What are MWRR and TWRR?

What is cash management?

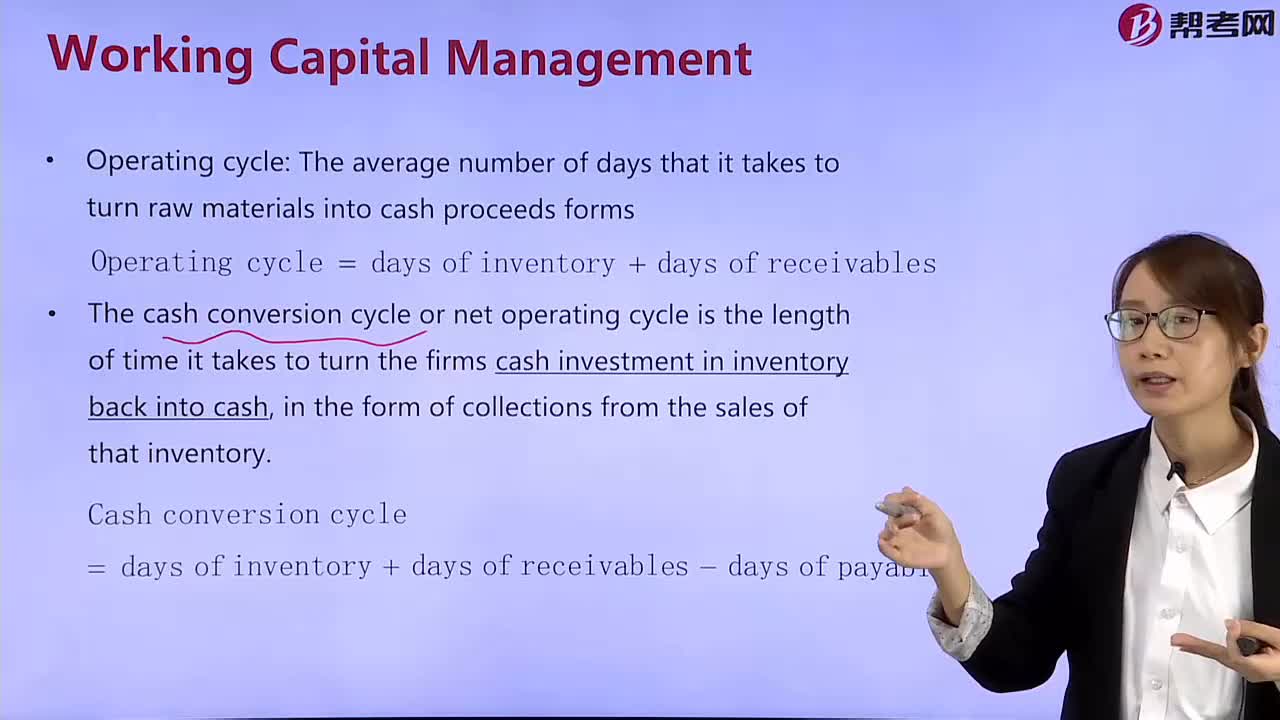

What is the cash operating cycle measured?

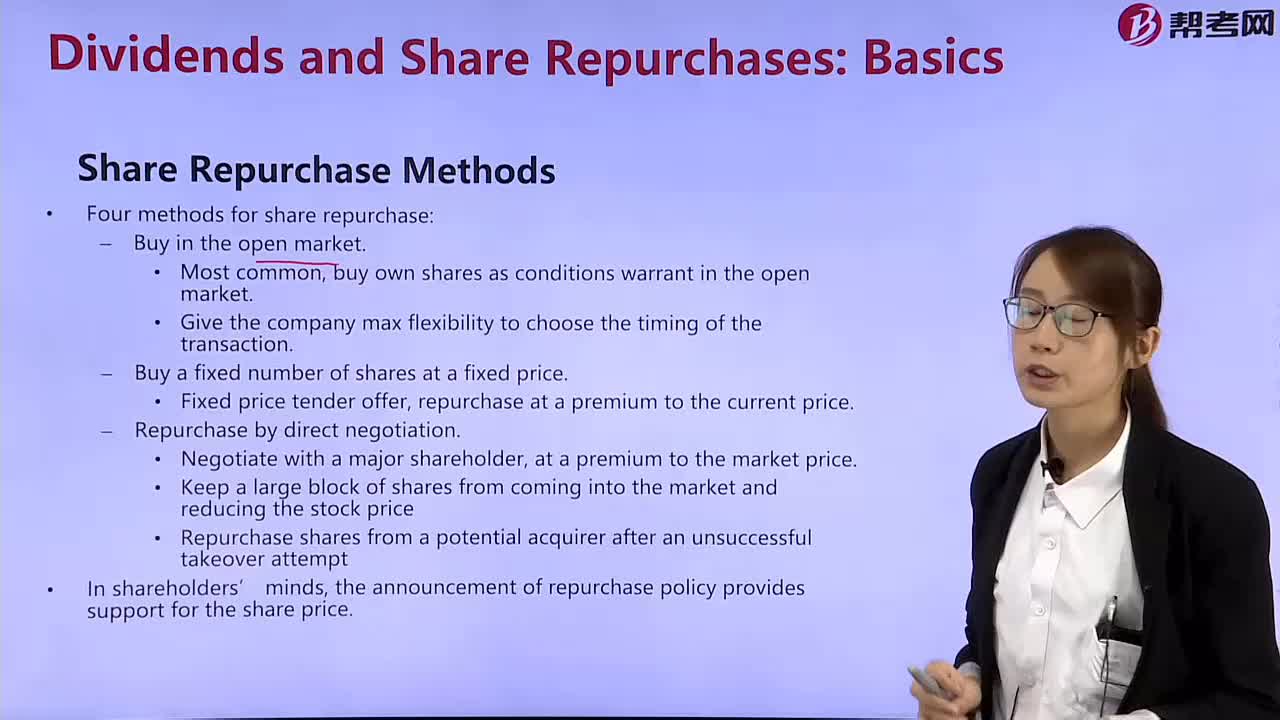

What are the methods of share repurchase?

What is a cash dividend?

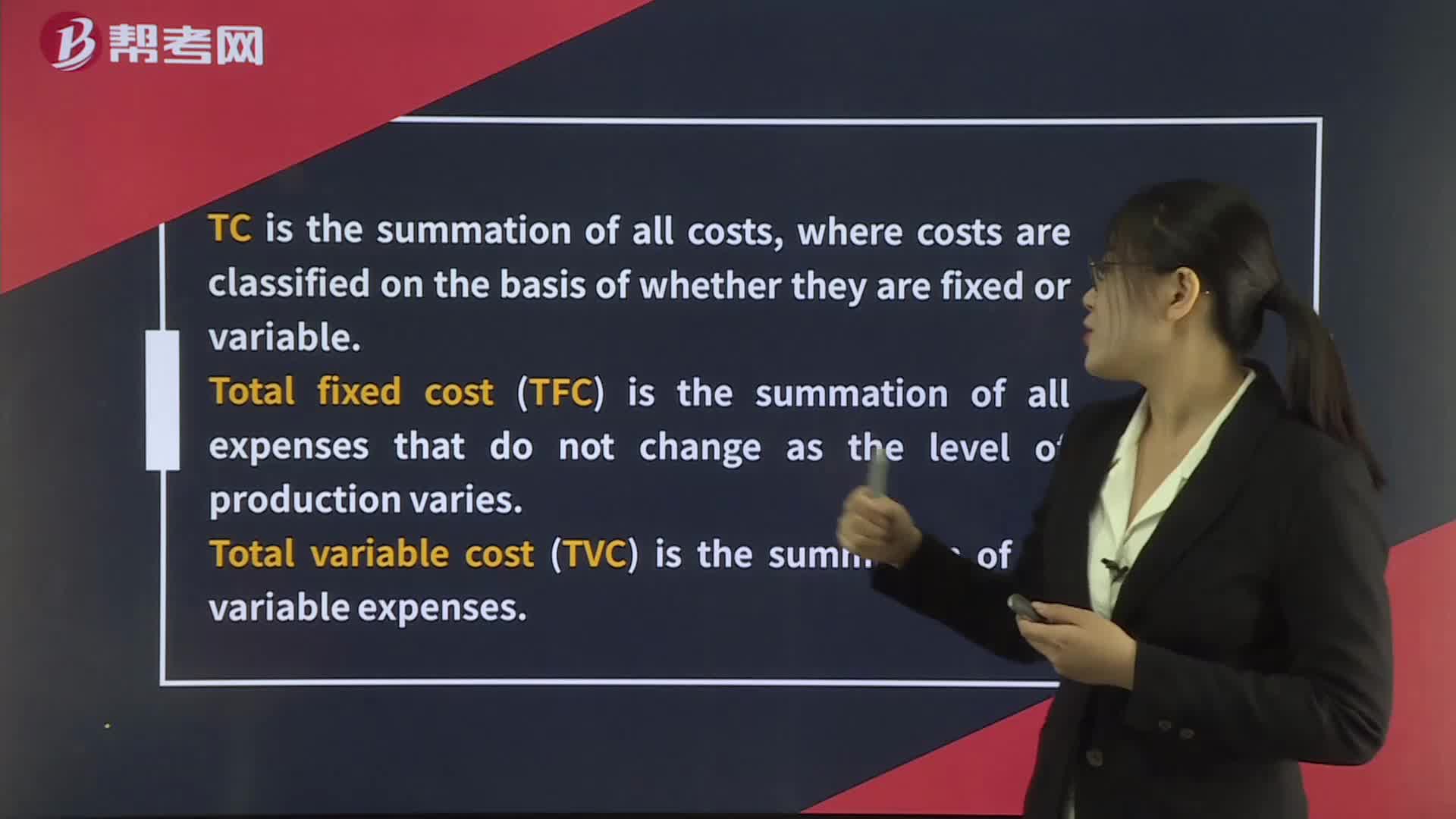

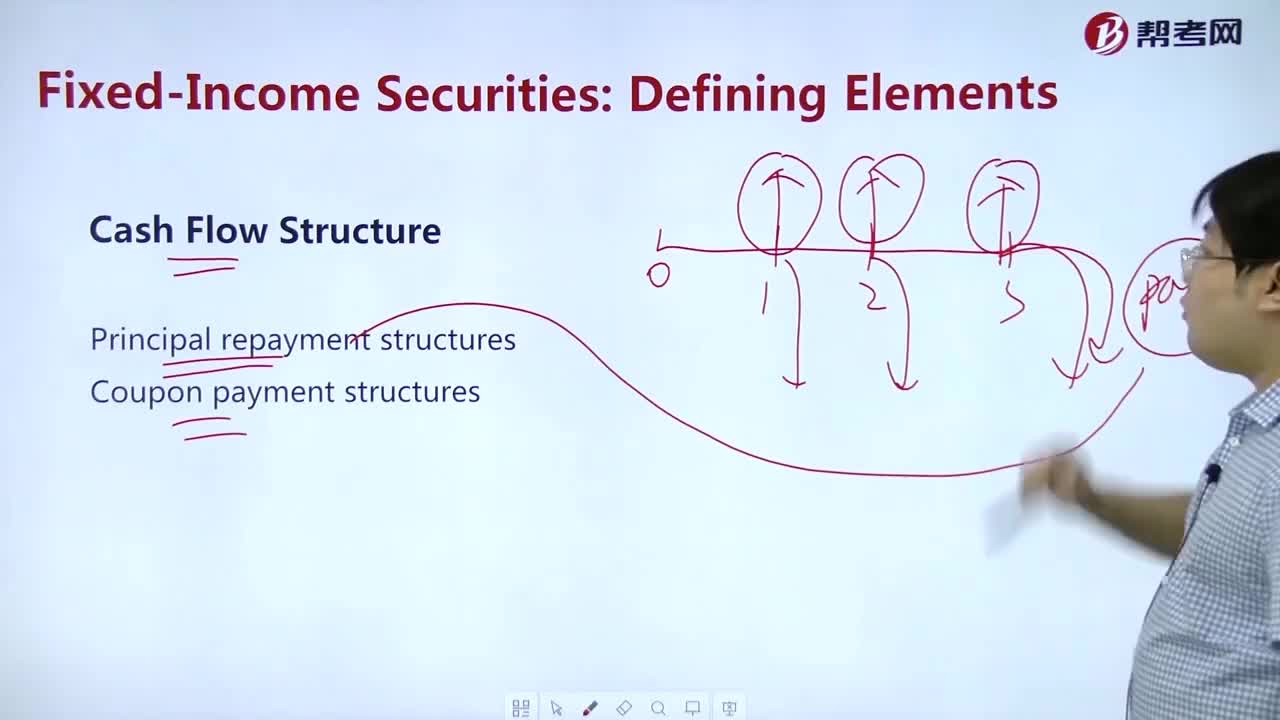

How to understand Cach Flow Structure?

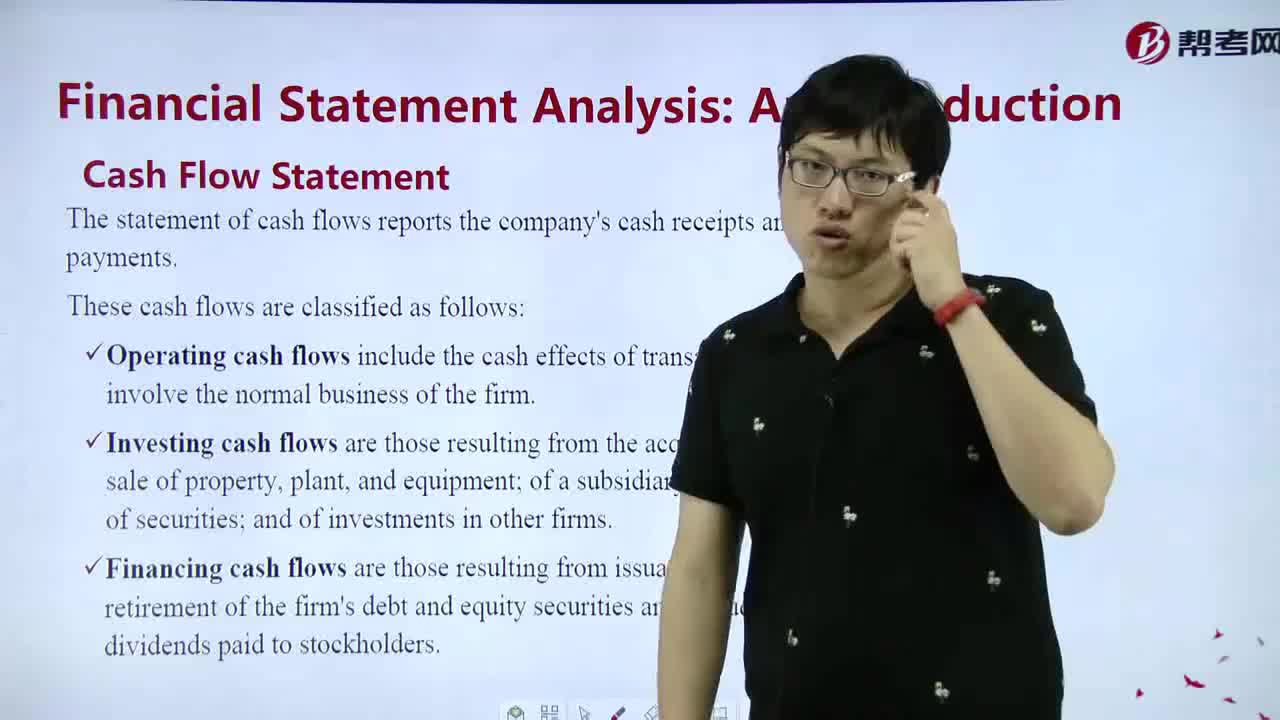

How to master Cash Flow Statement?

What are the methods of dividend discount model?

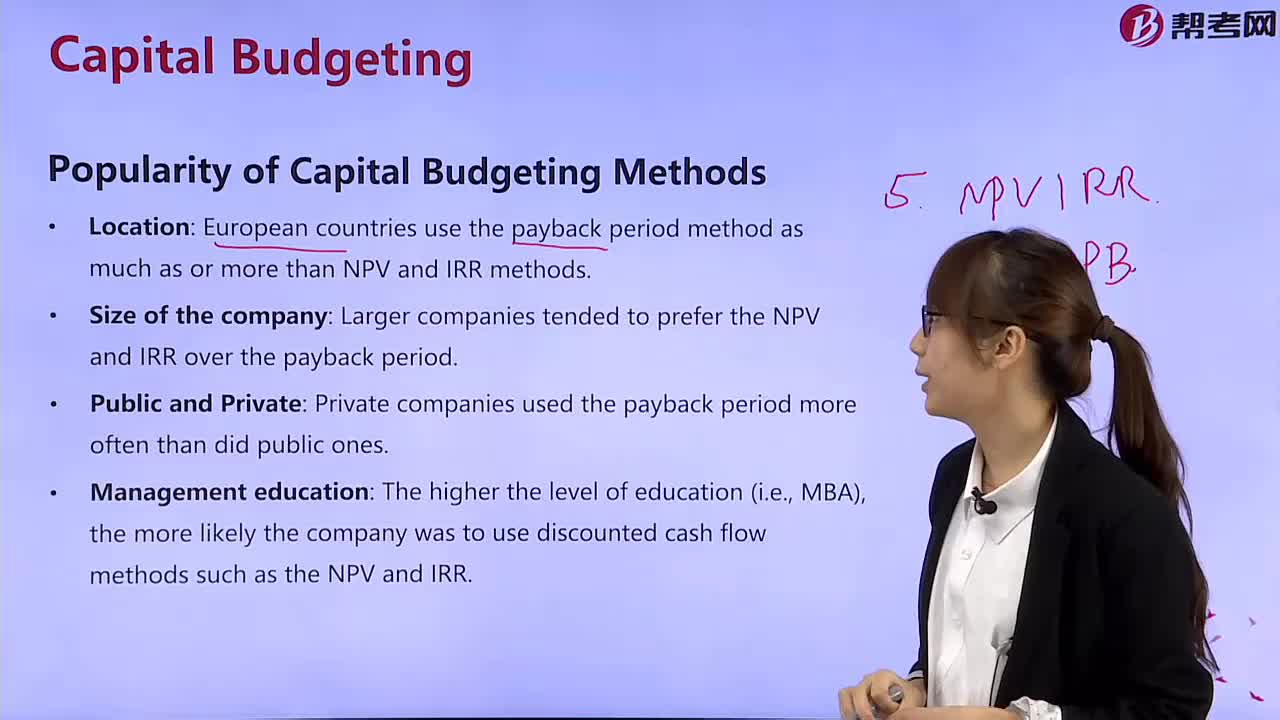

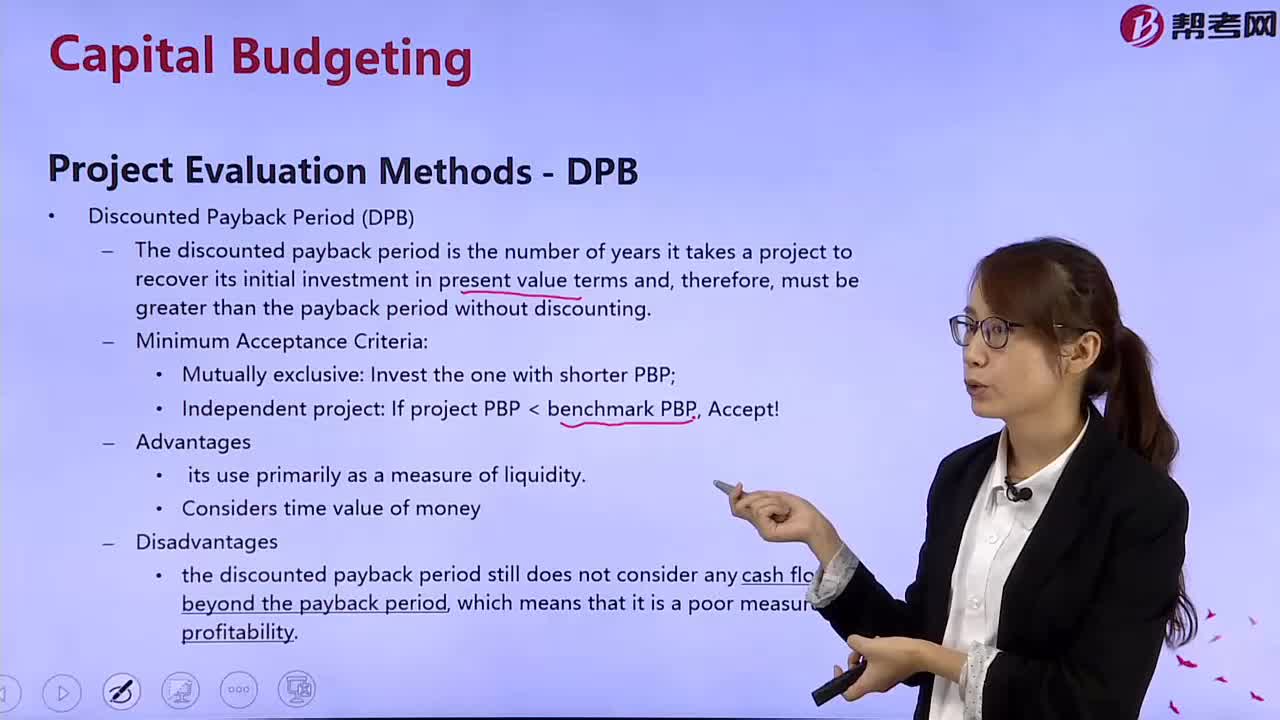

What are the popular capital budgeting methods?

What is the discounted payback period?

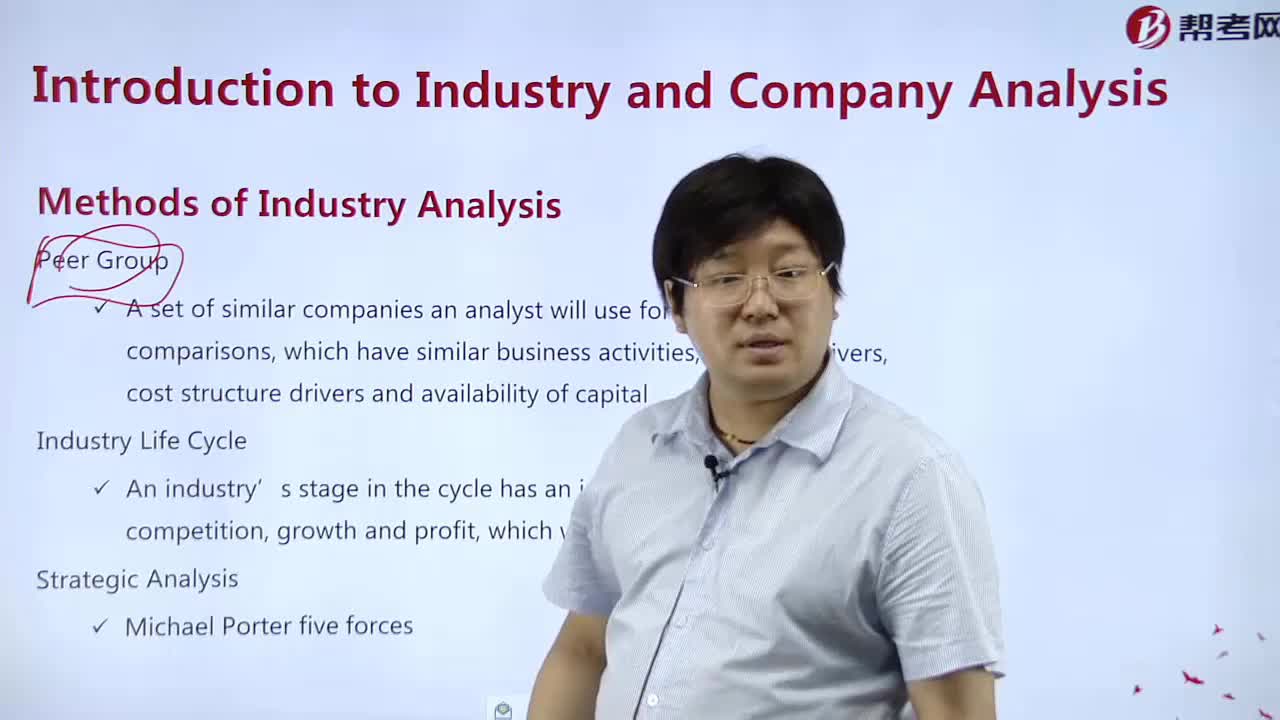

What are the methods of industrial analysis?

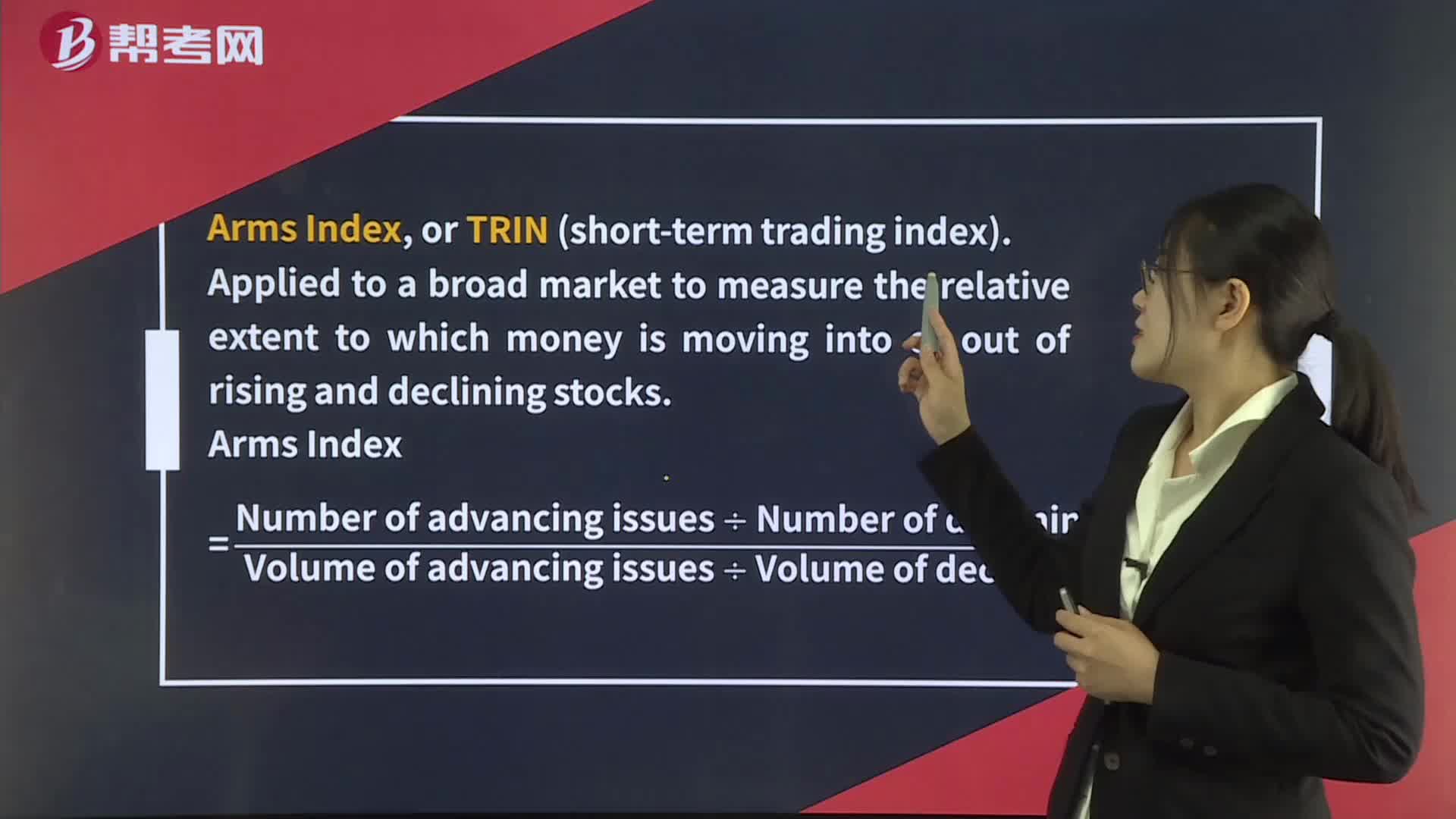

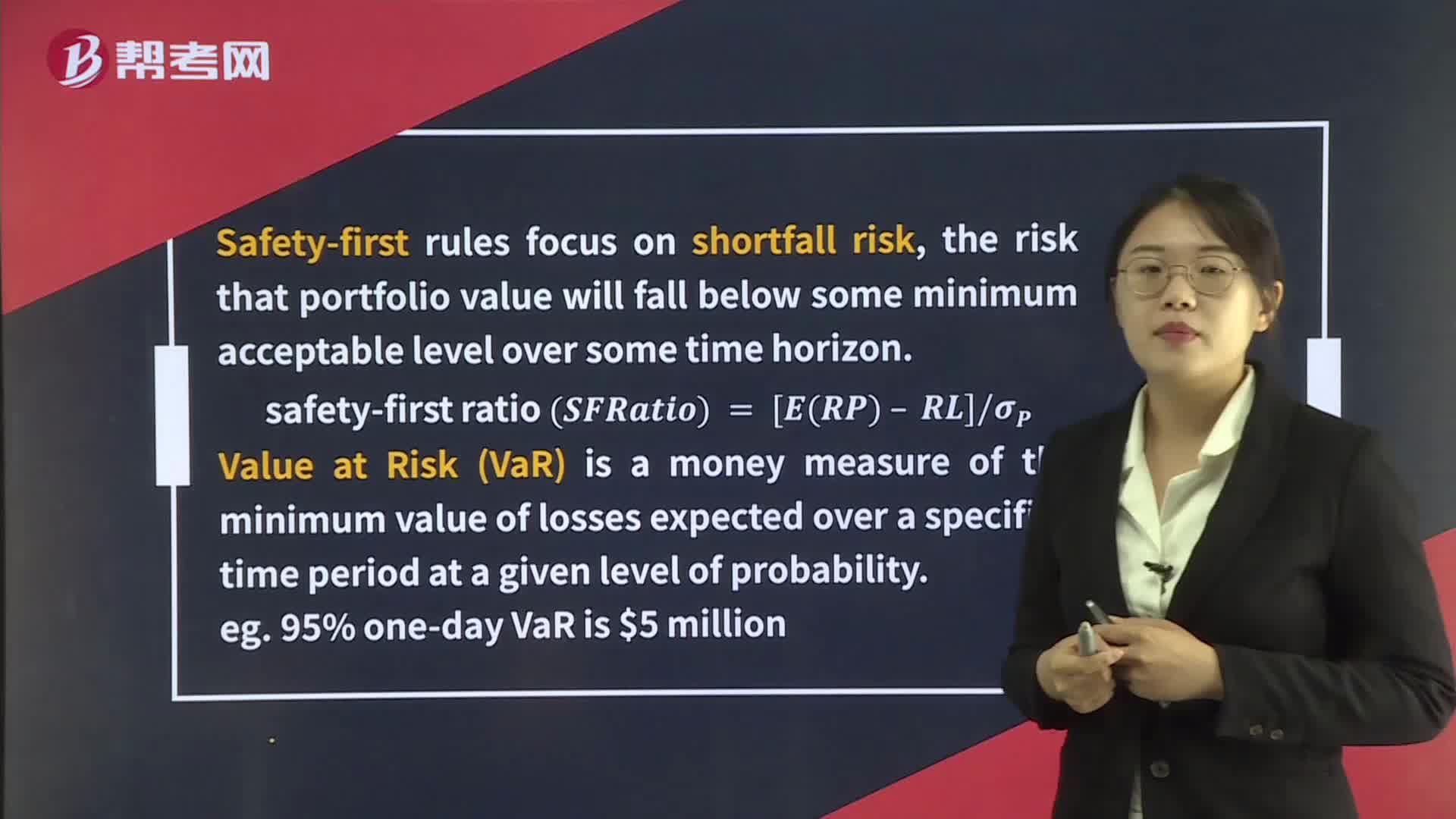

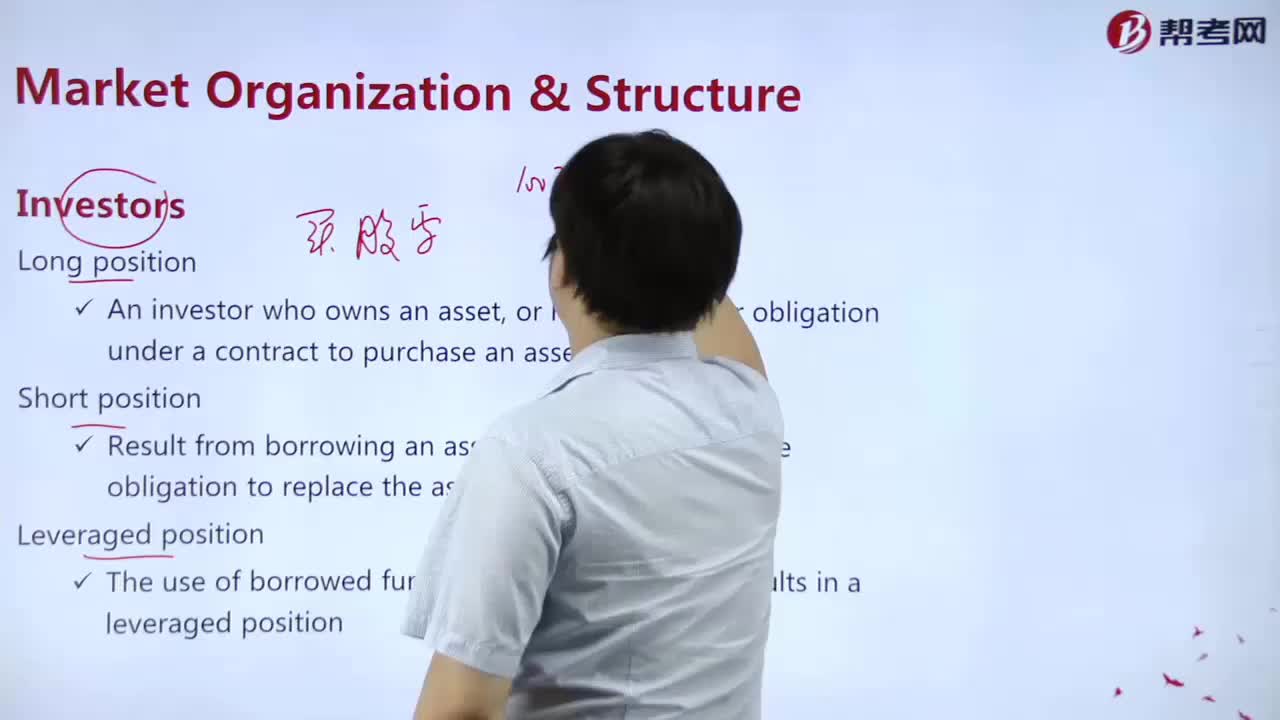

What are the investor's investment methods?

下载亿题库APP

联系电话:400-660-1360