下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

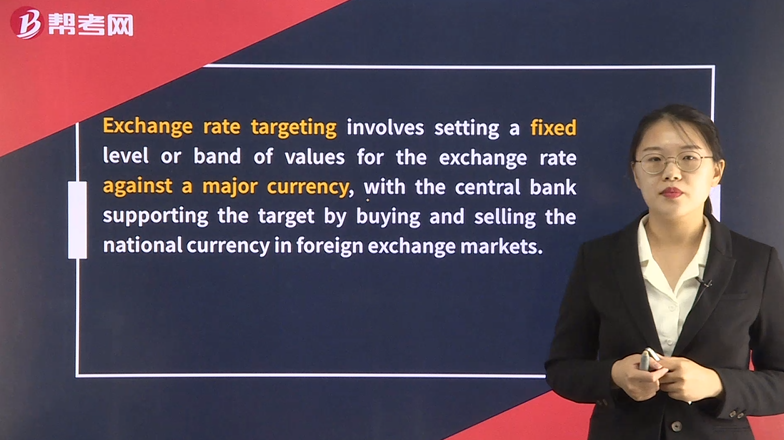

Exchange Rate Targeting

Exchange rate targeting involves setting a fixed level or band of values for the exchange rate against a major currency, with the central bank supporting the target by buying and selling the national currency in foreign exchange markets.

When the central bank or monetary authority chooses to target an exchange rate, interest rates and conditions in the domesticeconomy must adapt to accommodate this target and domestic interest rates and money supply can become more volatile.

The monetary authority’s commitment to and ability to support the exchange rate target must be credible for exchange rate targeting to be successful.

Many currencies are pegged to other currencies, most notably the US dollar.

Other currencies operate under a “managed exchange rate policy,” where they are allowed to fluctuate within a range that is maintained by a monetary authority via market intervention.

583

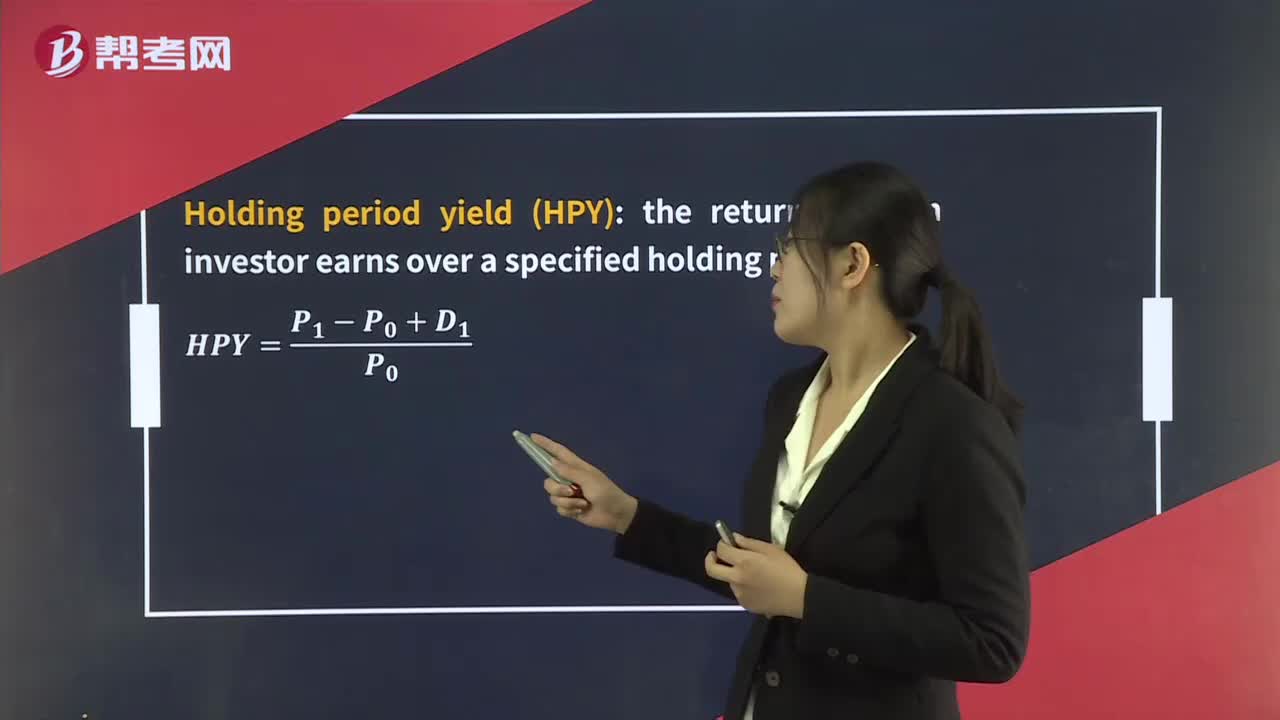

583Money-Weighted Rate of Return & Time-Weighted Rate of Return:[Solutions] C

129

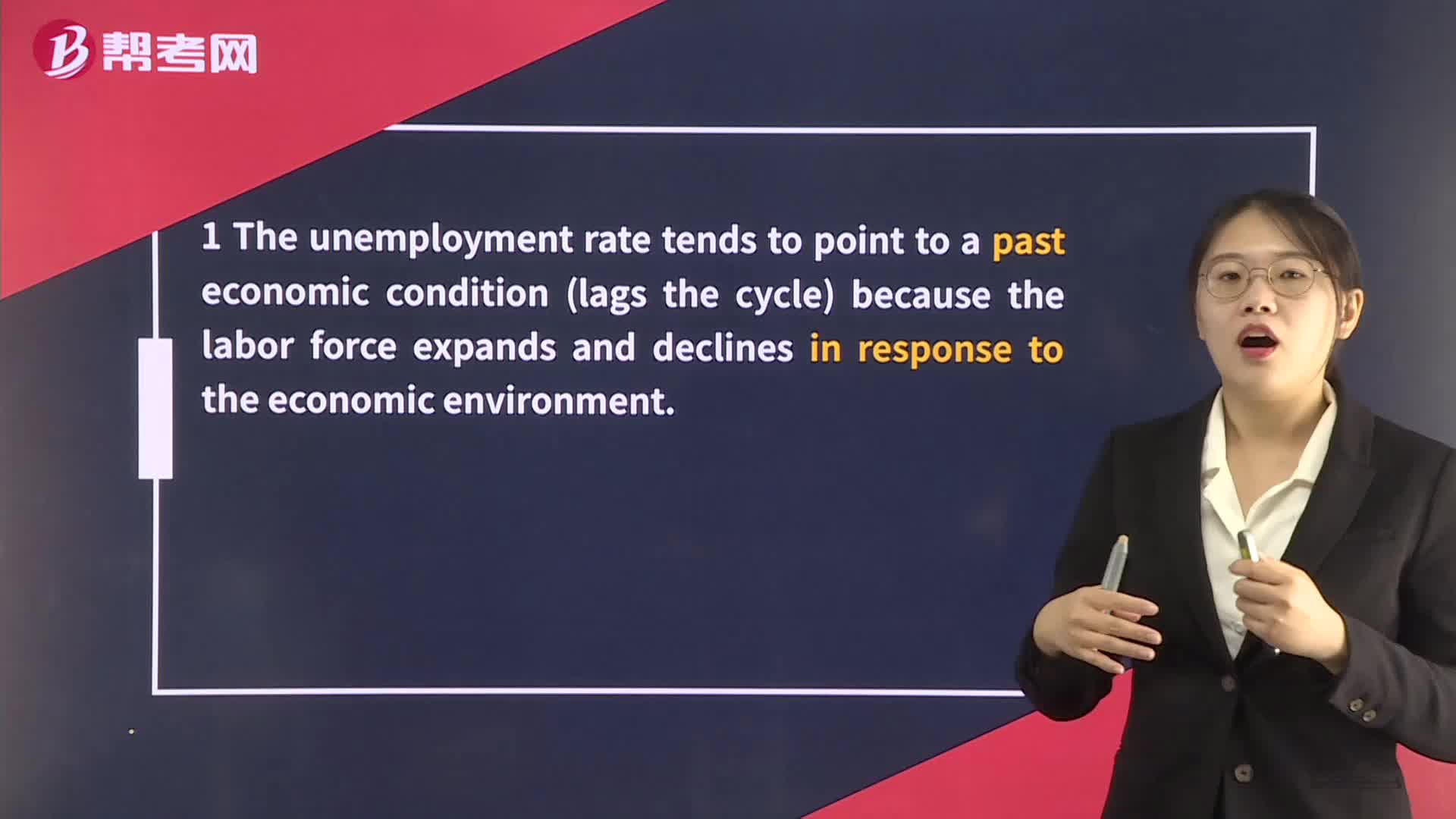

129The Unemployment Rate:The Unemployment Rate:environment.measure the labor force in terms of the working-age population.constraints written into labor contracts that make layoffs expensive.

136

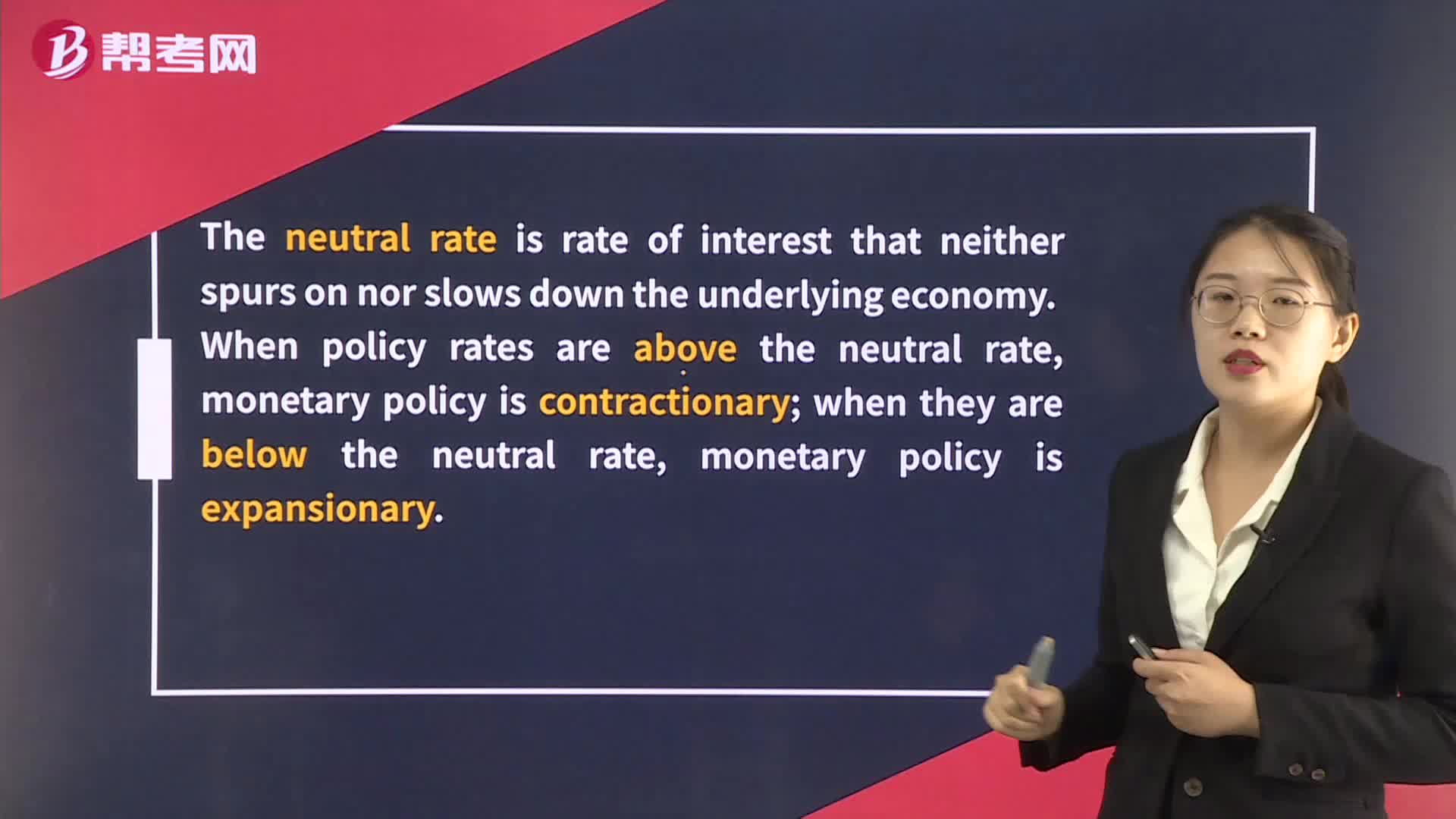

136The Neutral Rate:The neutral;underlying economy.:economyLong-runrates might make a bad situation worse.

微信扫码关注公众号

获取更多考试热门资料