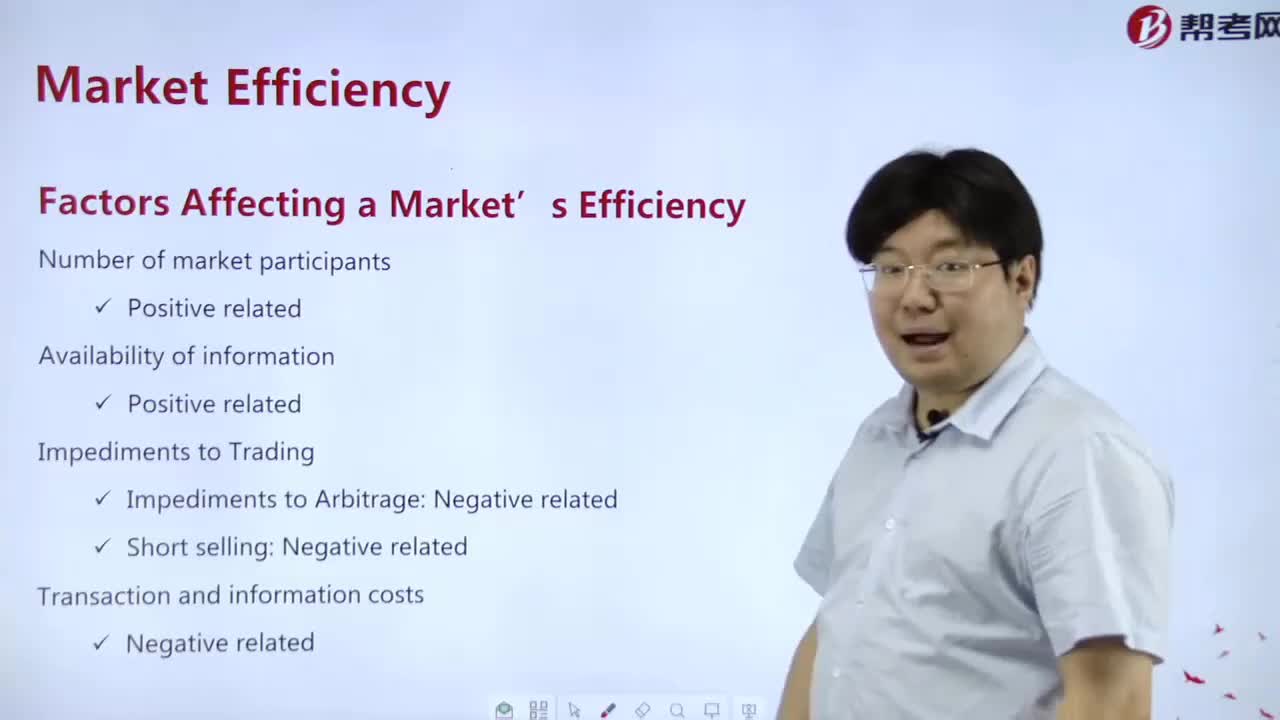

Which ones Factors Affecting a Market’s Efficiency?

There are several factors that can affect the efficiency of a market:

1. Information availability: The more information available to market participants, the more efficient the market is likely to be. This includes information about the underlying assets, market trends, and economic indicators.

2. Transaction costs: High transaction costs, such as fees and taxes, can reduce the efficiency of a market by discouraging trading and reducing liquidity.

3. Market structure: The structure of the market, including the number and size of participants, can impact efficiency. For example, a market dominated by a few large players may be less efficient than one with many small players.

4. Regulations: Regulations can both improve and hinder market efficiency. Regulations that promote transparency and fair competition can improve efficiency, while regulations that create barriers to entry or limit trading can reduce efficiency.

5. Investor behavior: The behavior of investors, including their risk preferences and trading strategies, can impact market efficiency. For example, if investors are overly risk-averse, they may be less likely to trade, reducing liquidity and efficiency.

6. External shocks: External events, such as natural disasters or political upheaval, can disrupt markets and reduce efficiency.

7. Market sentiment: Market sentiment, or the overall mood or attitude of investors, can affect market efficiency. If investors are overly optimistic or pessimistic, they may make irrational decisions that can impact market efficiency.

帮考网校

帮考网校