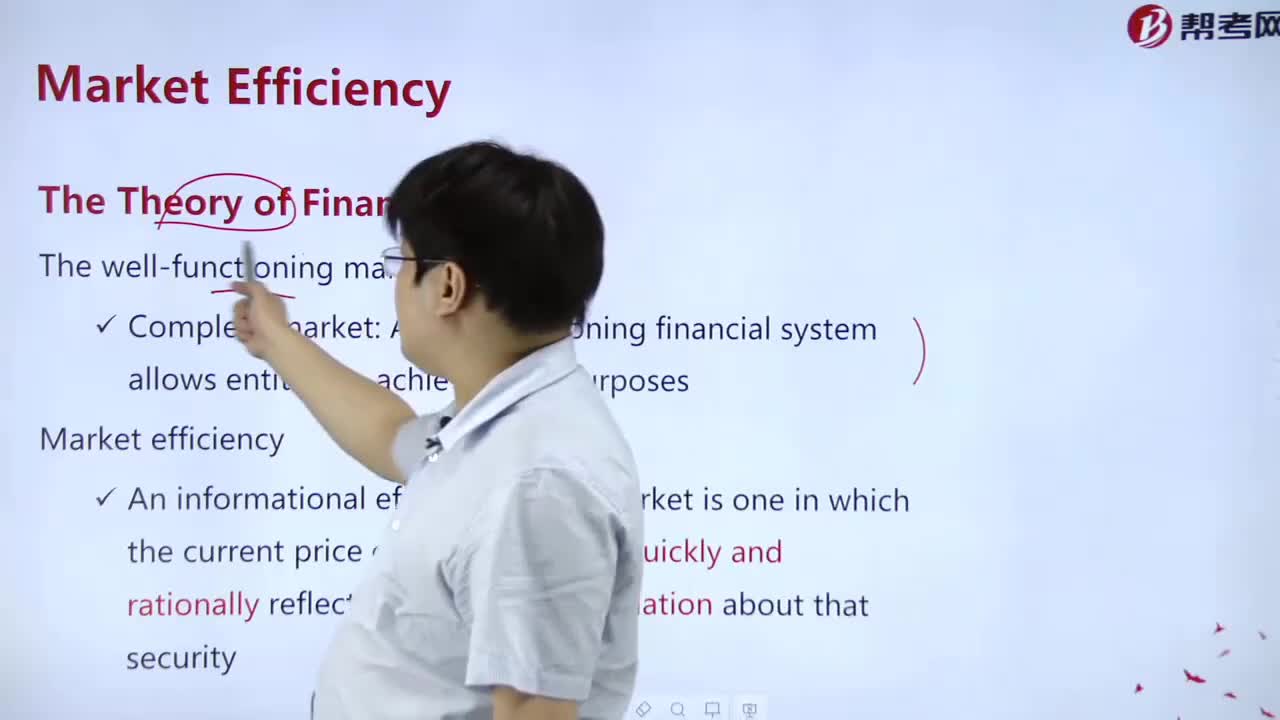

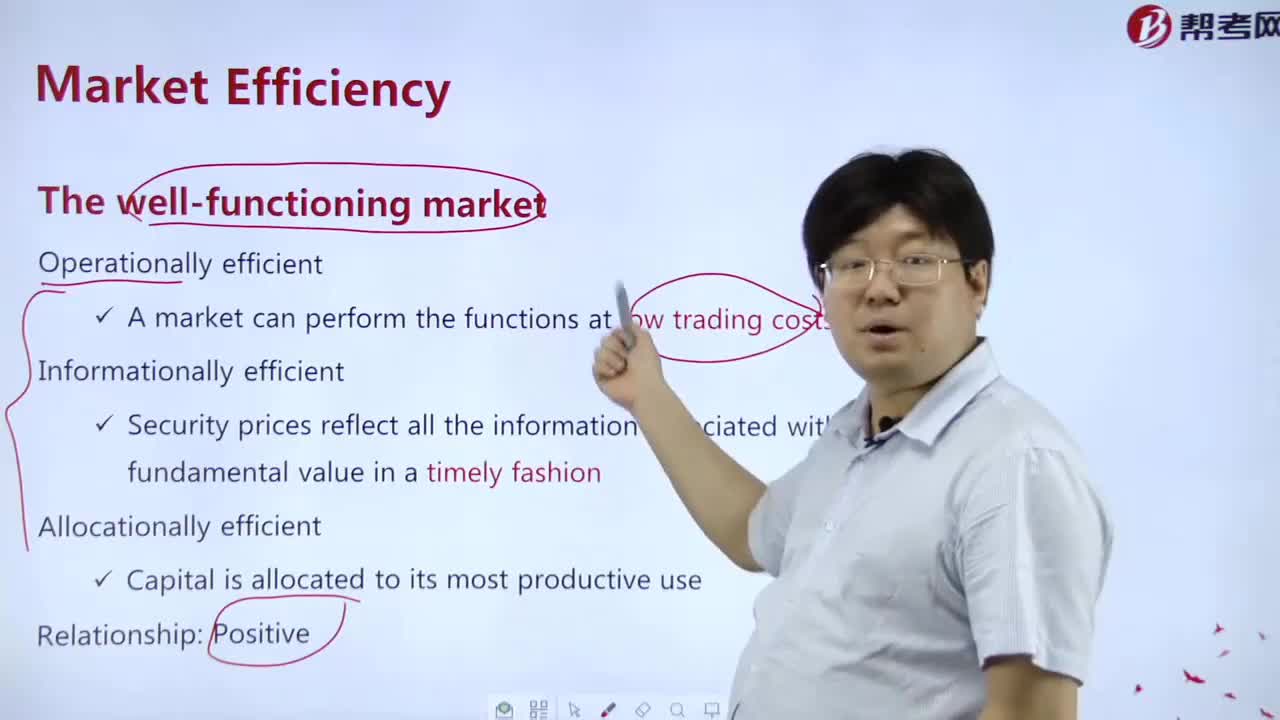

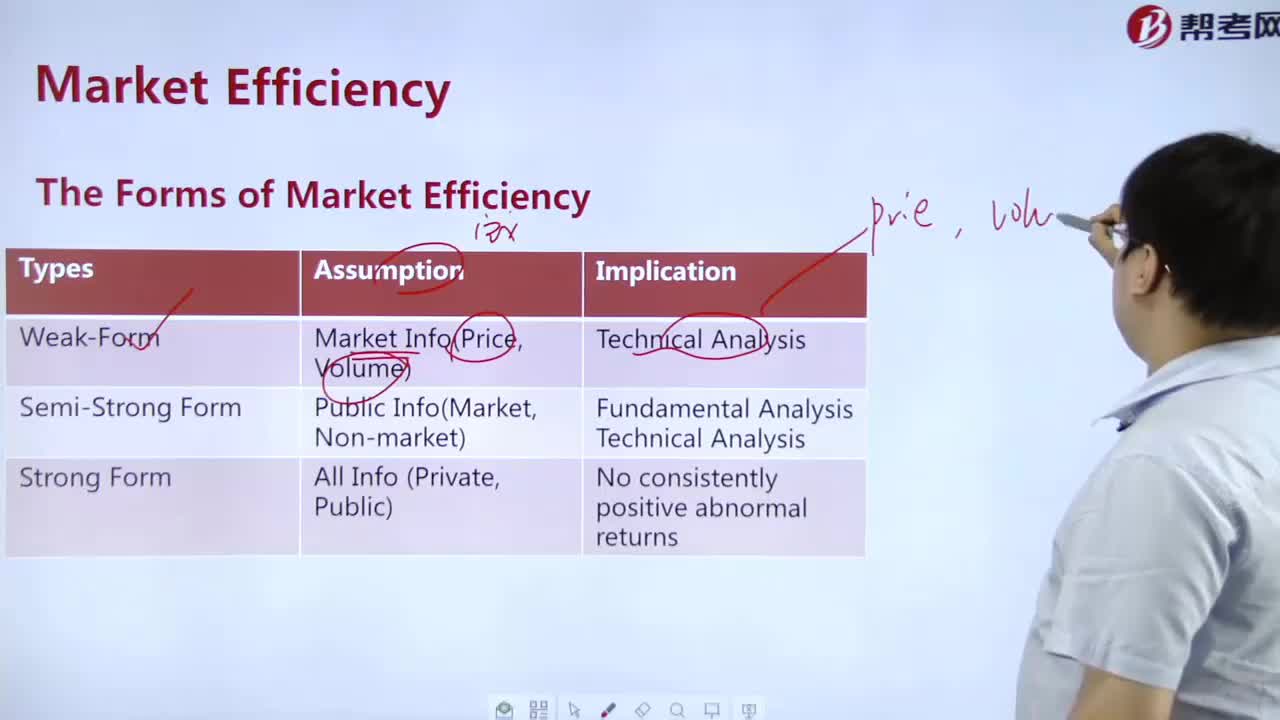

What is the representativeness of market efficiency?

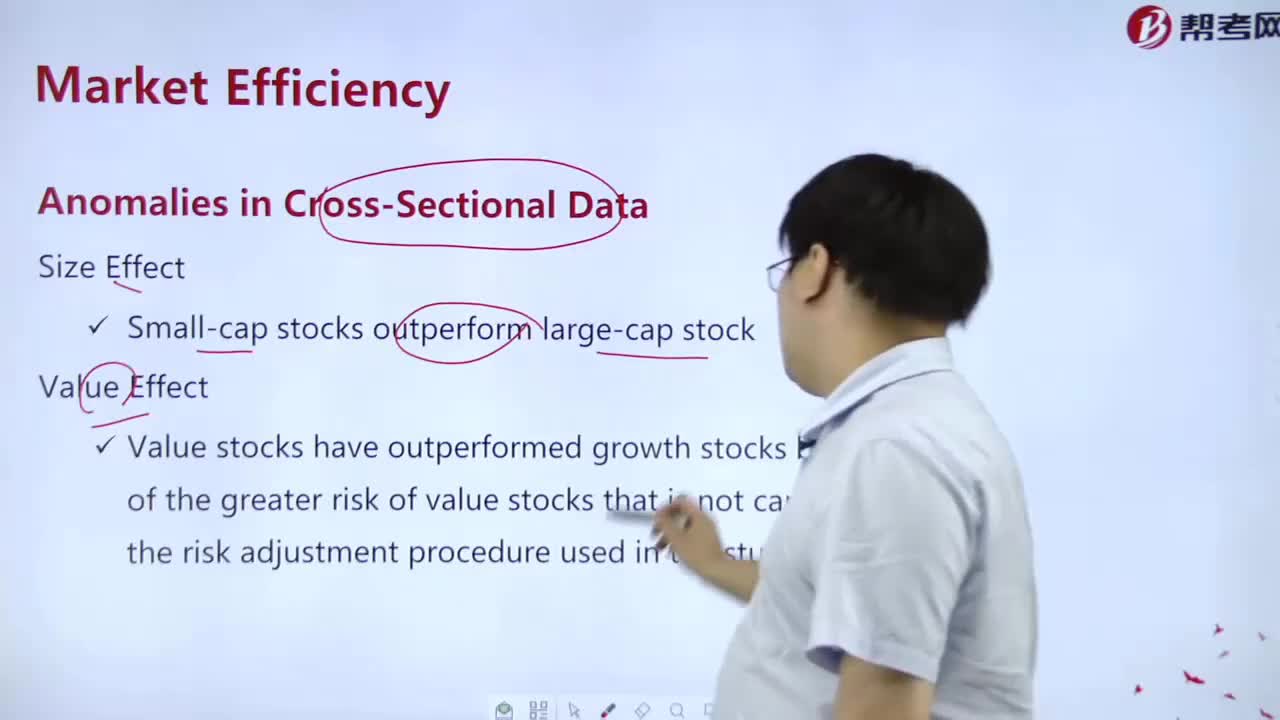

What are the effects of cross-sectional data?

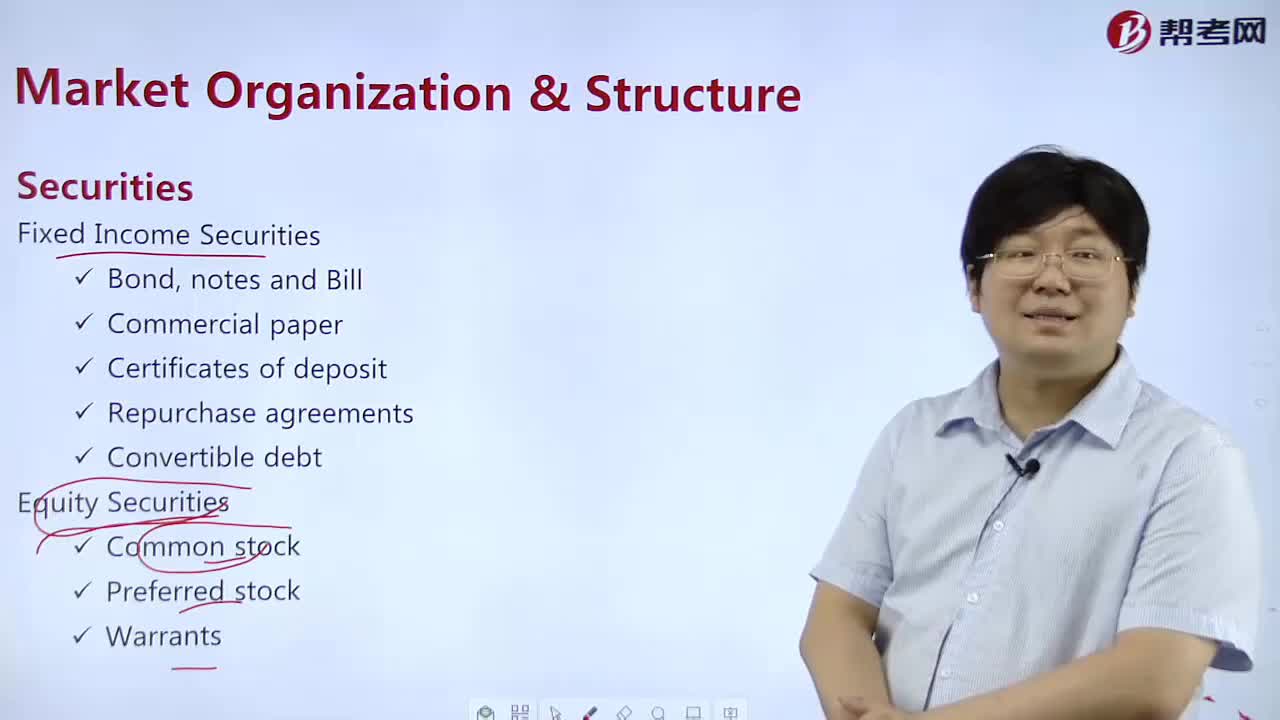

What are the types of securities?

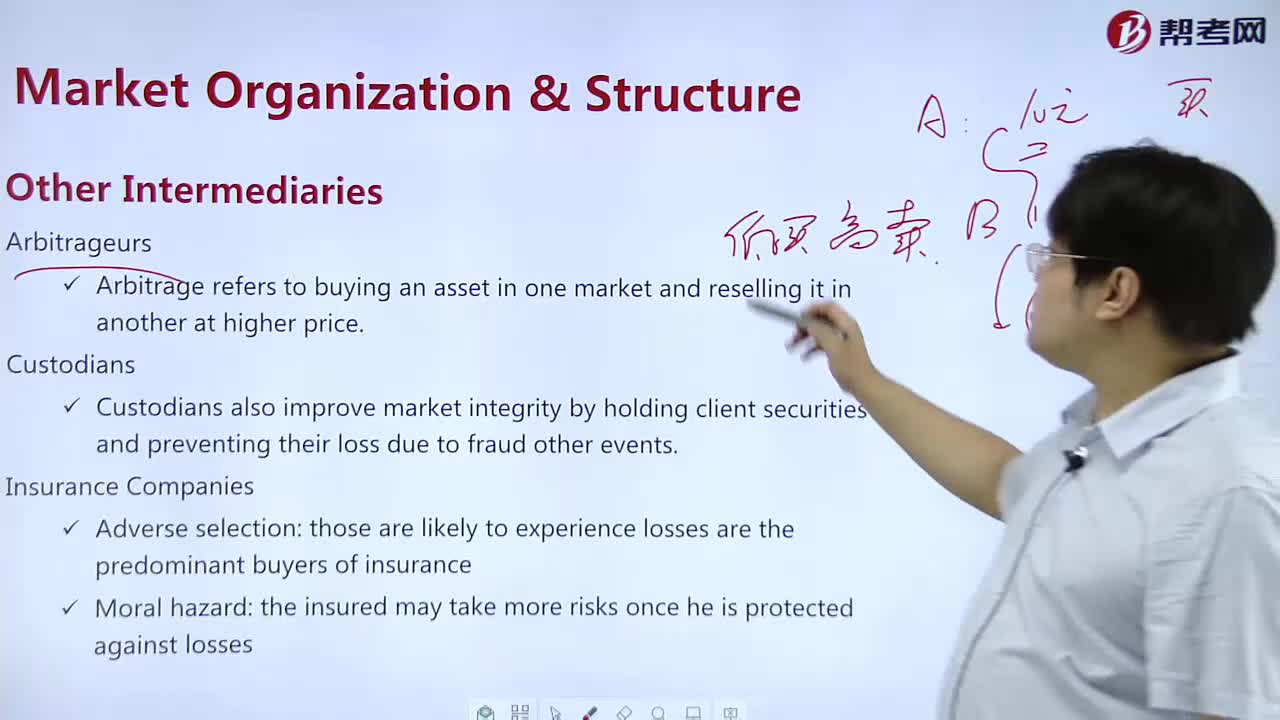

What are the other intermediaries?

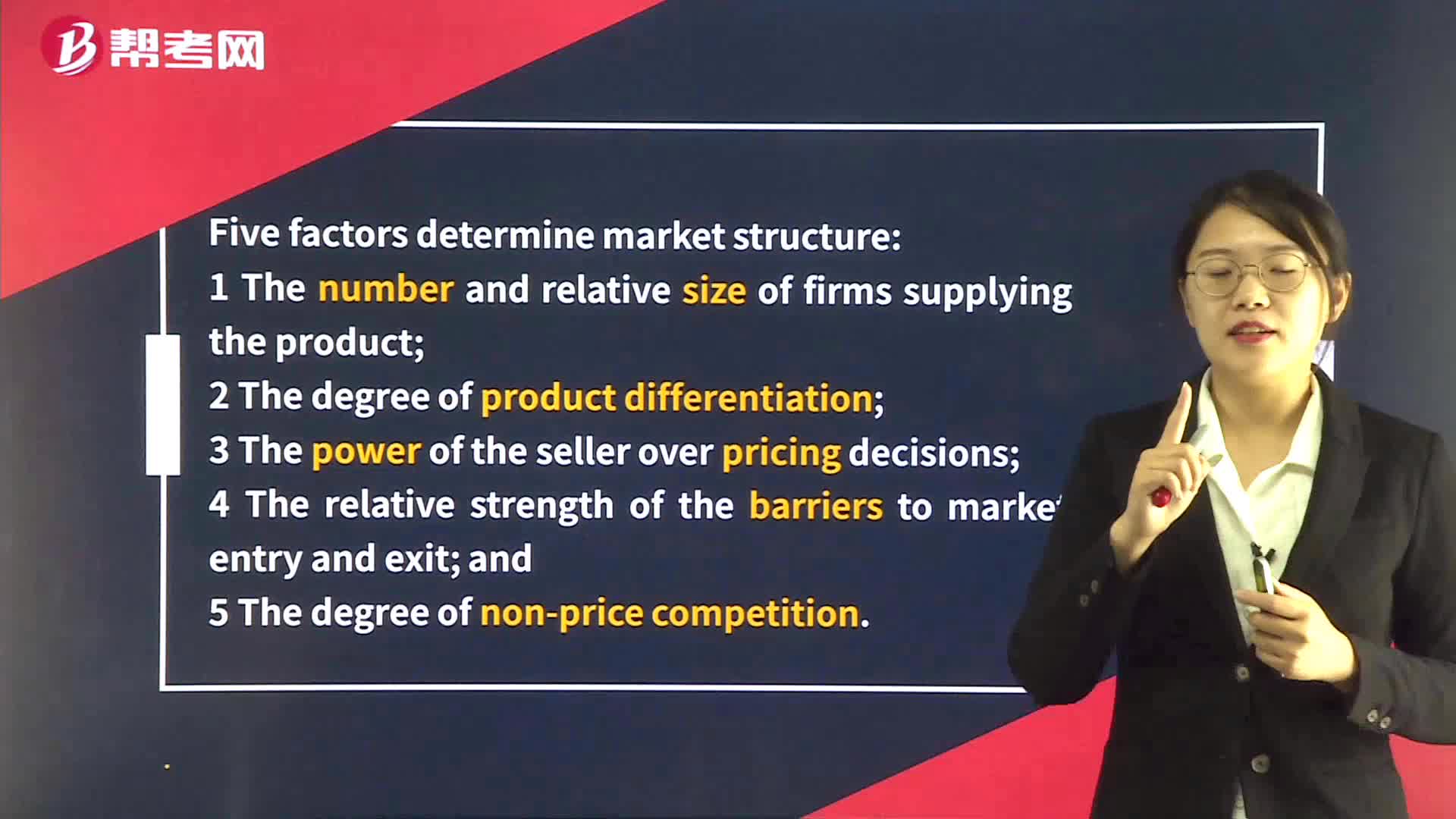

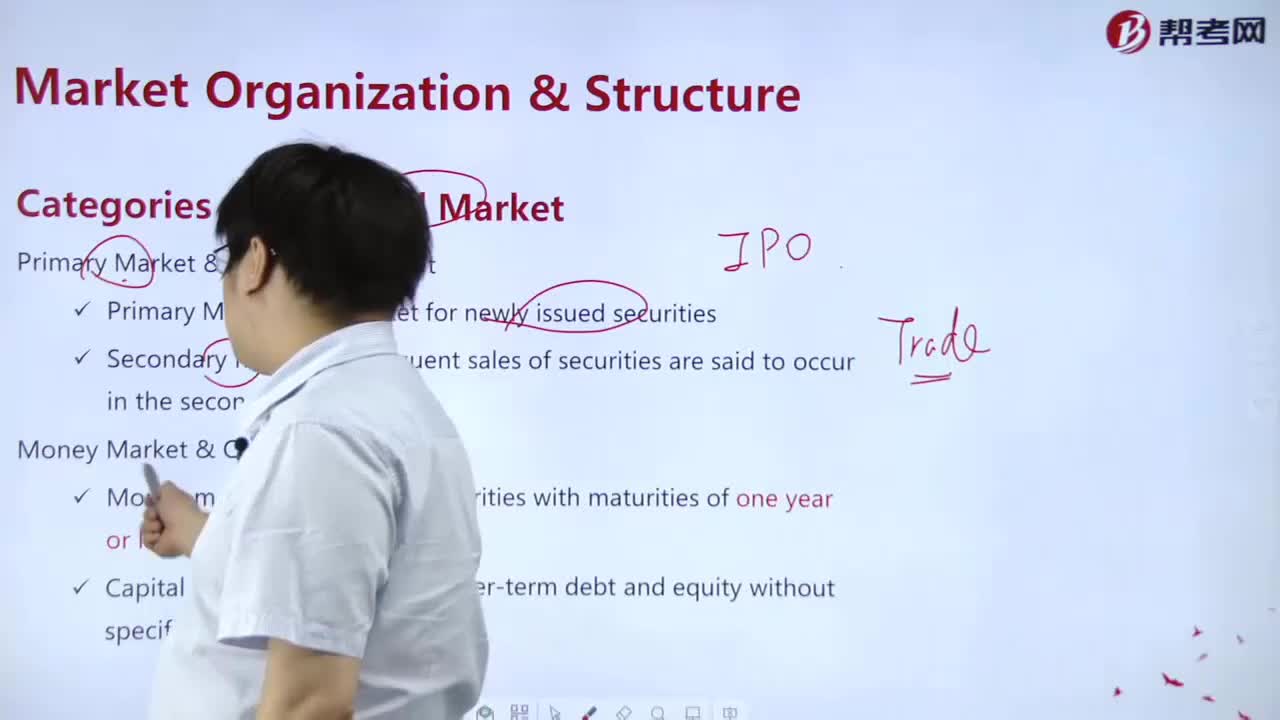

What are the classifications of Financial Market?

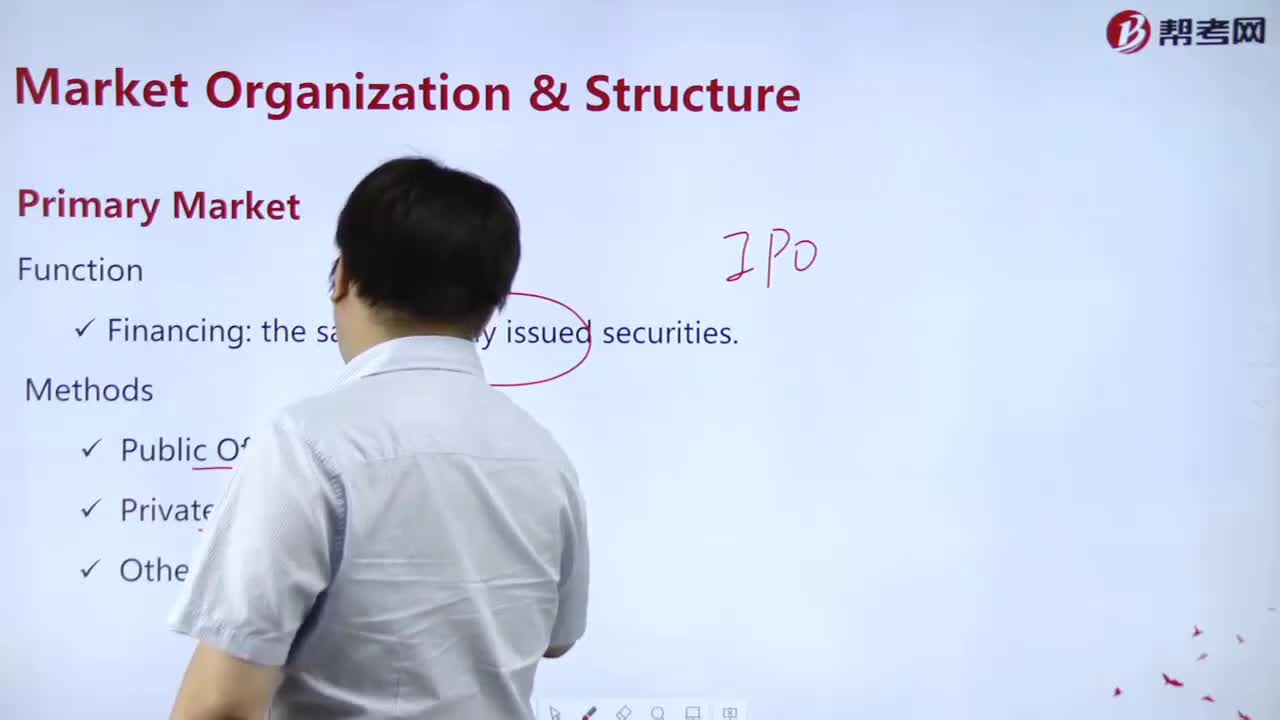

What is the function of the Primary Market?

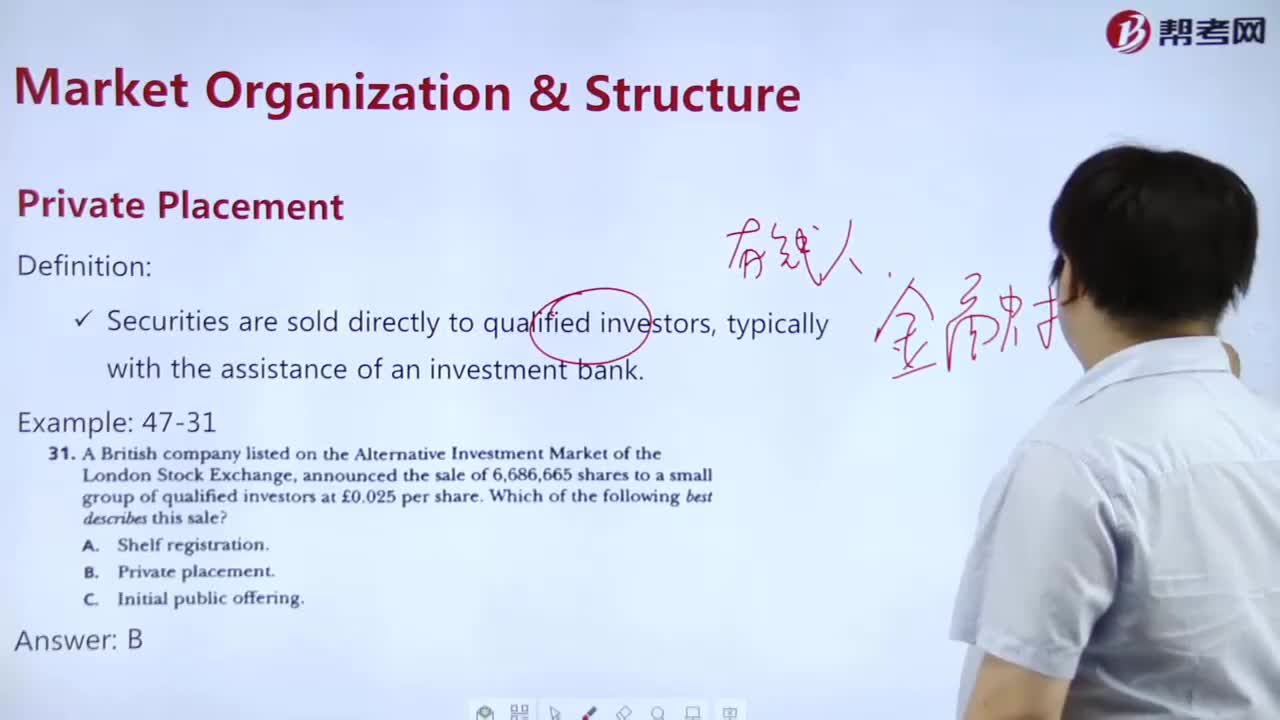

What is Private Placement Definition?

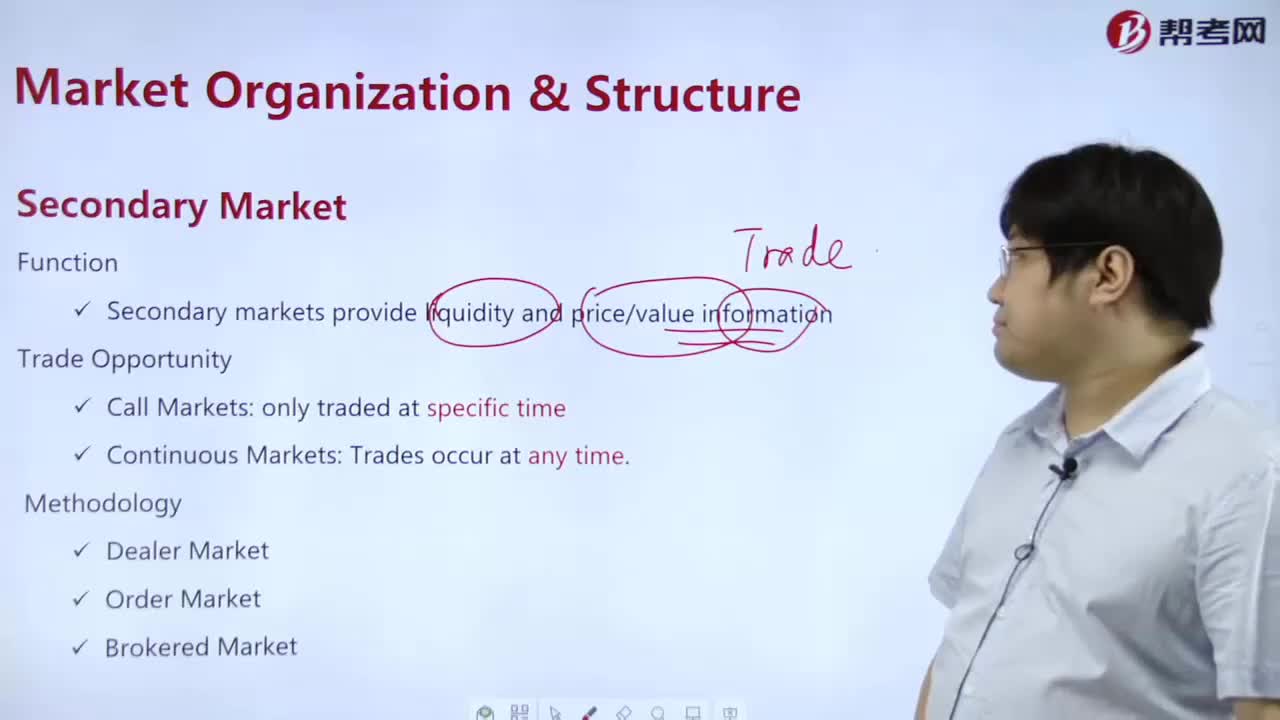

What is the role of the secondary market?

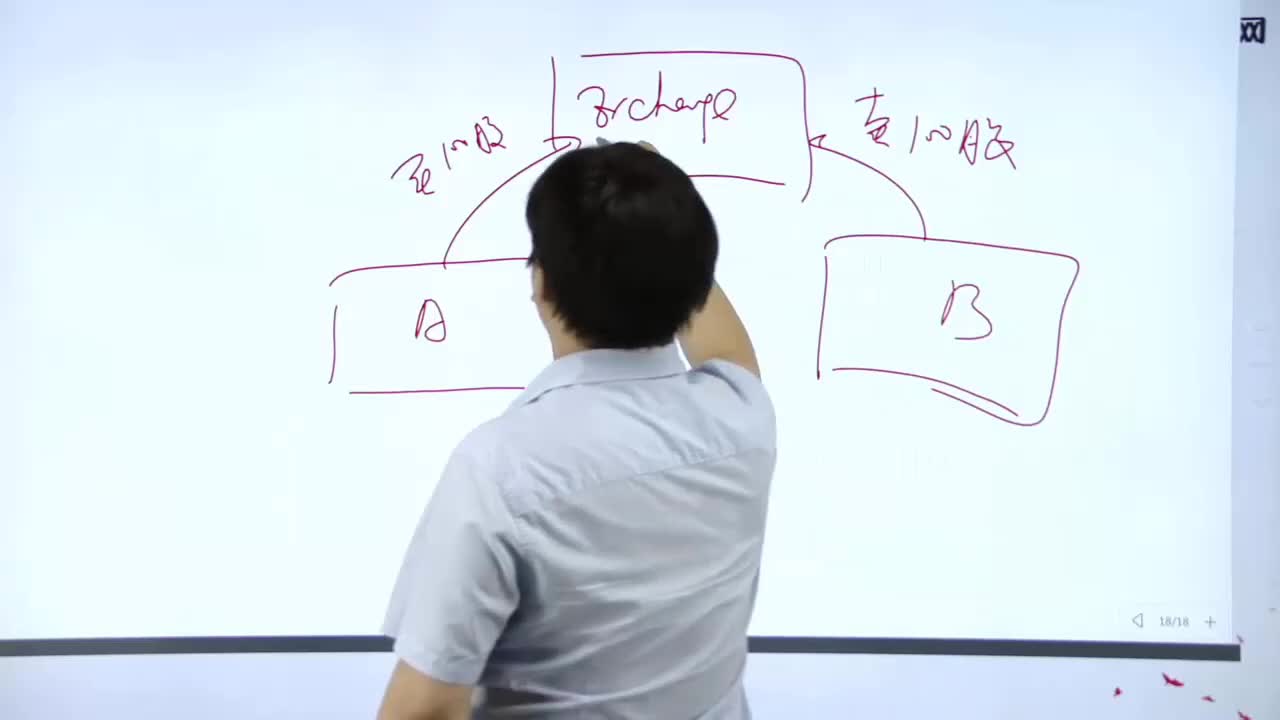

What is an order driven market?

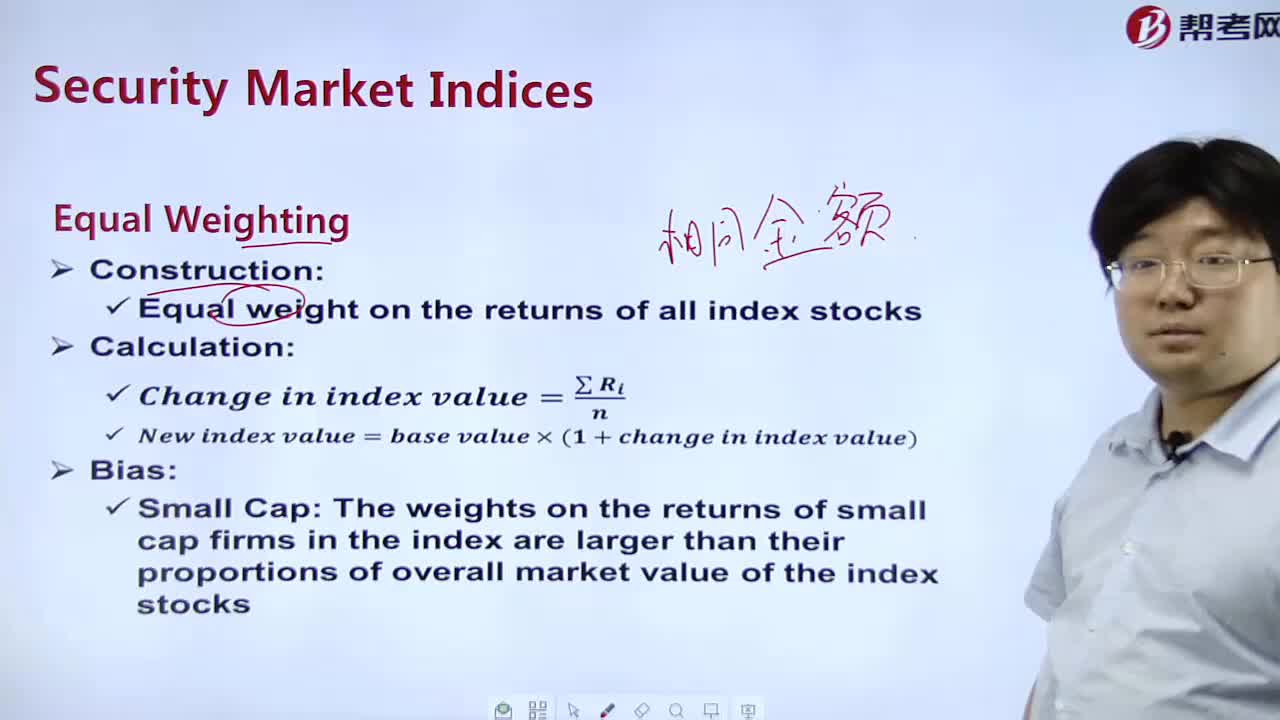

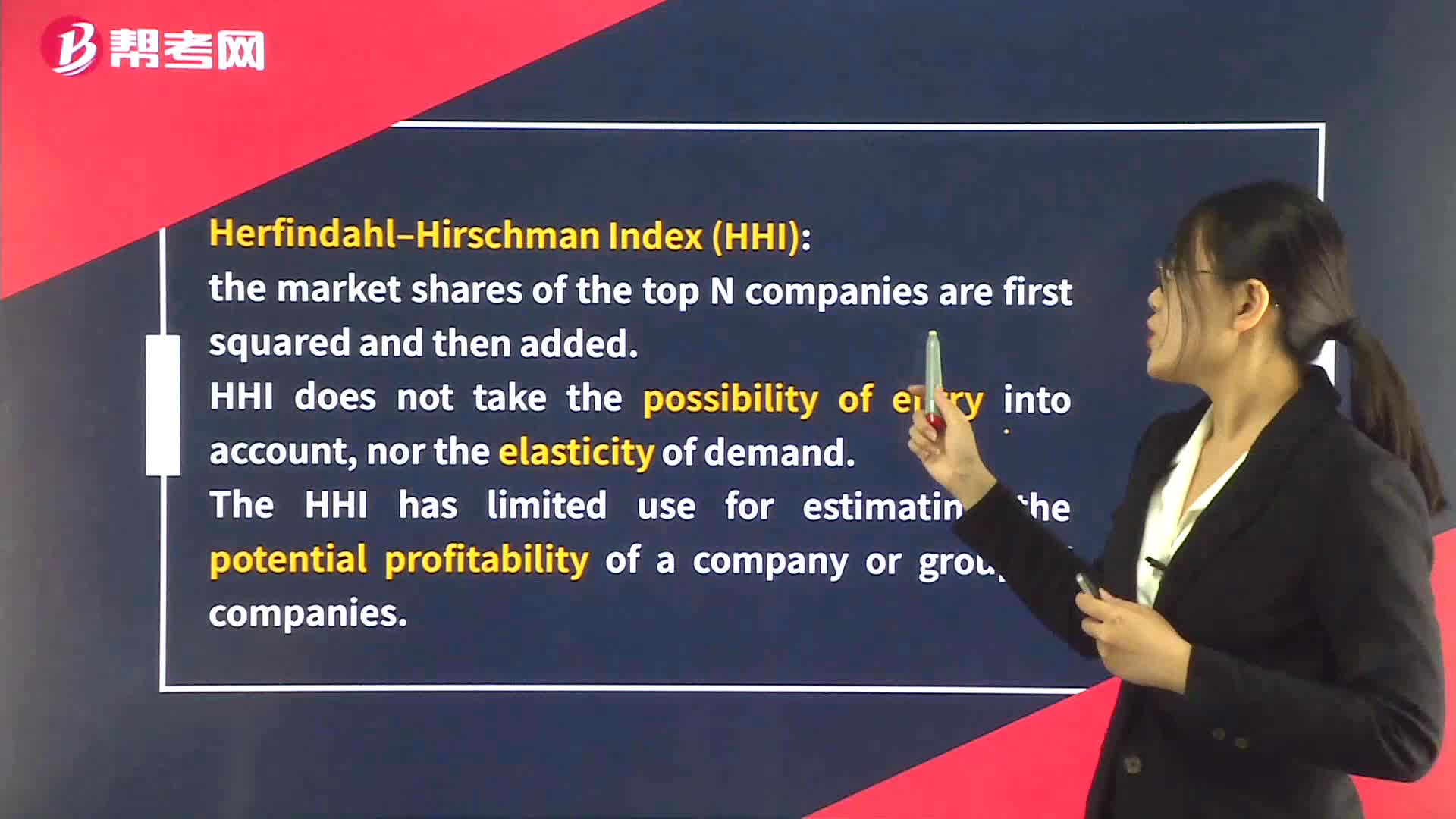

Definition of Security Market Indices What is it?

What is the construction of an exponent?

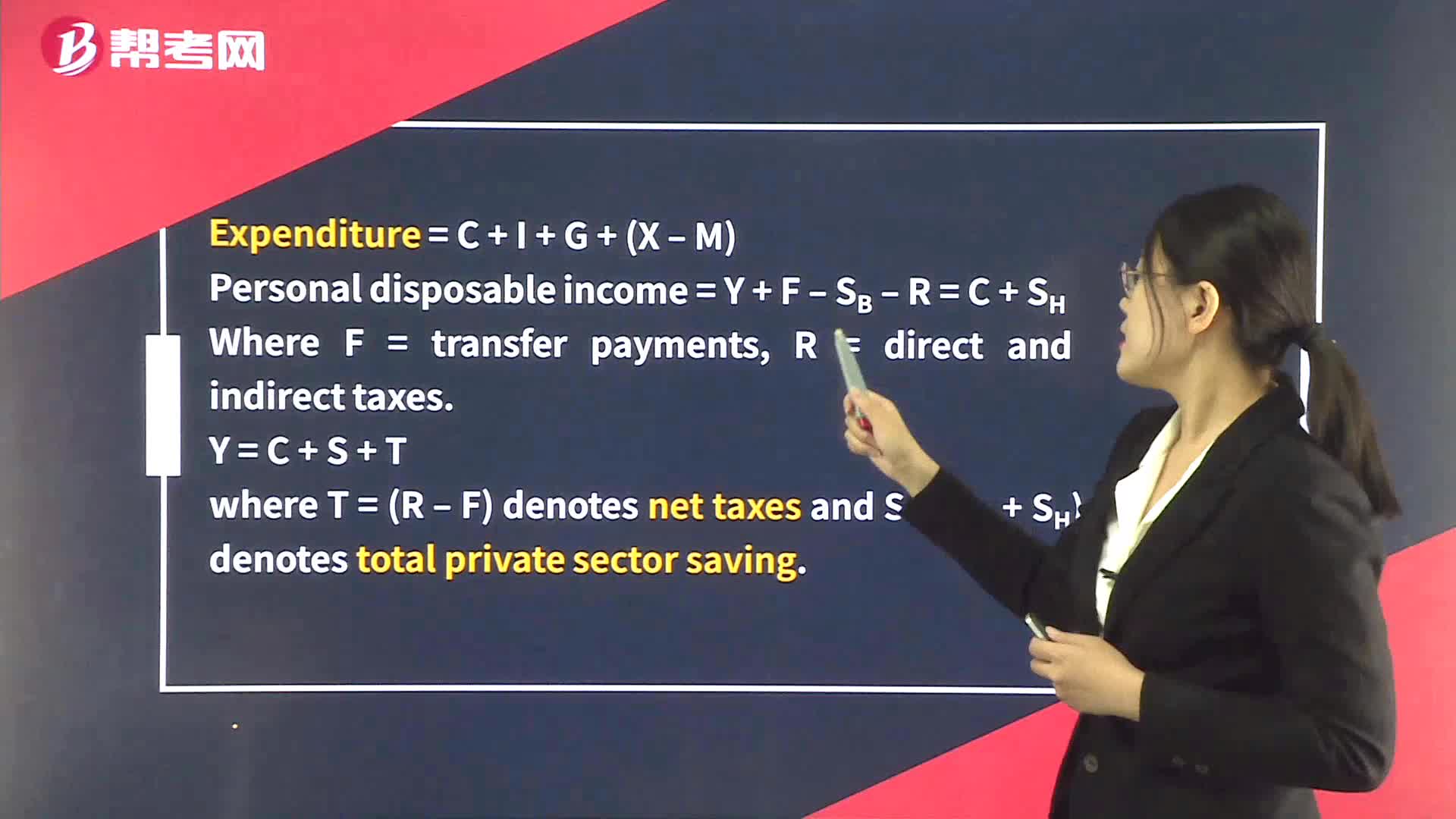

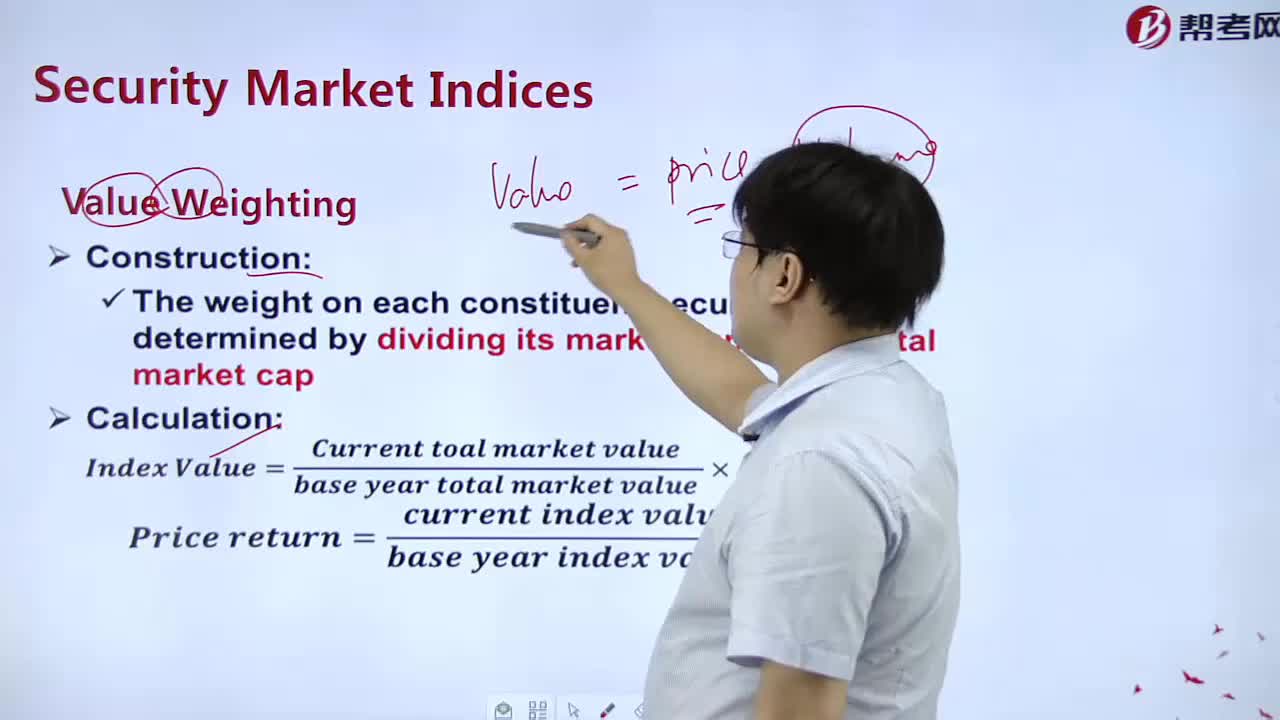

What is the measurement of Value?

下载亿题库APP

联系电话:400-660-1360