下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

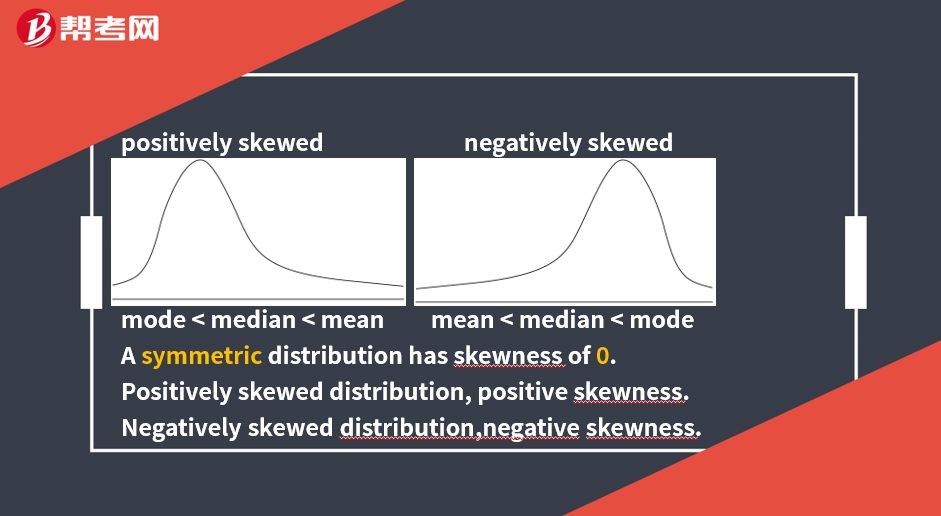

Symmetry, Skewness, Kurtosis

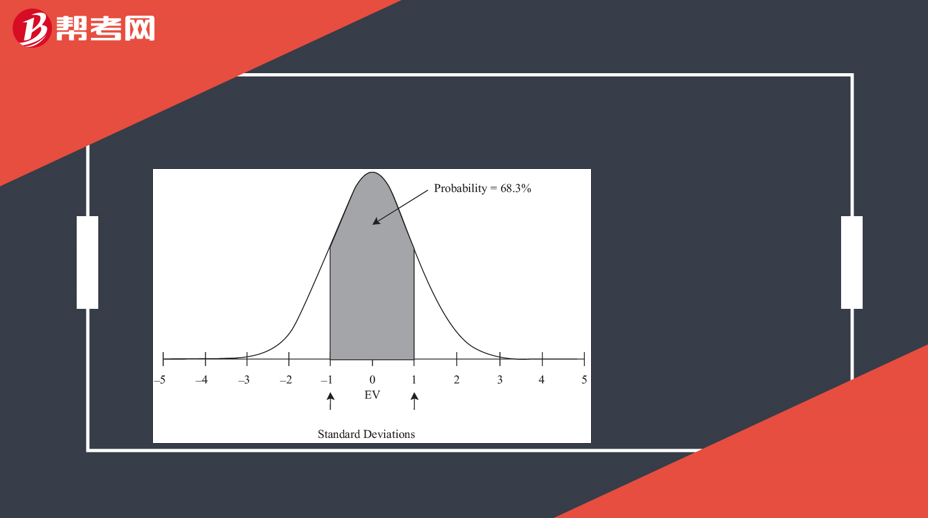

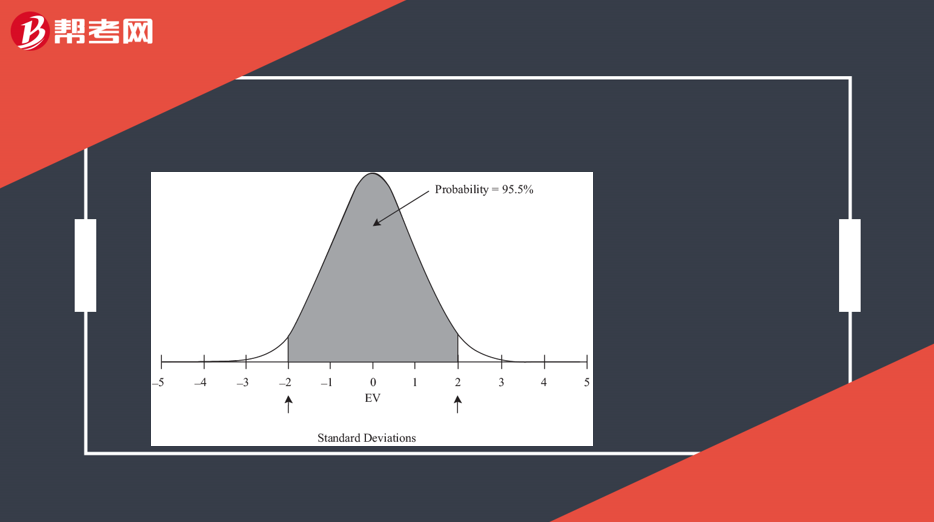

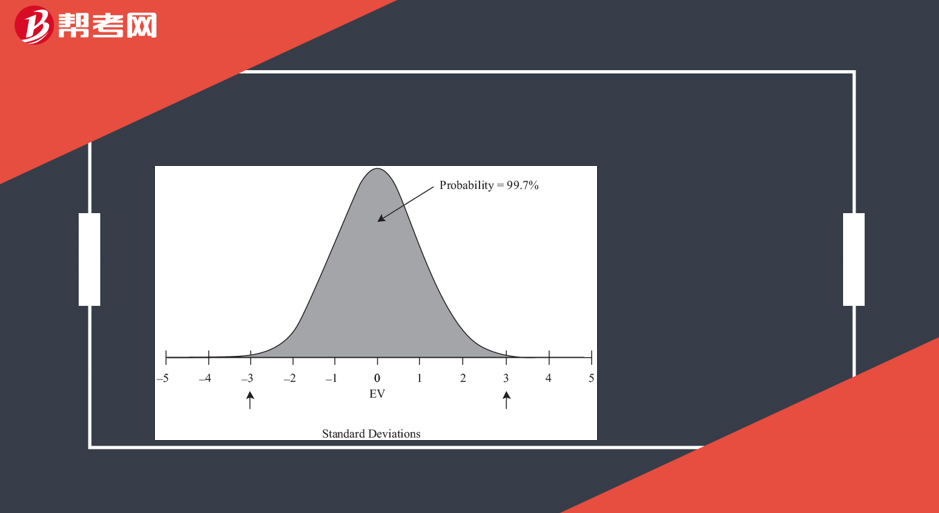

The normal distribution

Symmetrical.

mean = median

Completely described by two parameters—its mean and variance.

Roughly 68.3% of its observations lie between ± 1 standard deviation from the mean; 95.5% lie between ± 2 standard deviations; and 99.7% lie between ± 3 standard deviations.

[Practice Problems] Two portfolios have unimodal return distributions. Portfolio 1 has a skewness of 0.77, and Portfolio 2 has a skewness of –1.11. Which of the following is correct?

A. For Portfolio 1, the median is less than the mean.

B. For Portfolio 1, the mode is greater than the mean.

C. For Portfolio 2, the mean is greater than the median.

[Solutions] A

Portfolio 1 is positively skewed, so the mean is greater than the median, which is greater than the mode.

Kurtosis is a measure of the combined weight of the tails of a distribution relative to the rest of the distribution.

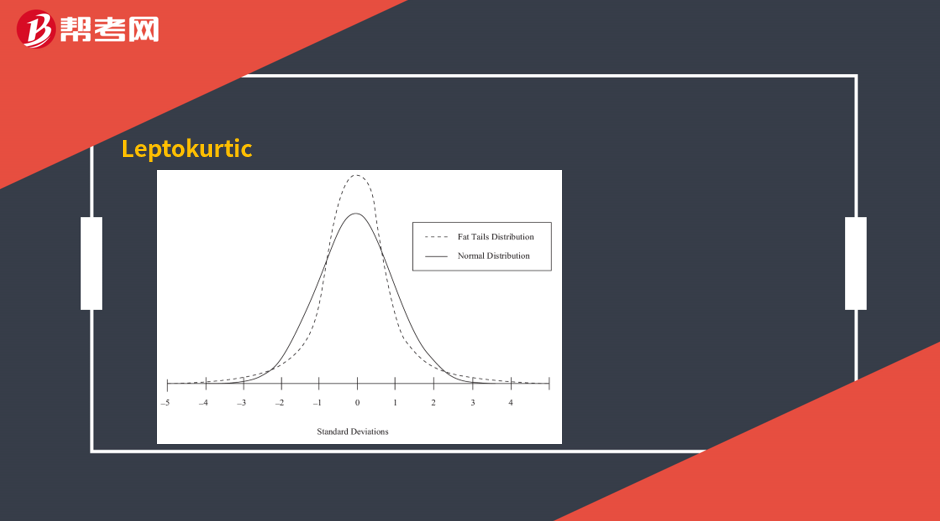

leptokurtic: fatter tails than the normal distribution

platykurtic: thinner tails than the normal distribution

mesokurtic: identical to the normal distribution

For all normal distributions, kurtosis is equal to 3.

Excess kurtosis: kurtosis minus 3. (Normal or other mesokurtic=0. Leptokurtic > 0, Platykurtic < 0.)

[Practice Problems] A portfolio has excess kurtosis of 6.2. Compared with a normal distribution, the distribution of returns for this portfolio most likely:

A. has less weight in the tails.

B. has a greater number of extreme returns.

C. has fewer small deviations from its mean.

[Solutions] B

The portfolio has positive excess kurtosis, which indicates that its return distribution is leptokurtic and has fatter tails than the normal. The fatter tails mean the portfolio has a greater number of extreme returns.

微信扫码关注公众号

获取更多考试热门资料