下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

备考CFA考试,一定要多刷题,多练习。2022年CFA考试《CFA一级》考试共240题,以下是帮考网为您准备的练习题,附答案解析,供您备考练习。

1、A commodity market is in contango when futures prices are:【单选题】

A.lower than the spot price.

B.higher than the spot price.

C.the same as the spot price.

正确答案:B

答案解析:“Investing in Commodities”, Global Perspectives on Investment Management: Learning from the Leaders, edited by Rodney N. Sullivan, CFA

2011 Modular Level I, Volume 6, pp. 262

Study Session 18-75-a

Explain the relationship between spot prices and expected future prices in terms of contango and backwardation.

B is correct. When a commodity market is in contango, futures prices are higher than the spot price because market participants believe the spot price will be higher in the future.

2、When analyzing the value of a single normally distributed populations variance,the most appropriate test is a(n) :【单选题】

A.chi-squared test.

B.paired comparison test.

C.F-test.

正确答案:A

答案解析:检验单个总体方差是否等于某个数值用开方检验。检验两个正态分布的总体方差是否相等用F检验。检验两个非独立总体的均值之差用配对检验。

3、The behavioral bias in which investors tend to avoid realizing losses but rather seek to realize gains is best described as:【单选题】

A.mental accounting.

B.the disposition effect.

C.the gambler’s fallacy.

正确答案:B

答案解析:Behavioral biases in which investors tend to avoid realizing losses but, rather, seek to realize gains is the disposition effect.

2014 CFA Level I

“Market Efficiency,” by W. Sean Cleary, Howard J. Atkinson, and Pamela Peterson Drake

Section 5.3

4、An analyst does researchabout lease.When compared to a leasor, which of thefollowing is most appropriate adjustment to the balance sheet of a leasee?【单选题】

A.increasing assets and liabilities by the sum of future lease payments.

B.increasing assets and liabilities by the present value of future leased payments.

C.decreasing assets and liabilities by the present value of future leased payments.

正确答案:B

答案解析:对于经营性租赁(operating lease):资产负债表没有变化,直接产生租赁费用。对于资本性租赁(capital lease):在租期一开始,在资产负债表上的长期资产和负债中分别加上未来租金的现值。

5、The liquidity premium can be best described as compensation to investors forthe:【单选题】

A.risk of loss relative to an investment’s fair value if the investment needs to be converted to cash quickly.

B.increased sensitivity of the market value of debt to a change in market interest rates as maturity is extended.

C.possibility that the borrower will fail to make a promised payment at the contracted time and in the contracted amount.

正确答案:A

答案解析:“The Time Value of Money,” Richard A. DeFusco, CFA, Dennis W. McLeavey, CFA, Jerald E. Pinto, CFA, and David E. Runkle, CFA

2013 Modular Level I, Vol. 1, Reading 5, Section 2

Study Session 2–5–b

Explain an interest rate as the sum of a real risk-free rate and premiums that compensate investors forbearing distinct types of risk.

A is correct. “The liquidity premium compensates investors forthe risk of loss relative to an investment’s fair value if the investment needs to be converted to cash quickly.”

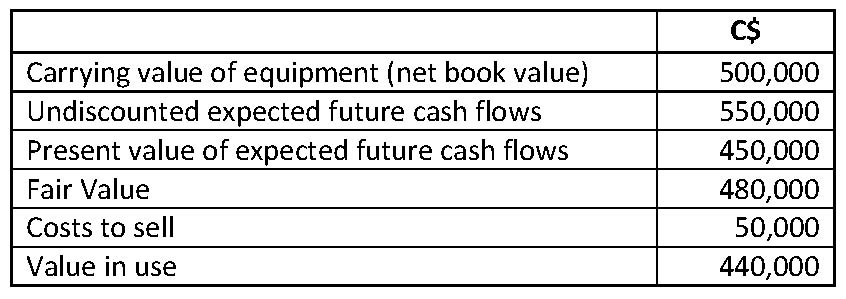

6、A Canadian printing company which prepares its financial statements according to IFRS has experienced a decline in the demand forits products. The following information relates to the company’s printing equipment as of 31 December 2010.

The impairment loss (in C$) is closest to:【单选题】

A.0.

B.60,000.

C.70,000.

正确答案:B

答案解析:"Long-lived Assets,” Elaine Henry, CFA, and Elizabeth A. Gordon

2011 Modular Level I, Vol.3, pp.434-436

Study Session: 9-37-h

Discuss the impairment of property, plant, and equipment, and intangible assets.

Under IFRS, an assetis considered to be impaired when its carrying amount exceeds its recoverable amount (the higher of fair value less cost to sell orvalue in use).

Fair value less costs to sell: 480,000 – 50,000 = 430,000

Value in use = 440,000

Recoverable amount (higher value) = 440,000

Impairment loss under IFRS = Carrying value – recoverable amount = 500,000 – 440,000 = 60,000

7、Assume that the nominal spot exchange rate (USD/EUR) increases by 7.5%, the eurozone price level decreases by 4%, and the U.S. price level increases by 2.5%. The change in the real exchange rate (%) is closest to:【单选题】

A.14.8%.

B.0.7%.

C.–6.3%.

正确答案:B

答案解析:Real exchange rate = Nominal spot exchange rate × CPI of the foreign country / CPI of the domestic country

Change in the real exchange rate = [(1 + change in exchange rate) × (1 + change in price level in foreign country)] / (1 + Change in price level in domestic country) –1

2014 CFA Level I

“Currency Exchange Rates,” by William A. Barker, Paul D. McNelis, and Jerry Nickelsburg

Section 2

8、Consider two countries, A and B. Country A is a closed country with a relative abundance of laborand holds a comparative advantage in the production of textiles. Country B has a relative abundance of capital. When the textile trade is opened between the two countries, Country A will most likely experience a favorable impact on:【单选题】

A.labor.

B.capital.

C.both capital and labor.

正确答案:A

答案解析:“International Trade and Capital Flows,” Usha Nair-Reichert and Daniel Robert Witschi

2012 Modular Level I, Vol. 2, pp. 450–452

Study Session 6-20-b, c, d

Distinguish between comparative advantage and absolute advantage.

Explain the Ricardian and Heckscher–Ohlin models of trade and the source(s) of comparative advantage in each model.

Compare types of trade and capital restrictions and their economic implications.A is correct. As a country opens up to trade, the benefit accrues to the abundant factor, which is laborin Country A.

9、The least likely way to terminate a swap is to:【单选题】

A.purchase and exercise a swaption.

B.pay the market value to the counterparty.

C.sell an offsetting swap listed on an exchange.

正确答案:C

答案解析:“Swap Markets and Contracts,” Don M. Chance

2011 Modular Level I, Vol. 6, pp. 133–134

Study Session 17-64-a

Describe the characteristics of swap contracts, and explain how swaps are terminated.

C is correct because swaps are not listed on an exchange.

10、An analyst does research aboutembedded options.Which of the following embeddedoptions is least likely to increase in value when interest rates increase?【单选题】

A.The right toput an issue.

B.The cap on a floater.

C.An accelerated sinking fund provision.

正确答案:C

答案解析:由于利率上升,对于浮动利率债券的利率顶的价值上升,因为更有可能超过其所设定的利率顶,而超过利率顶时,购买者就能得到报偿。由于利率上升,可回售债券价格下跌,被回售的可能性增加了,所以回售债券的权利增加价值了。加速沉没资金条款是公司可以选择提前偿还全部或部分本金,在利率下跌的情况下,该条款更有价值,因为可以更低成本进行融资,所以在利率上升的情况下,该权利减少价值。

希望以上练习题对您的复习有所帮助,帮考网祝您考试成功!

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料