下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2019年CFA考试《CFA一级》考试共240题,分为单选题。小编为您整理精选模拟习题10道,附答案解析,供您考前自测提升!

1、Which of the following is least likely to be a valid function/characteristic of money? Money:【单选题】

A.acts as a unit of account.

B.provides a means of payment.

C.requires a double coincidence of wants.

正确答案:C

答案解析:“Money, the Price Level, and Inflation,” Michael ParkinThe functions of money include being a means of payment, acting as a medium of exchange, acting as a unit of account, and acting as a store of value. It does not require a double coincidence of wants, as barter does.

2、A local laundry and dry cleaner collects the following data on its workforce productivity. Workers always work in teams of two, and the laundry earns $3.00 of revenue for each shirt laundered.The marginal revenue product ($ per worker) for hiring the fifth and sixth workers is closest to:【单选题】

A.14.

B.21.

C.42.

正确答案:B

答案解析:“Demand and Supply Analysis: The Firm,” Gary L. Arbogast and Richard V. EastinIn this problem, the marginal product of hiring the 5th and 6th workers (ΔL = 2) is 14 shirts per hour/2 workers = 7 shirts per hour/worker. With each shirt resulting in $3 of revenue, the MRP is 7 shirts per hour/worker × $3/shirt = $21 per worker.

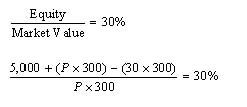

3、An investor opens a margin account with an initial deposit of $5,000. He then purchases 300 shares of a stock at $30 each on margin, and his account requires a maintenance margin of 30%. Ignoring commissions and interest, the price at which the investor will receive a margin call is closest to:【单选题】

A.$23.08.

B.$19.05.

C.$23.81.

正确答案:B

答案解析: Section 5.2

Section 5.2

4、A bond with a par value of $100 matures in 10 years with a coupon of 4.5%, paid semiannually; is priced to yield 5.83%; and has a modified duration of 7.81. If the yield of the bond declines by 0.25%, the approximate percentage price change for the bond is closest to:【单选题】

A.0.98%.

B.1.95%.

C.3.91%.

正确答案:B

答案解析:“Introduction to the Measurement of Interest Rate Risk,” Frank J. Fabozzi, CFAB is correct. Approximate percentage price change = –(7.81 × (–0.0025)) = 0.01953 or 1.95%.

5、Relative to traditional investments, alternative investments are best characterized as having:【单选题】

A.greater liquidity.

B.higher correlations.

C.more unique legal and tax considerations.

正确答案:C

答案解析:“Introduction to Alternative Investments”, Terri Duhon, George Spentzos, CFA, and Scott D. Stewart, CFAC is correct because alternative investments are more likely characterized as having unique legal and tax considerations because of the broad range and complexity of the investments.

6、James Woods, CFA, is a portfolio manager at ABC Securities. Woods has reasonable grounds tobelieve his colleague, Sandra Clarke, a CFA Level II candidate, is engaged in unethical tradingactivities that may also be in violation of local securities laws. Woods is not Clarke's supervisor, andher activities do not impact Woods or any of the portfolios for which he is responsible. Based on theCode and Standards, the recommended course of action is for Woods to:【单选题】

A.report Sandra Clarke to ABC's trading supervisor or compliance department,

B.not take any action because he is not directly involved.

C.report Sandra Clarke to the appropriate governmental or regulatory organization.

正确答案:A

答案解析:Under Standard 1(A) in situations where a member or candidate is aware of employer engagement inunethical or illegal activity, it is recommended that they attempt to stop the behavior by bringing it tothe attention of a supervisor or the firm's compliance department.Standard I(A)

7、A portfolio manager estimates the probabilities of the following events for a mutual fund:The least appropriate description of the events is that they are:【单选题】

A.dependent.

B.exhaustive.

C.mutually exclusive.

正确答案:B

答案解析:Events are exhaustive when they cover all possible outcomes. Mutually exclusive means that onlyone event can occur at a time. Two events are dependent if the occurrence of one event does affectthe probability of occurrence of the other event. In this situation, Event A and B are both mutuallyexclusive (because they cannot occur at the same time) and dependent (because if one event occurs,the probability of the other becomes zero). However, the two events are not exhaustive because theydo not cover the event that the fund will earn a return above 5%.Section 2

8、An analyst does capital budgeting about two independent projects.If the investor's required rate of return is 12%, which project should most likelybe accepted?【单选题】

A.Project 1.

B.Project 2.

C.Project 1 and Project 2.

正确答案:C

答案解析:对于单个项目,根据NPV和IRR会得出相同的决策。对于相互独立项目(independentprojects),只要NPV >0,就可以接受该项目;但如果NPV 0的项目中选择NPV最大的项目;当IRR与NPV对作决策有冲突时,以NPV为准,因为NPV越大,越能增加股东的权益。

9、An analyst does research about difference between forward market and futuremarket.Compared with contracts in the forward market, contracts in the futuresmarket are least likely to be appropriately described as transactions that are:【单选题】

A.public.

B.customized according to the counterparts' requests.

C.based on an agreement to buy or sell an underlying asset at a future date at aprice agreed on today.

正确答案:B

答案解析:期货市场是公开交易标准化的远期合约的,它与远期市场一样,都是约定在未来的某个时点按约定的价格买卖一项资产,但是期货市场是不能像远期市场那样,根据交易对手的要求来进行定制化。

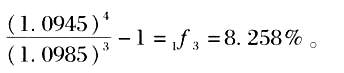

10、An analyst does research about spot and forward rate.The 4-year spot rate is 9.45%, and the 3-year spot rate is 9.85%.What is the 1-year forward rate 3years from today?【单选题】

A.8.3%

B.8.7%

C.9.4%

正确答案:A

答案解析:

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料