下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、A firm in the market environment characterized by monopolistic competition will most likely:【单选题】

A.continue to experience economic profit in the long run.

B.have a well-defined supply function reflecting its marginal and average costs.

C.have many competitors, each of which follows its own product differentiation strategy.

正确答案:C

答案解析:“The Firm and Market Structures,” Richard G. Fritz and Michele Gambera, CFA

2013 Modular Level I, Vol. 2, Reading 16, Section 2.2 and Exhibit 1

Study Session 4-16-a

Describe the characteristics of perfect competition, monopolistic competition, oligopoly, and pure monopoly.

C is correct. As the name implies, monopolistic competition is a hybrid market. The most distinctive factor in monopolistic competition is product differentiation. Although the market is made up of many firms that compose the product group, each producer attempts to distinguishits product from that of the others, and product differentiation is accomplished in a variety of ways.

2、A consumer has a budget of $30 per month to spend on two types of fruit, priced as follows:

? Apples: $2.50 per pound.

? Bananas: $2.00 per pound.

Assuming the quantity of apples is measured on the vertical axis and bananas on the horizontal axisthe slope of the budget constraint is closest to:【单选题】

A.1.25.

B.-0.80.

C.-1.25.

正确答案:B

答案解析:The budget constraint is given by the formula: 2.5  +2.0

+2.0  =30, where

=30, where  and

and  are quantitiesofapples and bananas purchased, respectively. With the quantity of apples measured on the verticalaxis, the slope is equal to-(

are quantitiesofapples and bananas purchased, respectively. With the quantity of apples measured on the verticalaxis, the slope is equal to-( )=-(2.00/2.50)=-0.8, where

)=-(2.00/2.50)=-0.8, where  and

and  are prices ofapples andbananas, respectively.

are prices ofapples andbananas, respectively.

CFA Level I

"Demand and Supply Analysis: Consumer Demand," Richard V. Eastin and Gary L. Arbogast

Section 4.1

3、Which of the following accounting warning signs was evident in the Enron accounting scandal?【单选题】

A.Recording revenue from contingent sales.

B.Accelerating sales from later periods into the present quarter.

C.Classifying financing cash flows as operating cash flows to increase operating cash flows.

正确答案:C

答案解析:“Financial Reporting Quality: Red Flags and Accounting Warning Signs,” Thomas R. Robinson, CFA and Paul Munter

2010 Modular Level 1, Vol.3, p. 580, 585

Study Session: 10-40-f, g

Describe the accounting warning signs related to the Enron accounting scandal.

Describe the accounting warning signs related to the Sunbeam accounting scandal.

Enron classified financing cash flows as operating cash flows.

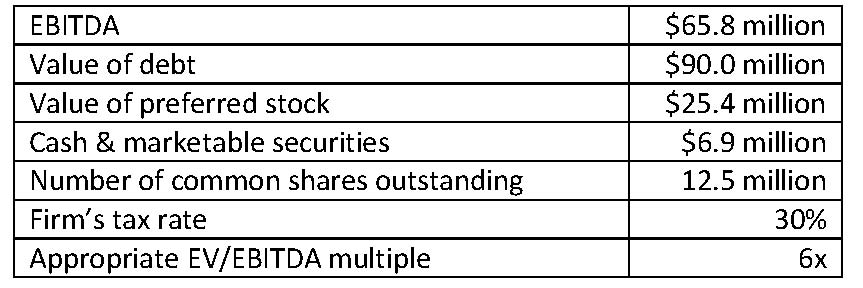

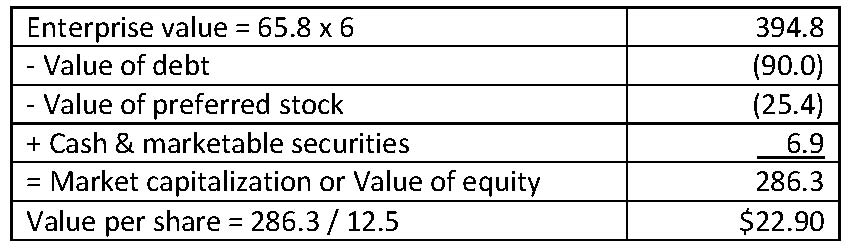

4、An investor considering the enterprise value approach to valuation gathers the following data:

The value per share of the company’s common stock is closest to:【单选题】

A.$13.43.

B.$22.35.

C.$22.90.

正确答案:C

答案解析:“Equity Valuation: Concepts and Basic Tools,” John J. Nagorniak, CFA, and Stephen E. Wilcox, CFA

2011 Modular Level I, Vol. 5, pp. 297-299

Study Session 14-60-i

Explain the use of enterprise value multiples in equity valuation and demonstrate the use of enterprise value multiples to estimate equity value.

First, compute the enterprise value (EV) from EBIDTA x EV/EBITDA multiple.

Then determine market capitalization (value of equity) using the following expression (see p. 297). Finally, compute the value per share.

EV = Market capitalization + MV of preferred stock + MV of debt – Cash and investments

Market capitalization = EV – MV of Preferred stock – MV of debt – Cash and investments

Value per share = Market capitalization/Number of outstanding shares

5、An analyst does research about the put-call parity.With respect to the put-callparity, which of the following positions is equal to a synthetic call position?【单选题】

A.Long a put, long the underlying, and short a risk-free bond.

B.Short a put, long the underlying, and short a risk-free bond.

C.Long a put, short the underlying, and long a risk-free bond.

正确答案:A

答案解析:P + S = C + X/ ,得出 C = P + S - X/

,得出 C = P + S - X/ 。

。

6、Generational accounting indicates the United States, as well as other developed nations, faces severe generational imbalances regarding government programs such as Social Security. Which of the following is most likely a possible outcome?【单选题】

A.Reduction in income taxes.

B.Increase in government discretionary spending.

C.Creation of new money to pay government obligations.

正确答案:C

答案解析:“Fiscal Policy,” Michael Parkin

2011 Modular Level I, Vol. 2, pp. 441-444

Study Session 6-26-c

Discuss the generational effects of fiscal policy, including generational accounting and generational imbalance.

Because the estimated fiscal balance is so large, the possible outcome will likely involve both lower benefits and higher taxes. One of these taxes could be the inflation tax – paying bills with new money and creating inflation.

7、The null hypothesis is most appropriately rejected when the p-value is:【单选题】

A.negative.

B.close to one.

C.close to zero.

正确答案:C

答案解析:“Hypothesis Testing,” Richard A. Defusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2010 Modular Level I, Vol. 1, pp. 525-526

Study Session 3-11-e

Explain and interpret the p-value as it relates to hypothesis testing.

The p-value is the smallest level of significance at which the null hypothesis can be rejected. The smaller the p-value, the more strong the evidence against accepting the null as true, P-values close to zero strongly suggest the null hypothesis should be rejected.

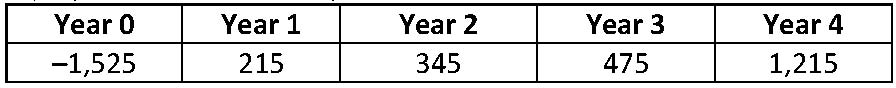

8、A project has the following cash flows (£):

Assuming a discount rate of 11% annually, the discounted payback period (in years) is closest to:【单选题】

A.3.4.

B.3.9.

C.4.0.

正确答案:B

答案解析:“Capital Budgeting,” John D. Stowe, CFA and Jacques R. Gagne, CFA

2013 Modular Level I, Vol.4, Reading 36, Section 4.4.

Study Session 11-36-d

Calculate and interpret the results using each of the following methods to evaluate a single capital project: net present value (NPV), internal rate of return (IRR), payback period, discounted payback period, and profitability index (PI).

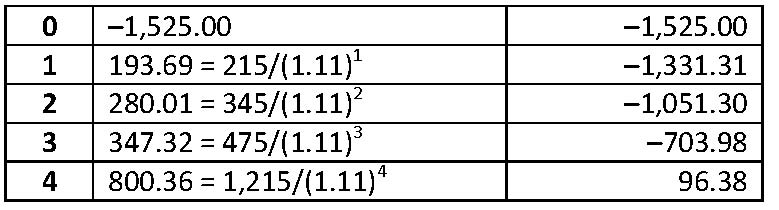

B is correct. The discounted cash flows and their cumulative sum are:

After three years, $821.02 of the $1,525 investment is recovered, leaving $703.98 left to recover in the fourth year. Proportionately, only 0.88 (= $703.98/$800.36) of the cash flow in the fourth year is necessary to recover all of the investment. This makes the discounted payback equal to 3.9 years (rounded up from 3.88).

9、With respect to the Standards relating to preservation of confidentiality, which ofthe following statements is least accurate? Members and candidates must keepinformation about all former current, and prospective clients confidential unless:【单选题】

A.the information concerns illegal activities on the part of the clients.

B.disclosure is required by firms' policies.

C.the clients permit disclosure of the information.

正确答案:B

答案解析:本题考查的是客户的私密信息是否可以公开。教材中列举了可以披露的三种情况,一般符合披露要求的情况是:法律上要求公开(而不是公司政策);客户或潜在客户允许公开;客户行为中包含非法行为,同时外加接受CFA协会专业行为项目(PCP)的调查。

10、Gus Hayden, CFA, has developed a mutual fund selection product based onhistorical information from 2000 - 2010 period and performs a hypothesis testabout performances of different styles.In order to minimize the probability ofboth Type I and Type II error, Hayden should increase the:【单选题】

A.the power of a test.

B.level of significance.

C.sample size.

正确答案:C

答案解析:同时减少第一类去真错误和第二类存伪错误的办法只有增加样本的容量。检验效力(the power of a test)是1减去犯第二类存伪错误的概率。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料