下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2022年CFA考试《CFA二级》考试共240题,分为单选题。很多备考CFA考试的考生可能对于题型不是很清楚,在学习备考时比较茫然,今天帮考网给大家带来了模拟习题10道,附答案解析,赶紧来看看:

1、If the US dollar were chosen as the functional currency forAcceletron in 2007, Redline could reduce its balance sheet exposure to exchange rates by:【单选题】

A.selling SGD30 million of fixed assets forcash.

B.issuing SGD30 million of long-term debt to buy fixed assets.

C.issuing SGD30 million in short-term debt to purchase marketable securities.

正确答案:A

答案解析:A is correct. If the US dollar is the functional currency, the temporal method must be used, and the balance sheet exposure will be the net monetary assets of 125 + 230 – 185 – 200 = –30, ora net monetary liability of SGD30 million. This net monetary liability would be eliminated if fixed assets (non-monetary) were sold to increase cash. Issuing debt, either short-term orlong-term, would increase the net monetary liability.

2、In relation to Kostecka’s handling of the Jabbertalk stock recommendation, which of the following CFA Institute Standards of Professional Conduct did he least likely violate?【单选题】

A.Priority of Transactions

B.Fair Dealing

C.Communication with Clients

正确答案:B

答案解析:B is correct. Standard III(B)–Fair Dealing requires members and candidates to deal fairly and objectively with all clients when providing investment analysis, making investment recommendations, taking investment action, orengaging in other professional activities. When Kostecka informs clients of the upcoming investment recommendation by Forkson, he has treated all clients fairly because this disclosure is provided to all of his current clients.A is incorrect because Kostecka has violated Standard VI(B)–Priority of Transactions. There is a potential conflict of interest because the client and the adviser hold the same stock, so the client should be given first priority to trade Jabbertalk.C is incorrect because according to Standard V(B)–Communication with Clients and Prospective Clients, Kostecka should have distinguished fact from opinion. In addition, Kostecka should also disclose to clients and prospective clients the basic format and general principles of the investment processes used to analyze investments, selectsecurities, and construct portfolios and must promptly disclose any changes that might materially affect those processes and use reasonable judgment in identifying which factors are important to his investment analyses, recommendations, oractions and include those factors in communications with clients and prospective clients.

3、Zhang////////////\'s statement to support using the harmonic mean is best described as:【单选题】

A.incorrect with respect to large outliers.

B.incorrect with respect to small outliners.

C.correct.

正确答案:B

答案解析:B is correct. Zhang’s statement is incorrect with respect to small outliers. The harmonic mean tends to mitigate the impact of large outliers. It may aggravate the impact of small outliers, but such outliers are bounded by zero on the downside.A is incorrect. The harmonic mean may aggravate the impact of small outliers, but such outliers are bounded by zero on the downside.C is incorrect. The harmonic mean may aggravate the impact of small outliers, but such outliers are bounded by zero on the downside.

4、Based on the mean-reverting level implied by the AR(1) model regression output in Exhibit 1, the forecasted oil price forSeptember 2015 is most likely to be:【单选题】

A.

4、Is Dua most likely correct with regard to the factors that drive demand fordifferent commercial real estate property types? 【单选题】

A.No, he is incorrect about retail space.

B.Yes.

C.No, he is incorrect about industrial and warehouse space.

正确答案:A

答案解析:A is correct. Dua is correct about factors that drive demand foroffice space and industrial and warehouse space but incorrect about retail space. Employment growth drives demand foroffice space, while warehouse space demand depends broadly on economic strength. The level of import and export activity is more directly related to demand forindustrial and warehouse space, not retail space. Demand forretail space depends on consumer spending, job growth, and economic strength.B is incorrect. Dua is correct about factors that drive demand foroffice space and industrial and warehouse space but incorrect about retail space.C is incorrect. Dua is correct about factors that drive demand forand industrial and warehouse space.

5、Bickchip’s cash-flow-based accruals ratio in 2009 is closest to:【单选题】

A.9.9%.

B.13.4%.

C.23.3%.

正确答案:A

答案解析:A is correct. The cash-flow-based accruals ratio = [ni – (cfo + cfi)]/(Average NOA) = [4,038 – (9,822 – 10,068)]/43,192 = 9.9%.

6、The fraction of SGC////////////\'s market price that is attributable to the value of growth is closest to:【单选题】

A.21%.

B.34%.

C.50%.

正确答案:B

答案解析:Using the Pastor-Stambaugh model to calculate SGC////////////\'s cost of equity:0.04 + (1.20 × 0.05) + (0.50 × 0.02) + (–0.20 × 0.04) + (0.20 × 0.045) =11.10%![]()

$28.45 = $18.74 + PVGOPVGO = $9.71PVGO/Price = $9.71/$28.45 = 34.13%

7、Based on Exhibit 2, the implied credit and liquidity risks as indicated by the historical three-year swap spreads forCountry B were the lowest:【单选题】

A.1 month ago.

B.6 months ago.

C.12 months ago.

正确答案:B

答案解析:B is correct. The historical three-year swap spread forCountry B was the lowest six months ago. Swap spread is defined as the spread paid by the fixed-rate payer of an interest rate swap over the rate of the “on the run” (most recently issued) government bond security with the same maturity as the swap. The lower (higher) the swap spread, the lower (higher) the return that investors require forcredit and/orliquidity risks.The fixed rate of the three-year fixed-for-floating Liborswap was 0.01% six months ago, and the three-year government bond yield was –0.08% six months ago. Thus the swap spread six months ago was 0.01% – (–0.08%) = 0.09%.One month ago, the fixed rate of the three-year fixed-for-floating Liborswap was 0.16%, and the three-year government bond yield was –0.10%. Thus the swap spread one month ago was 0.16% – (–0.10%) = 0.26%.Twelve months ago, the fixed rate of the three-year fixed-for-floating Liborswap was 0.71%, and the three-year government bond yield was –0.07%. Thus, the swap spread 12 months ago was 0.71% – (–0.07%) = 0.78%.

8、Using the data in Exhibit 2, the portfolio’s annual 1% parametric VaR is closest to:【单选题】

A.CAD 17 million.

B.CAD 31 million.

C.CAD 48 million.

正确答案:B

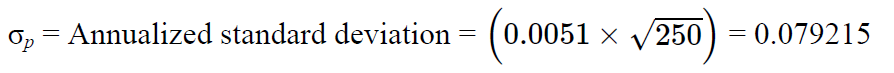

答案解析:B is correct. The VaR is derived as follows:VaR = [(e(rp) – 2.33σp)(–1)](Portfolio value)whereE(Rp) = Annualized daily return = (0.00026 × 250) = 0.065250 = Number of trading days annually2.33 = Number of standard deviations to attain 1% VaR Portfolio value = CAD 260,000,000VaR = –(0.065 – 0.184571) × CAD 260,000,000= CAD31,088,460

Portfolio value = CAD 260,000,000VaR = –(0.065 – 0.184571) × CAD 260,000,000= CAD31,088,460

9、Confabulated’s reported interest income would be lower if the cost was the same but the par value (in € thousands) of:【单选题】

A.Bugle was €28,000.

B.Cathay was €37,000.

C.Dumas was €55,000.

正确答案:B

答案解析:B is correct. The difference between historical cost and par value must be amortized under the effective interest method. If the par value is less than the initial cost (stated interest rate is greater than the effective rate), the interest income would be lower than the interest received because of amortization of the premium.

10、Is his response to Scahill’s question regarding the impact of changes in interest rate volatility on the OAS of callable and putable bonds, Morgan is most likely:【单选题】

A.incorrect about callable and putable bonds.

B.correct about callable bonds and incorrect about putable bonds.

C.correct about putable bonds and incorrect about callable bonds.

正确答案:A

答案解析:A is correct. Morgan’s response to Scahill is incorrect. As interest rate volatility declines, the embedded call option becomes cheaper; thus, the higher the arbitrage-free value (ormodel value) of the callable bond.Callable bond value = Value of straight bond – Value of call optionA higher value forthe callable bond means that a higher spread needs to be added to one-period forward rates to make the arbitrage-free bond value equal to the market price (i.e., the OAS is higher). Forputable bonds as interest rate volatility declines, the value of the put option declines as does the arbitrage-free value of the putable bond.Putable bond value = Value of straight bond + Value of put optionThis implies that a lower spread needs to be added to one-period forward rates to make the arbitrage free bond value equal to the market price. Thus, in this instance, the OAS is lower.B is incorrect. Morgan is correct about the impact on OAS forcallable bonds.C is incorrect. Morgan is correct about the impact on OAS forputable bonds.

以上是帮考网为大家带来的全部内容,关于更多的考试资讯可以关注帮考网,祝各位考生顺利通过考试!

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料