下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、Alexandra Zagoreos, CFA, is the head of a government pension plan. Whenever Zagoreos hires a money management firm to work with the pension plan, she finalizes the deal over dinner at a nice restaurant. At these meals, Zagoreos also arranges for the money manager to provide her payments equal to 10% of the management fee the manager receives from the pension plan. Zagoreos keeps half of the payments for her own use and distributes the remainder as cash incentives to a handful of her most trusted staff. Zagoreos least likely violated which of the following CFA Institute Code of Ethics and Standards of Professional Conduct?【单选题】

A.Referral fees.

B.Loyalty, Prudence and Care.

C.Additional Compensation Arrangements.

正确答案:A

答案解析:"Guidance for Standards I-VII,” CFA InstituteA is correct as the money should not be accepted without receiving written consent from all parties involved, therefore Zagoreos is in violation of Standard IV (B) Additional Compensation Arrangements. However, there is no indication that the member has received compensation, consideration, or benefit received from, or paid to, others for the recommendation of products or services and therefore has not violated Standard VI (6) related to referral fees.

2、A subset of a population is best described as a:【单选题】

A.sample.

B.statistic.

C.conditional distribution.

正确答案:A

答案解析:“Statistical Concepts and Market Returns,” Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E. RunkleA is correct. A sample is a subset of a population.

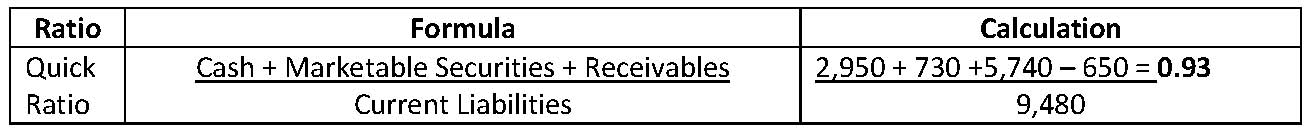

3、A company’s balance sheet shows the following:The company’s quick ratio is closest to:【单选题】

A.0.4.

B.0.9.

C.1.3.

正确答案:B

答案解析:"Understanding The Balance Sheet,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

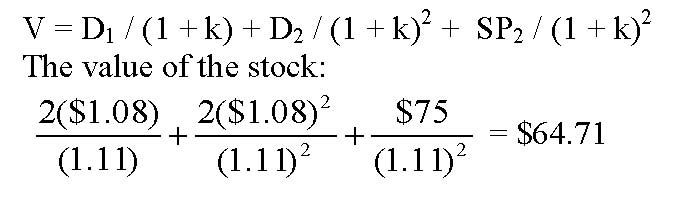

4、A company earned $3 a share last year and just paid a dividend of $2 a share. Thewilling to pay for this company’s stock (in $) today is closest to:【单选题】

A.58.68.

B.64.71.

C.66.63.

正确答案:B

答案解析:“An Introduction to Security Valuation,” Frank K. Reilly, CFA and Keith C.

5、A fund manager is compensated with a base management fee plus an incentive fee proportional to the fund’s return above a benchmark. This best describes the fee structure of:【单选题】

A.a hedge fund.

B.a mutual fund.

C.an exchange traded fund.

正确答案:A

答案解析:“Alternative Investments”, Global Investments, Sixth Edition, by Bruno Solnik and Dennis McLeavey, CFAA is correct. A hedge fund manager is compensated through a base management fee based on the value of the assets under management plus an incentive fee proportional to the fund’s return above a benchmark.

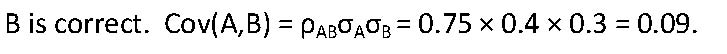

6、The correlation between the historical returns of Stock A and Stock B is 0.75. If the variance of Stock A is 0.16 and the variance of Stock B is 0.09, the covariance of returns of Stock A and Stock B is closest to:【单选题】

A.0.01.

B.0.09.

C.0.16.

正确答案:B

答案解析:“Portfolio Risk and Return: Part I”, Vijay Singal, CFA

7、The joint probability of returns, for securities A and B, are as follows: Joint Probability Function of Security A and Security B Returns (Entries Are Joint Probabilities)The covariance of the returns between Securities A and B is closest to:【单选题】

A.13.

B.14.

C.12.

正确答案:C

答案解析:First calculate the expected returns on Securities A and B with the followingformula:Then calculate the covariance of returns between securities A and B with the following formula2014 CFA Level I“Probability Concepts,” by Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E. RunkleSection 3

8、Under U.S.GAAP, loans made to others are most likely classified in the cashflow statement as:【单选题】

A.an investing activity.

B.a financing activity.

C.an operating activity.

正确答案:A

答案解析:若在U.S.GAAP下,企业给予其他人的贷款在现金流量表上被作为投资性活动。

9、According to put-call parity, if a fiduciary call expires in the money, the payoff is most likely equal tothe:【单选题】

A.market value of the asset.

B.face value of the risk-free bond.

C.difference between the market value of the asset and the face value of the risk-free bond.

正确答案:A

答案解析:A fiduciary call, defined as a long position in a call and in a risk-free bond, generates a payoff that isequal to the market value of the asset if it expires in the money.Section 4.1.9

10、An analyst does research about security market line (SML).With respect tothe security market line, if an investor's estimated return is below the SML, asecurity is most likely:【单选题】

A.overvalued.

B.correctly valued.

C.undervalued.

正确答案:A

答案解析:如果预期回报低于由资本市场定价理论(CAPM)决定的必要回报,那么该证券会在SML线下面,表明该证券价格被高估了。

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料