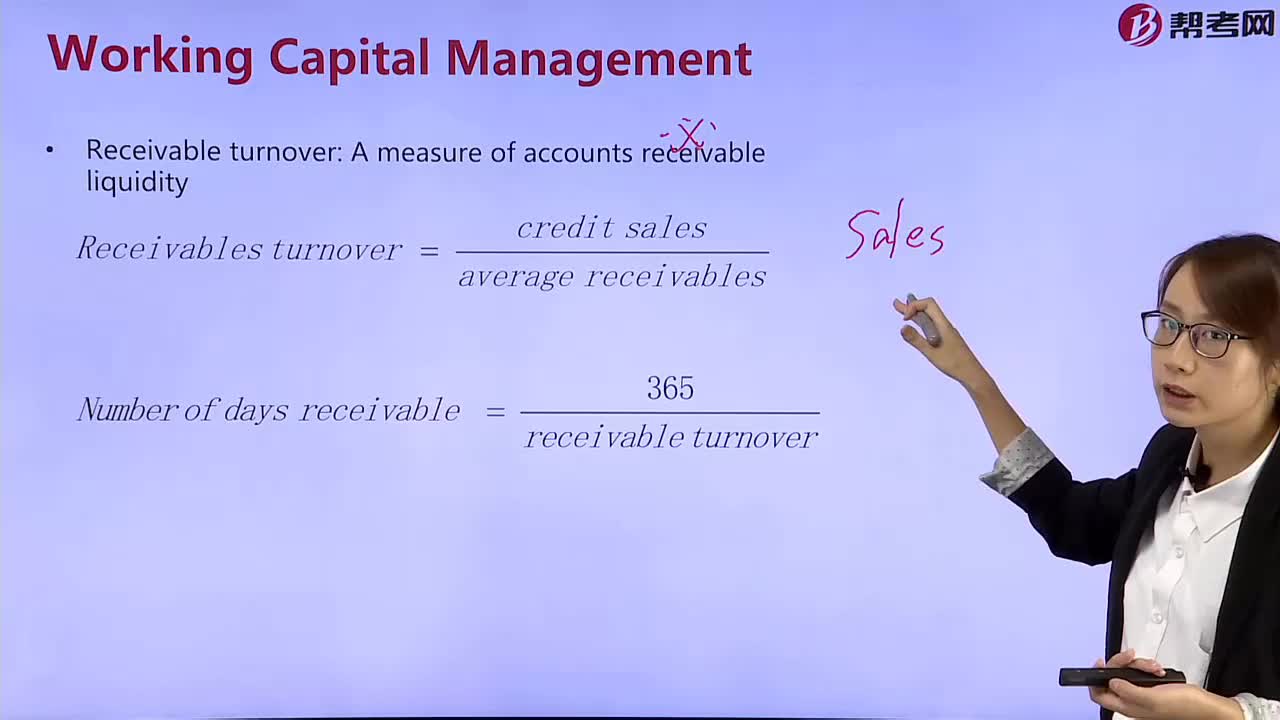

How to calculate the turnover of accounts receivable?

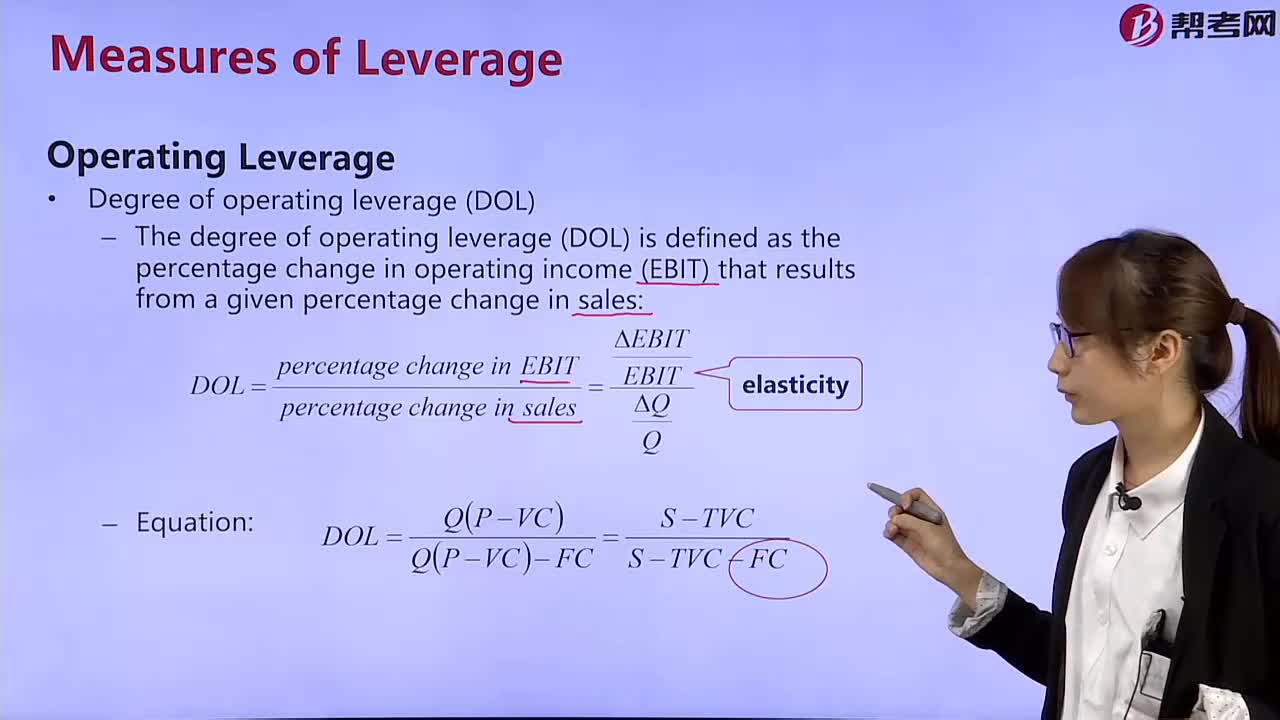

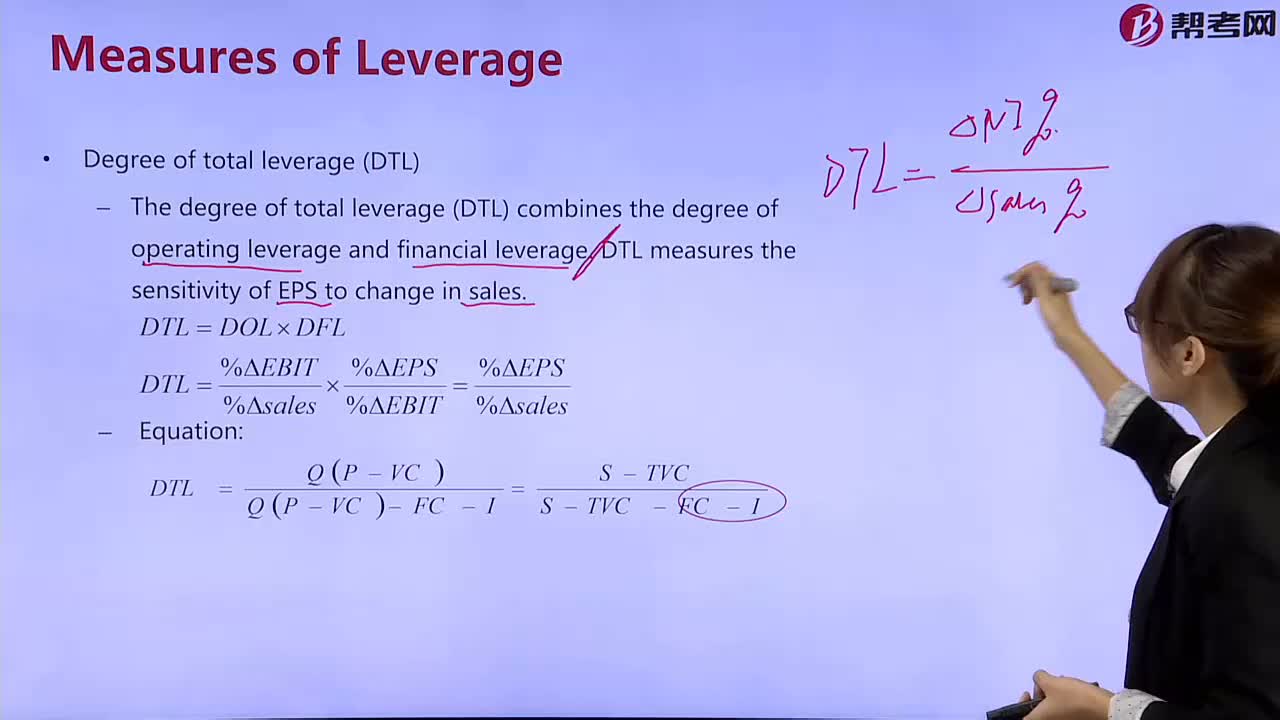

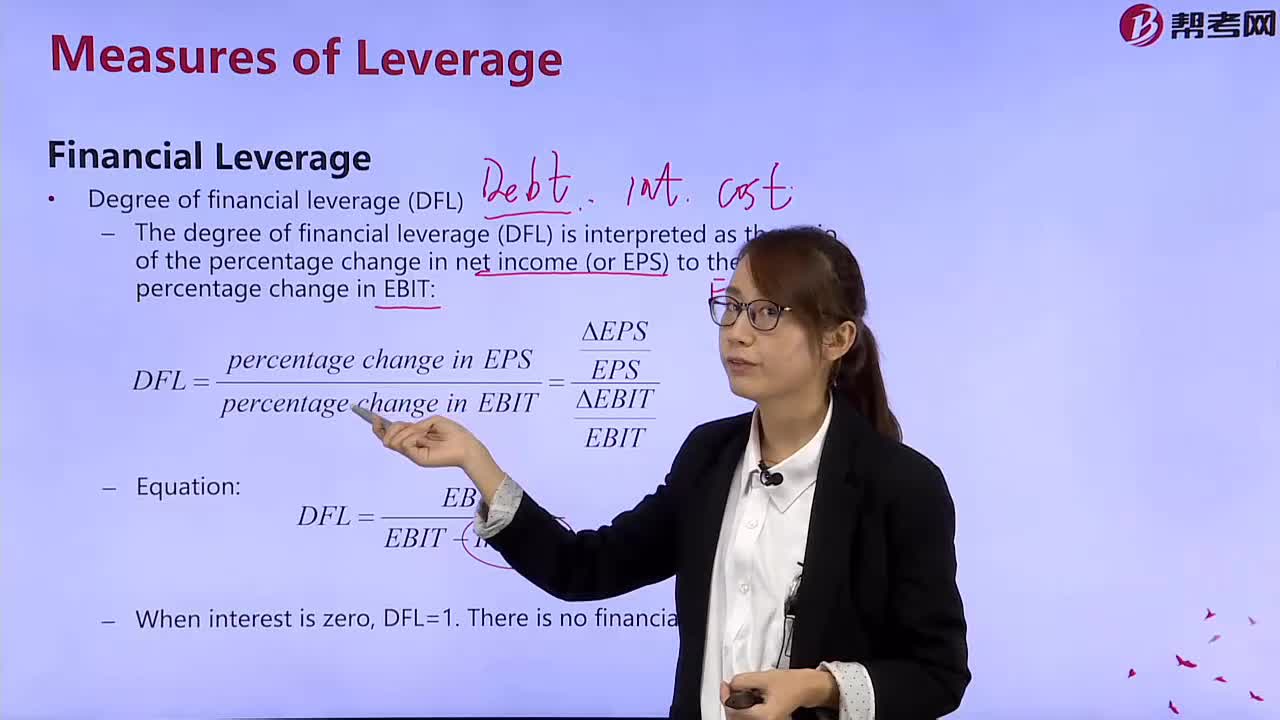

How to calculate the degree of financial leverage?

下载亿题库APP

联系电话:400-660-1360