The Roles of Central Banks

The Objectives of Monetary Policy

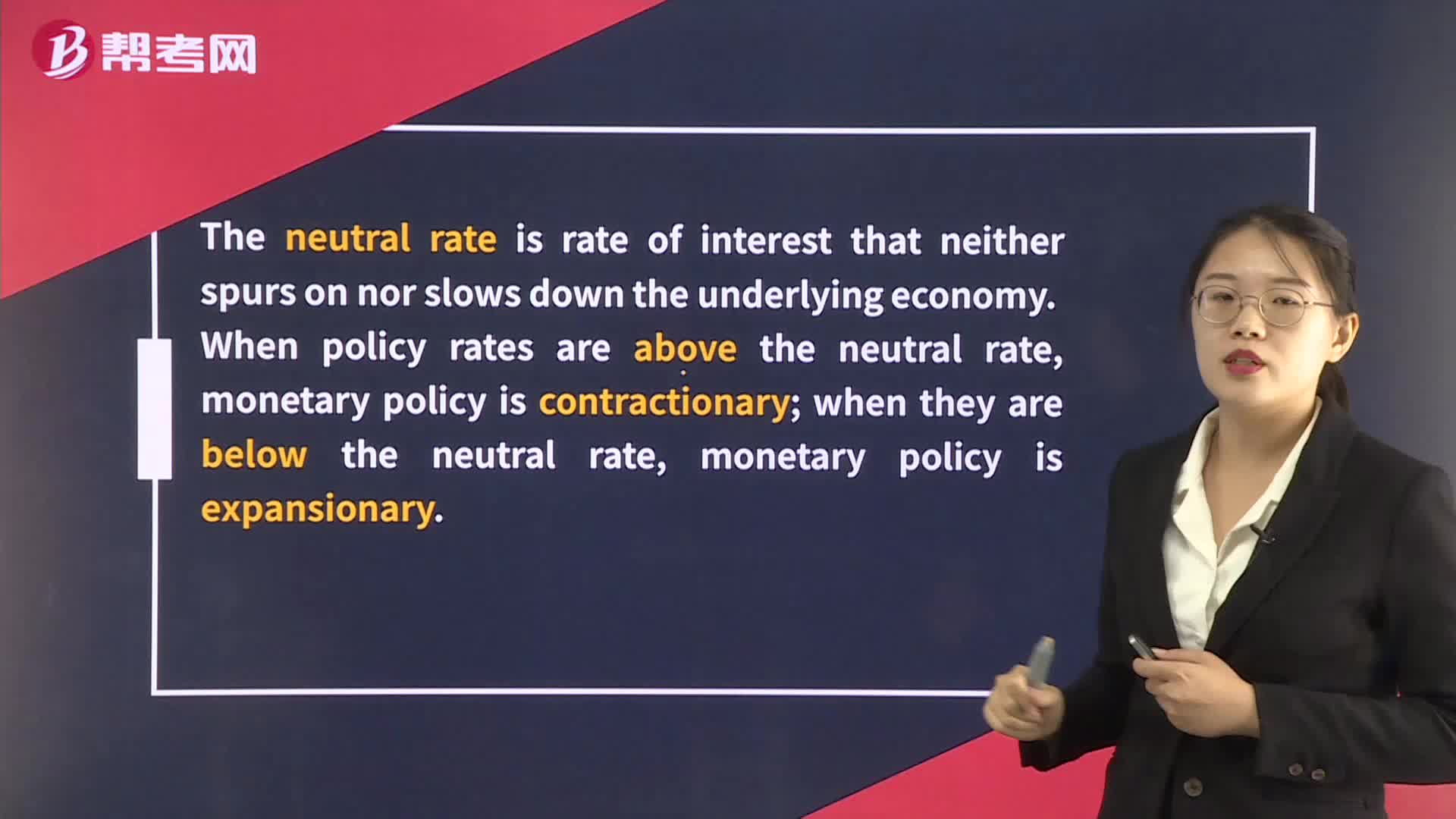

The Neutral Rate

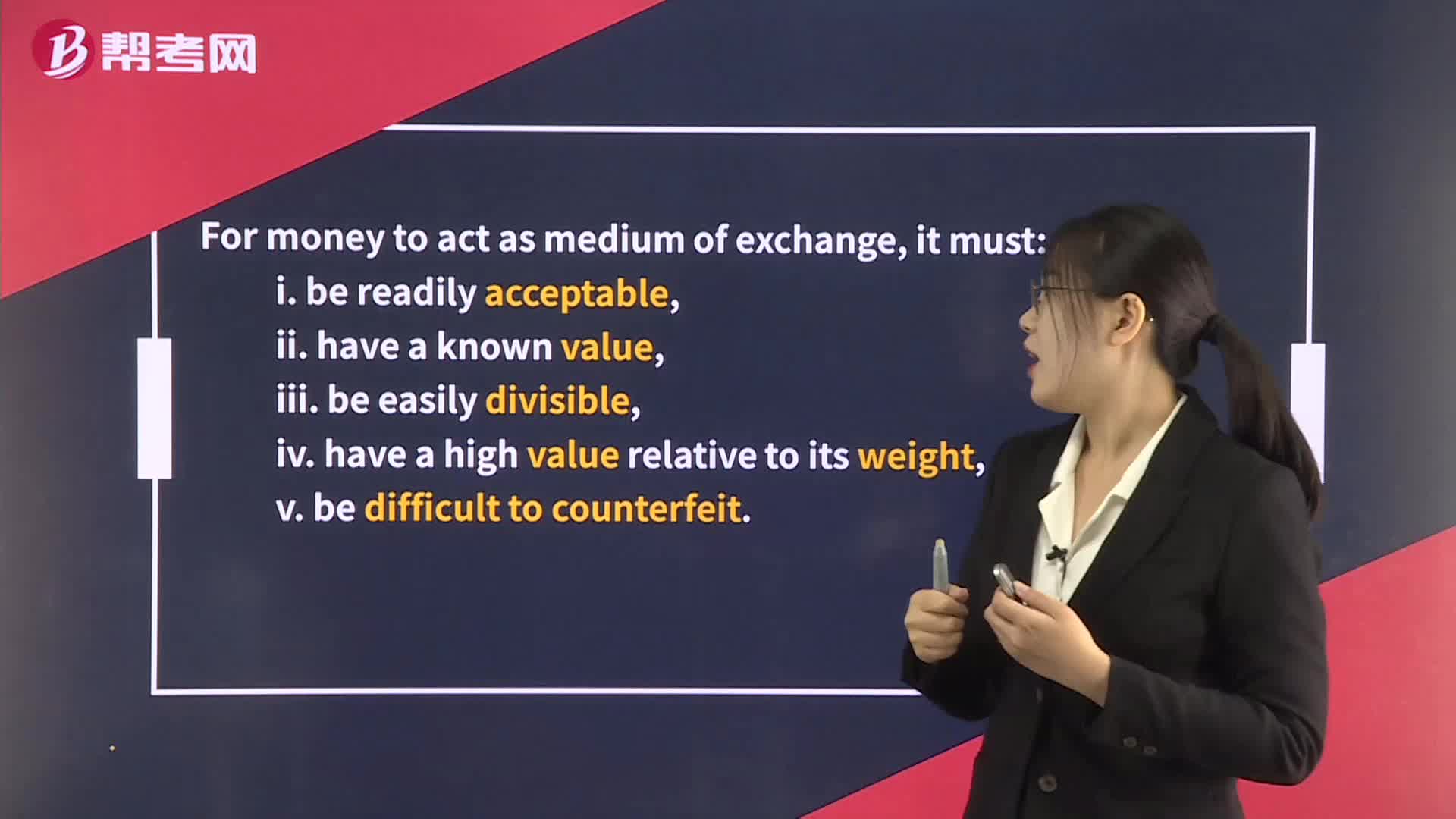

The Functions of Money

The Fisher Effect

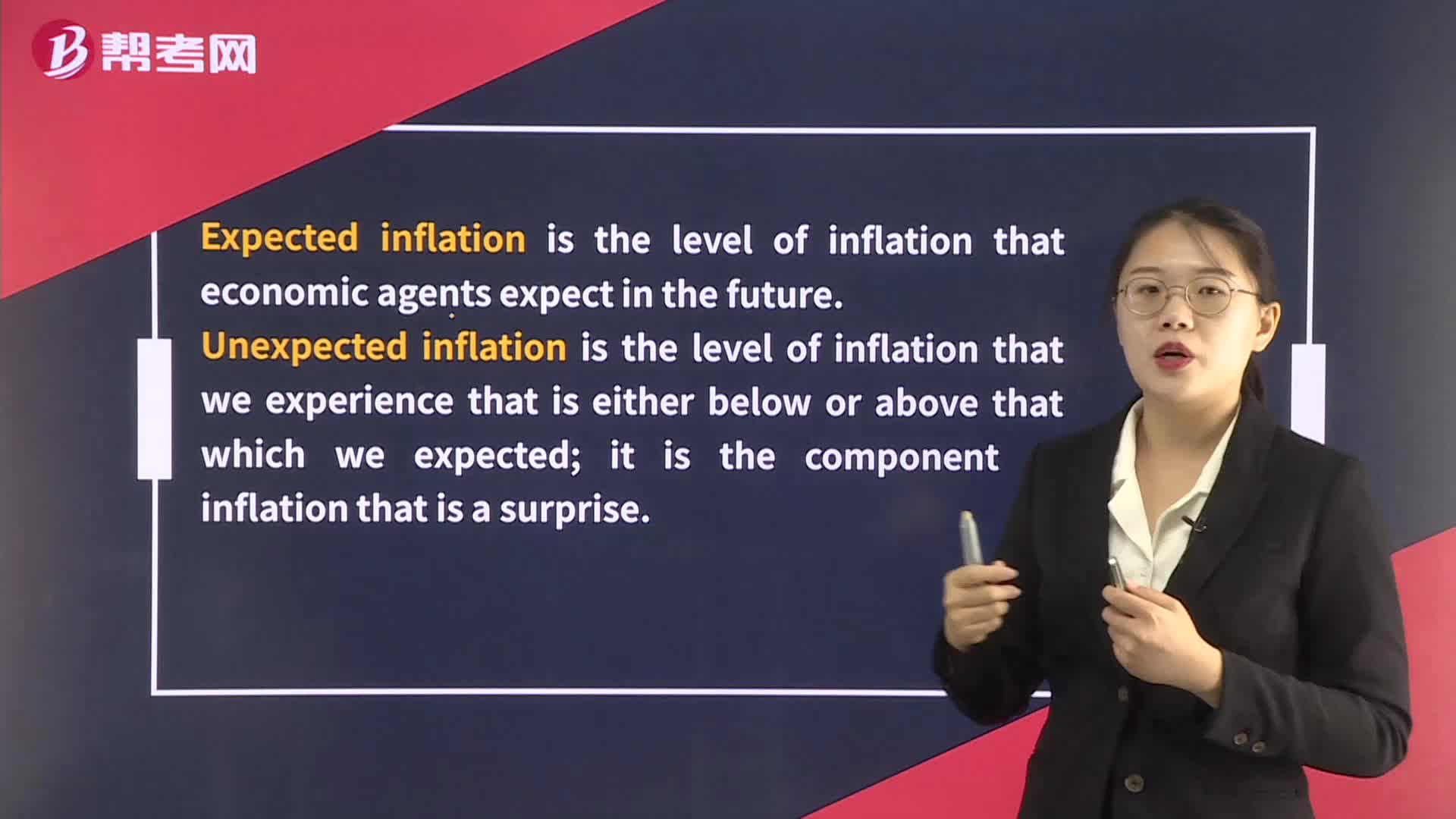

The Costs of Inflation

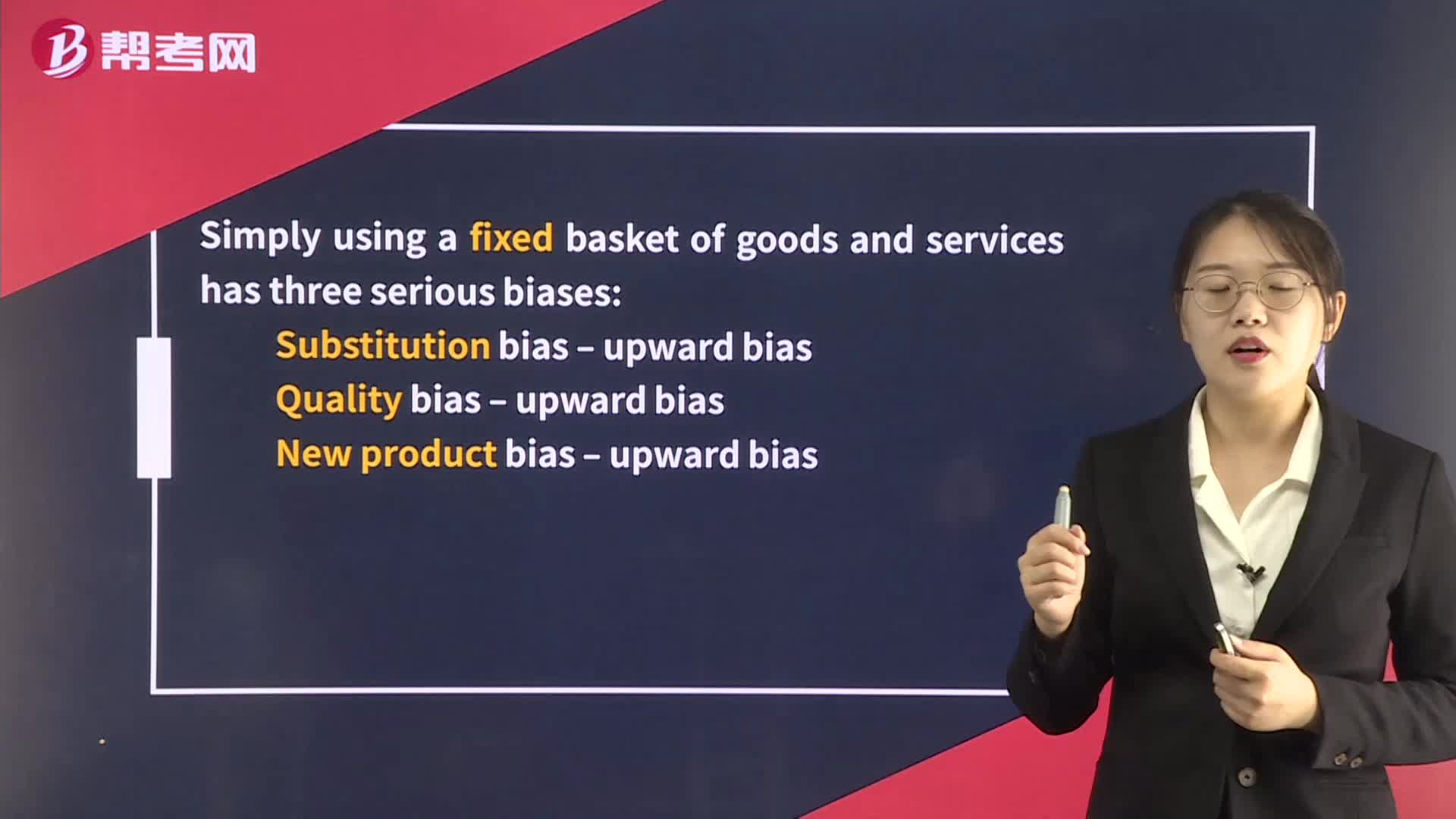

The Construction of Price Indexes

The Central Bank’s Policy Rate

The Advantages and Disadvantages of Using the Different Tools of Fiscal Policy

Factors Influencing the Mix of Fiscal and Monetary Policy

Theories of the Business Cycle - Neoclassical and Austrian Schools

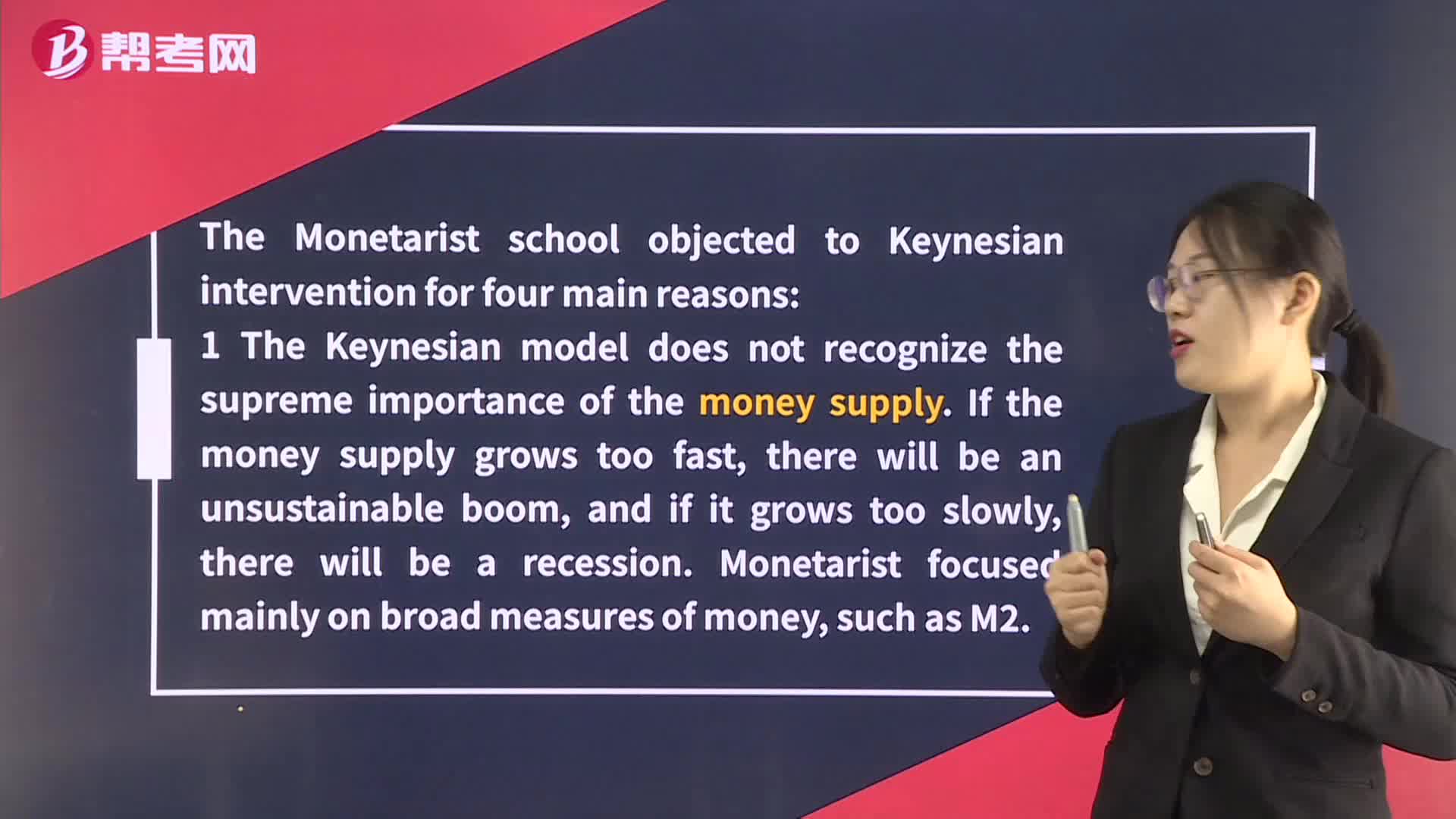

Theories of the Business Cycle - Monetarist School

下载亿题库APP

联系电话:400-660-1360