下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、The number of ways we can choose r objects from a total of n objects, when the order in which the r objects are listed does matter is given by the permutation formula:How many permutations are possible when choosing 4 objects from a total of 10 objects?【单选题】

A.30.

B.210.

C.5,040.

正确答案:C

答案解析:“Probability Concepts,” Richard A. Defusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA2011 Modular Level I, Vol. 1, p. 474Study Session 2-8-oIdentify the most appropriate method to solve a particular counting problem and solve counting problems using the factorial, combination, and permutation notations.

2、A two-tailed t-test of the null hypothesis that the population mean differs from zero has a p-value of 0.0275. Using a significance level of 5%, the most appropriate conclusion is:【单选题】

A.reject the null hypothesis.

B.accept the null hypothesis.

C.the chosen significance level is too high.

正确答案:A

答案解析:“Hypothesis Testing,” Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E. RunkleA is correct. The p-value is the smallest level of significance at which the null hypothesis can be rejected. In this case, the given p-value is less than the given level of significance and we reject the null hypothesis.

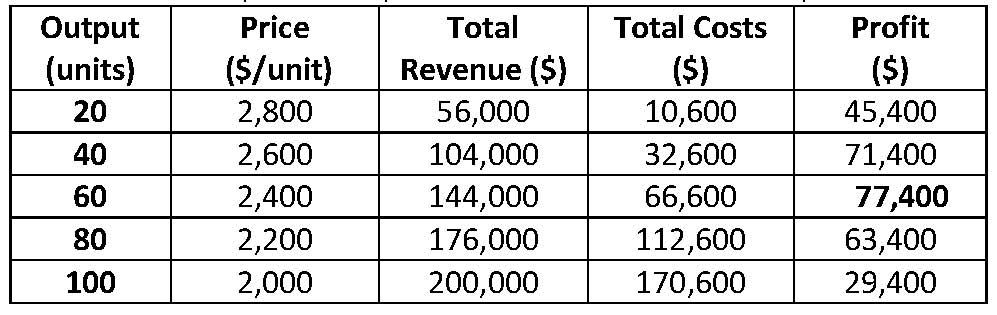

3、With its existing production facilities, a monopolist firm can produce up to 100 units. It faces the following demand and cost schedules:The optimal output level for this producer (in units) is closest to:【单选题】

A.20.

B.60.

C.100.

正确答案:B

答案解析:“The Firm and Market Structures,” Richard G. Fritz and Michele Gambera, CFA

4、Assume that an economy is composed of two products, X and Y, with the following details:Assuming 2012 is the base year for measuring GDP and the GDP deflator for the economy in 2013 is 102.4, the unit price of Y in 2012 is closest to:【单选题】

A.10.8.

B.11.2.

C.11.5.

正确答案:B

答案解析: Section 2.1.2

Section 2.1.2

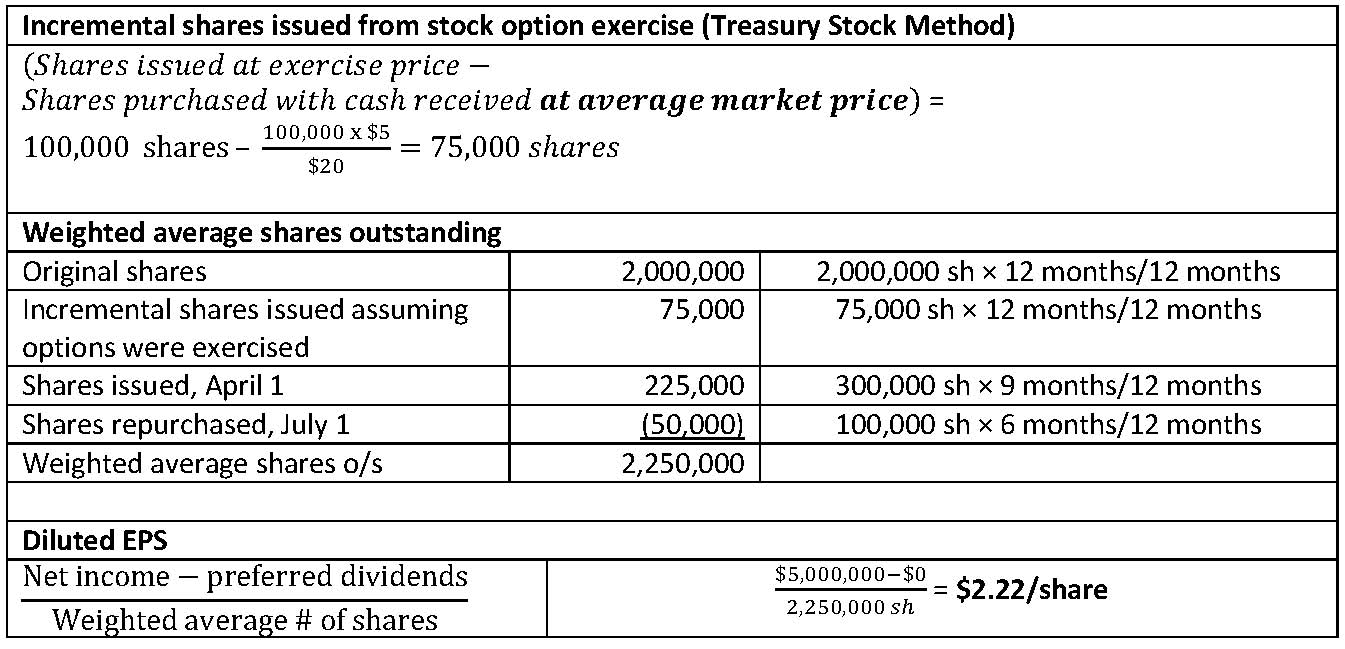

5、The following relates to a company’s common equity over the course of the year:If the company’s net income for the year is $5,000,000, its diluted EPS is closest to:【单选题】

A.$2.17.

B.$2.20.

C.$2.22.

正确答案:C

答案解析:“Understanding Income Statements,” Elaine Henry, CFA and Thomas R. Robinson, CFA

6、Information about three stocks is provided below:If the expected market return is 9.5% and the average risk-free rate is 1.2%, according to the capital asset pricing model (CAPM) and the security market line (SML), which of the three stocks is most likely overvalued?【单选题】

A.Heisen Inc.

B.Booraem Inc.

C.Gutmann Inc.

正确答案:B

答案解析:“Portfolio Risk and Return Part II,” Vijay Singal0.1365 = 0.012 + 1.5(0.095 – 0.012).

7、An analyst does research about difference between forward market and futuremarket.Compared with contracts in the forward market, contracts in the futuresmarket are least likely to be appropriately described as transactions that are:【单选题】

A.public.

B.customized according to the counterparts' requests.

C.based on an agreement to buy or sell an underlying asset at a future date at aprice agreed on today.

正确答案:B

答案解析:期货市场是公开交易标准化的远期合约的,它与远期市场一样,都是约定在未来的某个时点按约定的价格买卖一项资产,但是期货市场是不能像远期市场那样,根据交易对手的要求来进行定制化。

8、An analyst does research about options.A series of interest rate call options expiringon different dates but having the same exercise rate is best characterized as【单选题】

A.zero-cost collar.

B.interest rate cap.

C.interest rate floor.

正确答案:B

答案解析:一系列有相同执行价和不同到期日的利率看跌期权构成的是利率底(interest ratefloor),而一系列利率看涨期权可被看作利率顶(interest rate cap)。

9、An analyst does research about characteristic of Exchange Trade Fund.Which ofthe following statements is least accurate? Exchange Trade Fund (ETF) :【单选题】

A.may have large bid-ask spreads.

B.can be sold or brought on margin.

C.have lower exposure to capital gains tax distribution than traditional mutualfund.

正确答案:A

答案解析:ETF基金可以被卖空或进行保证金交易,由于被动管理费用低,买卖价差比较小,资本利得税也比较少,所以选项B和c都是正确的,选项A是错误的。

10、An analyst does research about relationship between duration and actual price.An option-free bond having the duration of 8, if yields decrease by 100 basispoint, the actual price of the bond will:【单选题】

A.increase by more than 8%.

B.increase by less than 8%.

C.decrease by more than 8%.

正确答案:A

答案解析:相比较于仅仅采用久期所计算的价格变化,债券的真实价格变化是“当利率下降时涨得快,当利率上升时跌得慢”。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料