下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、In countries where new local laws relating to calculation and presentation of investment performance conflict with GIPS standards, firms who have claimed GIPS compliance should most likely:【单选题】

A.stop claiming GIPS compliance.

B.follow local laws, continue to claim GIPS compliance, and disclose conflicts.

C.continue to claim GIPS compliance, disclosing non-compliance with new laws.

正确答案:B

答案解析:“Global Investment Performance Standards (GIPS),” CFA Institute2012 Modular Level I, Vol. 1, p. 180Study Session 2-4-cExplain how the GIPS standards are implemented in countries with existing standards for performance reporting, and describe the appropriate response when the GIPS standards and local regulations conflict.B is correct because where local laws and regulations regarding calculation and presentation conflict with GIPS standards, firms must abide by the local laws and regulations. They are still allowed to claim GIPS compliance but must disclose areas where the local requirements conflict with those of the GIPS standards.

2、Li Chen is a CFA candidate and an equity research analyst at an independent research firm. She is contacted by Granite Technologies, Inc., to write an issuer-paid research report on the company to increase awareness of Granite's stock within the investment community. Which statement best represents how Chen should respond to this assignment request? She should:【单选题】

A.negotiate a flat fee and disclose this relationship in her report.

B.accept long-term warrants on Granite's stock in lieu of any cash compensation.

C.decline to write the report because doing so would compromise her independence.

正确答案:A

答案解析:If Chen negotiates a flat fee, her independence and objectivity would not be questioned because her fee would not be based on the results of her research. In addition, by fully disclosing the relationship in her report, she allows the reader to determine whether her judgment is compromised. As a result, Chen is maintaining compliance with Standard I(B)-Independence and Objectivity. 2014 CFA Level I "Guidance for Standards I-VII," CFA Institute Standard I(B)

3、Amanda Covington, CFA, works for McJan Investment Management. McJan employees must receive prior clearance of their personal investments in accordance with McJan’s compliance procedures. To obtain prior clearance, McJan employees must provide a written request identifying the security, the quantity of the security to be purchased, and the name of the broker through which the transaction will be made. Precleared transactions are approved only for that trading day. As indicated below, Covington received prior clearance.Two days after she received prior clearance, the price of Stock B decreased, so Covington decided to purchase 250 shares of Stock B only. In her decision to purchase 250 shares of Stock B only, did Covington violate any CFA Institute Standards of Professional Conduct?【单选题】

A.Yes, relating to diligence and reasonable basis

B.No

C.Yes, relating to her employer's complicance procedures

正确答案:C

答案解析:Prior-clearance processes guard against potential and actual conflicts of interest; members are required to abide by their employe's compliance procedures. (See Standard VI(B)). 2014 CFA Level I "Guidance for Standards I-VII," CFA Institute Standard V(A), Standard VI(B)

4、Which of the following sources of short-term financing is most likely used by smaller companies?【单选题】

A.Uncommitted lines

B.Collateralized loans

C.Commercial paper

正确答案:B

答案解析:Smaller companies use collateralized loans, factoring, or loans from non-bank companies as their sources of short-term financing. Larger companies can take advantage of commercial paper, banker's acceptances, uncommitted lines, and revolving credit agreements.Section 8.1-8.2

5、An analyst has compiled the following information on a company:The amount of dividends declared (£ ‘000s) during the year is closest to:【单选题】

A.150.

B.300.

C.650.

正确答案:C

答案解析:“Financial Reporting Mechanics,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Karen O’Connor Rubsam, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

6、An analyst collects the following set of 10 returns from the past:The geometric mean return is closest to:【单选题】

A.10.89%.

B.9.62%.

C.10.80%.

正确答案:C

答案解析:The geometric mean return is calculated as the Tth root of the product of T terms, where the terms are one plus the returns and T is the number of returns. After taking the Tth root, subtract one:where RG is the geometric mean return,T is the number of returns, and2014 CFA Level I“Statistical Concepts and Market Returns,” by Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E. RunkleSection 5.4

7、Jagdish Teja, CFA, is a buy-side analyst covering the furniture industry in alarge investment management firm.She is invited to attend a conference callmeeting with the top executives of a large furniture manufacturing company andfour buy-side analysts.During the meeting, the CEO mentions that they havejust calculated the company's earnings for the past quarter and they have unexpectedlyand significantly dropped.The CFO adds that this drop will not be releasedto the public until next week.According to the Standards of PracticeHandbook, Tejas' most appropriate initial course of action would be to:【单选题】

A.encourage the company to make the information public as soon as possible.

B.disclose the information to her firm's compliance department personnel.

C.disclose the information to five equally important sell-side analysts so thatthe information is distributed in an equitable manner.

正确答案:A

答案解析:当知道重大非公开信息时,首先应该鼓励公司尽快将此信息公开,如果公开信息未能取得成功,可以将此信息告知公司法律或者合规部门以决定如何处理,这是推荐的做法,但在这里并不是最合适的。

8、The following sample of 10 items is selected from a population. The population variance is unknown.The standard error of the sample mean is closest to:【单选题】

A.10.84.

B.3.43.

C.3.60.

正确答案:B

答案解析:When the population variance is unknown, the standard error of the sample mean is calculated as:The standard error of the sample mean is therefore CFA Level I"Sampling and Estimation," Richard A. DeFusco, Dennis W. McLeavey, Jerald E. Pinto, and David E.RunkleSection 3.1

9、Jack Smith, CFA, manages the Heaven Foundation Portfolio and does researchabout yield calculation.Which of the following yields considers an annualizedrate of return that accounts for the impact of interest on interest for differentfrequencies of compounding?【单选题】

A.Holding period yield.

B.Effective annual yield.

C.Money market yield.

正确答案:B

答案解析:有效年利率(Effective annual yield)是指考虑利息的再投资收益,且假设年天数为365天的年化收益率。持有期收益率(Holding period yield)是指只考虑在持有期限内的收益率,不考虑利息的再投资收益。货币市场收益率(Money market yield)是指假设年天数为360天的年化的持有期收益率,但不考虑利息的再投资收益。

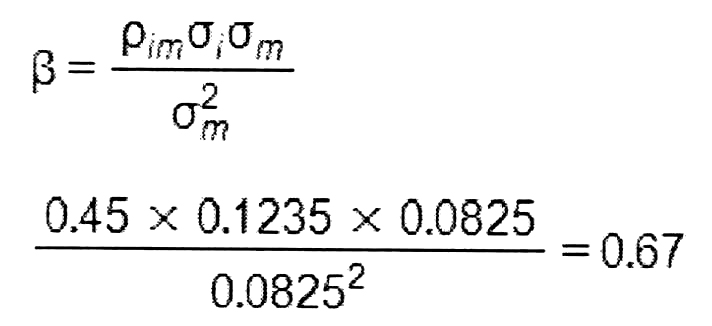

10、A stock has a correlation of 0.45 with the market and a standard deviation of returns of 12.35%. Ifthe market has a standard deviation of returns of 8.25%, then the beta of the stock is closest to:【单选题】

A.0.67.

B.1.50.

C.0.30.

正确答案:A

答案解析: Section 3.2.4

Section 3.2.4

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料