下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

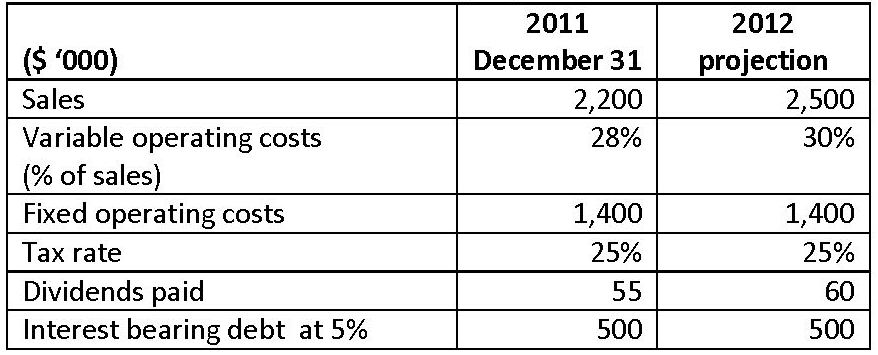

1、Selected information about a company is as follows:

The forecasted net income (in ‘000s) for 2012 is closest to:【单选题】

A.$169.

B.$202.

C.$244.

正确答案:C

答案解析:“Financial Statement Analysis: Applications,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA and Michael A. Broihahn, CFA

2013 Modular Level 1, Vol. 3, Reading 35, Section 3.2, Example 5

Study Session: 10-35-b

Prepare a basic projection of a company’s future net income and cash flow.

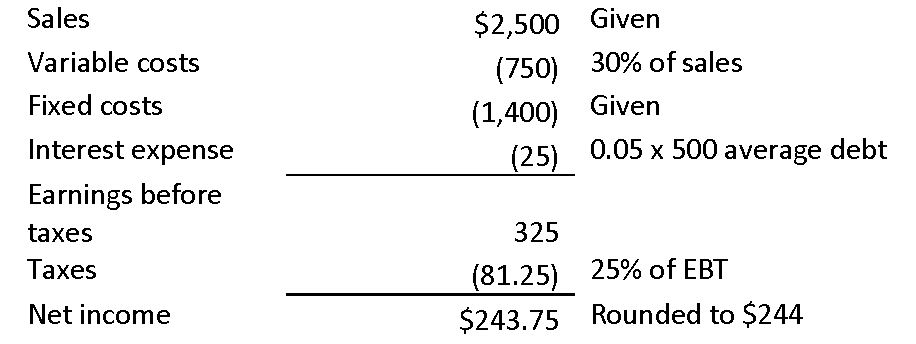

C is correct. Forecasted net income is calculated as follows:

2、Returns from a depository receipt are least likely impacted by which of the following factors?【单选题】

A.Exchange rate movements

B.Analysts' recommendations

C.The number of depository receipts

正确答案:C

答案解析:“Overview of Equity Securities,” Ryan C. Fuhrmann, CFA and Asjeet S. Lamba, CFA

2011 Modular Level I, Vol. 5, p. 182

Study Session 14-58-e, f

Discuss the methods for investing in non-domestic equity securities.

Compare and contrast the risk and return characteristics of various types of equity securities.

The price of each depository receipt (and returns in turn) will be affected by factors that affect the price of the underlying shares, such as company fundamentals, market conditions, analysts’ recommendations, and exchange rate movements. The number of depository receipts issued affects their price, but does not impact the returns.

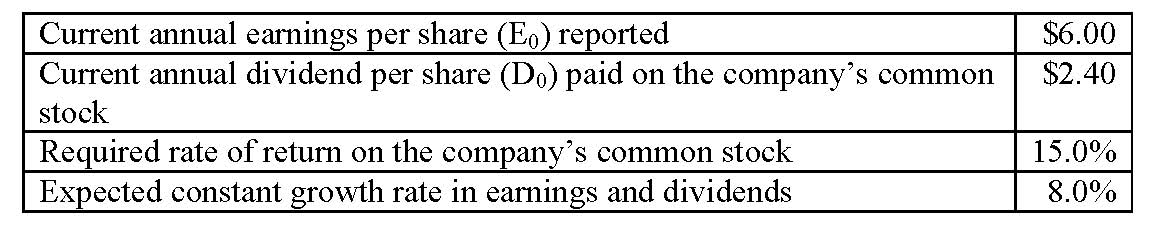

3、An analyst gathered the following information about a company:

If markets are in equilibrium, which of the following statements best describes the company’s price-to- earnings (P/E) ratio? The company’s P/E ratio based on the infinite period dividend discount model (DDM) is:【单选题】

A.less than the company’s trailing P/E ratio.

B.the same as the company’s trailing P/E ratio.

C.greater than the company’s trailing P/E ratio.

正确答案:A

答案解析:“An Introduction to Security Valuation,” Frank K. Reilly, CFA and Keith C. Brown, CFA

2010 Modular Level I, Vol. 5, pp. 142-143, 148-150

“Introduction to Price Multiples,” John D. Stowe, CFA, Thomas R. Robinson, CFA, Jerald E. Pinto, CFA, and Dennis W. McLeavey, CFA

2010 Modular Level I, Vol. 5, p. 198-200

Study Session 14-56-d; 14-59-b

Show how to use the DDM to develop an earnings multiplier model and explain the factors in the DDM that affect a stock’s price-to-earnings (P/E) ratio.

Calculate and interpret P/E, P/BV, P/S, and P/CF.

The trailing P/E ratio is computed as the current stock price divided by the current or trailing 12-months’ EPS. On the other hand, the P/E ratio based on the infinite period dividend discount model is computed as (D/E) / (k – g).

If markets are in equilibrium, the price per share reflects the value determined by the constant growth dividend. Using the constant growth model the stock's value is ($2.40)(1.08) / 0.07 = $37.03;

The trailing P/E = 37.03 / 6 = 6.17. The DDM P/E is the dividend payout ratio divided by k-g = 0.4 / 0.07 = 5.71. Another way of computing DDM P/E is: Current Market Price/Expected 12-month earnings: 37.03/(6.00 x 1.08) = 5.71. (see p. 148)

4、Which of the following transactions is most likely to affect a company's financial leverage ratio?【单选题】

A.An increase in cash dividends paid

B.Payment of a 9% stock dividend

C.Completion of a previously announced 1-for-20 reverse stock split

正确答案:A

答案解析:Cash dividends affect a company's capital structure and financial leverage ratios by reducing assets and shareholders' equity.

2014 CFA Level I

"Dividends and Share Repurchases: Basics," by George H. Troughton and Gregory Noronha

Section 2.4

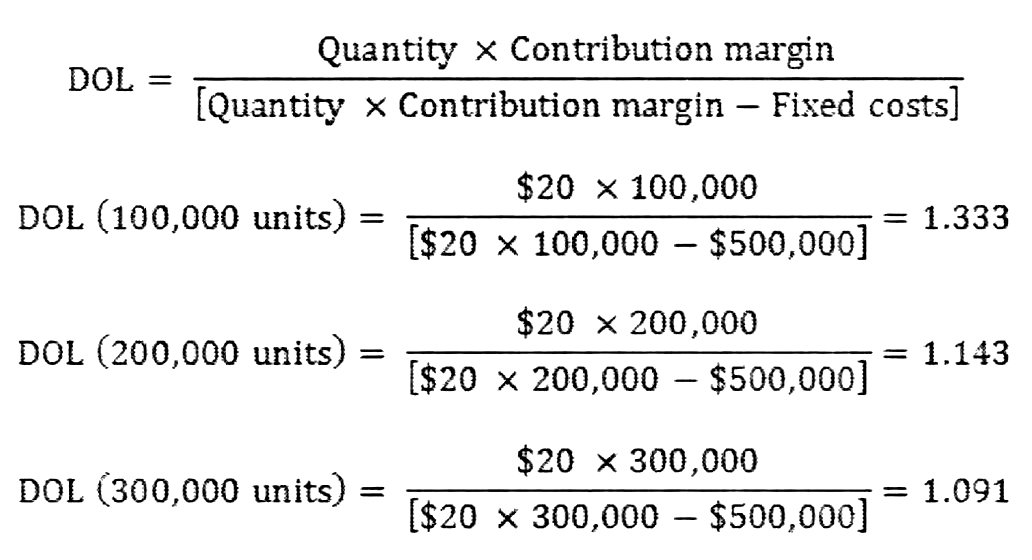

5、The unit contribution margin for a product is $20. A firm's fixed costs of production up to 300,000units is $500,000. The degree of operating leverage (DOL) is most likely the lowest at which of thefollowing production levels (in units):【单选题】

A.200,000.

B.100,000.

C.300,000.

正确答案:C

答案解析:

The DOL is lowest at the 300,000 unit production level.

CFA Level I

"Measures of Leverage," Pamela Peterson Drake, Raj Aggarwal, Cynthia Harrington, and AdamKobor

Section 3.3

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料