下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

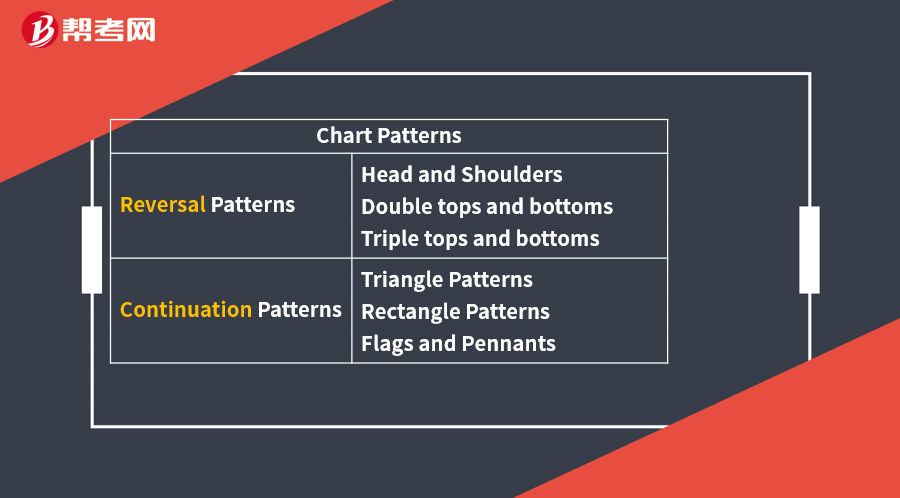

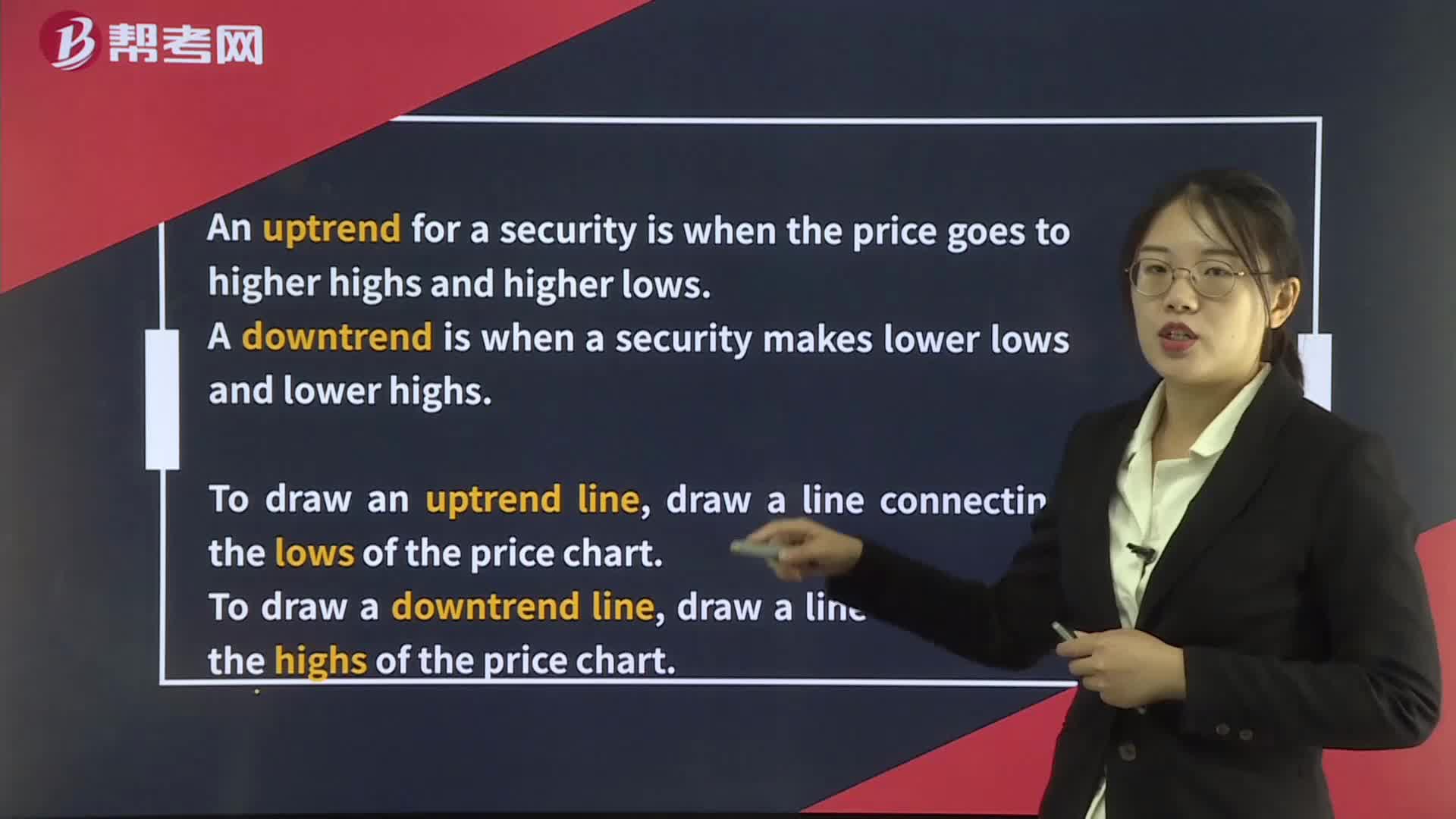

Technical Analysis Tools— Chart Patterns

Chart patterns are formations that appear in price charts that create some type of recognizable shape.

Categories: reversal patterns and continuation patterns.

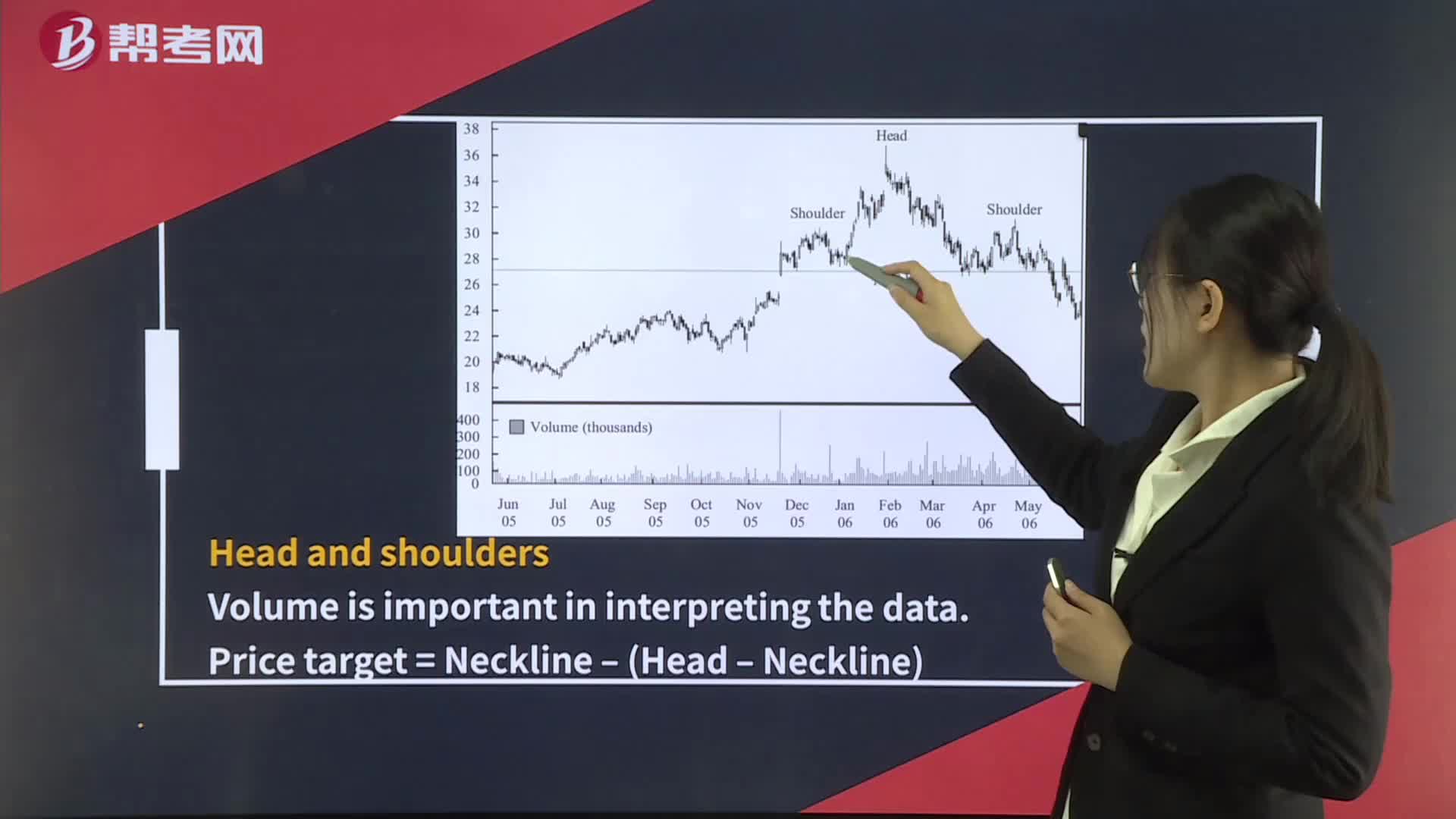

A reversal pattern signals the end of a trend, a change in direction of the financial instrument’s price.

Other reversal patterns include:

Double tops, Double bottoms, Triple tops and Triple bottoms.

For a double top, price is expected to decline below the low of the valley between the two tops by at least the distance from the valley low to the high of the double tops.

For double bottoms, the price is expected to appreciate above the peak between the two bottoms by at least the distance from the valley lows to the peak.

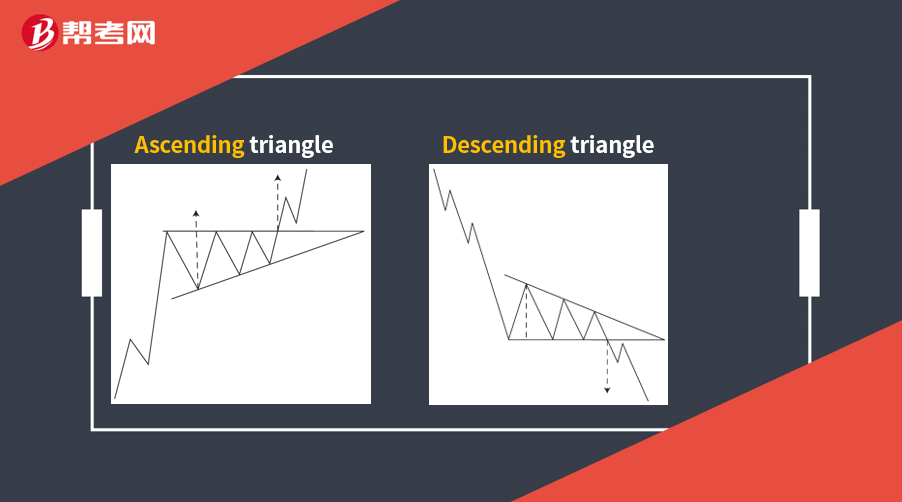

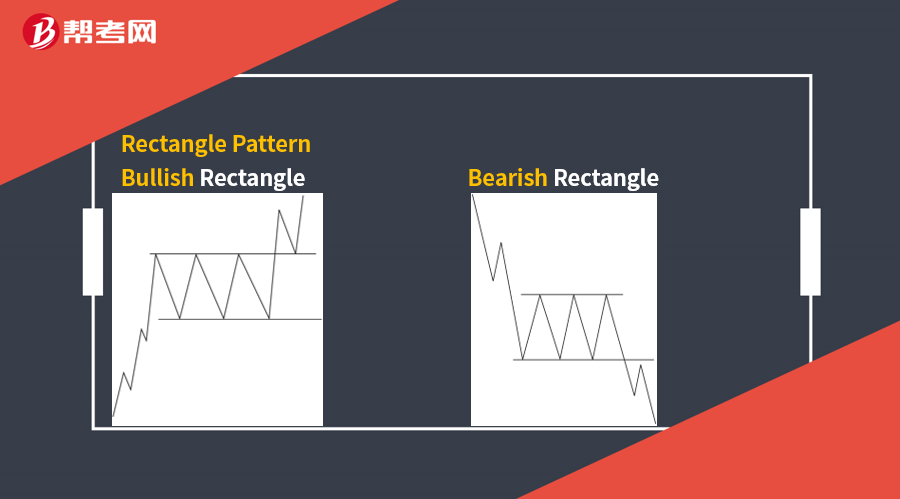

A continuation pattern is used to predict the resumption of a market trend that was in place prior to the formation of a pattern.

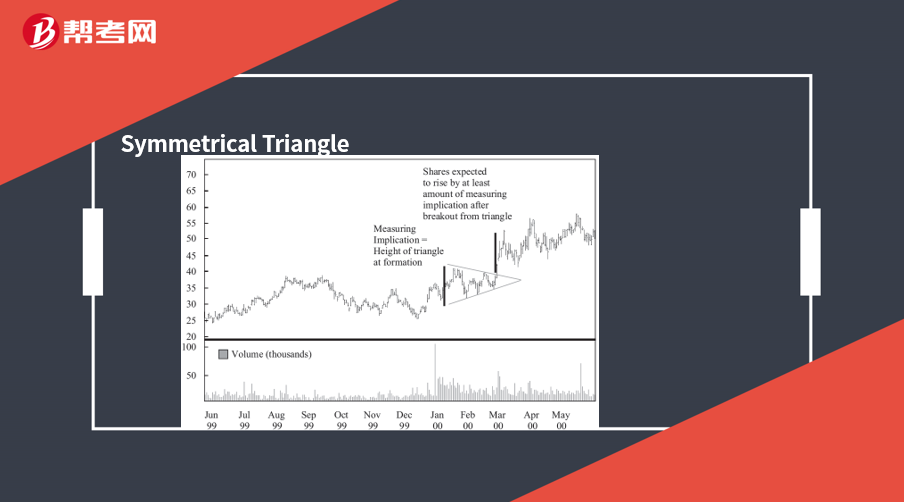

Triangle patterns come in three forms, symmetrical triangles, ascending triangles, and descending triangles.

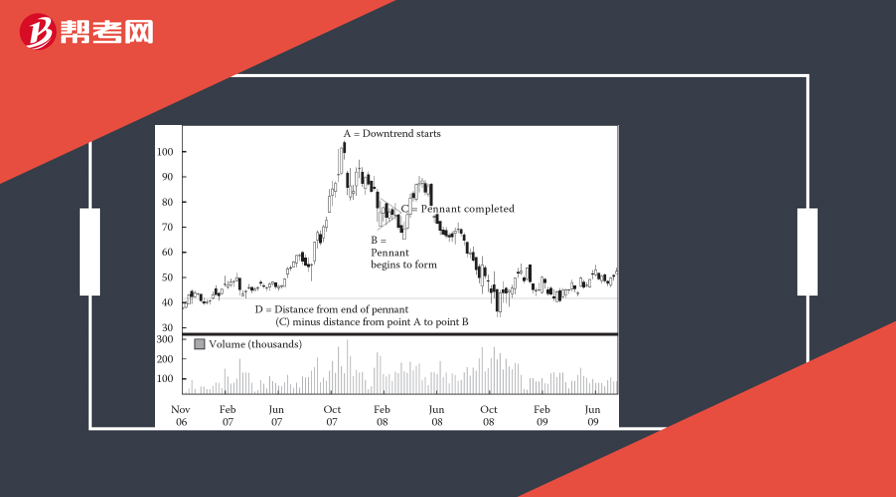

Flags and pennants form over short periods of time—on a daily price chart, typically over a week.

Flag: parallel trendlines.

Pennant: trendlines converge.

A pennant is a short-term formation whereas a

triangle is a long-term formation.

The expectation: the trend will continue after the pattern in the same direction it was going prior to the pattern.

The price is expected to change by at least the same amount as the price change from the start of the trend to the formation of the flag or pennant.

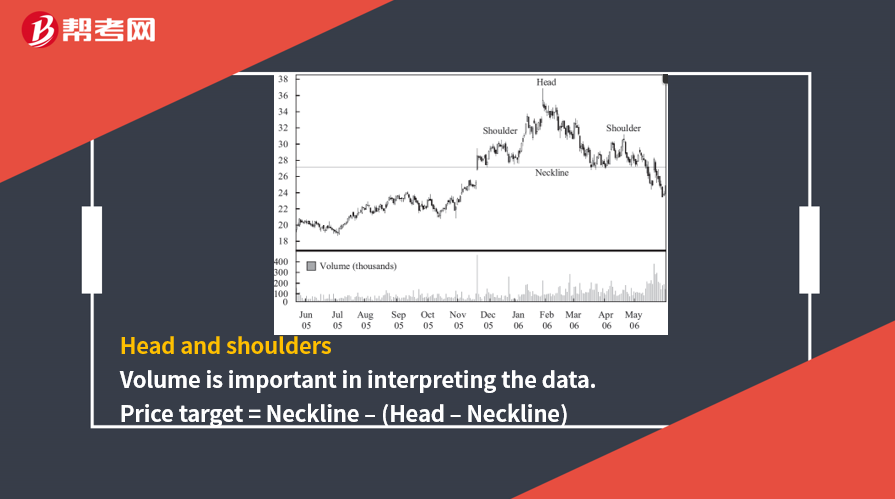

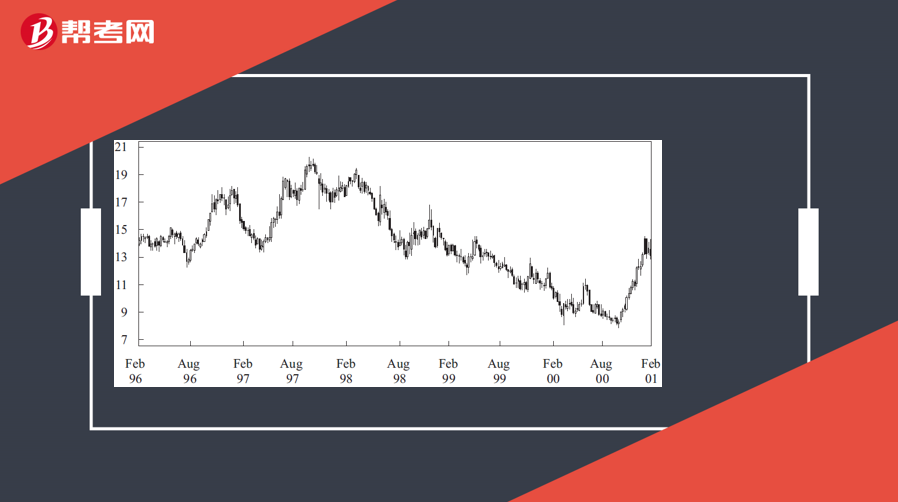

[Practice Problems] The exhibit depicts Archer Daniels Midland Company common shares, traded on the New York Stock Exchange, for 1996 to 2001 in US dollars. The exhibit illustrates most clearly which type of pattern?

A.Triangle.

B.Triple top.

C.Head and shoulders.

[Solutions] C

The left shoulder formed at around US$18.50, the head formed at around US$20.50, and the second shoulder formed at around US$19.

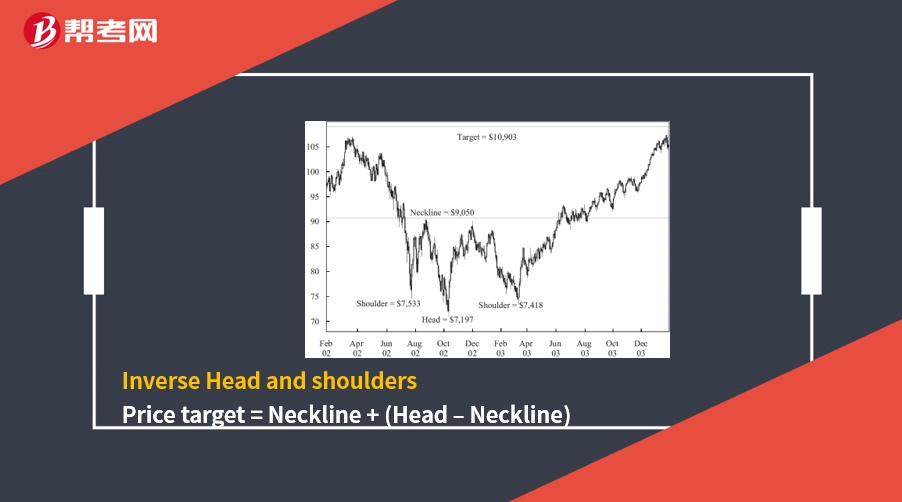

[Practice Problems] In an inverted head and shoulders pattern, if the neckline is at €100, the shoulders at €90, and the head at €75, the price target is closest to which of the following?

A.€50.

B.€110.

C.€125.

[Solutions] C

Target

= Neckline + (Neckline − Head)

= €100 + (€100 − €75) = €125

241

241Technical Analysis Tools— Trend:line,draw a line connecting the highs of the price chart.:price.[PracticeLtd.Change

345

345Technical Analysis Tools— Reversal Patterns:Doublethe price is expected to appreciate above the peak between the two bottoms by at least the distance from the valley lows to the peak.

391

391Technical Analysis Tools— Continuation Patterns:Triangle:symmetrical triangles:FlagsFlagA pennant is a short-term formation whereas a triangle is a long-term formation.flag or pennant.

微信扫码关注公众号

获取更多考试热门资料