下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2022年CFA考试《CFA一级》试题共240题,均为单选题。帮考网为大家整理了Fixed Income Investments5道练习题,附答案解析,供各位小伙伴备考练习。

1、An analyst does research about moneyness of stock options.With respect to stockoptions, the potential foran infinite loss exists foran investorwho:【单选题】

A.sells a put option.

B.buys a put option.

C.sells a call option.

正确答案:C

答案解析:卖出一个看涨期权,从理论上来讲,当股票价格上升无穷大时,该卖方的损失也会无穷大;而卖出一个看跌期权,因为股票价格最低也就跌到零,所以该卖方的损失是有限的。对于看涨期权和看跌期权的买方来讲,当不考虑期权成本时,不会发生亏损。

2、An investorpurchases 10 futures contracts priced at $100 each. The initial margin is $20 per contract and the maintenance margin requirement is $10 per contract. The investorwill most likely be required to post variation margin if the end-of-day prices over the next three days are:【单选题】

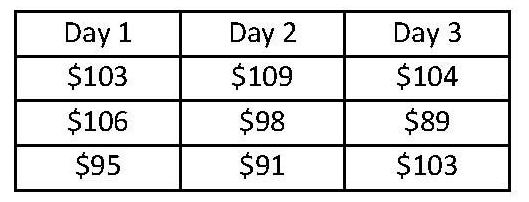

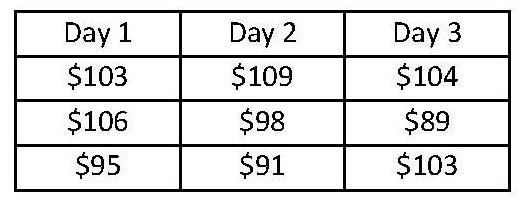

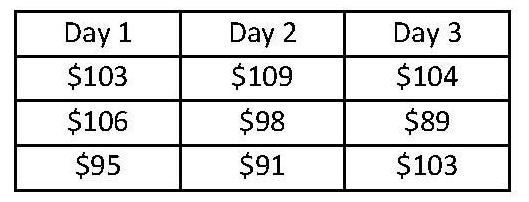

A.

正确答案:B

答案解析:“Derivative Markets and Instruments,” Don M. Chance

2011 Modular Level I, Vol. 6, pp 55-59

Study Session 17-70-d

Describe price limits and the process of marking to market, and calculate and interpret the margin balance, given the previous day’s balance and the change in the futures price.

B is correct. $110 of variation margin is required since the $90 margin balance after Day 3 is below the $100 maintenance margin. The $110 variation margin will re-establish the $200 initial margin.

The calculation is below:

Day 1 activity: $260 closing margin balance results from $200 initial margin plus $60 gain ($6 increase X 10 contracts)

Day 2 activity: $180 closing margin balance results from $260 opening margin balance minus $80 loss ($8 decline X 10 contracts)

Day 3 activity: $90 closing margin balance results from $180 opening margin balance minus $90 loss ($9 decline X 10 contracts)

3、The intrinsic value of an option is always zero:【单选题】

A.at expiration.

B.when its time value is zero.

C.when it is out-of-the-money.

正确答案:C

答案解析:“Option Markets and Contracts,” Don M. Chance

2011 Modular Level I, Vol. 6, pp. 98–100

Study Session 17-63-i

Define intrinsic value and time value, and explain their relationship.

C is correct because an out-of-the-money option will have an intrinsic value of zero at all times.

4、An analyst does research about difference between forward market and futuremarket.Compared with contracts in the forward market, contracts in the futuresmarket are least likely to be appropriately described as transactions that are:【单选题】

A.public.

B.customized according to the counterparts//////////////\\' requests.

C.based on an agreement to buy orsell an underlying assetat a future date at aprice agreed on today.

正确答案:B

答案解析:期货市场是公开交易标准化的远期合约的,它与远期市场一样,都是约定在未来的某个时点按约定的价格买卖一项资产,但是期货市场是不能像远期市场那样,根据交易对手的要求来进行定制化。

5、When purchasing a futures contract, the initial margin requirement refers to the:【单选题】

A.minimum account balance required as prices change.

B.performance bond ensuring fulfillment of the obligation.

C.amount needed to finance the purchase of the underlying asset.

正确答案:B

答案解析:“Futures Markets and Contracts,” Don M. Chance

2011 Modular Level I, Vol. 6, pp. 55–56

Study Session 17-62-c

Distinguish between margin in the securities markets and margin in the futures markets, and explain the role of initial margin, maintenance margin, variation margin, and settlement in futures trading.

B is correct because the initial margin required is a good faith deposit orperformance bond.

以上就是本次帮考网为大家带来的全部内容,如果大家还有不清楚的,请持续关注帮考网,我们将继续为大家答疑解惑,并带来更多有价值的考试资讯!

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料