下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

Forward Calculations

The points on a forward rate quote are the difference between the forward exchange rate quote and the spot exchange rate quote, with the points scaled so that they can be related to the last decimal in the spot quote.

Spot euro–dollar exchange rate (USD/EUR) 1.2875, the one-year forward rate 1.28485.

The one-year forward points were quoted as –26.5.

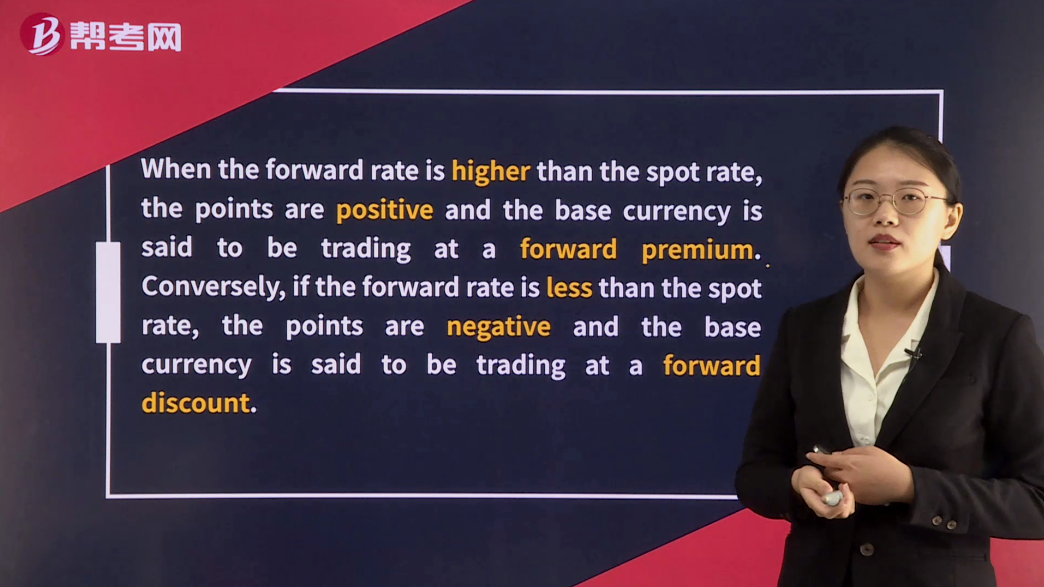

When the forward rate is higher than the spot rate, the points are positive and the base currency is said to be trading at a forward premium. Conversely, if the forward rate is less than the spot rate, the points are negative and the base currency is said to be trading at a forward discount.

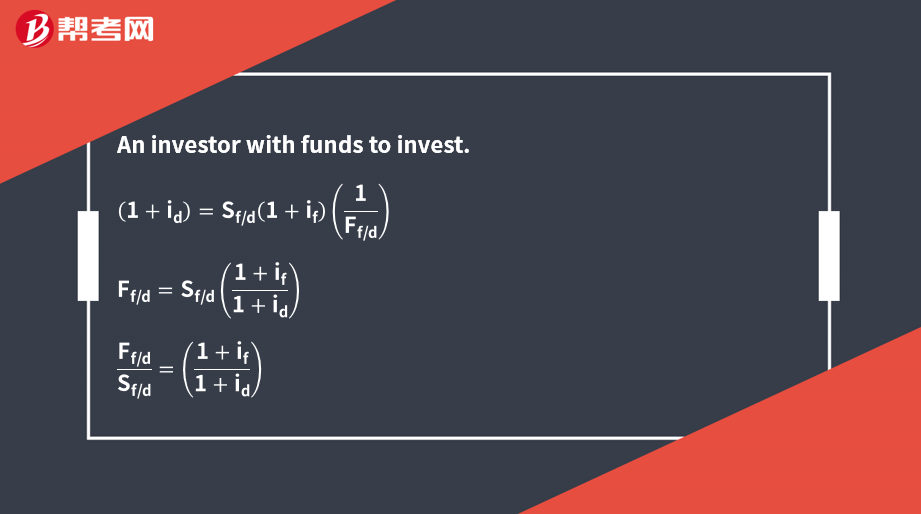

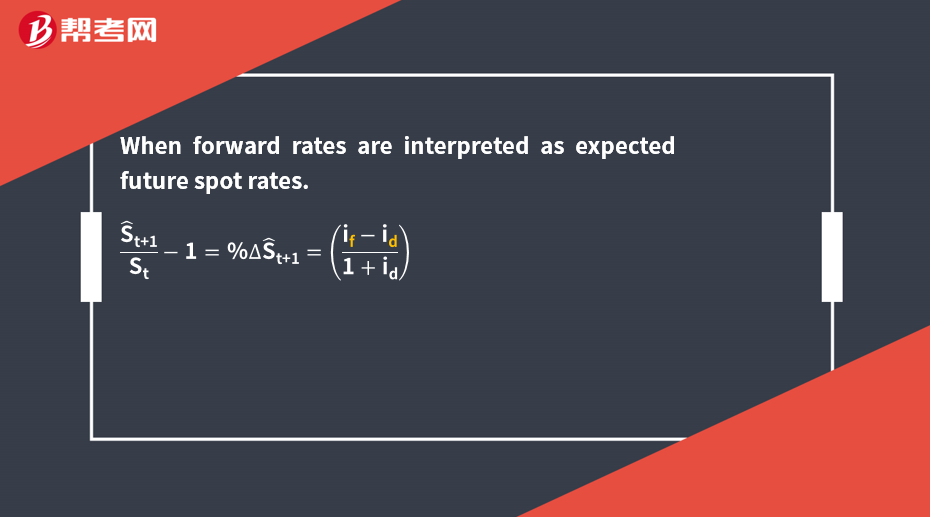

Given an f/d quoting convention, the forward rate will be higher than (be at a premium to) the spot rate if foreign interest rates are higher than domestic interest rates.

The currency with the higher (lower) interest rate will always trade at a discount (premium) in the forward market.

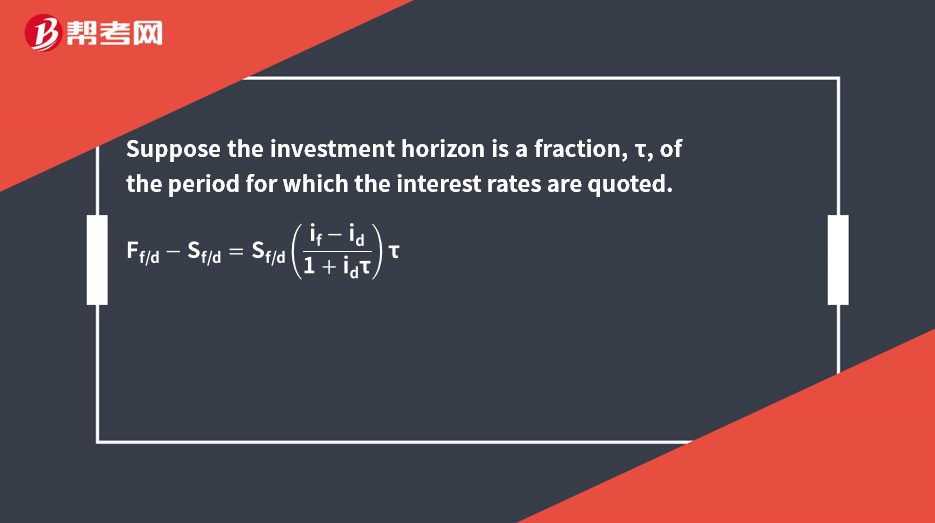

Forward points (appropriately scaled) are proportional to the spot exchange rate and to the interest rate differential and approximately (but not exactly) proportional to the horizon of the forward contract.

93

93Futures Contracts vs.OTC Forward Contracts:Futures Contracts vs.OTC Forward Contracts:only available for fixed contract amounts and fixed settlement dates;default risk.

625

625Forward Calculations:Spot euro–dollar,The one-year forward points were quoted as –26.5.rateForward

97

97Foreign Exchange Market - Spot Rates and Forward Rates:called forward exchange rates.

微信扫码关注公众号

获取更多考试热门资料