下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2022年CFA考试《CFA一级》试题共240题,均为单选题。帮考网为大家整理了Fixed Income Investments5道练习题,附答案解析,供各位小伙伴备考练习。

1、A 5-year floating-rate security was issued on January 1, 2006. The coupon rate formula was 1-year LIBor+ 300 bps with a cap of 10% and a floorof 5% and annual reset. The 1-year LIBorrate on January 1st of each year of the security’s life is provided in the following table:

During 2010, the payments owed by the issuer were based on a coupon rate closest to:【单选题】

A.4.5%.

B.5.0%.

C.6.5%.

正确答案:B

答案解析:“Features of Debt Securities,” Frank J. Fabozzi, CFA

2011 Modular Level I, Vol. 5, p. 326-328

Study Session 15-61-b

Describe the basic features of a bond, the various coupon rate structures, and the structure of floating-rate securities.

B is correct because LIBor+ 300 bps at the resetdate equals 1.5% + 3.00% = 4.5%, which is below the floorof 5.00% so the coupon rate will be equal to the floor.

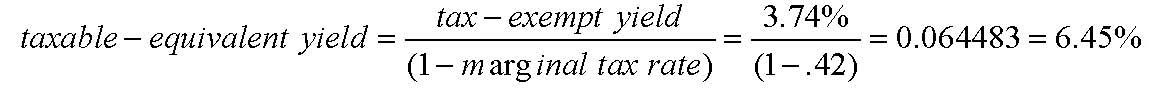

2、An investorwho has a 42% marginal tax rate is analyzing a tax-exempt bond that offers a yield of 3.74%. The taxable-equivalent yield of the bond is closest to:【单选题】

A.5.31%.

B.6.45%.

C.8.90%.

正确答案:B

答案解析:“Understanding Yield Spreads,” Frank J. Fabozzi, CFA

2011 Modular Level I, Vol. 5, pp. 464-465

Study Session 15-64-i

Calculate the after-tax yield of a taxable security and the tax-equivalent yield of a tax-exempt security.

B is correct because the tax-equivalent yield of a tax-exempt security is

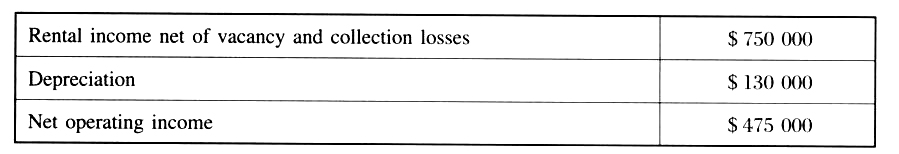

3、An analyst does research about real estate investment and gathered the followingannual information about a real estate investment:

If the property above is valued at $3 925 000 based on the income approach, thecapitalization rate is closest to:【单选题】

A.8.8%

B.12.1%

C.15.8%

正确答案:B

答案解析:在收入法之下,appraisal price = NOI/market cap rate,因而有:

$3 925 000 = $475 000/market cap rate,得出market capitalization rate = 12.1%.

4、Duration is most accurate as a measure of interest rate risk fora bond portfolio when the slope of the yield curve:【单选题】

A.increases.

B.decreases.

C.stays the same.

正确答案:C

答案解析:“Risks Associated with Investing in Bonds,” Frank J. Fabozzi

2012 Modular Level I, Vol. 5, pp. 359–363

Study Session 15-54-g

Describe yield-curve risk, and explain why duration does not account foryield-curve risk.

C is correct because duration measures the change in the price of a portfolio of bonds if the yields forall maturities change by the same amount; that is, it assumes the slope of the yield curve stays the same.

5、An analyst does research about tax-exempt bonds.An investorwith 28% marginaltax rate purchase a tax-exempt bond yielding 3.5%.The investor//////////////\\'s taxequivalentyield is closest to:【单选题】

A.2.52%

B.4.86%

C.12.50%

正确答案:B

答案解析:设税收等同收益率(tax-equivalent yield)为 X,则 X × (1 - 28% ) = 3.5%,算出 X =4.86%。

以上就是本次帮考网为大家带来的全部内容,如果大家还有不清楚的,请持续关注帮考网,我们将继续为大家答疑解惑,并带来更多有价值的考试资讯!

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料