下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

Exchange Rates, International Trade, and Capital Flows

A trade deficit (surplus) must be exactly matched by an offsetting capital account surplus (deficit).

20200806154739319.jpg)

The impact of exchange rates and other factors on the trade balance must be mirrored by their impact on capital flows.

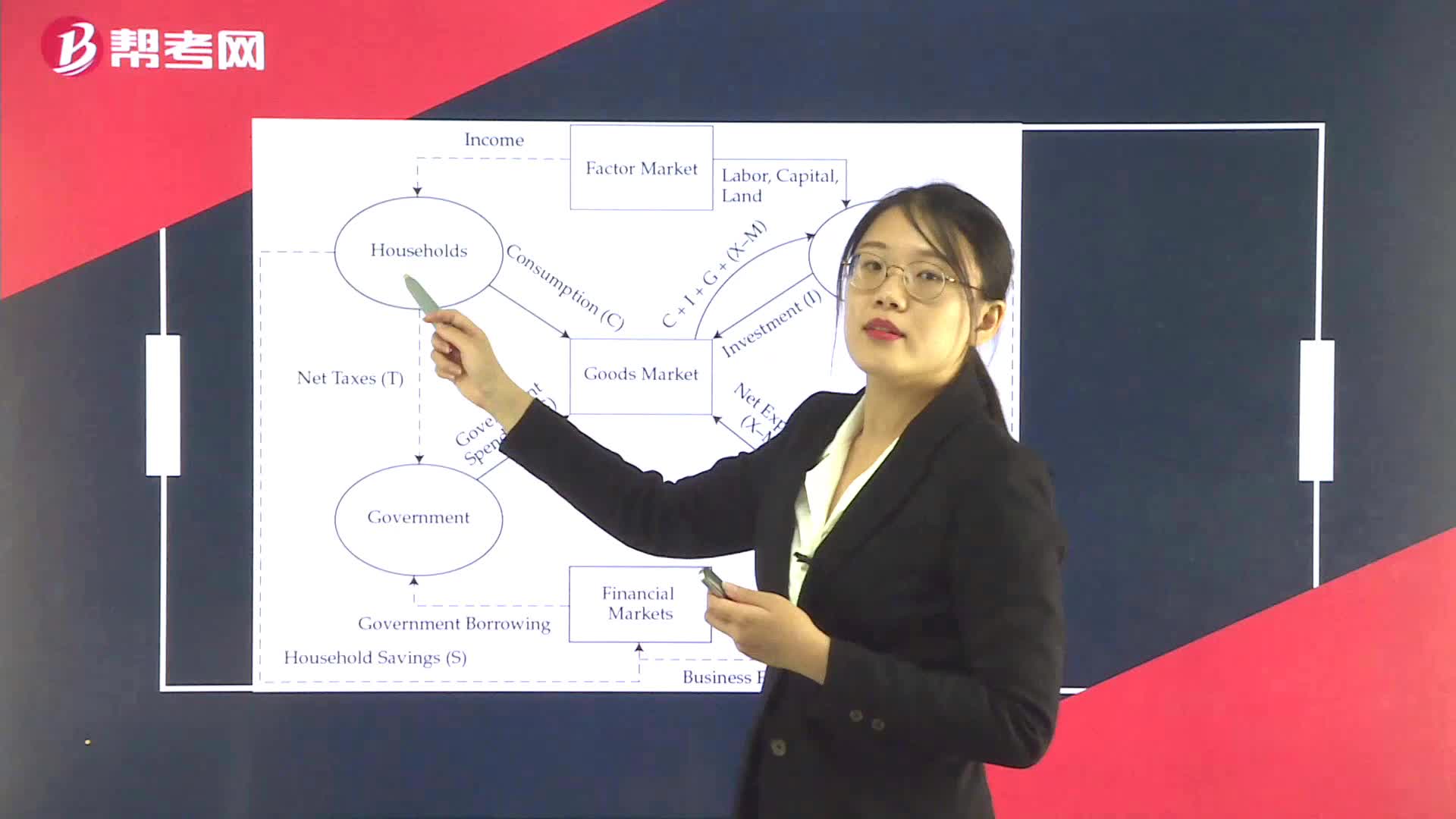

The relationship between the trade balance and expenditure/saving decisions:

X – M = (S – I) + (T – G)

where X represents exports

M is imports

S is private savings

I is investment in plant and equipment

T is taxes net of transfers

G is government expenditure.

Asset prices and exchange rates adjust so that the potential flow of financial capital is mitigated and actual capital flows remain consistent with trade flows.

Capital flows—potential and actual—are the primary determinant of exchange rate movements in the short-to-intermediate term.

To examine the impact of exchange rate changes on the trade balance:

The elasticities approach: Focuses on the effect of changing the relative price of domestic and foreign goods.

The absorption approach: Focuses on the impact of exchange rates on aggregate expenditure/saving decisions.

296

296Output, Income, and Expenditure Flows:and Expenditure Flows

244

244Exchange Rates, International Trade, and Capital Flows:deficit surplus must be:Capitalapproachexpendituresaving decisions.

138

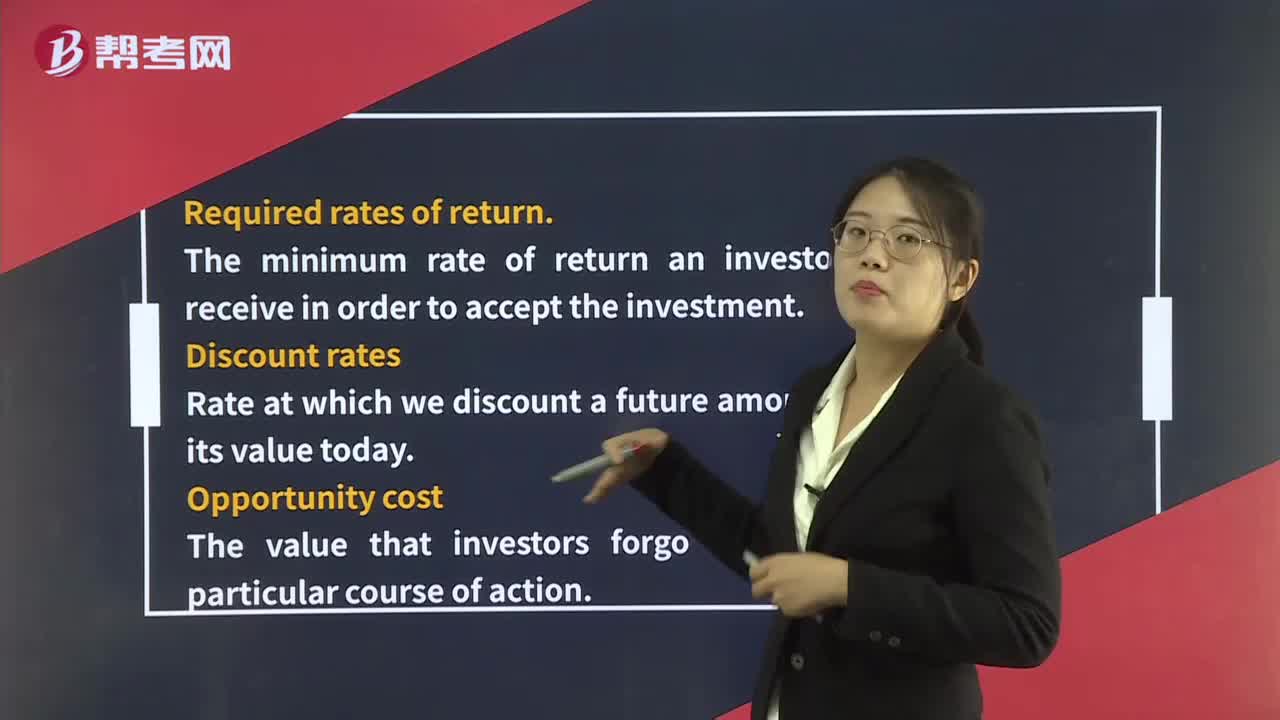

138Interest Rates:rateRequiredDiscountOpportunitycostparticular course of action.

微信扫码关注公众号

获取更多考试热门资料