下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

Nominal and Real Exchange Rates

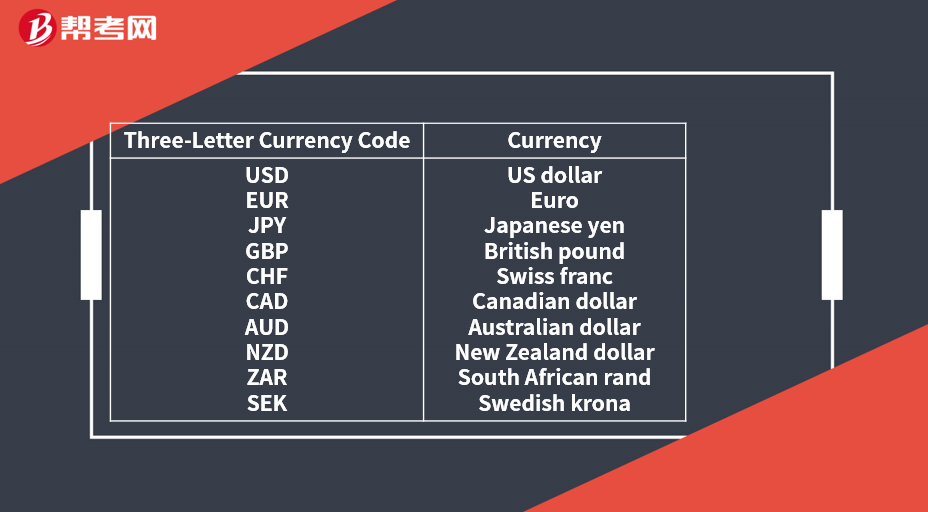

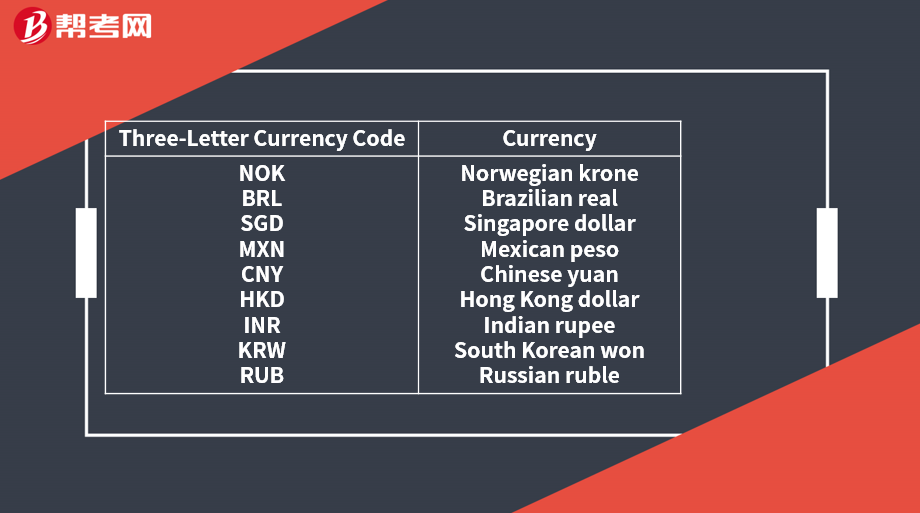

The exchange rate is the number of units of one currency (called the price currency) that one unit of another currency (called the base currency) will buy.

Or, the cost of one unit of the base currency in terms of the price currency.

USD/EUR exchange rate of 1.2875

1 euro will buy 1.2875 US dollars (i.e., 1 euro costs 1.2875 US dollars).

A decline in this exchange rate indicates that the USD is appreciating against the EUR or, equivalently, the EUR is depreciating against the USD.

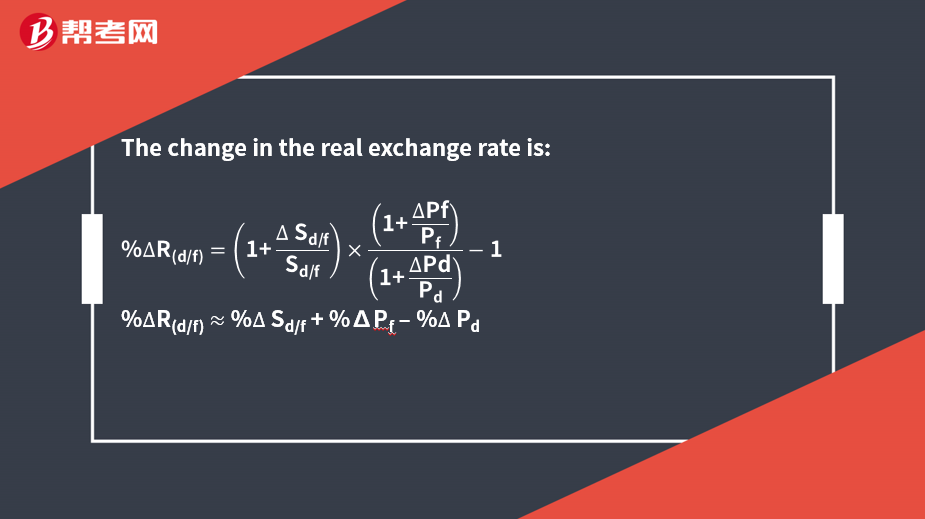

Real exchange rates: Adjust the nominal exchange rate by using the price levels in each country of the currency pair in order to compare the relative purchasing power between countries.

Purchasing power parity (PPP) asserts that nominal exchange rates adjust so that identical goods (or baskets of goods) will have the same price in different markets.

The purchasing power of different currencies is equalized for a standardized basket of goods.

Foreign price level in domestic currency = Sd/f × Pf

where

Sd/f is the spot exchange rate (quoted in terms of the number of units of domestic currency per one unit of foreign currency)

Pf is foreign price level quoted in terms of the foreign currency.

The ratio between the foreign and domestic price levels is:

Real exchange rate(d/f) = (Sd/f × Pf)/Pd = Sd/f× (Pf/Pd)

where Pd is the domestic price level, in terms of the domestic currency.

138

138Real GDP & Nominal GDP:Real GDP Nominal GDP:Real:PerGDPthe quantity of output available for consumption and investment.

244

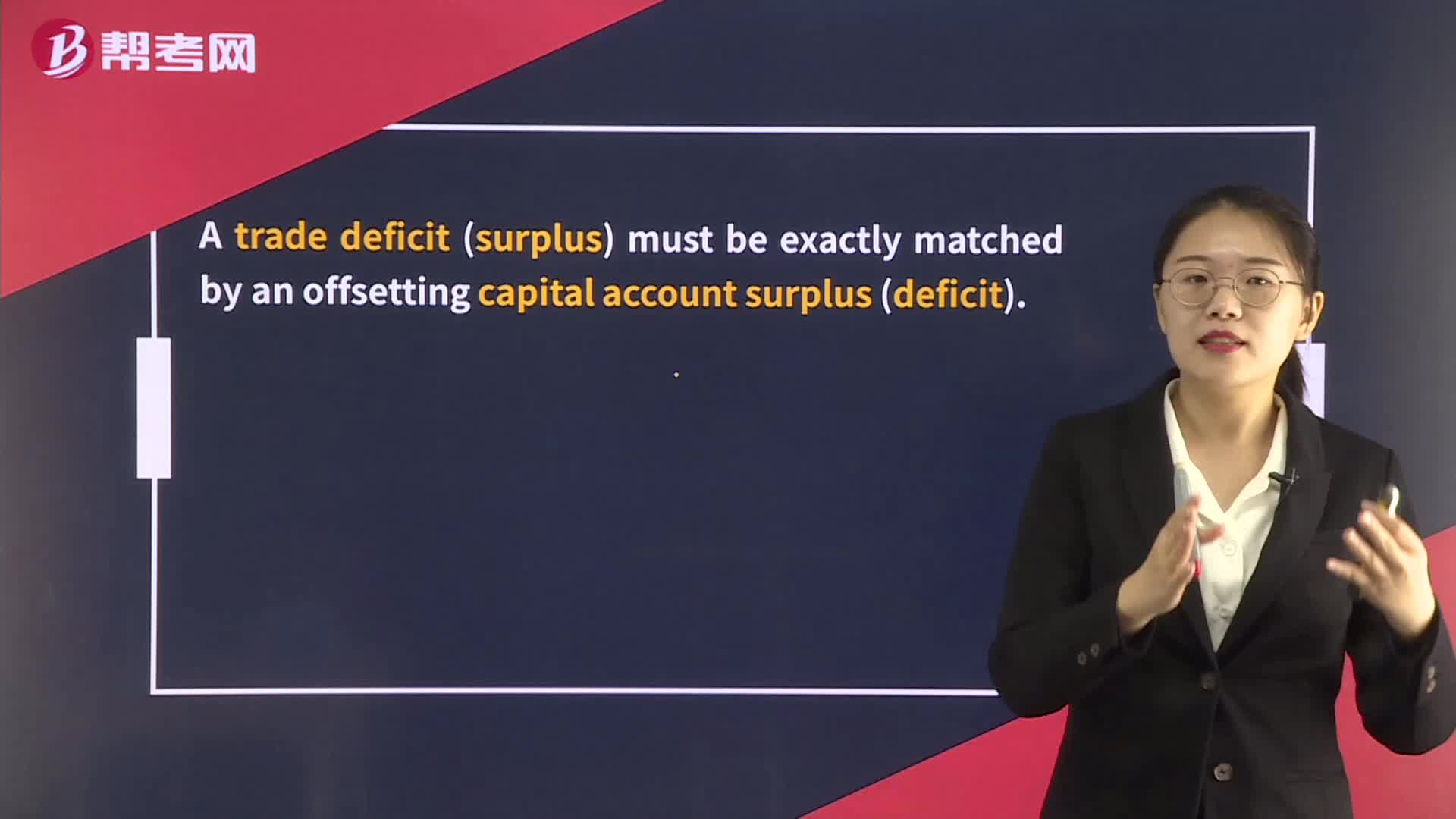

244Exchange Rates, International Trade, and Capital Flows:deficit surplus must be:Capitalapproachexpendituresaving decisions.

138

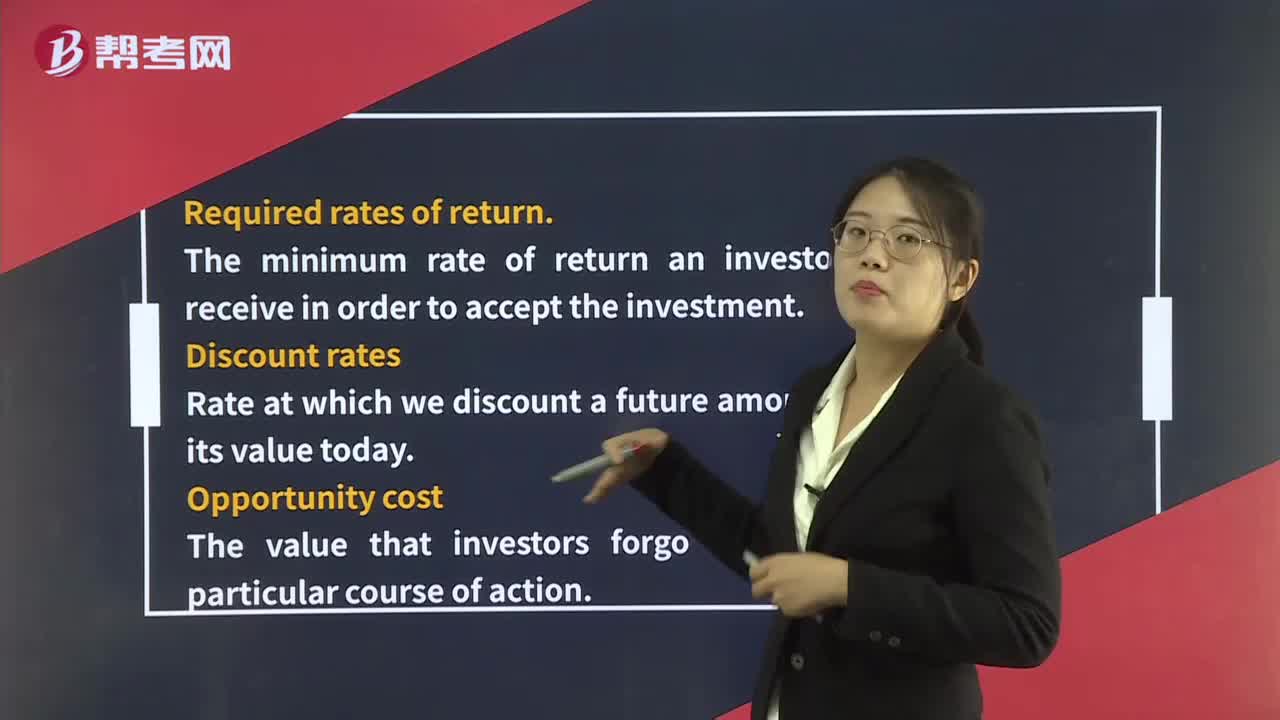

138Interest Rates:rateRequiredDiscountOpportunitycostparticular course of action.

微信扫码关注公众号

获取更多考试热门资料