The Demand for Money

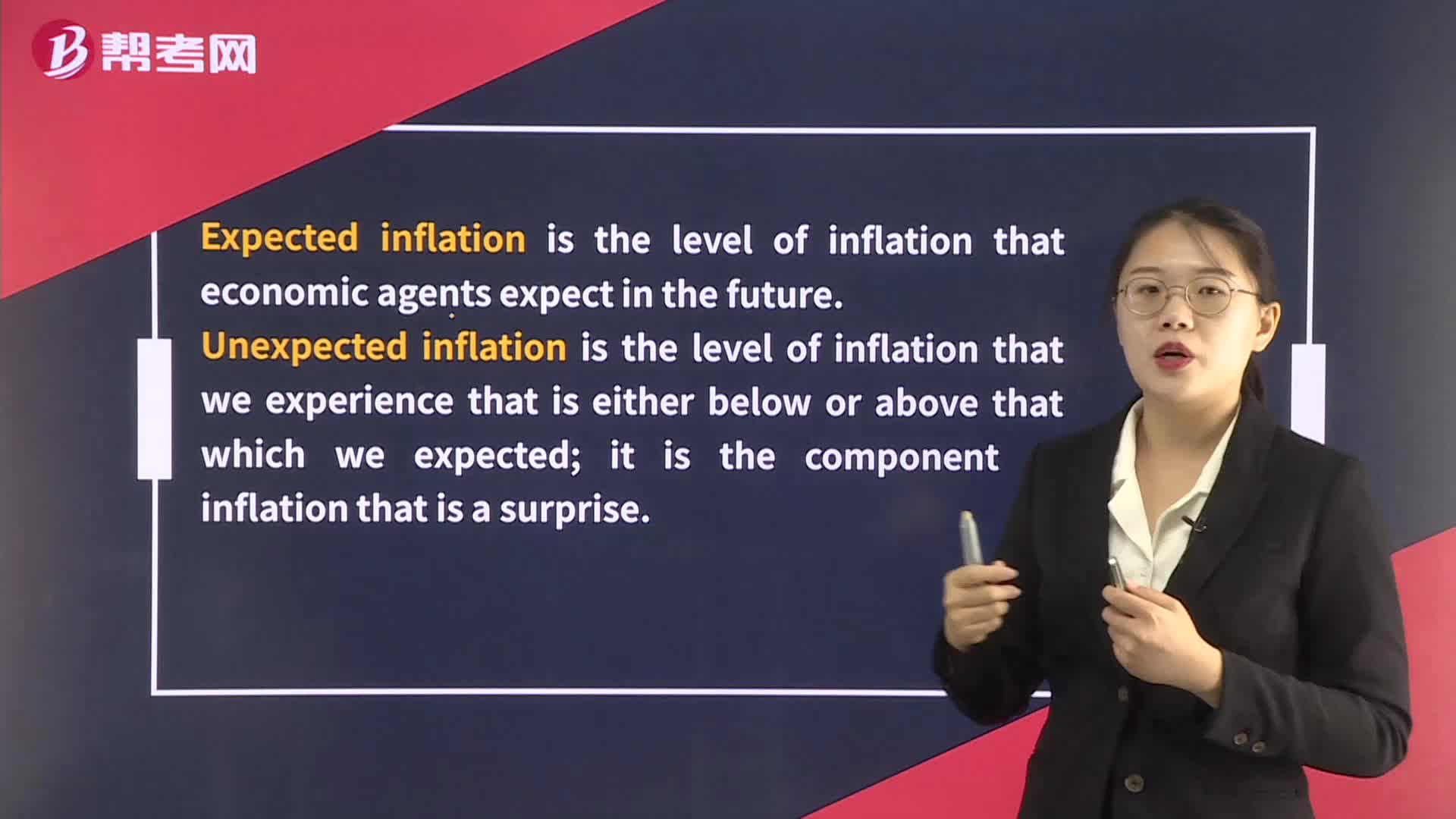

The Costs of Inflation

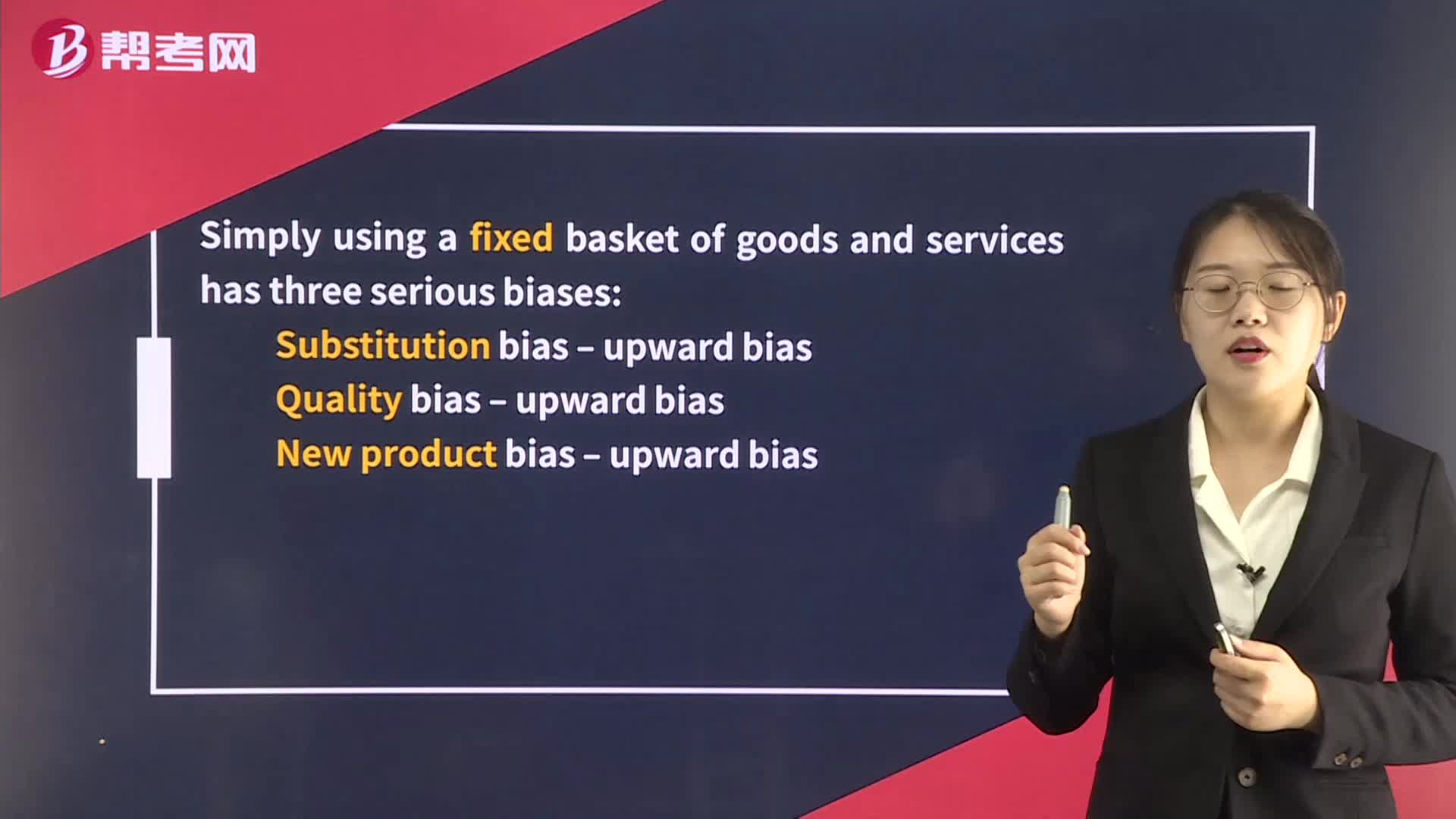

The Construction of Price Indexes

The Relationship Between Fiscal and Monetary Policy

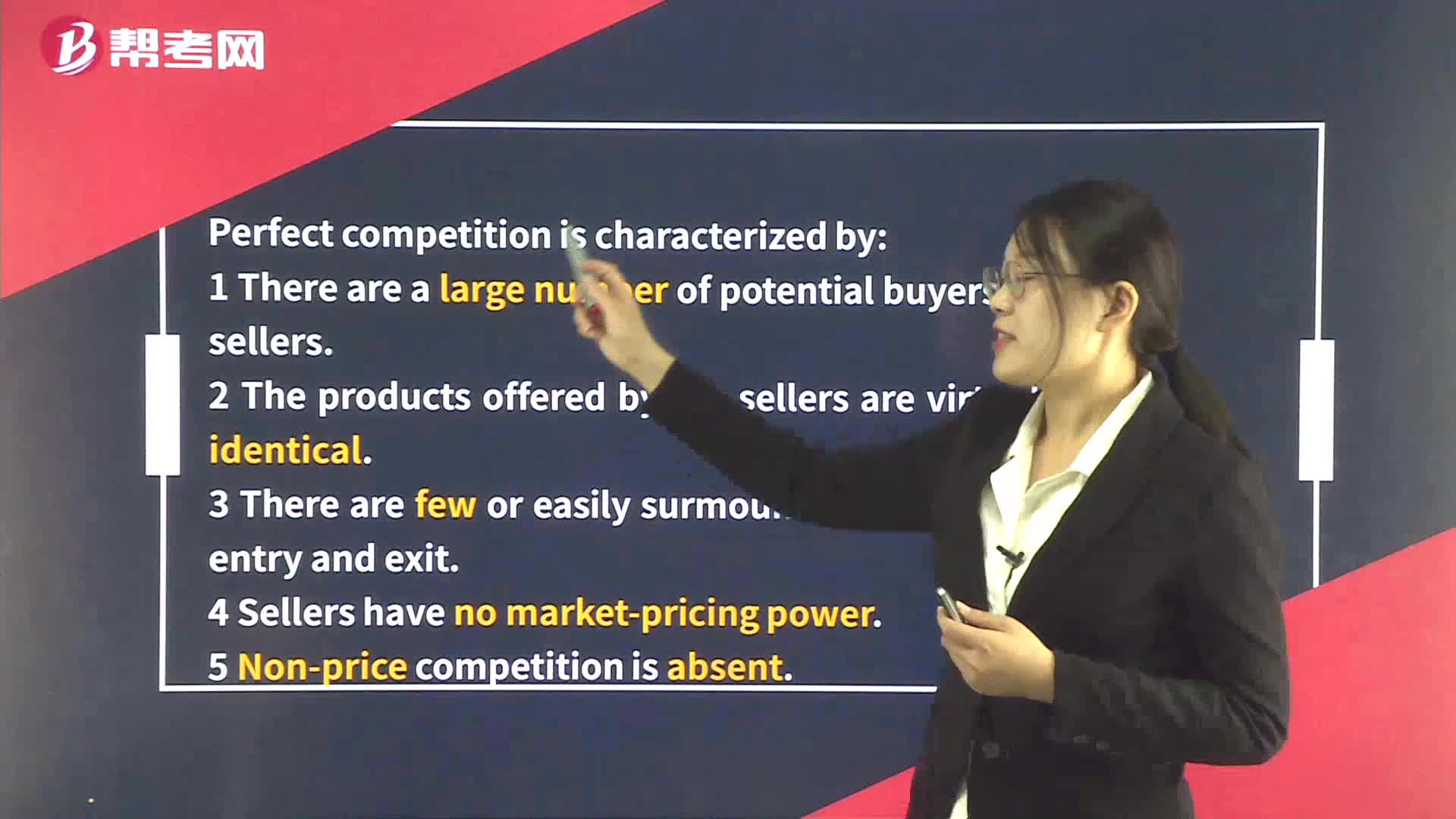

Demand Analysis in Perfect Competition

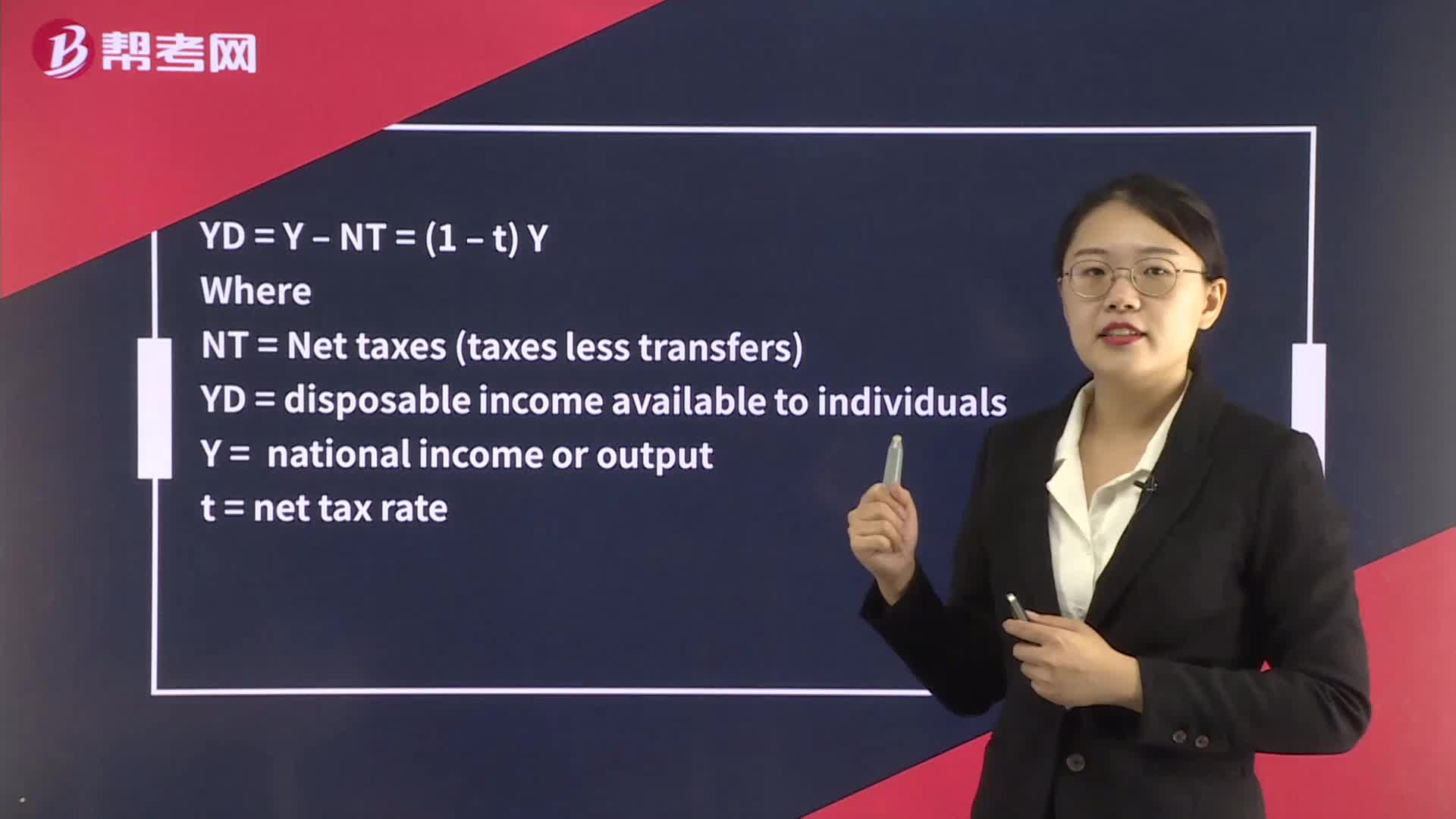

The Fiscal Multiplier

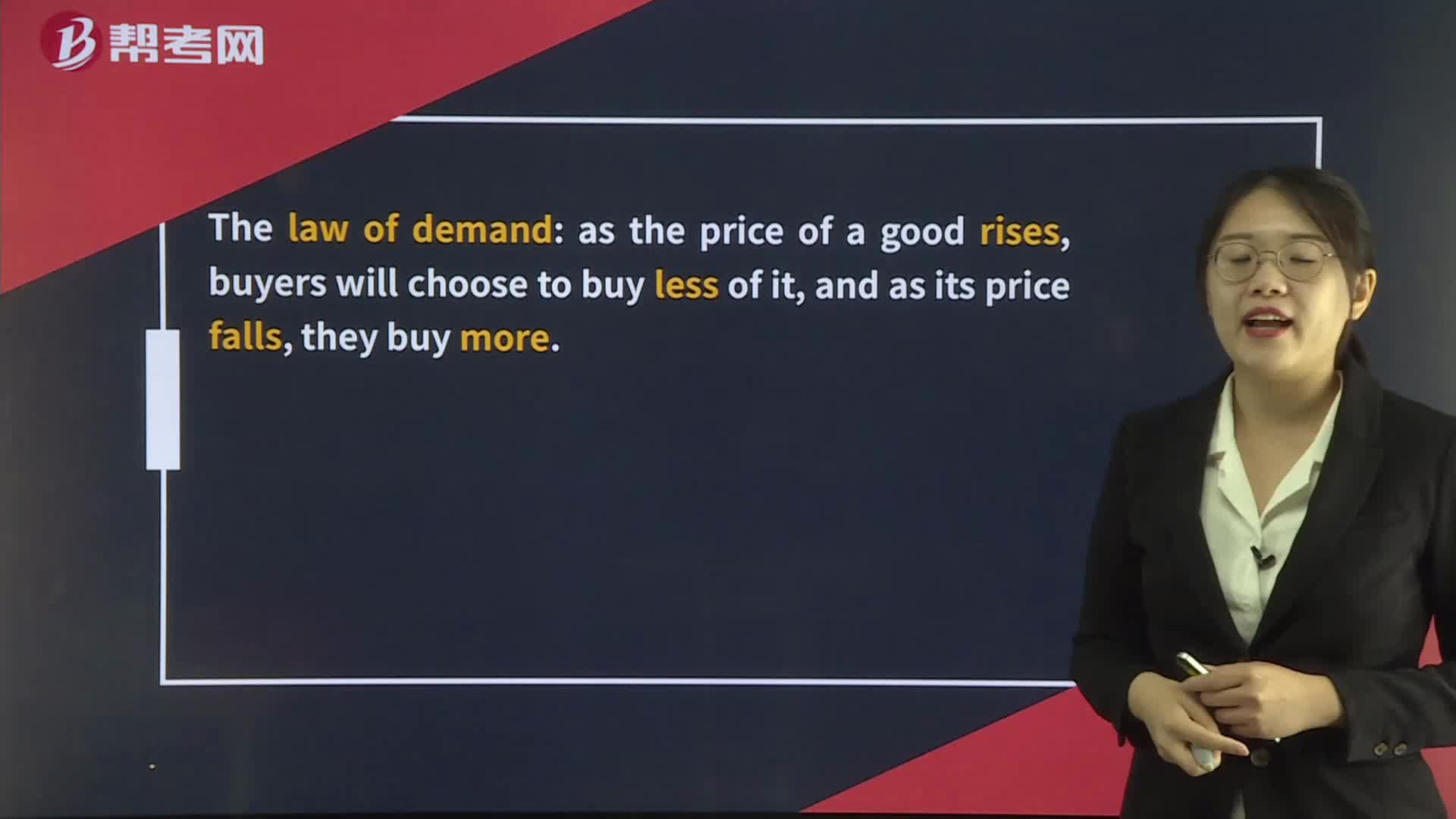

Demand Analysis:The Consumer

The Advantages and Disadvantages of Using the Different Tools of Fiscal Policy

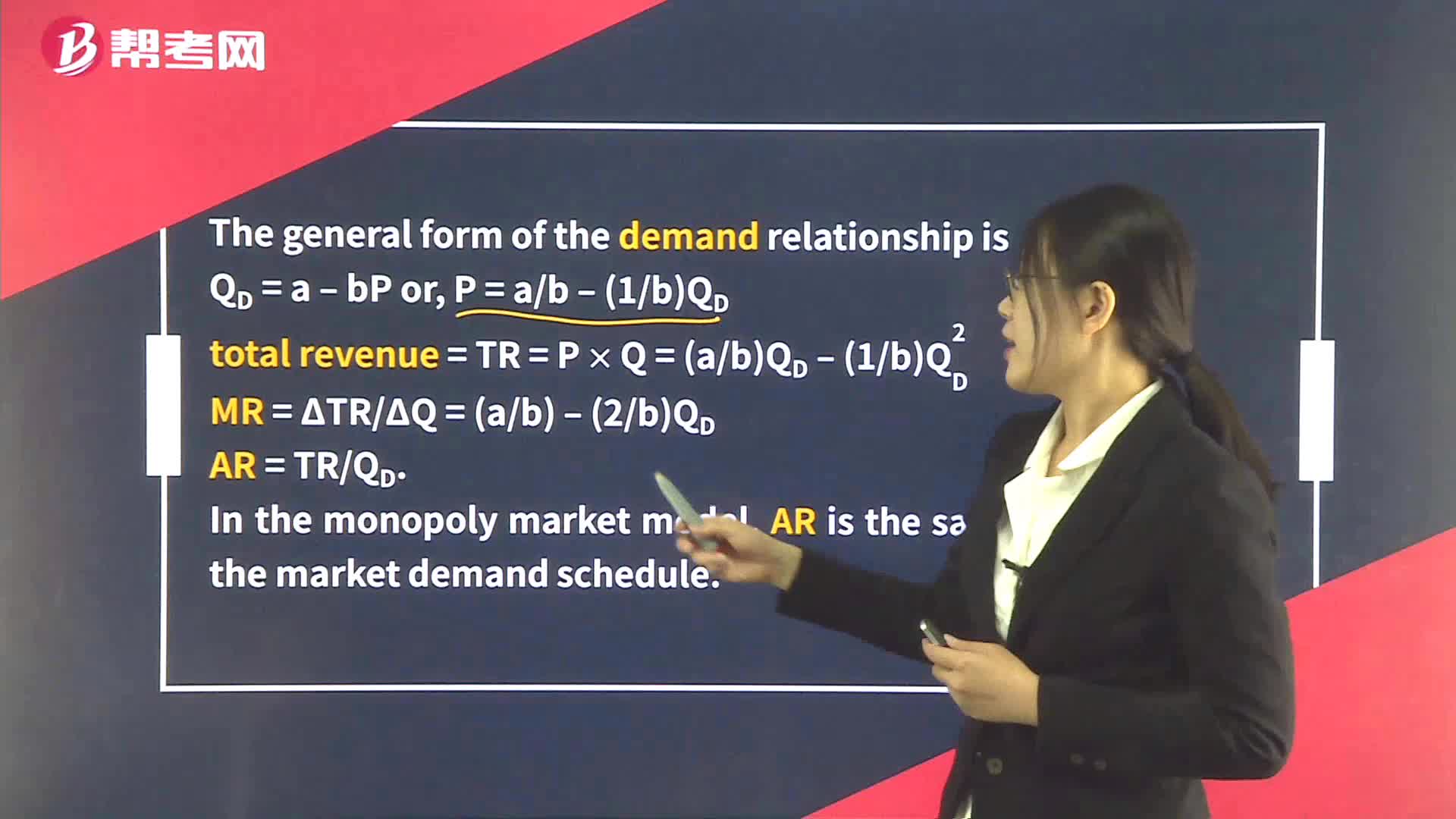

Demand Analysis in Monopoly

Deficits and the Fiscal Stance

The New Classical School

Resource Use through the Business Cycle

下载亿题库APP

联系电话:400-660-1360