下载亿题库APP

联系电话:400-660-1360

下载亿题库APP

联系电话:400-660-1360

请谨慎保管和记忆你的密码,以免泄露和丢失

请谨慎保管和记忆你的密码,以免泄露和丢失

2020年CFA考试《CFA一级》考试共240题,分为单选题。小编每天为您准备了5道每日一练题目(附答案解析),一步一步陪你备考,每一次练习的成功,都会淋漓尽致的反映在分数上。一起加油前行。

1、If investors expect stable rates of inflation in the future, the pure expectations theory suggests that the yield curve is currently:【单选题】

A.flat.

B.inverted.

C.upward-sloping.

正确答案:A

答案解析:“Understanding Yield Spreads,” Frank J. Fabozzi

2010 Modular Level I, Vol. 5, pp. 365-366

Study Session 15-63-c

Explain the basic theories of the term structure of interest rates and describe the implications of each theory for the shape of the yield curve.

The pure expectations theory explains the term structure in terms of expected future short-term interest rates. Assuming that interest rates reflect a relatively stable real rate of interest plus a premium for expected inflation, stability in inflation expectations would mean unchanged future short-term interest rates and a flat yield curve.

2、Lin Liang, CFA, is an investment manager and an auto industry expert. Last month, Liang sent securities regulators an anonymous letter outlining various accounting irregularities at Road Rubber Company. Shortly before he sent the letter to the regulators, Liang shorted Road stock for his clients. Once the regulators opened an investigation, which Liang learned about from his sources inside the company, Liang leaked this information to multiple sources in the media. When news of the investigation became public, the share price of Road immediately dropped 30%. Liang then covered the short positions and made $5 per share for his clients. Liang least likely violated which of the CFA Institute Standards of Professional Conduct?【单选题】

A.Misconduct

B.Market Manipulation

C.Priority of Transactions

正确答案:C

答案解析:“Guidance for Standards I-VII”, CFA Institute

2013 Modular Level I, Vol. 1, Standard I (A) Knowledge of the Law, Standard I (D) Misconduct, Standard II (B) Market Manipulation, Standard VI (B) Priority of Transactions, GuidanceStudy Session 1-2-b

Distinguish between conduct that conforms to the Code and Standards and conduct that violates the Code and Standards.

C is correct because the member has engaged in information-based manipulation of Road stock in violation of Standard II (B) Market Manipulation and Standard I (D) Misconduct. Members and candidates must refrain from “pumping up” (or down, in this case) the price of an investment by issuing misleading positive (or negative) information for their or their clients’ benefit. The member has not violated Standard VI (B) Priority of Transactions because this standard concerns client investment transactions having priority over member or candidate investment transactions and is not applicable here.

3、An analyst uses a stock screener and selects the following metrics: a global equity index, P/E ratio lower than the median P/E ratio, and a price-book value ratio lower than the median price-book value ratio. The stocks so selected would be most appropriate for portfolios of which type of investors?【单选题】

A.Value investors.

B.Growth investors.

C.Market-oriented investors.

正确答案:A

答案解析:“Financial Statement Analysis: Applications,” Thomas R. Robinson, CFA, Jan Hendrik van Greuning, CFA, Elaine Henry, CFA, and Michael A. Broihahn, CFA

2011 Modular Level I, Vol. 3, pp. 608-611

“Security Market Indices,” Paul D. Kaplan, CFA, and Dorothy C. Kelly, CFA

2011 Modular Level I, Vol. 5, pp. 105

Study Session: 10-42-d; 13-56-k

Discuss the use of financial statement analysis in screening for potential equity investments.

Compare and contrast the types of security market indices

Metrics such as low P/E and low price-book are aimed at selecting value companies; therefore the portfolio is most appropriate for value investors.

4、The effective annual rate for an investment with a stated annual rate of 10% ifcompounded quarterly is closest to:【单选题】

A.10.25%

B.10.38%

C.10.52%

正确答案:B

答案解析:有效年收益率 EAR = -1=10.38%。

5、An annual-pay bond with a yield to maturity of 5.90% has a bond equivalentyield closest to :【单选题】

A.2.9%

B.5.8%

C.6.0%

正确答案:B

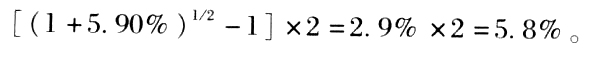

答案解析:

459

459What are the indices for a skewed distribution?:What are the indices for a skewed distribution?

265

265What are the responsibilities of the members in reference to the CFA Institute?:Once accepted as a member:每年交述职报告和年费but must not over promise the competency and future investment results.Case

640

640What members and candidates should notice in CFA examinations?:or security of the CFA examinations.(不能恶心CFA),考试不能作弊:考试内容要保密:A. No.:Responsibilities as a CFA Institute Member.right④Case

微信扫码关注公众号

获取更多考试热门资料