下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

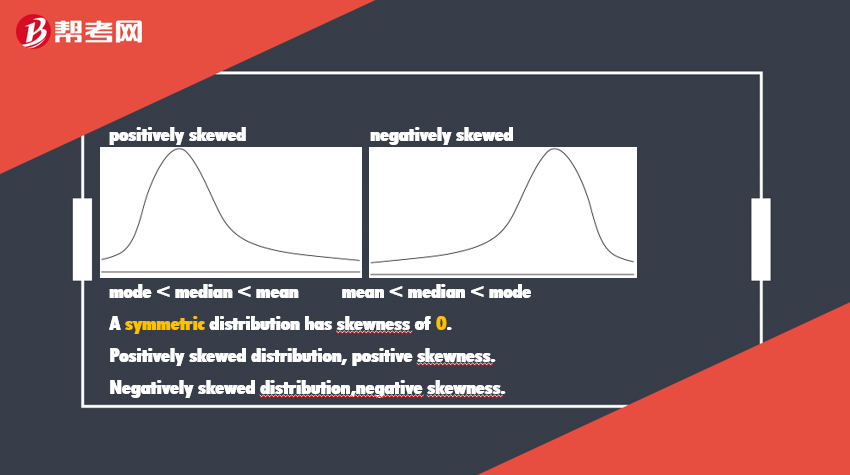

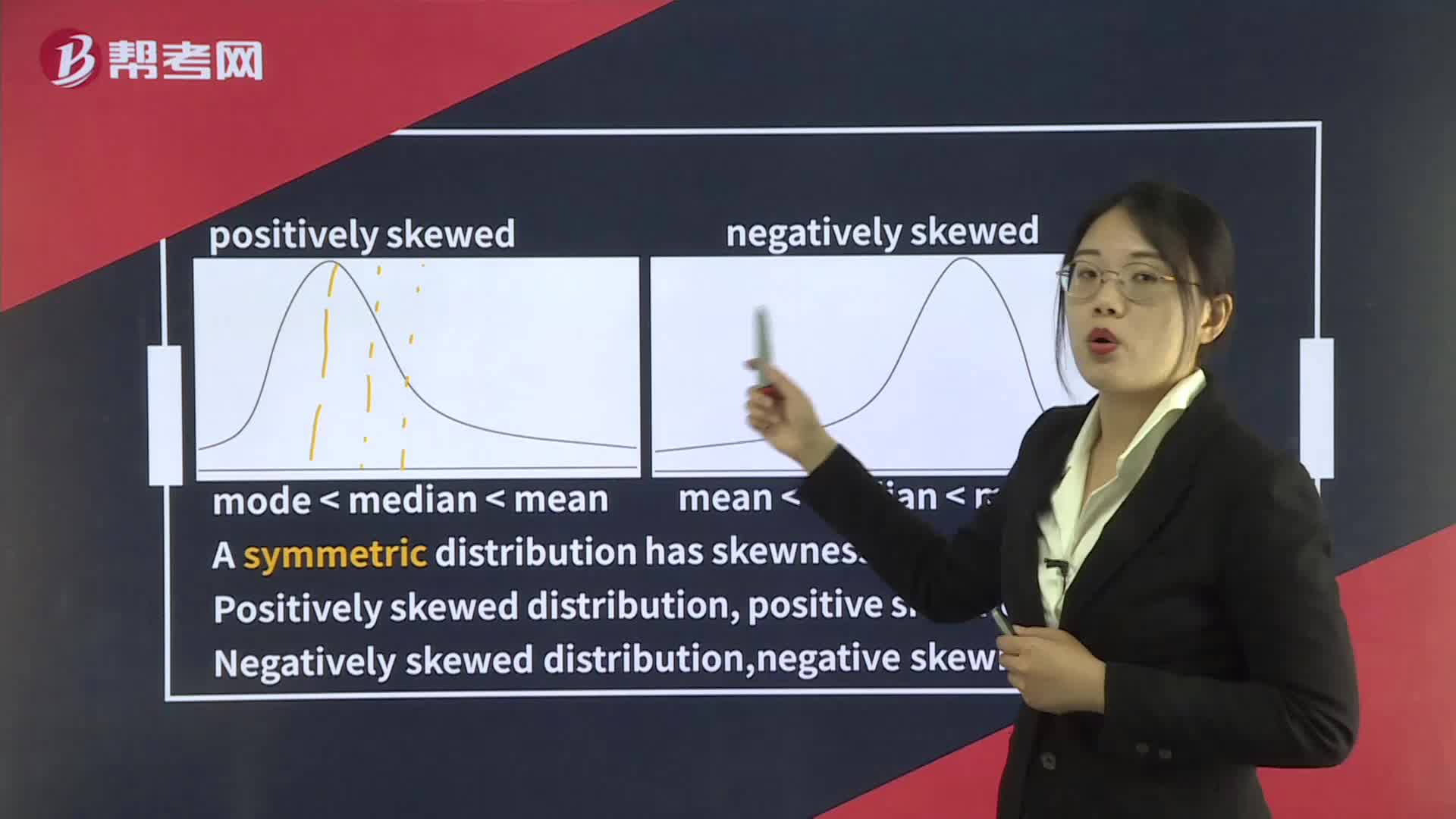

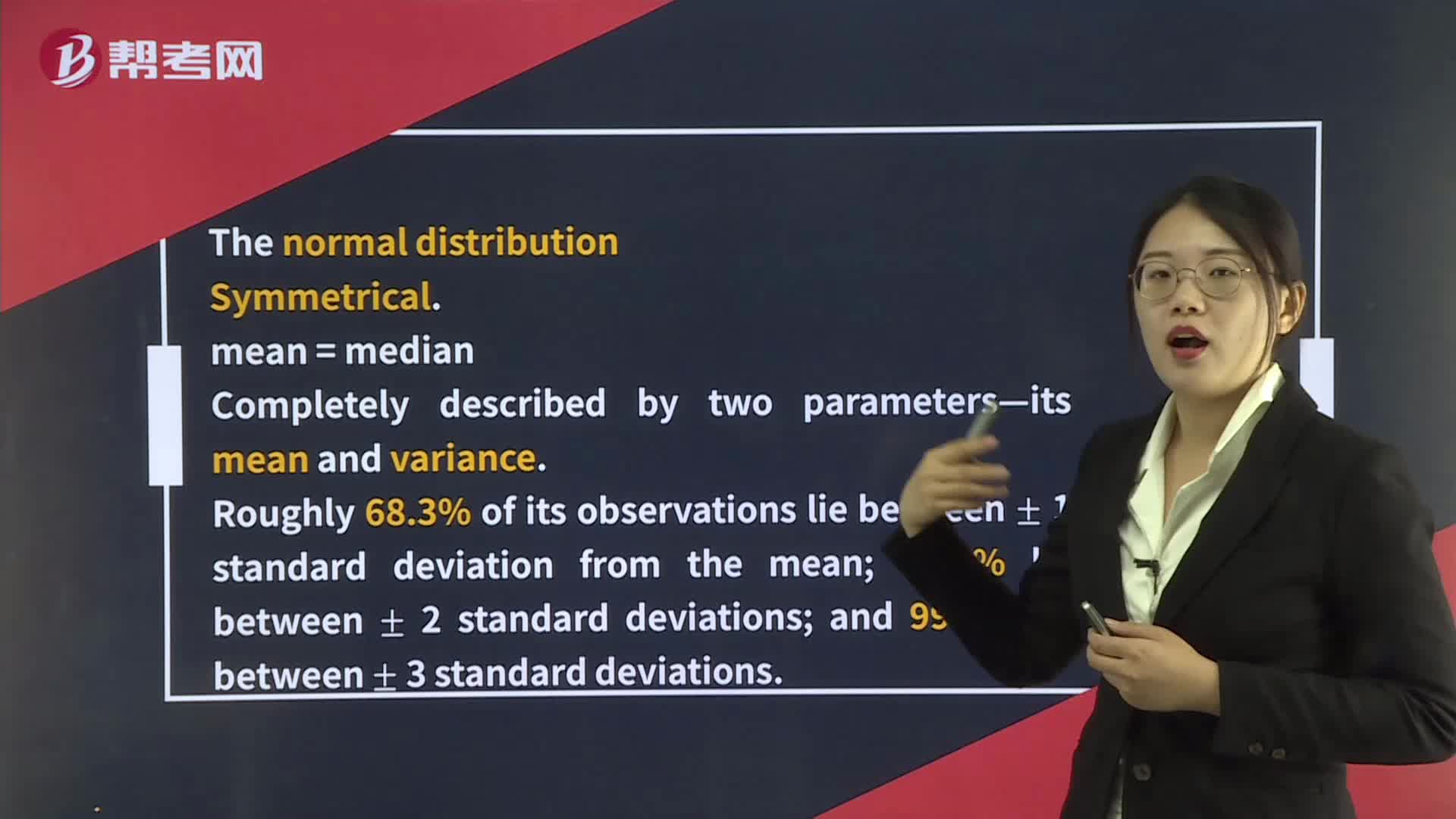

Skewness

[Practice Problems] Two portfolios have unimodal return distributions. Portfolio 1 has a skewness of 0.77, and Portfolio 2 has a skewness of –1.11. Which of the following is correct?

A. For Portfolio 1, the median is less than the mean.

B. For Portfolio 1, the mode is greater than the mean.

C. For Portfolio 2, the mean is greater than the median.

[Solutions] A

Portfolio 1 is positively skewed, so the mean is greater than the median, which is greater than the mode.

199

199Skewness:which is greater than the mode.

644

644Symmetry, Skewness, Kurtosis:Symmetry,distribution,[Practice:A. For:C.[Practicereturns.C.

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

微信扫码关注公众号

获取更多考试热门资料